VWCE won the hearts of many European investors and became the go-to ETF for a one-fund portfolio.

I can see the appeal of that.

You buy a single ETF and you’re done – no need to rebalance, no need to worry about asset allocation, etc.

However, there is another parameter that many investors seem to ignore: the total expense ratio.

In this post, I’ll describe why VWCE might not be optimal for many investors and I’ll provide alternatives.

But first of all: what is VWCE?

VWCE: Details and Facts

Ticker symbols: VWCE, VWRA, VWRP

VWCE (Vanguard FTSE All-World UCITS ETF (Acc.)) is an ETF by Vanguard that’s quite popular with investors from Europe.

The reason for this is because it offers global exposure, but also because it’s an accumulating ETF.

As you already know, it means that it reinvests the dividends received from the underlying companies. This makes it a great opportunity for many investors as it doesn’t create a burden of reporting or paying dividend tax. Thus, it’s usually the preferred option over its distributing equivalent, VWRL.

Back to its global diversification.

As the ETF’s name suggests, it tracks the FTSE All-World index.

The FTSE All-World index is a market-cap weighted measure that tracks over 3700 companies from all around the world. By buying VWCE, you automatically gain both the exposure and the diversification benefits of the index.

It’s worth mentioning that VWCE covers both developed markets (US/EU/CA/AU/JP) and also emerging markets (i.e. emerging Asia, Latin America, Middle East/Africa).

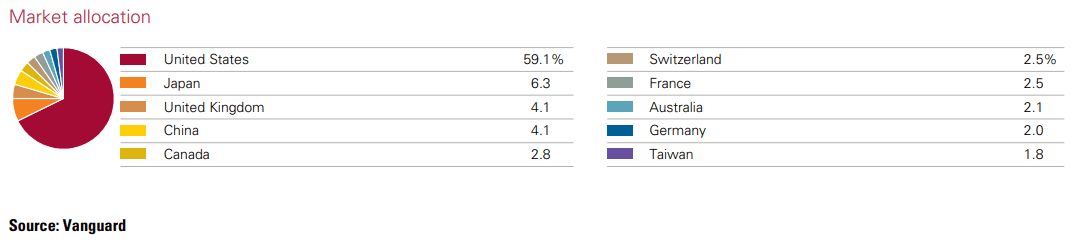

Here’s a screenshot from the Factsheet of VWCE, showing the top countries’ distributions as of July 2022:

As such, it’s one of the few available opportunities where an investor can build an actual “one-fund portfolio”.

Because if you hold VWCE, you know that you’re as diversified as it gets.

Basically, having a portfolio of an ETF that tracks the FTSE All-World is the embodiment of index investing.

And of course, investors love it because of this.

Is VWCE the Best ETF for European Investors?

Based on the previous section, VWCE seems like the perfect opportunity.

It’s indeed a good option for a passive ETF investor. But there’s one thing I dislike about it:

It has an expense ratio of 0.22%.

This is not high in absolute terms, but at the end, we’re buying an ETF that tracks an index. And compared to other such ETFs, it’s on the higher side.

Thus, I’ll attempt to construct a few portfolios which replicate the performance of VWCE while significantly lowering the cost.

Replicating VWCE

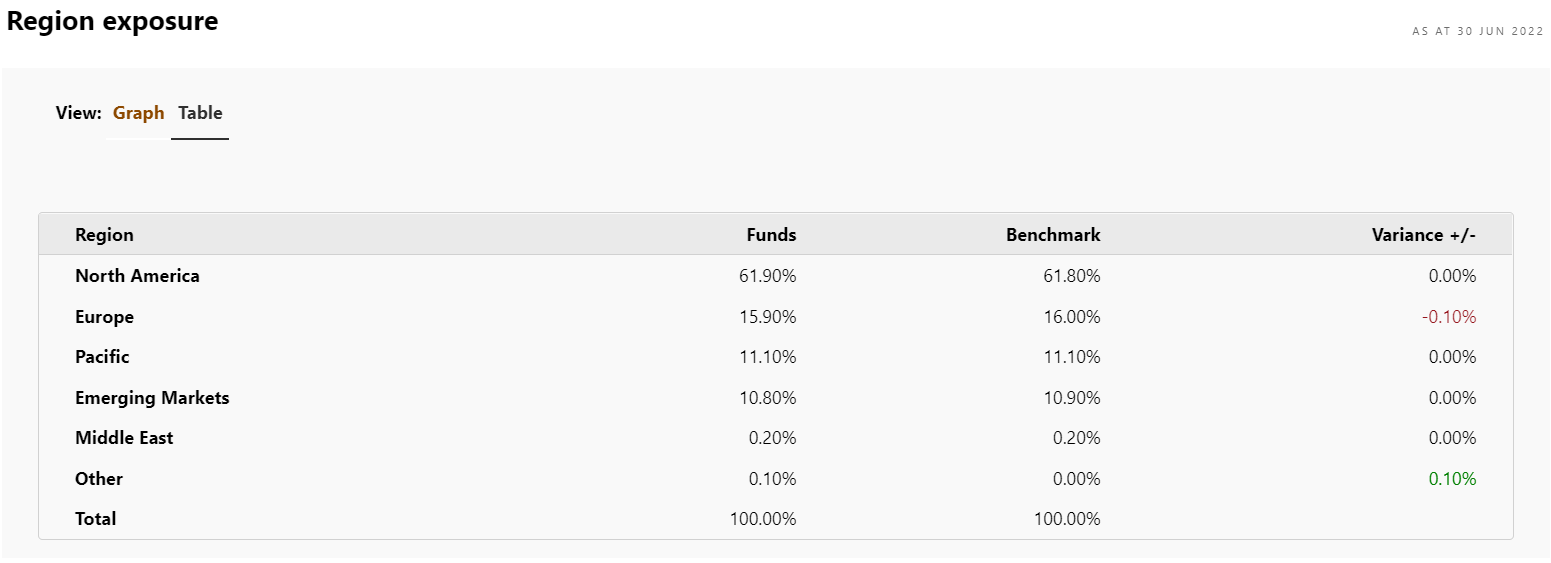

To replicate VWCE, we need to be mindful about its internal geographical distribution.

At the moment of writing, it is as shown in the screenshot from Vanguard’s VWCE page:

The way I’ll approach this problem is I’ll go to justetf.com and look for cheaper accumulating ETFs that track these regions.

If you’re a beginner, it’s a good exercise to learn to do this yourself.

Portfolio #1: Full Replication (Still Expensive)

The most common alternative investors choose is IWDA + EMIM.

- 89% IWDA (iShares Core MSCI World UCITS ETF), accumulating, TER of 0.2%

- 11% EMIM (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

Explanation:

- IWDA is also a globally diversified ETF, but it only tracks the developed markets. It’s also market-cap weighted, so the internal allocation is aligned with the one of DM in VWCE.

- EMIM covers all emerging markets, so there’s no need to look for separate Asia / Middle East / Latin America ETFs. Also, it’s market-cap weighted, so the internal allocation is on point.

This is quite a straight-forward alternative, as we just need to pick $IWDA for the developed markets and $EMIM for the emerging markets.

Given that the EM allocation is quite obvious from the regional exposure of VWCE, constructing this portfolio is quite easy.

If we sum the allocations multiplied by their weights, we get to the total expense ratio of this portfolio:

It has a TER of . (Hover over the number to see the calculation)

This is a bit cheaper than VWCE’s 0.22%, but I’d say it’s still expensive.

Portfolio #2: Full Replication (Cheaper)

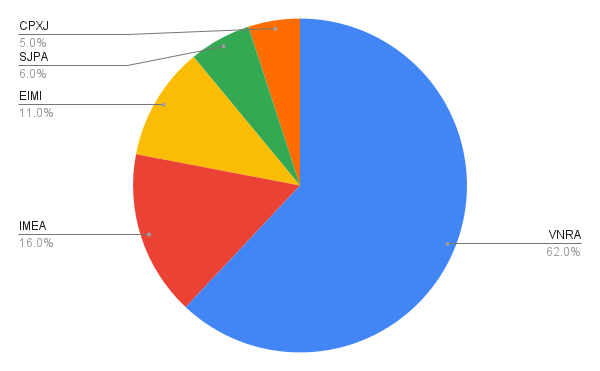

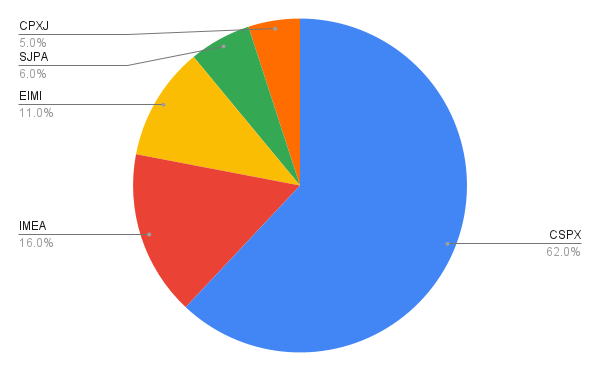

Here’s an example portfolio that’s almost exactly the same as VWCE:

- 62% VNRA (Vanguard FTSE North America UCITS ETF), accumulating, TER of 0.1%

- 16% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

- 11% EIMI (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

- 6% SJPA (iShares MSCI Japan ETF), accumulating, TER of 0.15%

- 5% CPXJ (iShares Core MSCI Pacific ex Japan UCITS ETF), accumulating, TER of 0.15%

Explanation:

- VNRA covers USA and Canada. As it’s also a market-cap weighted index, it means that the internal allocation between the two is on point.

- IMEA covers developed Europe, so that’s self explanatory – we just use the same weight as in $VWCE.

- EIMI (same explanation as in Portfolio #1 above).

- SJPA and CPXJ because I couldn’t find a cheap and accumulating ETF covering both developed Asia-Pacific and Japan. I checked on VWCE’s country distribution that Japan’s allocation is ~6%, so 6% goes to $SJPA and the other 5% to $CPXJ.

Now, for the good part.

If we calculate the TER of this portfolio, we get . (Hover to see the calculation)

That’s almost half the cost of VWCE for the same allocation.

Portfolio #3: Replication with Tracking Error

We can optimize the portfolio to decrease the TER even further.

As there aren’t any cheaper ETFs than those in Portfolio #2, we’d need to sacrifice some diversification for price. So the following portfolio won’t cover everything from $VWCE, but will use a sampling strategy to achieve the same (or arguably better) performance.

Now, you, as an investor, need to answer the following question:

If you had to build a portfolio yourself, would you invest in Canada?

My answer to that question would be no.

For me, the Canada exposure is purely a diversification play. Its performance is so correlated to the US market that I’d argue its <3% allocation can be “sacrificed” for good.

Also, we’re already quite diversified across tens of mutually correlated first world countries, so excluding a single one doesn’t really increase the risk.

Thus, in this portfolio, we substitute VNDA (North America) with CSPX – an ETF tracking the US market.

- 62% CSPX (iShares Core S&P 500 UCITS ETF), accumulating, TER of 0.07%

- 16% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

- 11% EIMI (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

- 6% SJPA (iShares MSCI Japan ETF), accumulating, TER of 0.15%

- 5% CPXJ (iShares Core MSCI Pacific ex Japan UCITS ETF), accumulating, TER of 0.15%

As you see, CSPX has a TER of 0.07 and, with its highest allocation in the portfolio, will lower the total cost even further:

The TER of this portfolio is . (You know you can hover for details)

Officially, more than two times cheaper than $VWCE.

Portfolio #4: Sampling

The only downside of the third portfolio is that it has 5 ETFs.

This is not inherently bad, but it’s 5 times more than what you’d get with $VWCE. So many investors might accept to pay double TER in order not to rebalance quarterly.

Okay.

Let’s see if we can make some more exclusions in order to:

- Make the portfolio less complex to maintain

- Decrease the price even further

So, again, time for you to answer another question:

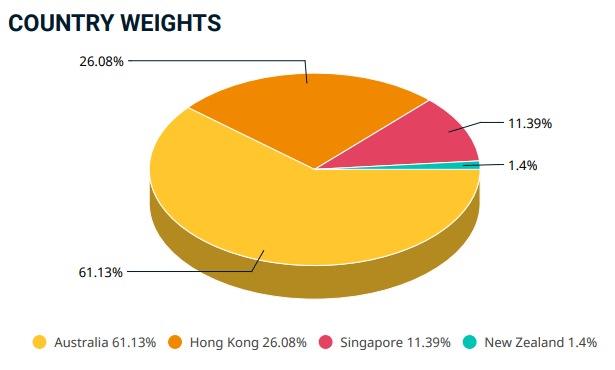

If you had to build a portfolio yourself, would you invest in Australia?

For very similar reasons as for Canada above, my answer to that question would be no.

However, we cannot really single out Australia, as it’s a part of CPJX, tracking the MSCI Pacific ex Japan index:

The weight of $CPJX in the portfolio is 5%.

And with Australia being more than 60% of it, the question becomes:

Would you sacrifice ~3% more of your diversification in order to lower your costs and simplify your portfolio?

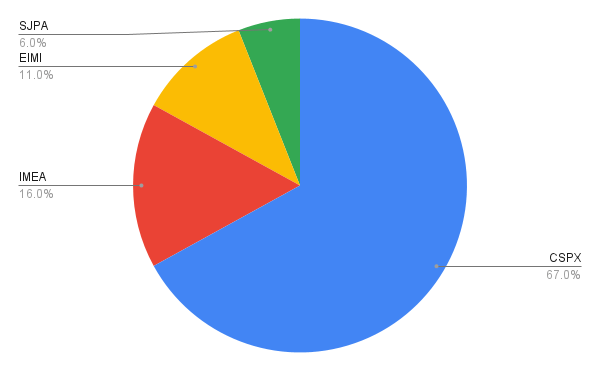

If the answer to that question is yes, than you’d fully exclude $CPJX and end up with:

- 67% CSPX (iShares Core S&P 500 UCITS ETF), accumulating, TER of 0.07%

- 16% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

- 11% EIMI (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

- 6% SJPA (iShares MSCI Japan ETF), accumulating, TER of 0.15%

As you notice, the allocation of the excluded countries went in the US market. This makes sense because it has a “first-mover advantage” in performance when compared to the rest of the developed markets. I write more about this in the Core Portfolio Post, so won’t elaborate in detail here.

The TER of this portfolio is .

It’s only slightly better than the previous one, but this portfolio wins in simplicity.

And of course, it’s significantly cheaper than $VWCE.

Remember: you don’t need to sacrifice any diversification if you’re uncomfortable with it. But since you’d be saving >50% in fees, you should at least consider it.

Portfolio #4: Further Simplification

There’s another point to cover with the investor that still wants to make his portfolio cheaper and less complex:

Enter Japan.

I guess you already know where this is going.

Japan is currently the third largest economy in the world, right after USA and China. Also, it’s less correlated with the rest of the developed markets than they’re to one-another.

On the other hand though, its performance in the last decades hasn’t been stellar. Below is the Nikkei 225 index since the 1990s:

Of course, nobody can predict with absolute certainty if this will continue or Japan is entering a decade-long uptrend.

We all know that history is not an indicator for future results.

But that’s why we’re adding a personal preference. And the question becomes:

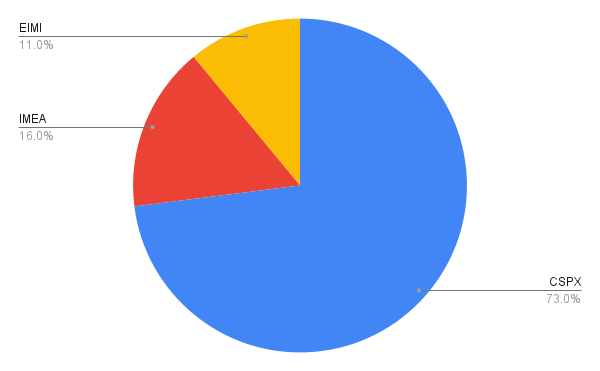

Would you exclude Japan’s market in the name of having a three-fund portfolio that’s cheaper?

I can’t and won’t answer that question for you. But I know that many would. And then the portfolio becomes:

- 73% CSPX (iShares Core S&P 500 UCITS ETF), accumulating, TER of 0.07%

- 16% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

- 11% EIMI (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

Now, the portfolio becomes a simple distribution of US, EU, and emerging markets.

The total expense ratio of this portfolio is .

Portfolio #5: Favorable Allocation

Now we enter the “personal preference” section.

When we already simplified a portfolio to three ETFs, there’s no reason to withhold our personal preferences from its asset allocation.

For example, an emerging markets exposure of 11% might be quite high for certain investors. For some, it may be too low. Some investors might prefer a slightly higher US exposure to capture the growth of the leading sector of tech. Some might like it as it currently stands.

Since the variables are plenty and the variations are endless, I’ll give a single example and leave it at that.

But remember, you’re free to shift the weights however you prefer. It simply needs to be aligned with your knowledge, experience, and expectations. Just make sure that your approach can still be considered index investing.

Example portfolio:

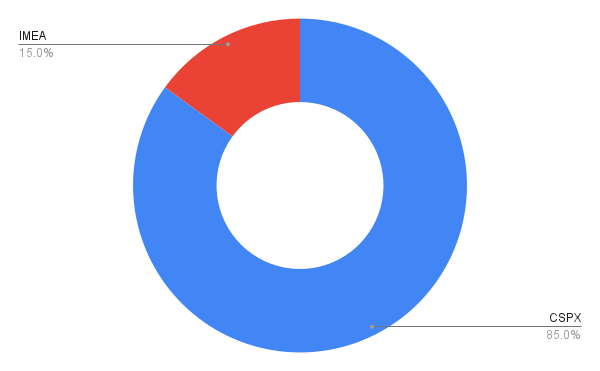

- 85% CSPX (iShares Core S&P 500 UCITS ETF), accumulating, TER of 0.07%

- 10% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

- 5% EIMI (iShares Core MSCI EM IMI UCITS ETF), accumulating, TER of 0.18%

TER: .

Of course, due to the difference in allocation and exposure, there will be some “tracking error” compared to $VWCE… But being almost 3 times cheaper greatly compensates for it.

Also, I’d argue that this portfolio would overperform $VWCE in the long run.

More details about the reasoning in Core Portfolio for European Investors.

Portfolio #6 (Bonus): Replicating IWDA

IWDA – the other go-to ETF for many European investors.

It is the one-fund portfolio option for those that don’t want an exposure to emerging markets.

If we apply a similar set of exclusions and shifts as we did for $VWCE, we’d end up with this simple two-fund portfolio:

- 85% CSPX (iShares Core S&P 500 UCITS ETF), accumulating, TER of 0.07%

- 15% IMEA (iShares Core MSCI Europe UCITS ETF), accumulating, TER of 0.12%

It has a TER of , which is >60% cheaper than $IWDA’s 0.2%.

Of course, this amount will depend on the asset allocation that the investor would pick. The image represents just one of the many possibilities.

Conclusion: VWCE and Chill or Not?

At the end, it really boils down to what an investor wants and expects.

In any case, if reading the post caused you to nod in agreement, you’re more than welcome to try out (variations of) the example portfolios. Don’t copy them 1-to-1, but takeaway the approach of thinking about optimizing cost in a smart way.

Remember: always add a personal twist to your portfolio. Make sure to use your weights for the geographical exposure and asset allocation to mitigate concentration risk.

If you want to see my actual preferences, check out Core Portfolio for European Investors.

For more intermediate posts on investing from Europe, visit: EU Investors Handbook.

If these concepts are too advanced for you, visit the free How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer