Category: Finance & Economics

EU Countries Without Capital Gains Tax (2025)

Europe is known for high taxes and overregulation. However, there are places throughout this continent that are quite favorable for investors, and especially welcoming for the less active ones. In this post, I’ll summarize the European countries in which it’s possible to lower the capital gains tax rate to 0%. No Capital Gains Tax in Europe …

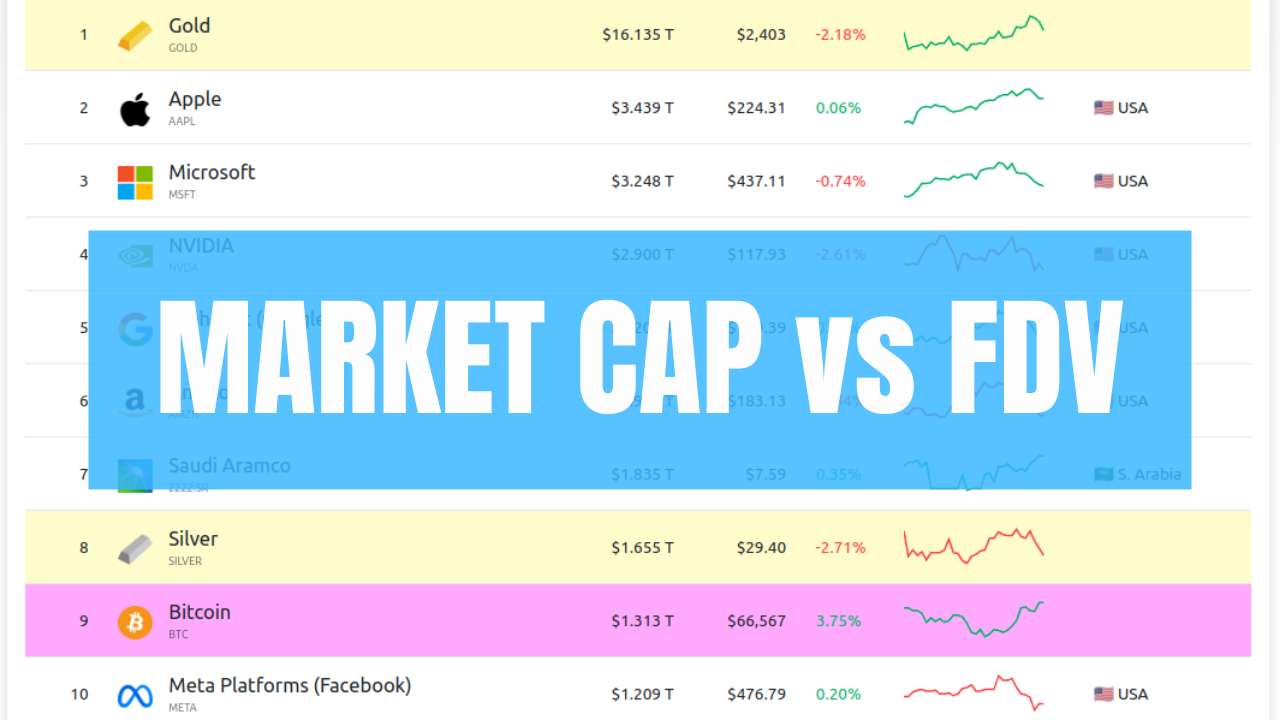

Market Cap vs Fully Diluted Valuation (FDV) – Explanation & Practical Analysis

Market capitalization (or market cap) represents the total value of an asset. For a publicly traded company, the market cap is its current share price multiplied by the number of shares. A hypothetical example: The price per share is $50 There are 10,000,000 shares outstanding The market cap is the price * the shares = …

Sticking to a Strategy (Notes From the 2020 Recession)

I wrote this post for a discontinued blog during the market crash of March 2020, before the Covid recession was officially announced. I decided to republish it on dpetkovski.com because it’s evergreen content – it gives unique insights into the mind of a retail investor during market turmoil. And the thought process should be applicable …

Taxes for Dummies – How Tax Works?

Recently I published multiple posts about different types of taxes and their treatment per country. People with similar interests reached out and we’ve had extremely insightful discussions. But I also received questions from beginners that motivated me to write a more general introduction. This post assumes that the reader has absolutely no previous knowledge about …

Linear vs Annuity Mortgage (The Netherlands)

Many expats in the Netherlands aren’t sure whether to get a linear mortgage or an annuity mortgage. In this post, I will explain the differences between linear vs annuity mortgages. This will allow you to avoid overspending on a cookie-cutter solution from a financial advisor. Annuity Mortgage Annuity mortgage is the most common type of mortgage in the …

Inflation Explained

I’ll start with a story from 2014. A friend from Macedonia started an interesting discussion – how much money a person would need to stop relying on a salary: “In our country”, he said, “you can live comfortably on €400 per month, which is less than €5k per year. Multiply that by 40 (years), and …

Net-Worth Taxation in Europe (EU Wealth Taxes) (2024)

Net-worth based taxation (AKA wealth tax) is becoming more common in Europe, and especially in the EU. In this post, I’ll cover all countries in Europe that implement wealth taxes and rough approximations of the rates and conditions. If you’re interested in a more general European taxation post, I covered all investment taxes in all …

Opportunity Cost With a Twist

Opportunity Cost is the cost associated with foregone opportunities. Most of the time when we make a decision, we pick one of multiple mutually exclusive options. Although people usually consider the risks and returns of the chosen option, many tend to neglect the potential rewards of the alternatives. And it makes sense, as a person is …

Yield Conversion – HPY, EAY, BDY, MMY, BEY (Convert Easily)

This post is the ultimate lesson on conversion between different yield representations: Holding Period Yield (HPY) Effective Annual Yield (EAY) Bank Discount Yield (BDY) Money Market Yield (MMY) Bond Equivalent Yield (BEY) So, whether you ended up here because you want to learn more about the different yield representations, need help with a specific yield …

Recession Predictions vs Economists & the Media

“Economists predicted 9 of the last 4 recessions.” People often get obsessed with predictions and live in continuous fear of a market collapse. This is my attempt to convince you that uncertainty is normal. As someone that strategically invests since 2017, I know how to filter out the noise and sleep comfortably with a 7 …

I Didn’t Get Lucky – The Opportunity in Bitcoin

I keep seeing people in investing communities that are vocal about the alleged risks of Bitcoin. And price speculation is perfectly fine when observing an asset purely as an investment. However, that’s far from Bitcoin’s value proposition. But it’s understandable. This is mostly done by bad stock pickers that consider $BTC gambling, think that dividends …

Capital Gains Taxes in All EU Countries (for ETF Investors) (2024)

If you’re an index investor, you might want to compare the treatment of profits across various countries. Whether you plan to live off of your portfolio or simply want to optimize while accumulating, understanding the tax framework is of utmost importance. In this post, I’ll do a detailed breakdown of how UCITS ETFs are taxed …

Bitcoin Tax in All EU Countries (Capital Gains & Wealth Taxes) (2024)

If you’re a Bitcoin HODLer, this post might be not only relevant, but potentially life-changing for you. Whether you plan to live off of $BTC or simply want to optimize your taxes while stacking, understanding the tax treatment of this asset is of utmost importance. In this post, I’ll do a detailed breakdown of Bitcoin …

Investing Expenses – Full Breakdown

Investing is associated with various types of expenses. Your goal as an investor is to keep these as low as possible. Below are a few examples of expenses you’d face as a stock market investor: TER (Total Expense Ratio) Entry and exit fees Broker/bank fees Transaction fees FX conversion costs Taxes Not all of these …

Dividend Leakage – Understanding the Hidden Cost

Dividend leakage is an expense that many investors accrue without even knowing. It’s a hidden cost related to investing in international ETFs/funds that’s not reported in their factsheet or prospectus. In this post, I’ll explain what is dividend leakage and how to calculate it yourself. I generally recommend against dividend investing, but if you’re already living off …