Building a one-fund portfolio is quite popular with European investors. That’s why the questions of IWDA vs VWCE or IWDA vs VWRL pop up quite often.

Both IWDA and VWCE/VWRL are part of DeGiro’s core selection of ETFs (traded free of charge), which makes them even more popular for smaller investors in the EU.

In this post, I’ll cover the essential details for both ETFs and will give my take on the matter.

VWRL

Ticker symbols: VWRL, VWRD, VGWL; ISIN: IE00B3RBWM25

VWRL (Vanguard FTSE All-World UCITS ETF) is an ETF by Vanguard that tracks the FTSE All-World index.

It is a market-cap weighted ETF that tracks over 3700 companies from all around the world.

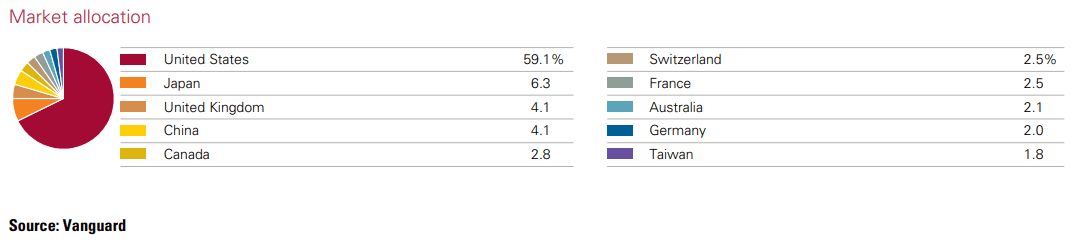

Here’s a screenshot from the Factsheet of VWRL, showing the top countries’ distributions:

What’s special about VWRL is that it’s globally diversified, but also covers both developed markets (US/EU/CA/AU/JP) and also emerging markets (i.e. emerging Asia, Latin America, Middle East/Africa).

Its total expense ratio is 0.22% and it’s a distributing fund (paying dividends quarterly).

For those that have a preference of accumulating funds instead, there’s VWCE – the accumulating equivalent of VWRL. Apart from the distribution policy, all other characteristics are the same.

Due to these characteristics, VWRL/VWCE is one of the go-to ETFs for many buy-and-forget investors.

IWDA

Ticker symbols: IWDA, SWDA, EUNL; ISIN: IE00B4L5Y983

IWDA (iShares Core MSCI World UCITS ETF) is an iShares ETF that tracks the MSCI World index.

It’s also a market cap weighted ETF that tracks over 1500 companies from over 20 countries.

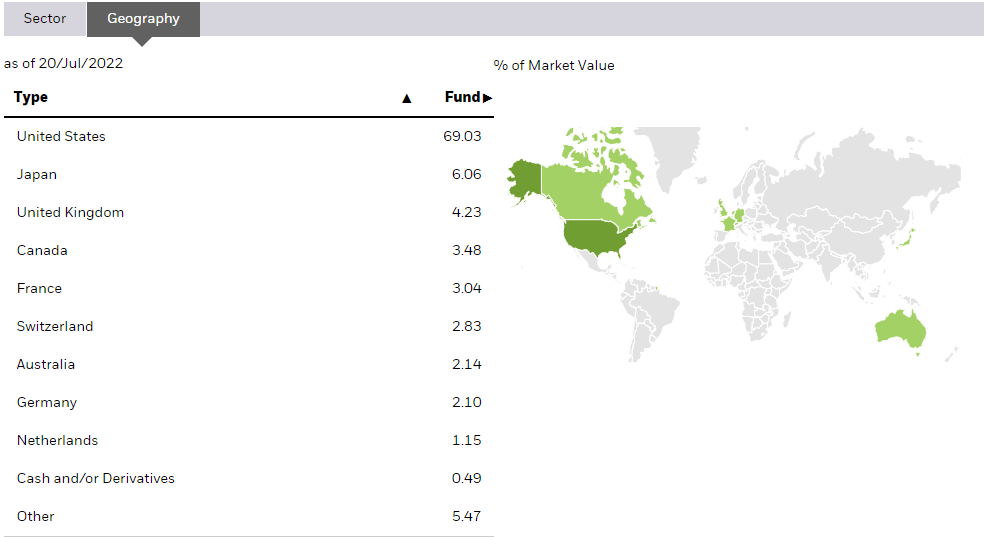

Here’s a screenshots of the geographic distribution of IWDA from the iShares website:

As you can see in the image, the main difference between IWDA and VWCE / VWRL is that IWDA only covers developed countries.

IWDA is an accumulating fund (reinvests the dividends) and has a slightly cheaper total expense ratio of 0.2%.

It’s one of the most commonly used ETFs by European investors, as it’s a straight-forward solution to achieve a thorough exposure across countries and sectors in the developed world.

IWDA vs VWCE?

Since many of the characteristics are based on personal preferences, I’ll only compare the objective parameters for both ETFs:

Diversification: VWCE wins

VWRL invests in over 3700 companies across 50 countries. IWDA invests in over 1500 companies across 23 first-world countries.

Cost: IWDA wins

IWDA’s TER is 0.2% while VWRL’s TER is 0.22%.

Conclusion: Undefined.

No surprises. It always comes down to “it depends”. The inclusion of emerging markets and picking distribution policies comes down to personal preferences.

Can an Investor Do Better?

Both IWDA and VWCE are great ETFs, but seasoned investors should not disregard the importance of keeping expenses low.

Thus my answer to the VWRL/VWCE vs IWDA dilemma is:

Neither.

The attachment to a one-fund portfolio, given the available alternatives, seems like an emotional decision rather than a rational one.

My recommendation: build a portfolio using multiple cheaper ETFs.

Multi-ETF is Superior to Both IWDA and VWCE

1. The Cost

First of all, there are ETF that cover the greater part of IWDA’s and VWRL’s portfolios, and cost only 0.07% (CSPX, VUSA, IUSA).

Given that they’re ~3 times cheaper, this should be the first indicator that we can do better in terms of costs. Actually, if you combine a handful of ETFs, you can achieve the same allocation and performance as any global ETF for a fraction of the cost.

Here’s a sample portfolio that would perform similarly to VWRL:

- 62% VNRA (Vanguard FTSE North America UCITS ETF), TER of 0.1%

- 15% IMEA (iShares Core MSCI Europe UCITS ETF), TER of 0.12%

- 12% EIMI (iShares Core MSCI EM IMI UCITS ETF), TER of 0.18%

- 6% SJPA (iShares MSCI Japan ETF), TER of 0.15%

- 5% VDPX (Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF), TER of 0.15%

Or an alternative one targeting developed markets:

- 85% CSPX (iShares S&P 500 UCITS ETF), TER of 0.07%

- 15% IMEA (iShares Core MSCI Europe UCITS ETF), TER of 0.12%

It drops certain regions/countries but keeps it simpler and drastically cheaper (total expense below 0.1%).

2. Geographical Exposure

All these ETF cover specific regions of the world, which means each of them separately is less diversified than IWDA or VWRL.

However, investors can achieve a similar geographical exposure by including ETFs to cover the regions of interest. As we did above, this may mean CSPX for the US, IMEA for Europe, SEMA/EMIM for emerging markets, etc.

So buying the more expensive ETF just to avoid rebalancing once per year sounds irrational to me, but I understand that some investors still want to pay for simplicity of having a one-fund portfolio.

3. Asset Allocation Flexibility

Going with multiple lower-cost ETFs greatly increases your flexibility regarding allocation choices.

If an investor prefers a higher US allocation than the one offered by VWRL, he’ll need to buy an extra US ETF and “overdiversify”. Instead, going with CSPX/IMEA from the start, he can choose how much US/EU exposure is adequate. And you can choose whether you want to lean more towards IWDA or towards VWRL, by adding an EM ETF or not.

When unsure, ask yourself the following question: would I invest in New Zealand if it weren’t a part of VWRL?

In Summary

Everyone is free to choose what they value most, but there’s a fact that can’t be ignored:

A long-term passive portfolio will perform best over the decades if it’s optimized for a single parameter:

The cost.

My preferences aside, I’d still recommend VWCE and IWDA to beginners that just “want to be done with it”. No asset allocation concerns, no rebalancing, and no burden of dividend taxes.

But for the seasoned investors that got attached to holding a single ETF – I recommend giving a 2-3-fund portfolio a chance.

To read why I prefer CSPX to other US ETFs (such as VUSA or IUSA), click here.

Further Reading

If you want more amazing posts on UCITS ETFs, check out the following links:

- Replicating VWCE – Optimize for Cost and Performance

- Core Portfolio for EU Investors (ETF Selection & Tips)

- CSPX vs VUSA vs IUSA – My Thoughts

- The Best Emerging Market ETFs for Europeans

- Northern Trust Funds vs ETFs – Full Comparison

- CSPX vs SXR8 – What’s the Difference

For more intermediate EU investing posts, visit: EU Investors Handbook.

If these posts are too advanced for you, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer