Self-custody gives people total control over their digital assets without having to trust anyone.

Ownership without trust is something that has never been possible in human history until now. And yet, many ignore it – even investors with hundreds of thousands in the cryptocurrency market.

In this post, I’ll cover why and how a person should take control and responsibility over their digital assets.

“Not Your Keys, Not Your Coins” Explained

The actual ownership of a crypto wallet boils down to having the private keys that control it.

Period.

When you buy crypto on an exchange, you don’t really have any control over your assets. The exchange does – they have the keys to the wallet where the cyrpto actually is.

What you have is their promise that, when you ask them to, they will allow you to transfer it or trade it for FIAT money.

So you need to trust them that they won’t break this promise.

And this relationship can last for years, even with a happy ending for many… But technically, you’re at the mercy the exchange.

Technically, you don’t own your crypto.

Crypto Exchanges vs Self-Custody

Any exchange that you gave your coins to (i.e. where you hold your assets) can literally freeze your account, pause withdrawals, or simply disappear with your money. These actually happen more often than you’d expect.

I often hear arguments that a certain exchange is “established”, “reputable”, “not a ponzi”, “not a scam”, etc.

Nothing wrong with having an opinion about who you trust.

But let’s not pretend that it doesn’t boil down to trust.

“Reputable” Exchanges

Okay, let’s say we’re 100% sure that the exchange of choice won’t run away with our money, although technically they can.

What we can’t be sure of is that the exchange itself won’t suffer from a third-party attack, commonly referred to as “get hacked”.

We can’t be sure that your password and 2FA won’t be bypassed by a social engineer, commonly referred to as “a hacker”.

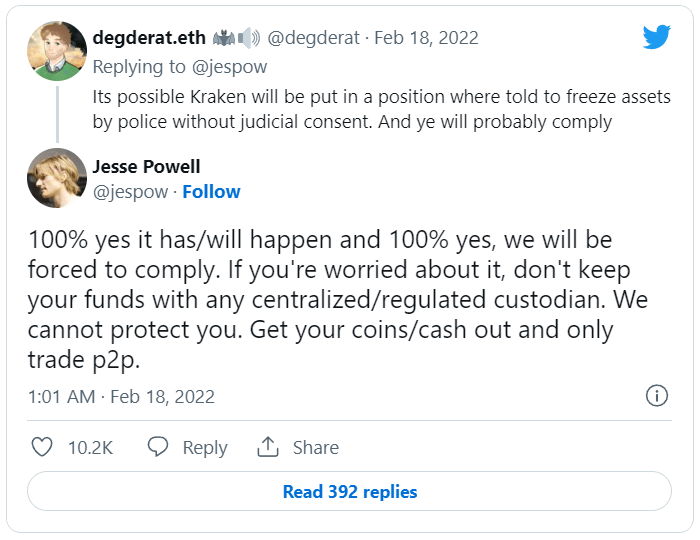

We also can’t be sure that the local government won’t tell them to “freeze all accounts of residents of country X” and they’ll be forced to comply in order to stay in business.

And this isn’t only applicable to third-world dictatorships or only to crypto exchanges… Western governments also use these tactics in traditional markets, for example Canada freezing bank accounts of its citizens for protesting.

Whatever I say here, I won’t communicate it better than Jesse Powell, the former CEO of the crypto exchange Kraken:

And worth mentioning, when you give your coins to platforms that generate “passive income”, you are even more vulnerable.

On top of everything I mentioned so far, you also bear the risk of the platform going bankrupt, as they’re taking financial risk (like Voyager, Celsius, BlockFi, FTX, QuadrigaCX, etc.). And if they do, to get your money back you’ll need to trust lawyers and judges, the bankruptcy laws of a (foreign) country, the legal framework that doesn’t care about your well-being, etc.

The solution to avoid all of this is simple: take ownership of your assets.

How to Self-Custody

The ownership of a crypto wallet boils down to having the private keys that control it.

A private key is a string of alphanumeric characters that allow users to access and use the funds in a crypto wallet.

Many beginners are afraid to start with self-custody because they think it’s too technical/complex/difficult.

It’s not – crypto is now more mainstream and there are many user-friendly solutions available.

It basically boils down to using a non-custodial wallet – a software you can use your private keys with to enjoy full control over your assets.

Such examples are Exodus (multi-currency wallet, available as a standalone application), Electrum Wallet (the go-to Bitcoin-only wallet), MetaMask (the most popular wallet for Ethereum and EVM compatible networks, available as a browser extension), and many others.

The Seed Phrase – Your Proof of Ownership

A seed phrase is a sequence of English words, usually 12 or 24, which can be used to regenerate your private key.

Remembering/having these words means that you’ll always be able to access the digital assets on that address.

The seed phrase, and thus the ability to control your assets, lives in your head.

Not on some server of a company and not in your laptop.

This makes your digital assets independent of the specific software. If it stops being supported, you just import your seed phrase in another wallet and you’re all set!

It also makes you unaffected by hardware malfunctions of your laptop or phone. You just import your seed phrase using another device and you’re good to go!

But most importantly, you’re also not affected by bankruptcies, negligence, centralized hacks, or border control bullies trying to meddle with your money.

In summary and without getting too technical, ownership of your seed phrase means ownership of the address it controls. And although not the same, the term “seed phrase” became synonymous with “private keys” because of how practically similar they are.

The one and only thing that you should do is not share your seed phrase with anyone.

Because whoever has those words, has total control over the assets they control.

The Last Steps to Self-Custody

This is the simple part.

Upon set-up of your non-custodial wallet, it will provide you with an address you can deposit to. Do the following steps:

- Log in to the exchange which controls your crypto

- Click withdraw all

Congratulations!

You’re finally an actual owner of your digital assets.

Further Reading

After you got accustomed to being your own bank, I’d suggest looking into the following concepts:

- Better protection of your seed phrase (i.e. use paper rather than a digital copy, don’t save it on your phone, don’t share it digitally, etc.)

- Hardware wallets – standalone offline devices that hold the private keys (i.e. the words will never be exposed to a machine connected to the internet)

Remember, understanding the concept of “not your keys, not your coins” is of paramount importance as your crypto portfolio grows.

Conclusion

Once you own your assets, absolutely no one can interfere between you and your wealth.

And when third-parties decide to leverage their monopoly on violence to enslave you, they’ll endure defeat.

Actually, this is exactly what happened when the oppressive regime of Canada asked the non-custodial wallet provider Nunchuk to “freeze” users’ accounts.

This is the response they got:

Nunchuk is a self-custodial, collaborative-multisig Bitcoin wallet. We are a software provider, not a custodial financial intermediary.

We also do not hold any keys. Therefore:

- We cannot “freeze” our users’ assets.

- We cannot “prevent” them from being moved.

- We do not have knowledge of the existence, nature, value and location of our users’ assets. This is by design.

Please look up how self-custody and private keys work. When the Canadian dollar becomes worthless, we will be here to serve you too.

Beautiful.

Remember: having full control over our money is the ultimate value proposition of cryptocurrency.

Husband & Father

Husband & Father  Software Engineer

Software Engineer