The Northern Trust index funds are quite popular with Dutch investors.

Due to their low costs, tax optimization, and availability at the local banks, many investors from the Netherlands prefer the Northern Trust (NT) funds over ETFs.

In this post, I’ll compare the total cost of a portfolio of NT funds with the alternatives.

Northern Trust Funds and the Banks

The Northern Trust Funds aren’t available directly to retail investors.

However, Dutch residents have an easy way to invest in these funds through the three major banks (ING, ABN Amro, Rabobank).

Thus, the total cost of investing in Northern Trust index funds can’t be analyzed in isolation. We must consider both the costs of the funds and the costs charged by the banks.

Dutch Banks’ Costs for Investors

All Dutch banks charge fees as a percentage of an investor’s portfolio. I already did the comparison and will publish it in a separate post.

In summary, if your portfolio is below €265k, ABN Amro is the cheapest option. Thus, I’ll use it for the calculations below.

For the purposes of this post, I’ll assume a €200k portfolio, as most beginners’ portfolios would be below this amount.

Why People Choose NT Funds?

Why would anyone invest in Northern Trust index funds, if there are extra costs by the banks?

The main selling point, and the reason why they gained popularity, is because of their tax optimization.

Basically, you can recover the dividend leakage. Make sure to read my post on it if you don’t know what it means.

In an oversimplified summary: it represents withheld dividend taxes when companies make their distributions to the fund.

Comparison: Northern Trust Index Funds vs ETFs

Before we can make a comparison of the total cost, we need comparable portfolios.

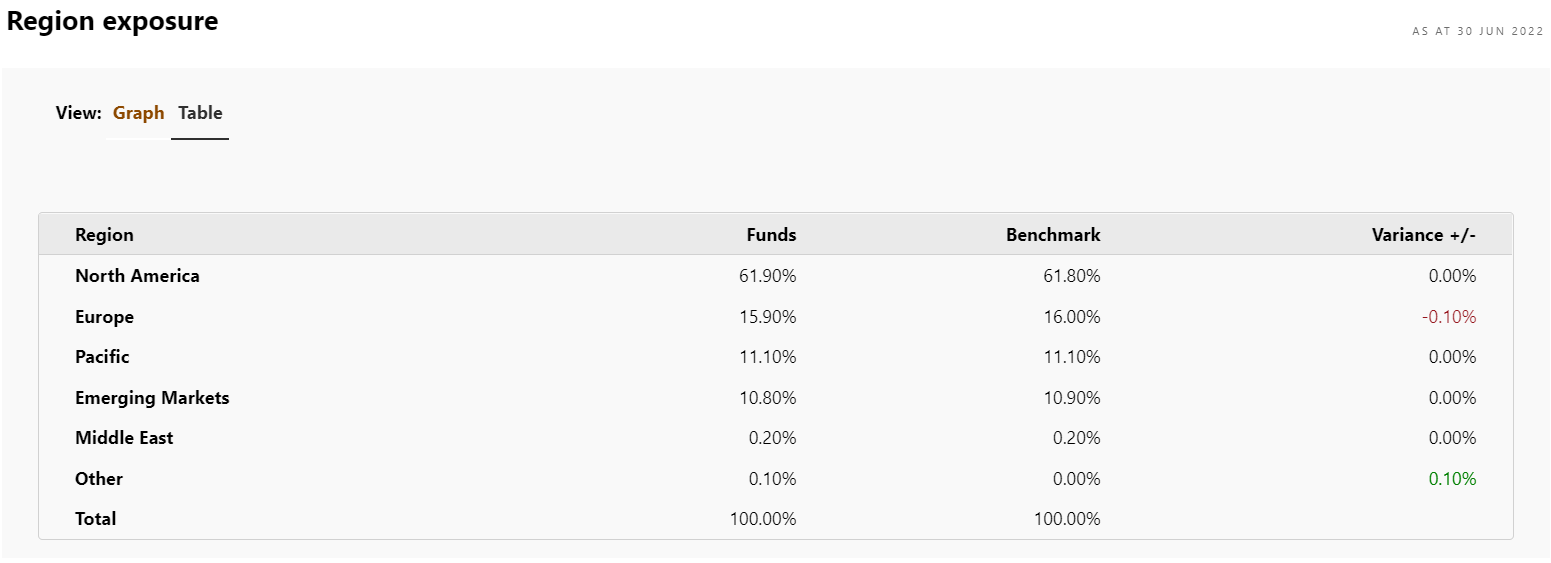

The go-to approach for Dutch investors is replicating VWRL/VWCE. As you probably already know, $VWCE is a globally diversified ETF with the following regional distribution:

As you can see, the developed/emerging markets allocation is roughly 89/11%. This is usually simulated by combining the following NT funds:

- 89% Northern Trust World Custom ESG Equity Fund (ISIN: NL0011225305)

- 11% Northern Trust Emerging Markets Custom ESG Equity Index (ISIN: NL0011515424)

Some investors also prefer to include the Northern Trust World Small Cap ESG Low Carbon fund (ISIN: NL0013552078). But for simplicity, we’ll focus on a two-fund portfolio.

VWCE: All Expenses Breakdown

1) VWCE: TER

The total expense ratio of $VWCE is 0.22%.

On a portfolio of €200k, this is €440.

2) VWCE: Dividend Leakage

The other cost is more implicit – the dividend leakage. As mentioned above, this is an amount that “leaks” when the companies pay out dividends to the fund.

The current dividend yield of the constituent companies is around 1.6%. This can be seen in the payout details of $VWCE’s distributing equivalent, $VWRL. Keep in mind that this amount varies based on the share price, but 1.6% is a good representation of the mid-term average.

Dividend leak means that around 10-15% of the dividend amount would be lost in taxes. The exact number depends on the internal allocation of the fund and the treatment of dividend across countries. I’ll use 12.5% for the calculation, as a good average.

12.5% (irrecoverable dividend tax) of 1.6% (dividend yield) is 0.2% (dividend leakage).

On a portfolio of €200k, this amounts to €400.

Again: this amount is variable. I will address the importance of this in a commentary at the end of this post.

VWCE: Total Cost

So the real total cost of $VWCE would be the TER + dividend leak. There are no additional costs, as Dutch investors can purchase this ETF at DeGiro, where it’s a part of the Core Selection (i.e. ETFs without transaction costs).

The total annual cost is the sum of the:

- Total Expense Ratio (€440)

- Dividend Leakage (€400)

So the total cost of a $200k portfolio invested in $VWCE is around €840.

Total Cost: €840.

Percentage-wise: 0.42%.

Northern Trust Funds: All Expenses Breakdown

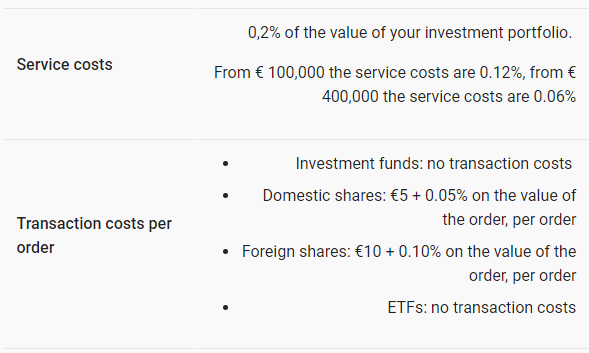

1) Bank Investment Account Expenses

As mentioned earlier, Dutch banks charge a fee as a percentage of the investor’s portfolio.

ABN Amro’s costs are as follows:

- 0.2% of the amount up to €100k

- 0.12% of the amount between €100k and €400k

- 0.06% of the amount over €400k

From ABN Amro’s website:

Thus, an investor with a portfolio of €200k would have the following costs for his investment account:

- 0.2% of the first €100k (€200)

- 0.12% of the second €100k (€120)

Total Bank Cost: €320

2) Fund Expenses

Northern Trust World has a TER of 0.15%. Northern Trust Emerging Markets has a TER of 0.25%.

Given their respective allocations (89% and 11%), the total expense ratio of this portfolio would be: .

Total Fund Cost: 0.16%

On a portfolio of €200k, this would be: €320.

Northern Trust Fund: Total Cost

All costs associated with owning a Northern Trust index fund with ABN are:

- Bank investment account costs (€320)

- TER (€320)

The total annual cost of a $200k portfolio invested in the Northern Trust funds is around €640.

Total Cost: €640.

Percentage-wise: 0.32%.

Conclusion 1.0: Northern Trust Funds vs VWCE

Investing in NT Funds is cheaper than $VWCE.

Even after the costs from the banks it, comes down to 0.32% vs 0.42%.

And the biggest contributor to this is the recovery of the dividend leak.

Commentary: Unfair Comparison

The appeal of $VWCE comes from the fact that it’s the usual candidate for a one-fund portfolio.

So if the alternative is managing a portfolio of multiple funds, we need to price this in.

For example, in my post Replicating VWCE, I gave an example portfolio that has the exact same allocation as $VWCE, but is twice as cheap. I also give ideas on how to decrease the TER even further, for some sacrifices in diversification. And this can get the expense even lower than those of the Northern Trust Funds.

Also, if an investor isn’t married with the internal allocation of $VWCE, he can check the examples at the Core Portfolio for EU Investors – which lower the costs even further. Most such portfolios (i.e. those that have $CSPX as a core component) are cheaper alternatives even after the dividend leakage.

My point: different portfolios would have different dividend leaks, so these need to be considered independently.

Also…

The dividend yield is not fixed.

It is basically the amount paid out per share divided by the price per share.

So, if a company’s share price falls, the dividend yield would be higher. If a company’s share price rises, the dividend yield would be lower. The latter would make the costs of ETFs more favorable.

It’s simple:

- Lower dividend yield leads to lower dividend leakage.

- Lower dividend leakage leads to lower total cost.

So realistically:

Conclusion 2.0

It depends.

VWCE/VWRL is not the only alternative to the NT Funds.

Actually, I think that investing in both $VWCE and the Northern Trust Funds is unnecessarily expensive and should be avoided.

Check out my Core Portfolio recommendations to get some preferable ideas.

But if we strictly compare Northern Trust Funds vs $VWCE, the NT funds through a bank should remain favorable. There’s a reason why the banks can charge such amounts – if it made no sense, every long-term investor would switch to DeGiro or IBKR.

Every portfolio deserves a dedicated evaluation.

Your Turn

Have you thought if index funds are a better fit for your portfolio than exchange traded funds?

What did you end up with?

Let me know in the comments below!

For more thorough posts on investing from Europe, visit: EU Investors Handbook.

For a comprehensive, beginner-friendly, and free resource on stock market investing, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer