Asset allocation is a wealth distribution strategy.

It represents the way an investor’s portfolio is divided into different investments.

Determining the asset allocation is one of the most important decisions an investor needs to make before deploying capital in any investment.

Examples of Asset Allocation

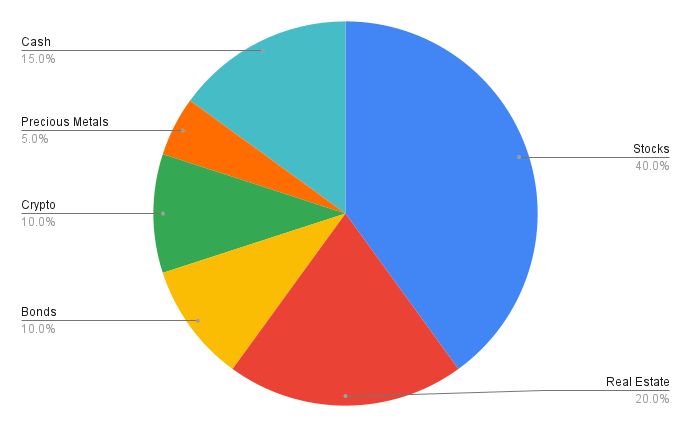

Let’s say an investor is exposed to the following asset classes:

- Stocks

- Real estate

- Bonds

- Cryptocurrency

- Precious metals

- Cash

Below is a pie chart showing what might be this investor’s asset allocation:

Note: this is just for illustrative purposes. I highly disagree with this allocation.

Remember, a long-term asset allocation is determined once, but it requires continuous nurturing.

This means that every time the investor contributes to his portfolio, he’ll aim to make the percentages as close as possible to the predefined allocation. Neglecting it may cause your allocation to shift and expose you to more risk than you’re ready to bear.

Asset Allocation vs Net-Worth Distribution

The asset allocation of an investor doesn’t always need to include all assets/asset classes he’s exposed to.

Let me give 2 examples of investors who implement the same investment strategy, but under different circumstances:

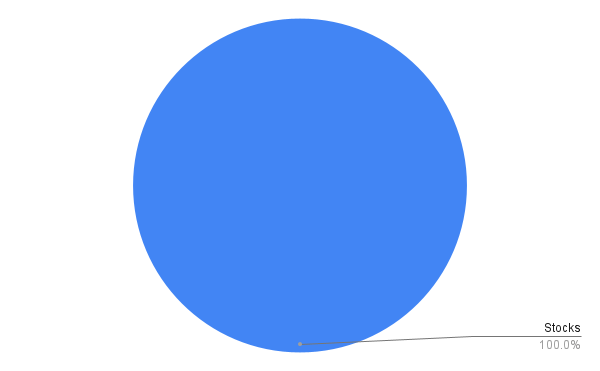

- Investor A always keeps $50k in cash as an emergency fund. Everything above this threshold gets invested in stocks.

- Investor B owns ten 1oz gold coins and 2 apartments. He’s not a regular buyer of any of those and doesn’t consider them “investments”. When he gets paid, he only buys stocks.

If each of them evaluates how their net-worth is distributed, it would be quite different from the other.

But since they don’t rebalance their cash, precious metals, or real estate positions to match their stock investments, their strategic asset allocations are basically the same:

They’re both 100% in stocks.

Remember: an asset allocation doesn’t show how an investor accidentally ended up with some distribution.

It represents the investor’s ideal exposure to the asset classes.

It’s a proactive strategy, where the percentages are defined upfront – and only then the investments are made in compliance with it.

Internal Asset Allocation

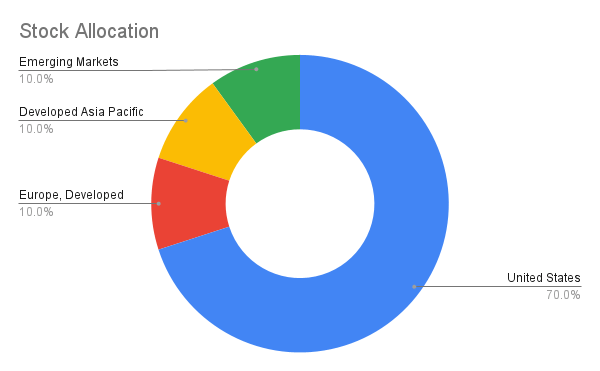

Apart from determining the asset allocation across various asset classes, the internal distributions are also important.

For example, a stock portfolio of 5000 companies would behave quite differently than a stock portfolio of one company.

If you’re picking stocks, you’d have a per-company allocation determined. But if you’re investing in ETFs, you can keep it higher-level.

For example: figuring out your ideal geographical distribution or exposure between developed and emerging markets, etc.

Below is an example of one such allocation:

Determining Your Ideal Allocation

In summary, your allocation should be based on the following three parameters:

- Goals

- Risk tolerance

- Investment horizon

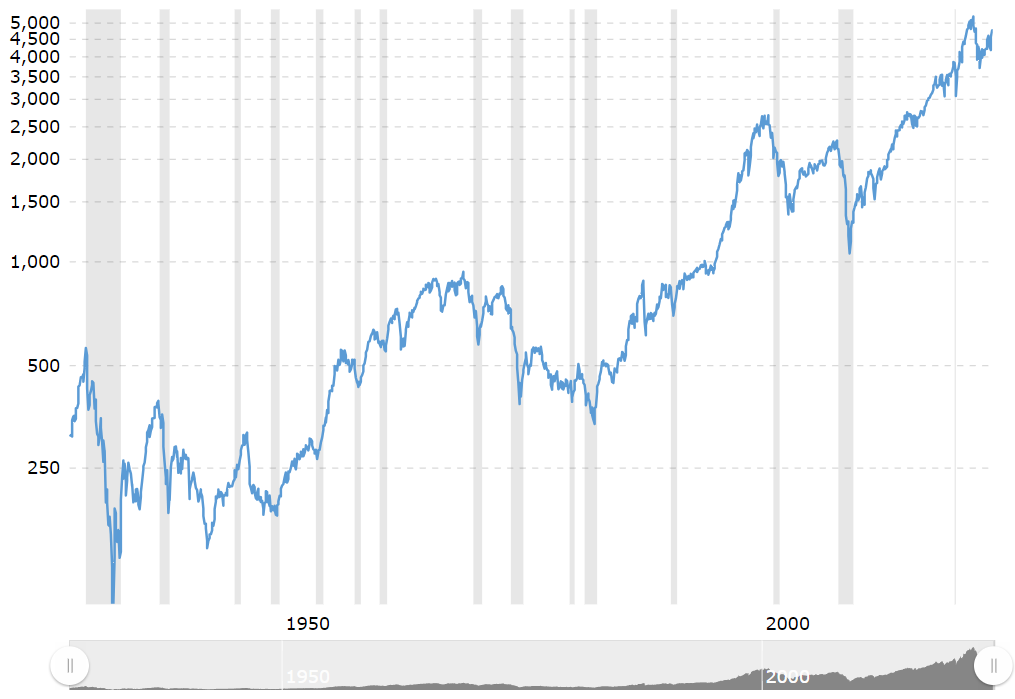

I’ll address these factors in a separate post. For now, I’d like to leave you with a reminder about time in the market – the period for which you plan to be “in the market”.

Someone who saves and invests for a 30+ year horizon can afford to take riskier positions than someone who will need the money in 6 months. The former could go all-in into stocks and the latter should keep his money in cash.

In the long term, the ultimate direction of the global stock market is up.

Here is a log-chart of the S&P 500 from before the 1930s until present times.

That’s the nature of the economy. Volatile and uncertain through the months, but stable and predictable through the decades.

And those grey lines – those are the recessions. We will have more of those in the future as well. But unless you’re planning to withdraw money within 5 years (and thus forced to sell low), you can let the time in the market to do its magic.

As long as we’re evolving in productivity and innovation, the market will always recover.

Conclusion

Determining your asset allocation is one of the most important decisions you’ll need to make on your investment journey.

Apart from the asset allocation, there are also considerations about the investment strategy one needs to adopt (i.e. DCA or lump sum) and also the amount of diversification and products to facilitate that (i.e. index funds and/or ETFs).

Make sure to familiarize yourself with all of those if you still haven’t.

Let me finish with this quote, directly from the Vanguard website:

Asset allocation is the first thing you should consider when getting ready to purchase investments, because it has the biggest effect on the way your portfolio will act.

And remember, there is no “right” allocation. It’s all about what makes you sleep well at night.

If you need help kick-starting your stock market investing journey, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer