Category: Investing

Why I Like WEBN as a One-Fund Portfolio

A couple of years ago, the expression “VWCE and chill” echoed among the fans of one-fund portfolios. While I never liked the approach due to its high TER (relative to replicating a similar allocation), now there are cheaper alternatives. In my opinion, WEBN is the strongest contender to take the throne of achieving global diversification …

ETFs I Like – QDVE, SEC0, ARKI, and More

Being an index investor means buying market cap-weighted funds that are as diversified as possible and not trying to outsmart “the market”. However, some of us think we know better. So we try to outperform traditional benchmarks such as the S&P 500 or FTSE All-World. I’ve done this successfully year over year. And in this …

Gifting My BTC to BlackRock (Bitcoin ETFs)

I recently decided to move my $BTC from self custody to Bitcoin ETFs. But why would I do such a thing? Definitely not the common “[company] has better security than I can ever have”. I don’t think that’s the case for me – my posts on self custody and cold storage are a testimony to …

$1M in 10 Minutes – Exploiting Market Inefficiencies on Polymarket

Disclaimer: I didn’t do this and I’m not a part of a group that did this – it’s all hypothetical. The goal of this post is to illustrate how knowledge about a specific event can help you spot inefficiencies even in highly liquid markets and potentially get an edge. Introduction I prefer my writing to …

The 4% Rule – Understanding the Safe Withdrawal Rate

The 4% rule is a well known framework for retirement planning among stock market investors. But most people never heard of it or aren’t sure what it represents. And if you’re one of them, this post is for you. Understanding the 4% Rule or SWR (safe withdrawal rate), starts with asking a simple question: What …

EU Tax Advantaged Accounts (401k for Europeans & Pension Investing)

Unlike the US with its IRA/401k, Europe’s tax-advantaged accounts differ per country. As such, we’ll need to explore the tax advantaged accounts in every country separately to understand their unique benefits, rules, and limitations. This post is an extension to my Investment Taxes in ALL EU Countries and focuses on tax optimization for investments: ASK (Aktiesparekonto) …

Pseudo-Intellectuals Can Ruin Your Life

Due to being relatively misinformed but overly confident in their level of expertise, pseudo-intellectuals can be especially harmful at the beginning of your investment journey. In this post, I’ll describe some of the common narratives they’re spreading so that you can recognize and protect yourself accordingly. But be careful, they’ll make it very easy for …

YCSH, E0UA, ERNX, TradeRepublic (Best MMF Alternatives in EU)

Every investor eventually faces the dilemma of where to park idle cash temporarily. In this post, I’ll compare my top Money Market Fund alternatives for Europeans. My goal is to show the importance of analyzing these opportunities in more detail – understanding how they achieve the returns and making an informed decision of what makes …

Why I Stopped Covering “The Cycle”

Let’s address the elephant in the room first: Yes, the 4-year cycle thesis is playing out once again. As someone that serially leveraged the cyclical nature of the Bitcoin market to maximize my returns, I was quite vocal about it during the bear market: The 4 Year Cycle Explained How I Accumulate Bitcoin During Bear …

How I Saved $40k Buying Real Estate in Dubai

As some of you already know, I recently bought an apartment in Dubai. I’ve already covered the overall experience, but in this post I’ll dive into the awesome ways I saved mid-five figures in the process. Although not all steps are directly replicable by anyone or at anytime, they’ll still provide interesting insights for people that are interested …

How to Invest as an Expat in The Netherlands

You can start investing from the Netherlands in the same way as you’d start investing from almost anywhere in the world. I recommend Interactive Brokers for buying stocks and Kraken as a crypto exchange. Note: there are other options, but these are my preferences after a long and ongoing evaluation. Do a SEPA transfer and …

What is “Rich”? A Discussion on Hard Money & Lifestyle

I recently had an in-depth discussion on X covering a plethora of intriguing topics: hard money, intrinsic value, gold, Bitcoin, what defines “rich”, taxes, lifestyle, etc. The discussion is between me (@petkovskix) and the user @anubisSonOfRa with whom I often have insightful exchanges. You can find the post on X, but I’ll present it here in …

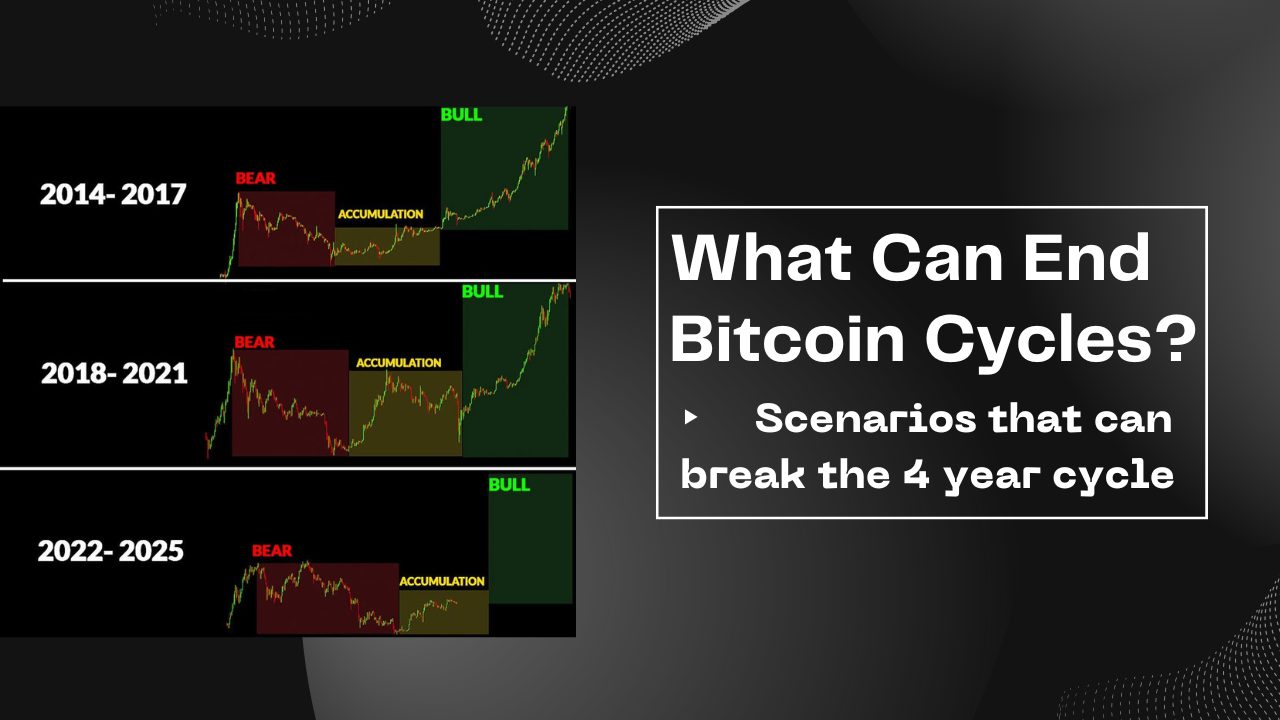

Can the 4 Year Cycle Break?

If you’re aware of 4 year cycle, you practically have predictive power over Bitcoin’s price performance without relying on luck. And you might wonder whether the “cycle is dead” or if we’re in a “supercycle”. Personally, I think that the 4 year cycle will remain intact for the foreseeable future. But not forever. There are …

I Bought an Apartment in Dubai with Crypto

This happened, ladies and gentlemen. I bought an apartment in Dubai, fully remotely (from the Netherlands), and I paid with USDT. But how did we get there? After a few good years in the market and hefty profits, we were sitting on a large pile of cash that needed to be utilized. With the yield …

Teleport Assets By Remembering 12 Words

Throughout history, many people lost assets through violence, coercion, or corruption. And it’s a sad reality that in many places and cases, people can still be stripped off everything they’ve worked for. In this post, I want to cover a few examples of inability to use the money that we’re convinced we own, especially in …