Dividend leakage is an expense that many investors accrue without even knowing.

It’s a hidden cost related to investing in international ETFs/funds that’s not reported in their factsheet or prospectus.

In this post, I’ll explain what is dividend leakage and how to calculate it yourself.

I generally recommend against dividend investing, but if you’re already living off of dividends, this post might save you hundreds of thousands in the long run.

Dividend Leakage Explained

Let’s say you’re a non-US person looking to invest using the S&P 500 as a benchmark.

So, you find an adequate (reputable & low cost) index fund in your country. Assuming that it’s a distributing fund, it means that the following will happen:

- The underlying companies will issue dividends, withholding US dividend tax

- The fund will receive the dividends and pay them out to you, withholding your country’s dividend tax

Dividend Leakage represents the taxes that “leak” while the underlying companies distribute dividends to the fund (step 1).

Note that you don’t have any bureaucratic burden because of this.

It’s just an extra (hidden) cost of international investing.

An Example of Dividend Leak

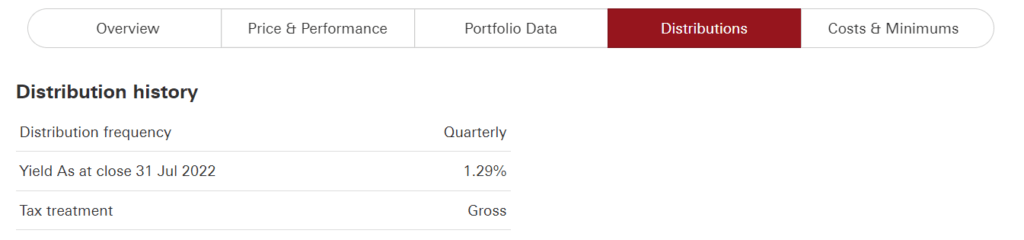

Let’s use an actual ETF for an example: $VUSA (Vanguard S&P 500 UCITS ETF).

Most of you are already familiar with it, so just a quick summary of its key characteristics:

- An ETF tracking the S&P 500

- Total Expense Ratio of 0.07%

- Distributing fund (pays out dividends to shareholders)

And as you can see in the image below, its annual dividend yield is 1.29%.

Calculating Dividend Leak for VUSA

We can calculate the dividend leakage using this step-by-step process:

All the dividend distributions from the underlying companies add up to 1.29% per share.

As $VUSA tracks the US market only, we can easily check the dividend tax rates for non-resident investors. For most European countries, the US corporate dividend withholding rate is 15%, which I’ll use for this example.

So, 15% (US withholding tax rate) of 1.29% (dividend yield) is 0.19%.

This represent the total amount of dividend tax that will “leak” when investing in this ETF.

Calculating the Total Cost of VUSA

So, we have $VUSA with its TER of 0.07%.

On top of that, we have the dividend leakage of 0.19%.

This means that the total cost of holding $VUSA is the sum of the two: 0.26% per year.

Commentary on the VUSA Example

An important thing to keep in mind is that this amount is not fixed.

It’s actually changes over time because it depends on the current dividend yield of the underlying companies.

But unless the dividend yields drastically change, you can estimate your dividend leak expense as:

- 0.2% for US ETFs

- 0.12% for global ETFs (such as VWRL, IWDA, VWCE, etc.)

Can Accumulating Funds Help?

As you should already know, an accumulating fund reinvests the dividends instead of distributing them to investors.

This means that the following would happen:

- (Between the companies and the fund) The fund would receive the dividends with US taxes withheld

- (Between the fund and the investor) The fund will reinvest these dividends instead of paying them out to the investor

As you’ve probably noticed, accumulating funds only affect the step “2. Between the fund and the investor”. The investor never received any cash payments, so he doesn’t bear a burden of reporting any taxes.

But the step “1. Between the companies and the fund” is still present – the dividend tax was paid out to the fund with US dividend taxes withheld.

Buying an accumulating ETF doesn’t mean that you’ll avoid dividend leakage.

The funds still receive the dividends with dividend taxes withheld. And only after they proceed to reinvest them instead of paying the dividends out to you.

Handling Dividend Leakage

Some brokers and funds offer a (partial) recovery of these withheld taxes. If applicable, you’ll need to fill out a form and they’ll take care of recovering the amount.

This depends on your country of residence and its relationship with the country that’s distributing the dividends. So we can’t talk about this in global context.

However, the first step is to make sure to understand your exposure to dividend leakage.

Then, one needs to understand that even removing it completely doesn’t mean that the option costs less in the grand scheme of things. You need to see it in the greater context of all expenses. For example, you don’t want a fund with TER of 1% to help you recover 0.2% of dividend leakage.

Afterword

I know all of this can be overwhelming for a beginner, but give it some time…

It becomes second nature after a couple of months.

Or!

Simply accept that a part of the dividend distributions will be lost and don’t worry about it.

Just make sure to fill out a W-8BEN form if your broker offers it.

For more intermediate posts on investing from Europe, visit: EU Investors Handbook.

If these concepts are too advanced for you, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer