I keep seeing people in investing communities that are vocal about the alleged risks of Bitcoin.

And price speculation is perfectly fine when observing an asset purely as an investment. However, that’s far from Bitcoin’s value proposition.

But it’s understandable. This is mostly done by bad stock pickers that consider $BTC gambling, think that dividends somehow make them wealthier, and will end up buying a Bitcoin ETF in a year… Which is also a sucker move btw.

Anyway, I’ll dedicate a post about demystifying some of this criticism in the future, but for now, I’ll point out some of the key benefits of being a Bitcoin holder.

Why Bitcoin

Its stellar price performance compared to any asset class aside, here are two characteristics unique to Bitcoin:

- Decentralization – no central point of failure or authority validating transactions, restricting users or use cases, or disrupting liquidity

- Ownership – as long as a hodler owns his keys, there is absolutely no way for anyone to steal or have any type of say in how he’s using his money

Before I developed a keen interest in traditional finance, I just shrugged these off. I didn’t know which risks I’m assuming by having my wealth:

- In a bank account owned by a private institution – one that doesn’t even have the cash reserves to fulfill withdrawals (not a conspiracy, a fact).

- In a currency created by a government – a valueless number I can’t use for anything outside the borders of a country or economic union.

- In an economy controlled by a central bank – one that freely adjusts the interest rates and the money supply, thus determining the value of everything I “own”.

Bitcoin solves all of this.

And without having the downsides and impractical aspects of any other asset with global value and limited supply.

Why Is This Relevant?

Well, the future will happen.

And the people who claim that Bitcoin is a scam are the same people who’ll look back and claim that “crypto investors” somehow got lucky.

This will be a result of a thought process such as this one: some people took stupid amounts of risk… way out of their risk tolerance… invested in speculative assets with no real value… and these assets somehow grew in price… because there was a greater fool to buy at all time highs…

So, if you’re reading this after 2020 2024 and you missed the opportunity, this is for you.

Read the following sentence, unambiguously and in its simplest form:

I Didn’t Get Lucky.

My participation in this market is neither a gamble nor hoping for quick profits.

On the contrary, I have ideological reasons to be a bitcoiner – not only as an investor, but simply a holder thereof.

If you need more clarification, read my post on The Inevitability of Bitcoin.

And if you’re interested in the investment perspective, read my post on The 4 Year Cycle.

PS I claim the rights to state these things confidently because I did it in the past and I’m doing it again.

Okay, but what does this mean for you, the person who thinks that hodling BTC is riskier than holding cash?

Well, I’m not trying to convey “buy BTC now!!!“. That’s not my decision to make.

However, I’d highly recommend to open your mind and start accumulating knowledge. And not necessarily limited to the topic I’m talking about here. I don’t know when you’re reading this post, but I’m sure that there are opportunities out there that the general population discards or is still not aware about. And here is where you should come in – firmly setting your role in the next big thing by the simple means of being curious about the world you live in.

And if you do decide to research Bitcoin, make sure to adopt the best practices of storing it securely. This is a space where scams are common and emotional n00bs often get rekt.

But of course, if you simply don’t want to learn about this technology or the problems it solves, at least learn about quantitative easing printing money.

That’s the bare minimum and affects you more than you may think.

The Value of FIAT Money

Let me put this in more relatable terms – 💰 money 💸.

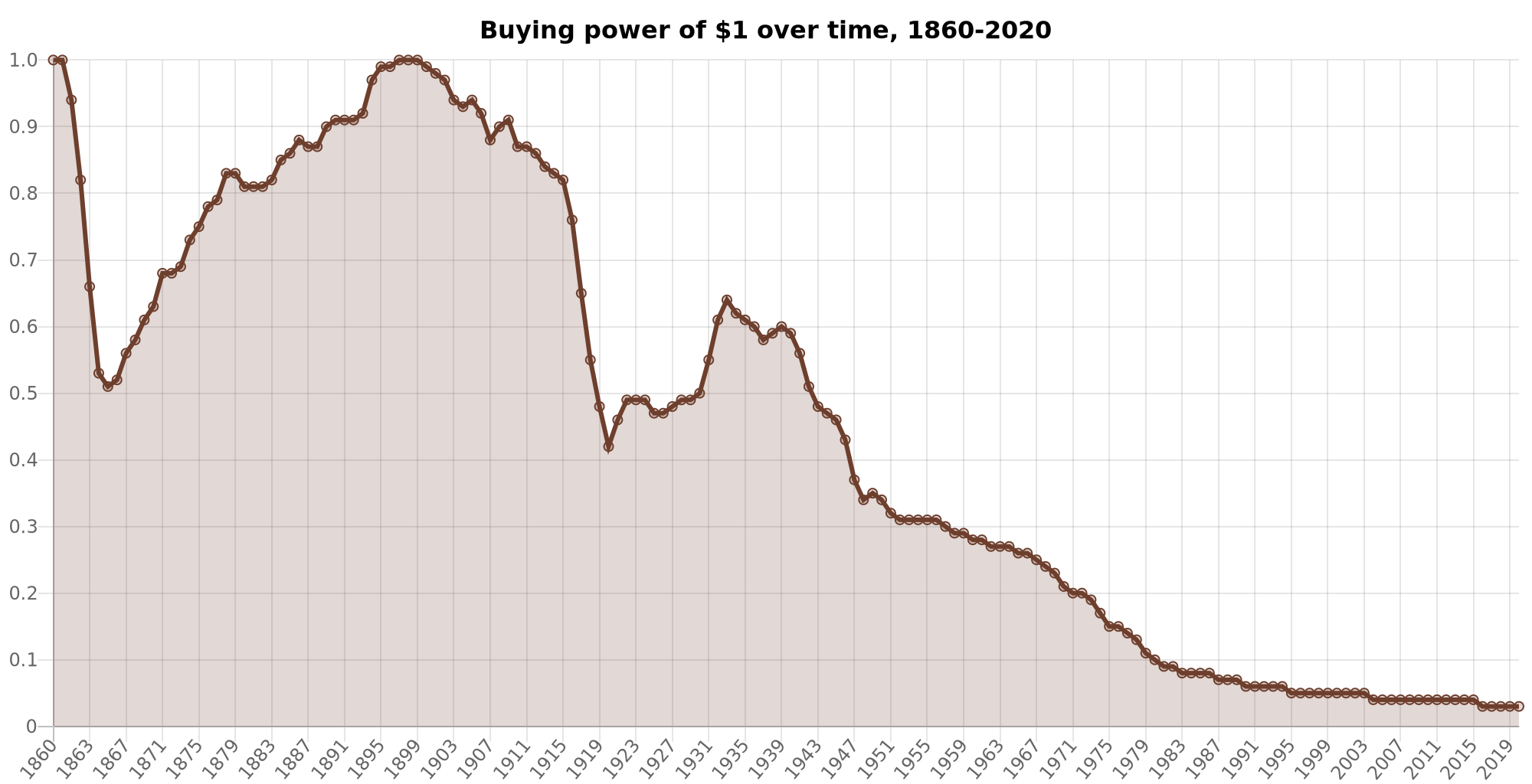

The long-term price performance of most high quality assets is driven by rate cuts, managing reserve requirements, and quantitative easing alchemy. Basically, creation of money that can be used for purchasing real, existing, valuable assets with. And it’s economics 101 that the oversupplied good will lose value.

And in this case, this is “the good” that we’re measuring assets’ prices against.

The oversupplied good is what people get paid in and pay taxes with.

What people use to transact and put their full faith in as a reliable payment system, which slowly bleeds and converges towards 0.

And although I’m not foreseeing hyperinflation in the first world in near future, this is something that can’t sustain in the long run.

Don’t take my word for it – here’s the purchasing power of $1 from 1860 until today:

If we’re a bit loose with definitions for the purpose of conveying a point, the following statement holds true:

FIAT is a ponzi scheme.

Remember, nothing has intrinsic value. Our collective perception is what gives value to assets.

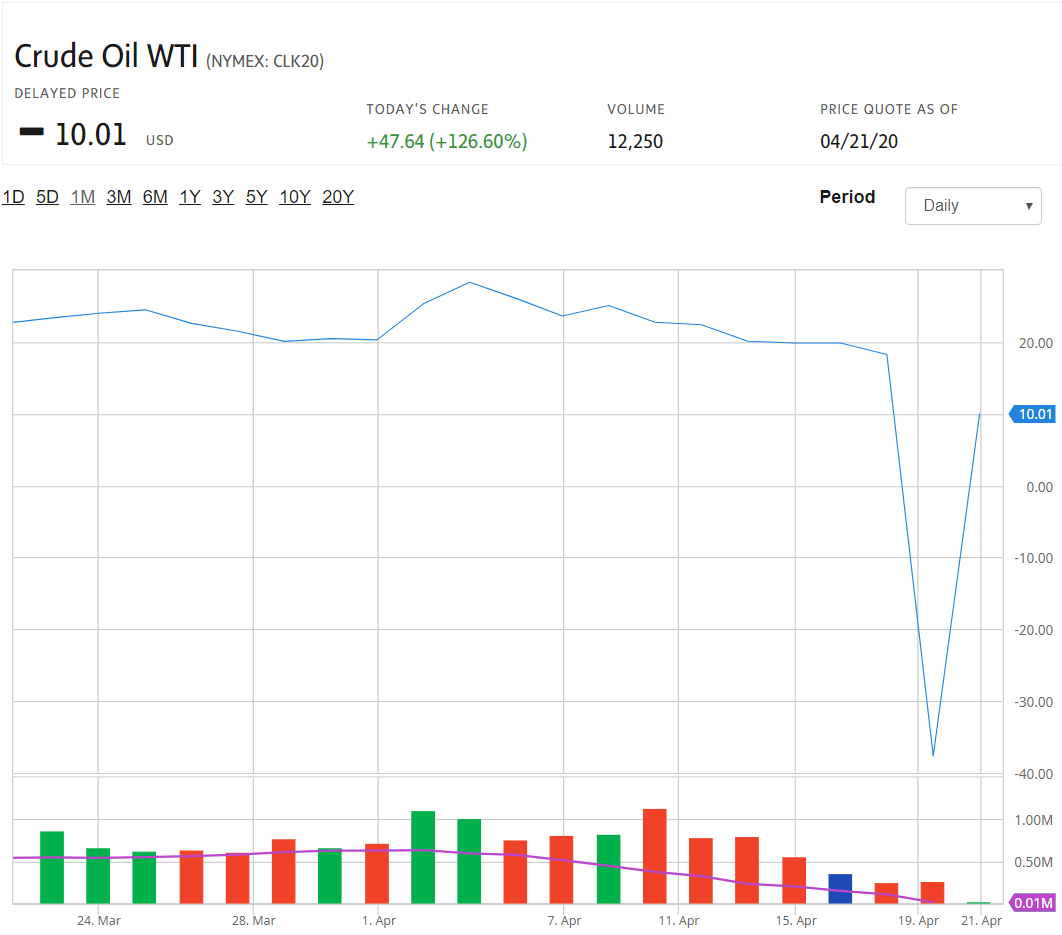

Think about it. Oil futures went negative in 2020, purely driven by supply and demand:

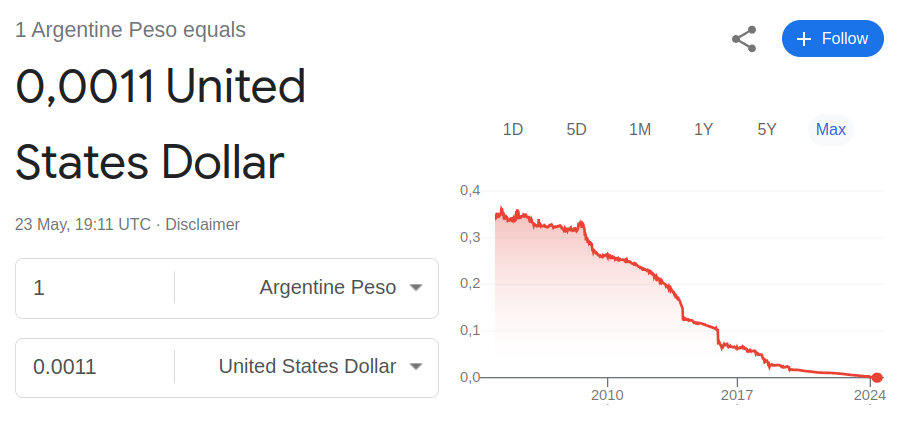

And when it comes to other currencies, here’s a chart of the Argentine Peso versus the already depreciating US Dollar:

And here’s a picture of Venezuelan bolivars:

The lesson? Money does grow on trees.

It’d be a shame to end up impoverished with lifeboats everywhere around you.

So don’t get too attached to your perception of “wealth” and fixations on “prices”.

Objectify, zoom out, and build your life accordingly.

If you want an introduction to Bitcoin without technical jargon and price speculation, check out my free series: Bitcoin for Beginners.

Husband & Father

Husband & Father  Software Engineer

Software Engineer