Category: Investing

Real Diversification – Banks, Passports, Residencies, Driving Licences, Assets

As investors, many of us understand the role of diversifying our portfolio across assets and asset classes. However, if you’re pursuing a free and abundant life, handling the financial aspect is just the base layer of the pyramid. In this post, I want to give examples of diversification that most people don’t consider – but …

My Hardware Wallet Recommendations: BitBox02 & Keystone 3 Pro

I write about self custody and security a lot on this blog. The holy grail of securing digital assets is using a hardware wallet. And I’ve compared most with each other: Trezor, BitBox02, Ledger, Coldcard or the Keystone 3 Pro review. In this post, I’ll give my summary and recommendations: BitBox02 & Keystone 3 Pro …

How to Cash Out Millions in the EU Tax Free

EU has a reputation of imposing oppressive tax rates. While this is true in general, investors can make use of the different treatments of investment profits to significantly lower or even fully avoid paying capital gains taxes. If you’ve made significant profits in the past years, this post will save you a lot of money. …

Bitcoin Exit Strategy (Cycle Based Rotation)

If you were smart and accumulated Bitcoin during the bear market, you’re sitting on a massive gains so far. Of course, most of us understand the benefits of being a long-term holder. You get Bitcoin’s inevitability and that it’s an antidote for inflation and the money printer. Still, some of us are also aware of the …

The Self Custody Manual: A Practical Guide to Buying Bitcoin and Hardware Wallets

The Self Custody Manual is a step-by-step guide on buying Bitcoin and securing it in cold storage. Get your free copy at: The Self Custody Manual.

What is a Seed Phrase – BIP39 Standard Simply Explained

Understanding seed phrases is essential for protection of your digital assets. I already covered best practices of seed phrase protection and today I’ll explain exactly what we’re protecting. Private Keys vs Seed Phrase The ownership of a crypto wallet boils down to having the private keys that control it. A private key is a string of alphanumeric characters that …

IWDA vs SWDA – What’s The Difference?

New investors that want to diversify globally don’t understand the difference between $IWDA vs $SWDA. And indeed, both of those represent the iShares Core MSCI World UCITS ETF (Acc), so the distinction might be confusing to beginners. In this post, I’ll explain why some ETFs have multiple tickers and how to choose between them. iShares …

10 Requirements: Choose a Good Hardware Wallet

Choosing a hardware wallet is a serious and extremely responsible decision. A user has to do dedicated homework instead of picking the cheapest or the first available option. When I was evaluating which hardware wallets to buy, I relied on the following list of requirements. Read on and see the reasoning behind each. 1) Has to …

The Art of De-Risking: A Mid-Curver’s Take on the Crypto Market

Are your legs shaking, anon? For those of you reading from the future, I’m writing this on a red day where most gamblers’ portfolios are down bad. Many speculate that it might be the end of the bull market. Instead of giving you my opinion on that, I’ll cover what has been consistent in the …

Bitcoin Cycle Top Indicators Analysis

As most of you already know, I like to accumulate Bitcoin during bear markets, in accordance with the 4 year cycle theory. In other words: my entries are based on time rather than on price. At the same time, I want to share certain indicators that people might consider following, especially during the pivotal moments …

EU Countries Without Capital Gains Tax (2025)

Europe is known for high taxes and overregulation. However, there are places throughout this continent that are quite favorable for investors, and especially welcoming for the less active ones. In this post, I’ll summarize the European countries in which it’s possible to lower the capital gains tax rate to 0%. No Capital Gains Tax in Europe …

Liquidity Provision (LP) and Impermanent Loss (IL) Explained

Executing trades in a decentralized manner is completely different to placing orders on exchanges. Instead of relying on an order book, DEXs (decentralized exchanges) use liquidity pools and AMMs (automated market makers). In this post, I’ll explain how this work in a beginner-friendly way. Note: this is an educational post, not a recommendation. I’m not …

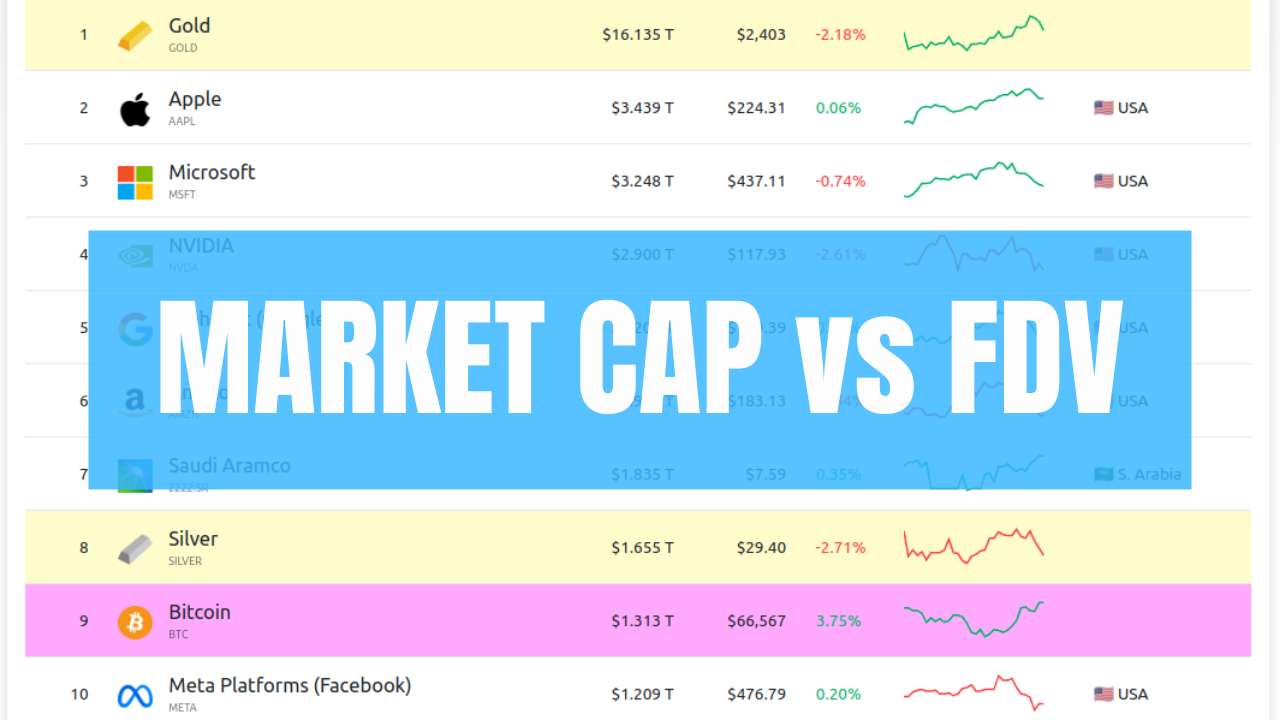

Market Cap vs Fully Diluted Valuation (FDV) – Explanation & Practical Analysis

Market capitalization (or market cap) represents the total value of an asset. For a publicly traded company, the market cap is its current share price multiplied by the number of shares. A hypothetical example: The price per share is $50 There are 10,000,000 shares outstanding The market cap is the price * the shares = …

Review of the Keystone 3 Pro Hardware Wallet

A couple of days ago, the CEO of Keystone stumbled upon my post “Is Ledger a Hot Wallet?“. This initiated a discussion and he offered to send me a Keystone 3 Pro device to try their Bitcoin-only firmware. I’m exceptionally selective in accepting gifts to avoid reciprocity bias, so I explicitly asked if there is anything …

CSPX vs SXR8 – What’s The Difference?

If you’re a beginner investor, you might be uncertain about the difference between $CSPX and $SXR8. And indeed, both of those represent the iShares Core S&P 500 UCITS ETF (Acc). In this post, I’ll explain why some ETFs have multiple tickers and how to choose between them. iShares Core S&P 500 UCITS ETF First, let’s …