The Total Expense Ratio (TER) is the annual cost an investor pays while investing in a fund.

From Investopedia:

The total expense ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund. These costs consist primarily of management fees and additional expenses, such as trading fees, legal fees, auditor fees, and other operational expenses.

TER (Total Expense Ratio): Introduction

The TER is basically a management fee. It is not an “extra cost” you’d need to pay in cash year after year, but an amount that will be automatically deducted from your portfolio by the fund.

Every fund, whether it’s a mutual fund, index fund, or an ETF, will have an ongoing charge – the total expense ratio.

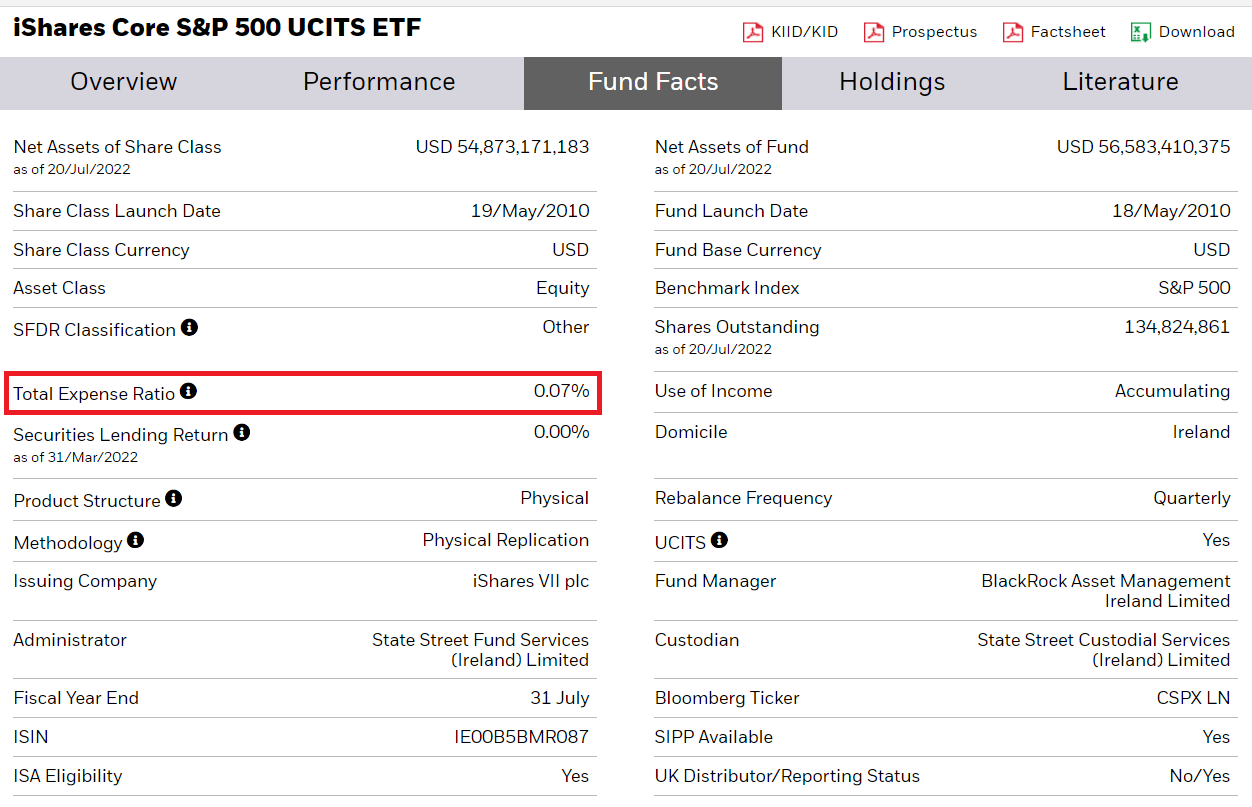

It is represented in percentage terms and can be found in the prospectus for any fund you’d be researching. Here’s an example of BlackRock’s S&P 500 UCITS ETF:

The Key Facts for the $CSPX ETF, highlighting its low TER of 0.07%

Note that the less involvement the management of a fund requires, the cheaper it will be. So index trackers will always be cheaper than actively managed funds.

Of course, as a “passive investor”, you’re not really interested in those anyway… But it’s worth mentioning that there are funds charging as high as 2% per year.

Why is a Low TER so Important?

Let’s take a look at two funds that yield the same hypothetical returns, but one is more expensive than the other.

Let’s say we’re investing $100k in a lump-sum manner for a 20 year time horizon, assume a 10% yearly return, and we will ignore taxes.

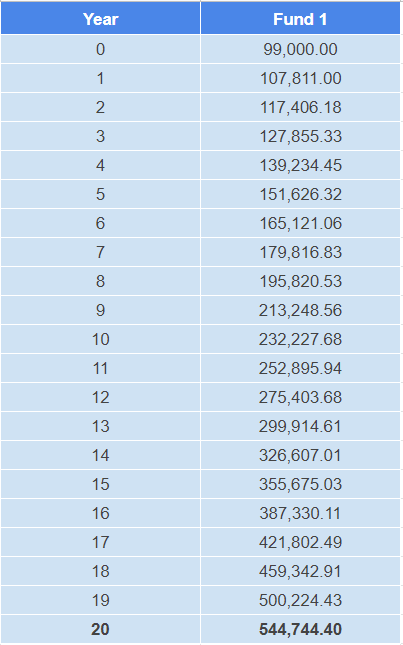

Fund 1

The first fund has a 1% entry fee, an ongoing TER of 1%, and eventually, a 1% exit fee.

- So, 100,000$ – 1% entry fee = 99,000$

- After 20 years, at 10% growth and 1% management expense per annum, the 99,000$ would be worth 544,744$:

Calculation: X = X-1 * 1.1 * 0.99

- When withdrawing the amount, we pay a 1% exit fee and we’re left with 539,296$.

Fund 1 final value: 539,296$

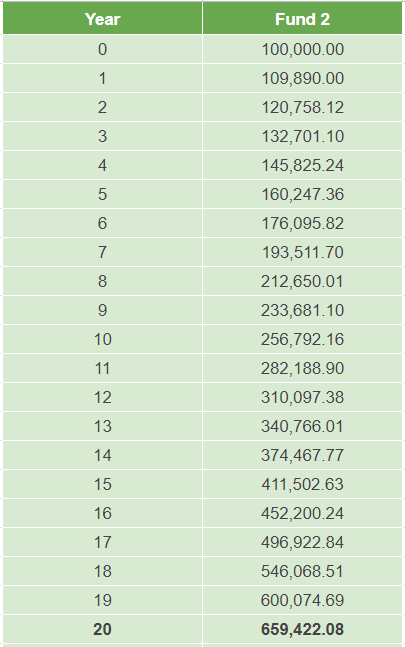

Fund 2

The other fund has no enter and exit fees, but just an unavoidable expense ratio of 0.1%.

- After 20 years, at 10% growth and 0.1% expense per annum, the $100k would be worth 659,422$.

Calculation: X = X-1 * 1.1 * 0.999

Fund 2 final value: 659,422$

Conclusion

in summary, the greater the expense, the lower your returns will be.

If you invest in a fund with a TER of 2% and your investment grows 10% during the year, your actual return would be only 8%.

As mentioned earlier, index-tracking funds’ costs are rarely that high. However, we see that even a seemingly small difference of sub-1% can make a drastic difference in your portfolio’s performance over the years.

In this post’s example, they made a difference of more than $100k.

So remember, there is a single parameter that will determine how your portfolio will perform over the long run:

The cost.

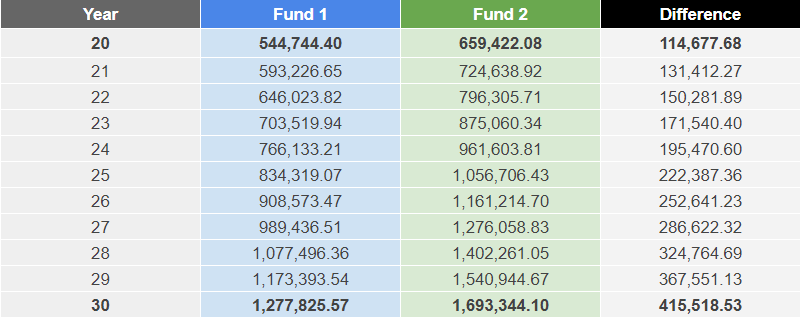

Difference After 30 Years

And it gets worse as time goes by.

Below is the difference in performance of the next 10 years:

Difference in performance of a fund with 1% TER (Fund 1) and a fund with 0.1% TER (Fund 2)

And note, the TER is just one type of cost.

To learn about the rest of them, head to All Investing Expenses – Full Breakdown.

To kick-start your stock market investment journey, visit my free resource: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer