You’ll never self-actualize if you allow fear to subdue you into paralyzing risk-aversion.

This post won’t necessarily show you where to start, but it will clearly show you why you’re in the position you’re in.

Follow the 5 levels below and figure out the decisive factor that prevents you to employ your past productivity (i.e. money) to work for you indefinitely.

Rules of the game

This post will include 5 levels to help you find the reason why you’re risk-averse a wuss.

The level that you relate to is the first line of resistance you need to overcome for an abundant future. So, in case you want to change your financial habits, you’ll know where to look and also how to proceed.

See where you stand. 👇

Level 1 – I Don’t Have an Income Stream

Understandable. If you don’t have a job or any type of income stream, investing has to be postponed for later.

The good thing is that you’ll have to overcome this stage anyway because you’ll be stuck in an unsustainable model of reality. Eventually the bubble will burst – so don’t leave it inflate.

How to overcome level 1?

Get a job, preferably in a field you can build a career in.

Level 2 – I Can’t Save Money

You’ve heard it before “it’s not how much you earn, it’s how much you save”.

While I think that pointless saving is for suckers, when you’re starting off, saving is the most important thing you can do. At the end, if you earn $500k and spend $510k per year, you’ll be poor and in debt.

So yes, the next step to overcome investing fear is to have something to spare at the end of the month. Any amount is fine. Every $ you save is way better off invested than in a savings account. Read about how much of a difference it can make in this post.

If you’re stuck at this stage, I’d suggest working on both sides of the spectrum: try to maximize your earning potential or cut your spending. Bonus points if you don’t sacrifice lifestyle along the way.

How to overcome level 2?

Don’t spend 100% of your income – cut dumb expenses and/or increase your marketable competences.

Level 3 – I’m Saving For Something

Beyond the normie-friendly activities of earning and saving, we can go in more depth.

The level 3 is self explanatory. If you’re saving for a planned expense, such as buying a home or a T-shirt, then you know your reason for not entering the market.

Not much to say here, it’s a matter of priorities and lifestyle.

However, after you do your purchase, don’t forget the healthy habits you developed in order to stack them cents. If you were enjoying your standard of living, keep it up after your purchase. After establishing an emergency fund (1-12 months worth of expenses), there’s not much to do but investing the rest.

Think about it, with no big expenses coming your way, you shouldn’t feel that big of a difference when having $30k or $100k in cash. But you will feel a difference if you invest the excess amount. To give you some motivation: imagine ending each month with an amount 5-10x your salary, after accounting for all expenses.

And all you need is just a little bit of patience.

How to overcome level 3?

Don’t become financially illiterate after a big purchase.

Level 4 – I Have No Interest in Investing

No interest? Time to get some!

Puns aside, what you should fear is the risk you’re taking by basing a life-changing decision on having interest or not. Certain actions are simply the right thing to do. And enduring some discomfort is oftentimes a mean to an end.

On the practical side, what is there to be or not to be interested in? I mean, it’s not like you need to have a deep understanding of finance or valuing stocks… That’s not the case for multiple decades already. The beauty of a lazy portfolio, apart from sharing a characteristic, is that you can literally let people that do have interest run the business, while you’re getting your share of the rewards.

You don’t have to be interested. You just need to be smart.

Buy the market and, to quote Warren Buffet, let diversification protect you against ignorance.

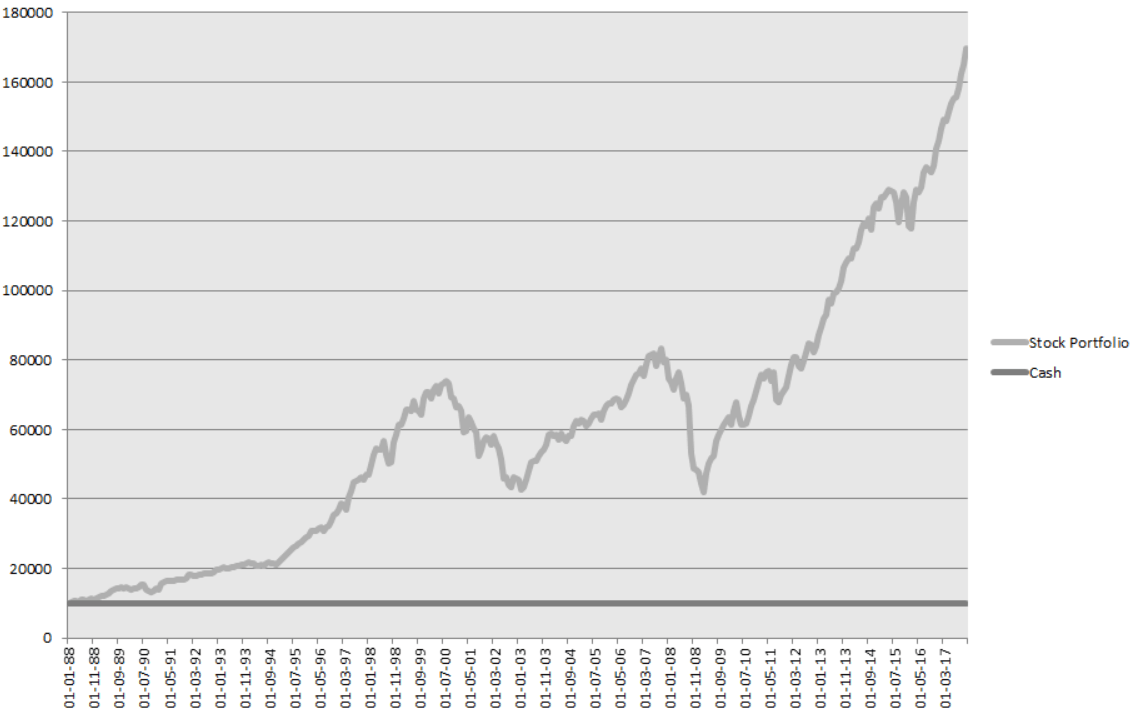

But let me try to spark some interest. Here’s the performance of an inflation adjusted stock portfolio vs a straight line that somehow beat inflation and kept its value over the years:

Check out the post Cash vs Stocks in 30 Years to get a more detailed perspective of this.

Bottom line, a person that sacrifices the scarcest of all resources, that being his time, in order to earn money, can’t afford to be disinterested in growing his wealth. Period.

How to overcome level 4?

Accept the reality – you’re a part of a generous system called capitalism so it’s your best bet to embrace it and make the most out of it.

Level 5 – I Have No Knowledge

Of course you don’t! There is no person that has the knowledge and decides to sabotage his legacy.

Turns out, it was never about fear. It was actually about lack of conditions or knowledge. Hence, I don’t recommend meditation or NLP techniques to overcome fear. I recommend practical steps you can take towards overcoming risk-aversion being a wuss.

And in case the market is too hot for you right now, it’s fine – sitting on the sidelines with cash while waiting for better valuations is better than just sitting on the sidelines with cash. Or you can start cost averaging.

But yeah, you don’t know what that is… So here you go:

How to overcome step 5?

Learn.

And this beginner-friendly guide might be the best free resource to start at:

How to Start Investing: A Complete Beginner Series

Husband & Father

Husband & Father  Software Engineer

Software Engineer