Category: Cryptocurrency

$1M in 10 Minutes – Exploiting Market Inefficiencies on Polymarket

Disclaimer: I didn’t do this and I’m not a part of a group that did this – it’s all hypothetical. The goal of this post is to illustrate how knowledge about a specific event can help you spot inefficiencies even in highly liquid markets and potentially get an edge. Introduction I prefer my writing to …

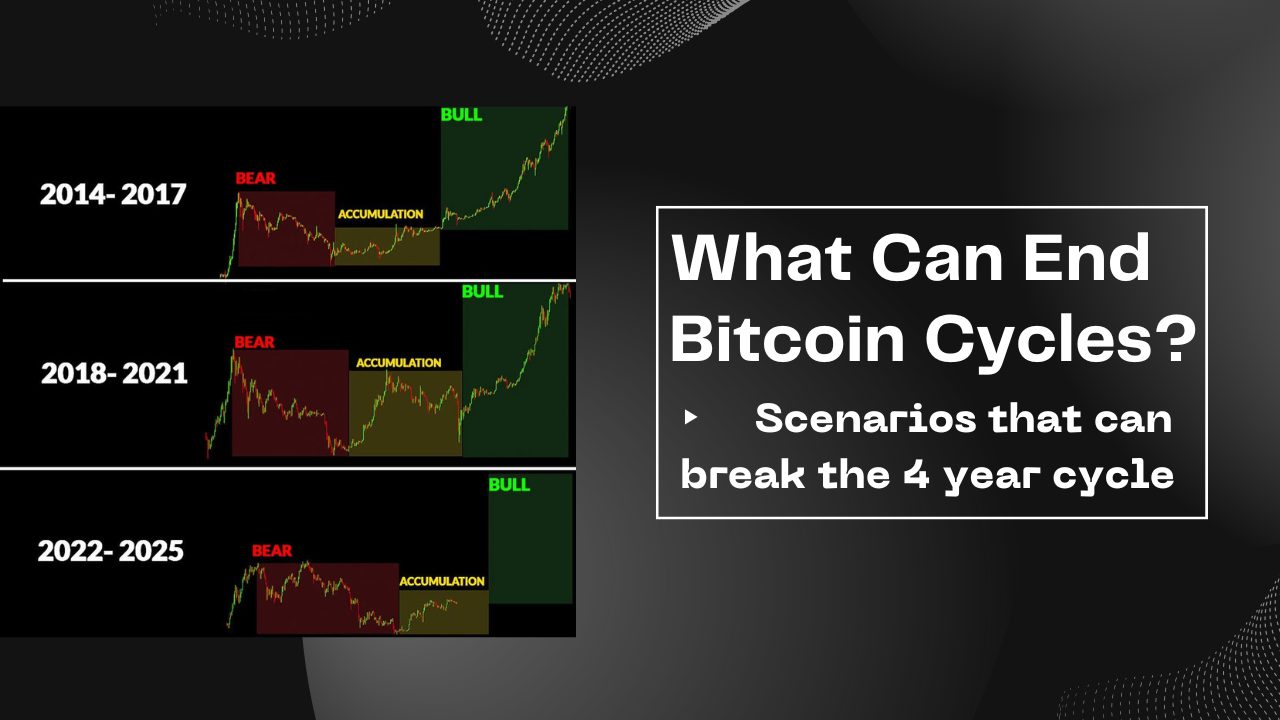

Why I Stopped Covering “The Cycle”

Let’s address the elephant in the room first: Yes, the 4-year cycle thesis is playing out once again. As someone that serially leveraged the cyclical nature of the Bitcoin market to maximize my returns, I was quite vocal about it during the bear market: The 4 Year Cycle Explained How I Accumulate Bitcoin During Bear …

Can the 4 Year Cycle Break?

If you’re aware of 4 year cycle, you practically have predictive power over Bitcoin’s price performance without relying on luck. And you might wonder whether the “cycle is dead” or if we’re in a “supercycle”. Personally, I think that the 4 year cycle will remain intact for the foreseeable future. But not forever. There are …

I Bought an Apartment in Dubai with Crypto

This happened, ladies and gentlemen. I bought an apartment in Dubai, fully remotely (from the Netherlands), and I paid with USDT. But how did we get there? After a few good years in the market and hefty profits, we were sitting on a large pile of cash that needed to be utilized. With the yield …

Teleport Assets By Remembering 12 Words

Throughout history, many people lost assets through violence, coercion, or corruption. And it’s a sad reality that in many places and cases, people can still be stripped off everything they’ve worked for. In this post, I want to cover a few examples of inability to use the money that we’re convinced we own, especially in …

Exit Into What? The Curious Case of Bitcoin

Whenever I present Bitcoin to a seemingly curious disciple, an infamous question always pops up: “And did you sell?” It’s disappointing but I don’t hold it against them. Bitcoin aside, a person without investing experience has no preference of holding assets to worthless cash. Most people think in terms of “making money”, effectively asking whether …

5 Cold Storage & Hardware Wallet Misconceptions

Many beginners to self custody are at risk of making expensive mistakes due to lack of knowledge. Although I’ve covered best practices at length, I want to write about the most common misconceptions beginners have regarding cold storage. If you’re new around here, this post might save you hundreds of thousands down the line. 1) …

Why You Can’t Create “The Next Bitcoin” (The Network Effect)

Every cycle, there are people that claim that their favorite crypto project will be “the next Bitcoin”. Usually this is because their choice is faster, cheaper, more private, or better in any arbitrary parameter that they value. This is unrealistic and misleading. I won’t debate whether those attributes make a blockchain “better” or not. Let’s …

Cold Wallet vs. Hot Wallet (Hardware & Software Wallets)

I keep getting questions whether it’s worth it to buy BitBox02 or Keystone 3 Pro if they already use MetaMask/Exodus/TrustWallet and have written the seed phrase on paper. Yes, it’s absolutely worth it. In this post, I’ll explain a few benefits and protections you gain with hardware wallets that hot wallets don’t offer. But first, …

Bitcoin Mining Isn’t “Solving Difficult Math Problems”

The common way content creators explain Bitcoin mining to their audience is: “… Miners are solving difficult math problems…” This is false and misleading. Nobody is “solving difficult math problems” or the even cringier version “difficult mathematical equations“. Please share this post with anyone claiming to be an educator and using such terminology. What is …

Recover Accounts on Different Hardware Wallet

Although I regularly cover hardware wallets and the seed phrase management on my blog, there is one concern that I’m often asked about. I’d paraphrase/summarize it as: “If my hardware wallet malfunctions after the company goes bankrupt, will I lose my money?” And the answer to that question is: no. As long as you have your …

Can Bitcoin Reach One Million Dollars?

Can Bitcoin reach million dollars? Undoubtedly! Probably not this cycle, but why am I so sure that it’ll happen at all? Well, let’s forget about Bitcoin for a moment. Let me take you on an eye-opening journey… And by the time you’re done reading, you’ll be as certain as I am. House Prices in 1963 …

Why I Don’t Like the Term “Hardware Wallet” – Signing Devices and Keychains

As most of you know, hardware wallets are devices that give users total control over their digital assets. I cover this in detail in my security posts and in the self custody manual for beginners. So let’s start with a quick recap: What is a Hardware Wallet? In an oversimplified summary, a hardware wallet is …

My Hardware Wallet Recommendations: BitBox02 & Keystone 3 Pro

I write about self custody and security a lot on this blog. The holy grail of securing digital assets is using a hardware wallet. And I’ve compared most with each other: Trezor, BitBox02, Ledger, Coldcard or the Keystone 3 Pro review. In this post, I’ll give my summary and recommendations: BitBox02 & Keystone 3 Pro …

Bitcoin Exit Strategy (Cycle Based Rotation)

If you were smart and accumulated Bitcoin during the bear market, you’re sitting on a massive gains so far. Of course, most of us understand the benefits of being a long-term holder. You get Bitcoin’s inevitability and that it’s an antidote for inflation and the money printer. Still, some of us are also aware of the …