Including an emerging market ETF in your portfolio is a great way to increase diversification, especially because of their lower correlation with developed markets ETFs.

If you already invest in IWDA or you’re not happy with the internal allocation of VWCE, you might want to add an emerging market ETF to your portfolio.

I’ll list a few options that are available in Europe and declare the winner afterwards.

Emerging Market ETFs Comparison

1) EMIM

Ticker symbols: EMIM, EIMI, ISIN: IE00BKM4GZ66

EMIM (iShares Core MSCI EM IMI UCITS ETF) is an iShares ETF tracking the MSCI Emerging Markets index.

It has a total expense ratio of 0.18% and is an accumulating fund (reinvests the dividends). Its TER is higher compared to US ETFs like CSPX or VUSA, but at the same time quite cheap for an emerging market ETF.

By investing in this fund, you get exposure to over 2800 companies in developing countries. These companies vary in market cap, so you’d be diversified in large, mid, small-cap companies.

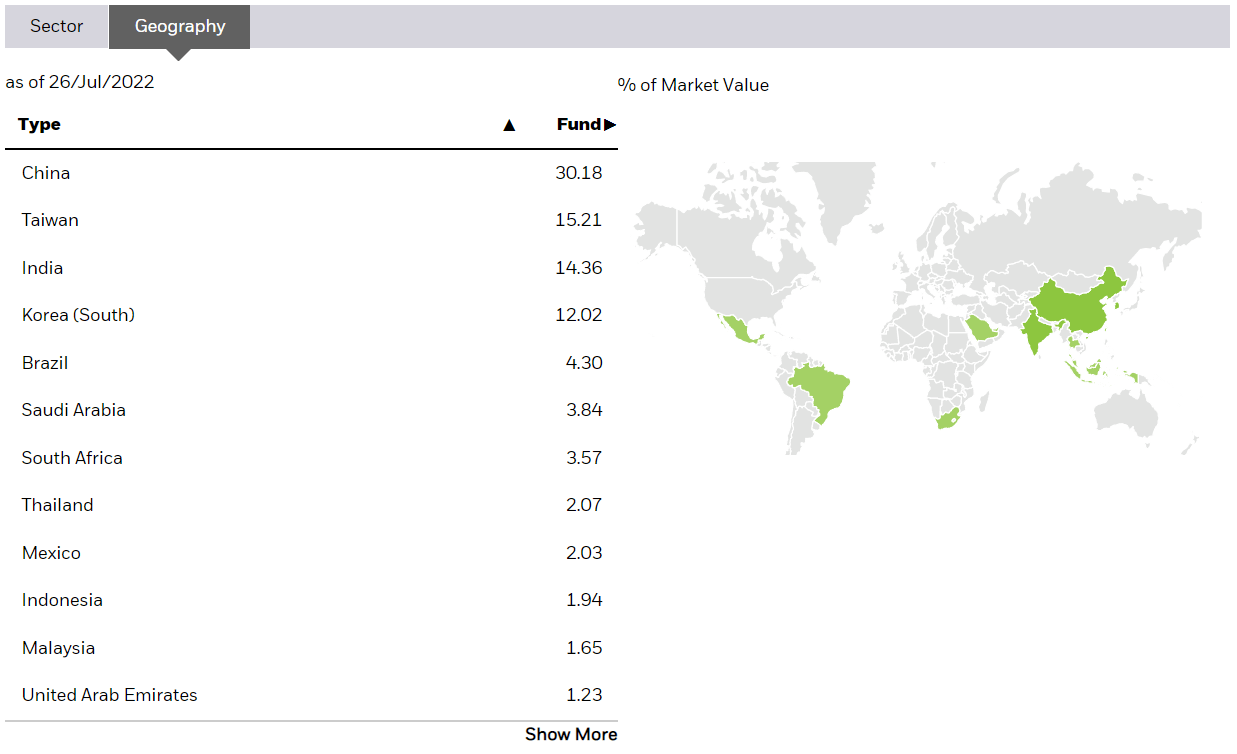

Below is the geographical distribution of EMIM:

For investors that prefer a distributing rather than an accumulating alternative of this ETF, there’s IEEM (iShares MSCI EM UCITS ETF (Dist)), sharing most of the characteristics and tracking the same index.

2) ICHN

Ticker symbols: ICHN, ICGA, ISIN: IE00BJ5JPG56

ICHN (iShares MSCI China UCITS ETF) is an ETF offered by the same provider that tracks the MSCI China index.

It has a TER of 0.4% and is an accumulating fund.

This is a good option for investors that want to invest in the Chinese stock market, but don’t like additional emerging markets exposure.

It’s worth mentioning that Tencent Holdings and Ali Baba Group are 20% of the allocation of the fund. At the same time, it’s quite diversified, covering ~85% of the Chinese market, distributed across large and mid-cap companies.

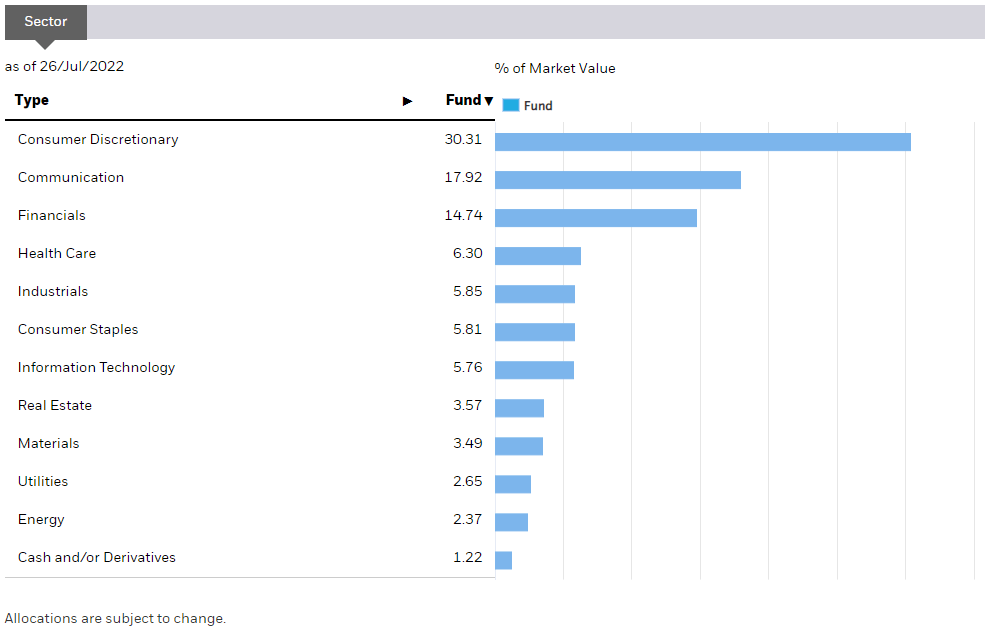

Because geographically its concentrated in one country, below is the sector distribution of the ETF:

3) BKF

BKF (iShares MSCI BIC ETF) is another emerging market ETF tracking the MSCI BIC index.

BIC stands for Brazil, India, China. There’s also a BRIC variation, which also includes Russia.

This ETF has a TER of 0.7% and distributes the dividends.

Although more expensive than the previous ones, BKF may be an option for investors that look for a more concentrated position than EMIM, but a more diversified one that ICHN. With China having ~65% allocation at the time of writing, it may be the sweet spot between the 30% and 100%. And the inclusion of India and/or Brazil might be crucial for some investors.

I wouldn’t recommend it for a large allocation in a diversified portfolio, as it’d heavily increase the average cost, reducing the long-term growth potential.

My Pick For an Emerging Market ETF

Given how different the choices are, the decision will really depend on what you want in your portfolio.

However, there’s an obvious choice when comparing all the relevant aspects of the ETFs:

- Geographical diversification: EMIM

- Cost: EMIM

- Number of companies: EMIM

- Market cap variety: EMIM

- Fund size: EMIM

EMIM is the clear winner.

It’s a fact, EMIM is the way to go for investors that seek global exposure.

The only reason not to go with it is if someone prefers a more concentrated position. As mentioned before, some investors might want exposure to China, but not necessarily to other countries. This, of course, should be taken into account, and I think that ICHN then becomes a reasonable pick.

And lastly, I don’t think that an emerging market ETF is a must in everyone’s portfolio. It really depends on the expectations and preferences of the investor.

Historically, EM’s performance behaves more like a hedge in a downturn economy than something that overperforms the developed markets during good times.

Anyway, I’ve never had more than 5% of my portfolio in emerging markets, and I think 5-10% is a reasonable allocation for investors that want EM exposure. Keeping it at 0% is perfectly fine as well, like I do now.

Now it’s your turn:

Which Emerging Markets ETF is your pick?

For more specific posts covering investing from Europe, visit: EU Investors Handbook.

If these posts are too advanced for you, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer