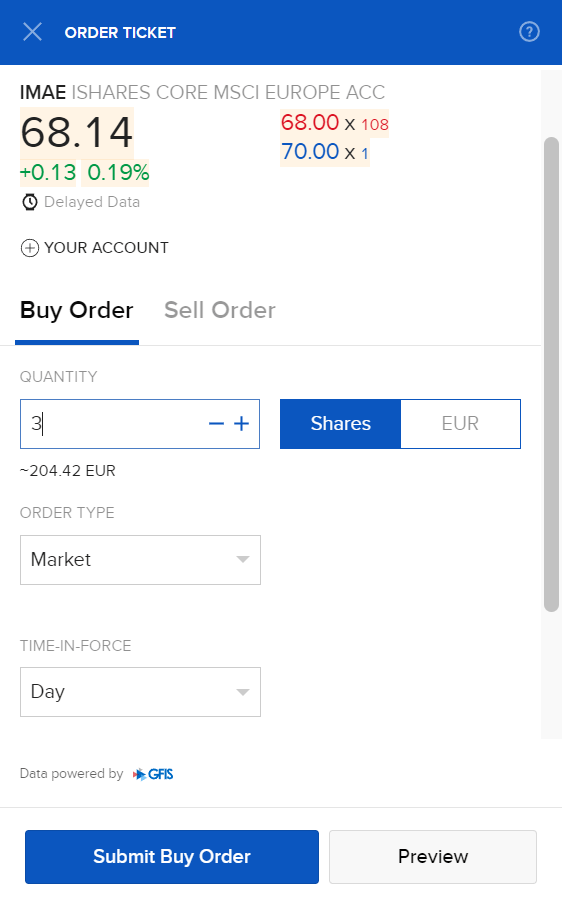

Understanding the terms “market order” and “limit order” becomes crucial once you’re ready to make trades.

If you’re a beginner, making your first buy order might terrify you. We’ve all been there. But it’s much simpler than it looks.

This post is a n00b-friendly introduction to executing a buy order.

Different Types of Orders

When you click buy, you’re presented with a screen that has multiple input fields.

The first thing you should select is the type of order you want to do. For the purposes of this post, these are:

- Market Order

- Limit Order

- Stop Order

Let’s see what each of them mean in more detail:

Market Order

A market order is the simplest order of all.

To execute this type of order, the only field you need to fill in is the Amount.

The amount field signifies how many shares of your chosen product you’re willing to buy.

Let’s say you want to invest $1,000 and a share of your ETF costs $10. This means that you would put 100 in the amount field.

And with most brokers, this is not a calculation you’ll need to do yourself. There’s usually a Total field right beneath it. It automatically calculates the total amount you’d spend if you buy that amount of shares.

Keep in mind, in a market order you’re not specifying your preferred price. So the broker will match you to the best available sell price at that moment.

Here’s how a market order would look like, buying 3 shares of $IMAE on IBKR:

Limit Order

A limit order is one of the most commonly used types of orders.

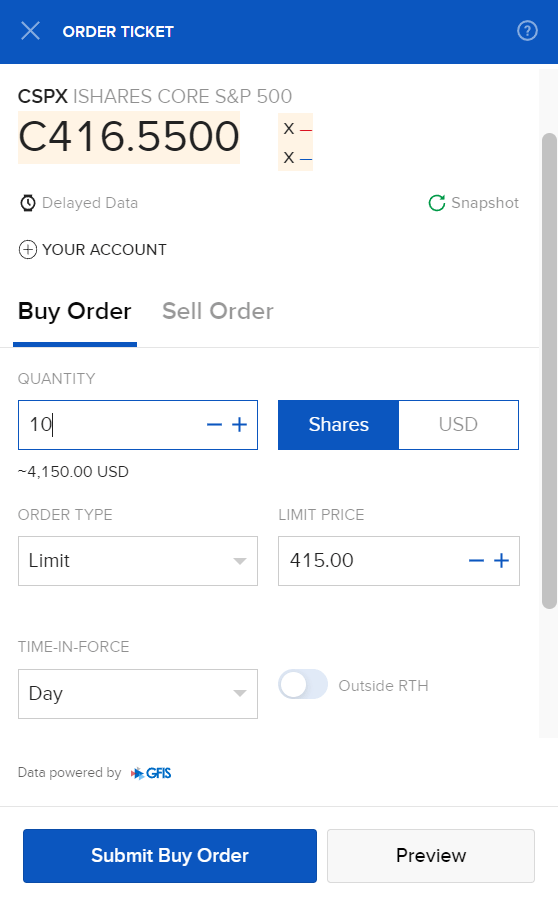

To execute a limit order, you’ll need to fill in the Amount field, but also the Limit Price field.

The Amount field signifies exactly the same thing as in a market order – the amount of shares you’re willing to buy. But besides that, you also specify the Limit Price – the price you’re willing to pay for each share.

Let’s say your ETF is trading at around $10 per share and you’re willing to buy 100 shares at $10, not above. You would put 10 for the Amount and $10 for the Limit Price.

A limit price ensures that you would buy the shares at the price at or lower than the one you specify.

Whenever there is an adequate seller, the broker will match your orders and execute them.

A limit order is “safer” than a market order, especially for larger purchases, because it allows the investor to specify a maximum price.

Note: in the example above, you’re also free to put the Limit Price to $2. However, this order won’t get executed. At the same time, you can also put the Limit Price to $50. In this case, the broker will still match you with the best sell price, which would be around $10. Again, a limit order executes at the price at or lower than the one you specify.

In the example picture below, I’m buying 10 shares of $CSPX for a maximum price of €415 per share.

Stop Order

A stop order is an order that triggers a market order at a price higher than the one specified by the investor.

As a long-term index investor or long-term Bitcoiner hodler you’ll probably never use a stop order. But I still want to cover it just so you know that there’s more than just market and limit orders.

Stop orders are usually used by investors who want to buy a stock “when it recovers”. For example, if the price per share dumped from $20 to $8, an investor might think “It’s probably game over… But if it rises back to $10, I’m buying 100 shares”. Then, he can place a stop order with Amount of 100 and a Stop price of $10. This means that once/if the price reaches $10, there’ll be a market order for the 100 shares.

Similar to a limit order, a stop order may never be executed if the price doesn’t reach the target.

This is not a complete list, but just the simplest of the buy-order types. You can read more about various types and their analogous sell order counterparts here. For the purposes of a long-term passive portfolio, market and limit orders are all you need.

Market Order vs Limit Order

If you understand what each of them represents, it’s really easy to choose what suits your needs.

I usually did market orders for my regular contributions. Given the amount of trading volume, it’s highly improbable that the price will rise significantly between the time I click buy and it gets filled. Moving the market is not something you should be worried about if you’re not buying in the 7 digits.

On the other hand, when I do larger lump-sum investments (or selling larger amounts as described here), I exclusively use limit orders. That ensures that I won’t end up paying higher, which can happen with products with insufficient liquidity or in less efficient markets.

It basically depends on the size of the trade. But if you want to be unnecessarily safe even with small amounts, you can’t go wrong with Limit Orders.

Time-in-Force

Apart from the type of order, you also need to specify the time-in-force.

Time in force represents a time period in which the order will remain active (i.e. can be executed). In case it’s not executed, the order expires after this period.

Here are three examples of timeframes you can choose:

- Good-for-day (GFD, or sometimes a Day Order) is an order valid throughout the current day’s trading hours.

- Good-til-cancelled (GTC) is an order that theoretically will remain active indefinitely.

- Immediate-or-cancel (IOC) is an order that is immediately executed or cancelled.

And similar to what we said about the order types – this is not a full list.

For the purposes of passive investing and maintaining a long-term portfolio, a day order is all you need.

If you still need to nail the theory before placing orders, visit my comprehensive, beginner-friendly, and free resource on stock market investing:

How to Start Investing: A Complete Beginner Series

https://dpetkovski.com/how-to-start-investing-a-complete-beginner-series/

Husband & Father

Husband & Father  Software Engineer

Software Engineer