“Economists predicted 9 of the last 4 recessions.”

People often get obsessed with predictions and live in continuous fear of a market collapse.

This is my attempt to convince you that uncertainty is normal.

As someone that strategically invests since 2017, I know how to filter out the noise and sleep comfortably with a 7 figure portfolio.

Recession Predictions

So where do we stand today? All the indicators are there – we’re crashing through ATHs, the 2/10 yield curve inverted, the S&P’s P/E and CAPE ratios are well above their historical means, rate cuts are overdue, etc., etc., etc.

So one question remains:

Will there be a global recession?

And the answer is:

Yes.

But what’s the information that this answer gave us? Without a time frame, it’s practically 0.

We’re always headed for a recession.

So what about the question: will there be a recession in 2025?

Nobody can answer that with 100% certainty (i.e. with their full net-worth backing up their claims).

Track Record Bias

What about people that successfully predicted a crash in the past?

Great job! Predicting a downturn and profiting off of it is nothing short of impressive. I’ve done it as well. But past performance doesn’t guarantee future results. Michael Burry got a movie about his big short in 2007 but he got it wrong in 2023.

Anyway, whenever someone predicts a collapse, check if they really called it or were they saying it for 5 years before it happened?

“Economists predicted 9 of the last 4 recessions.”, remember?

And the interesting part is that they’ll be right.

Whoever calls for a recession continuously will eventually be right. The cyclical nature of the economy is a fact.

However, if someone is confident in his forecasts, check if they’re shorting the market with size instead of barking from the sidelines. People that don’t put their money where their mouth is should be at least ignored and ideally ridiculed.

What Should You Do?

That heavily depends on your goals, risk tolerance, time horizon, etc. You can DCA and chill or try to outsmart the market.

But if you ever catch yourself thinking “I’ll sell and reenter after the doom”, be ready for the risk of multi-generational sidelining.

A comment from this Reddit thread summarizes this very well:

I sold all my stocks so that I have more money to buy stocks when the recession hits. That was in 2015.

I only need the stock market to drop by ~33% so I can buy in exactly where I was four years ago. I know that if I hold out I won’t lose money in the long run. Right?

And he said this in 2019. Now we’re up ~100% since then.

If you’re a beginner, you’ll eventually learn that reading headlines will always make it seem like the world is collapsing next year.

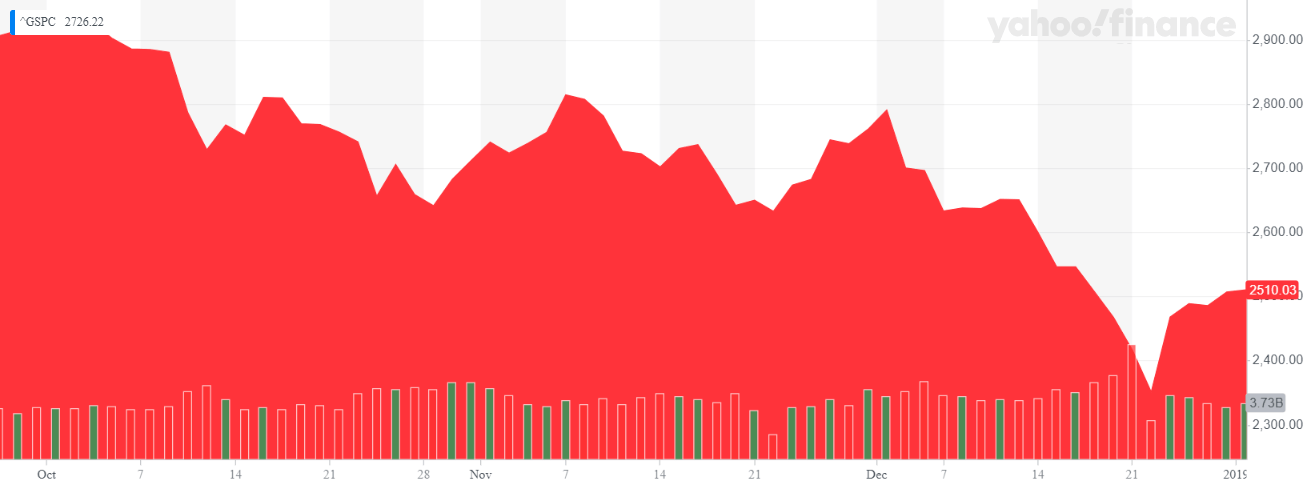

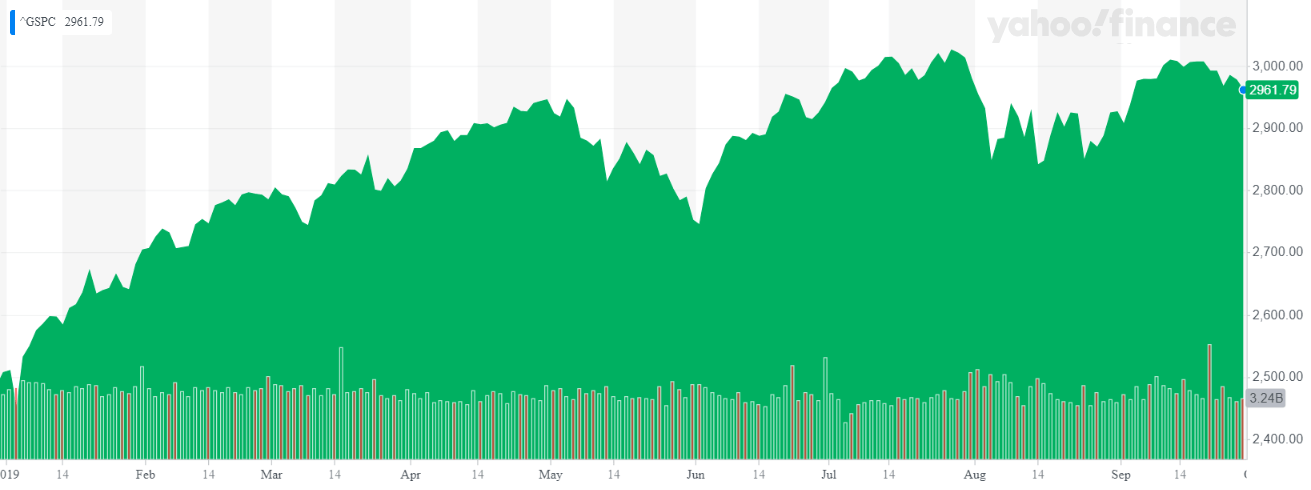

If definitely seemed like a recession was due back in December 2018:

And this is what followed throughout 2019.

You should always remember why the market goes up and never underestimate the ability of central banks to keep the economy on life support for a decade.

But the section title asked “what to do?” – let me summarize what I think is best protection against economic downturn:

Live within your means.

Both in good and in bad times.

That’s a hedge against everything and always.

And in regards to your long-term investing strategy – stay the course. You can reevaluate what you’re doing as you acquire knowledge and rebalance your allocation, but make sure not to do it motivated by panic or FOMO.

Because the most likely moment you’ll have these thoughts is when the prices hit the bottom.

Like this guy in his Boggleheads post from October 2008:

I have been retired for 10 years. I am one who has said over and over again. Stay the course. Look for the long term. Yeah, sure. That’s fine until today. Today did it. I am just starting to be scared so that I won’t tell my wife what happened today…stocks down…bonds down…I’m down. Our retirement funds are sucking down the drain. I lost today alone a year’s worth of normal distributions for expenses. I keep thinking tomorrow will be a turn around. I have said that for 30 days.

I am 25% capitulating tomorrow, maybe 50% to money markets….maybe all.

This is not me. I will see tomorrow.

Needless to say, the longest bull market in history started in Q1 2009.

Now, back to the topic of “Recession Predictions vs Economists & The Media”.

What If They’re Right?

They are right.

As long as “they” are not putting a hard date to address the when, they’re right for the what. As I said before: we’re always headed towards a recession.

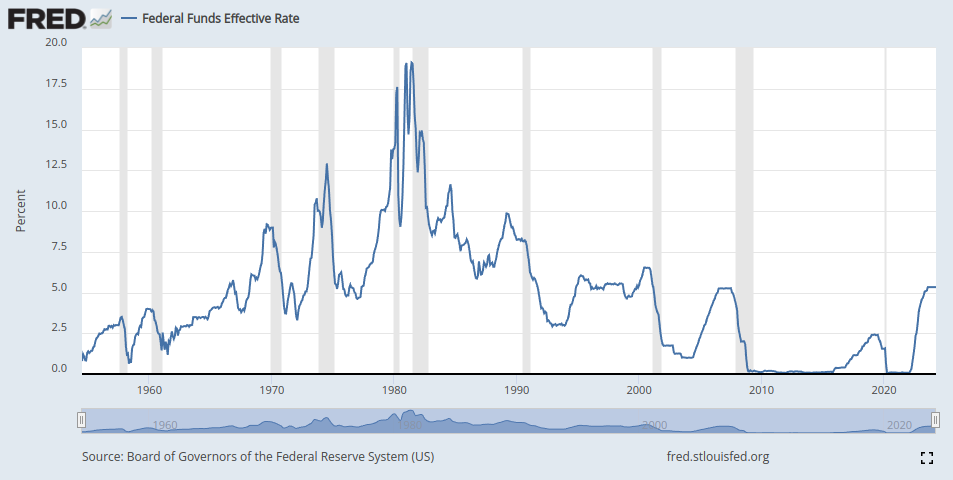

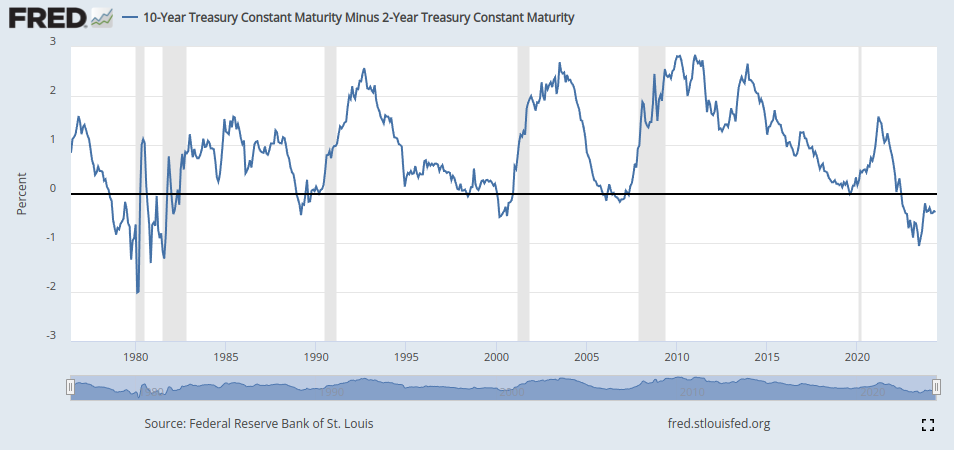

And there are always indicators that confirm we’re getting close overdue. Here are some visuals for the doomers.

The following chart shows US federal rate cuts relative to recessions (the grey areas).

The next one shows the 2/10 yield curve inversions relative to recessions (the grey areas).

So yes, something is definitely coming our way.

The leading indicators are on point. However, these are not scientific laws. Not every inversion was followed by a recession, but every recession was preceded by an inversion. And the delay is also not written in stone – sometimes it’s 6 months after, sometimes more than 18. Nobody can extrapolate exactly when the market will react to it.

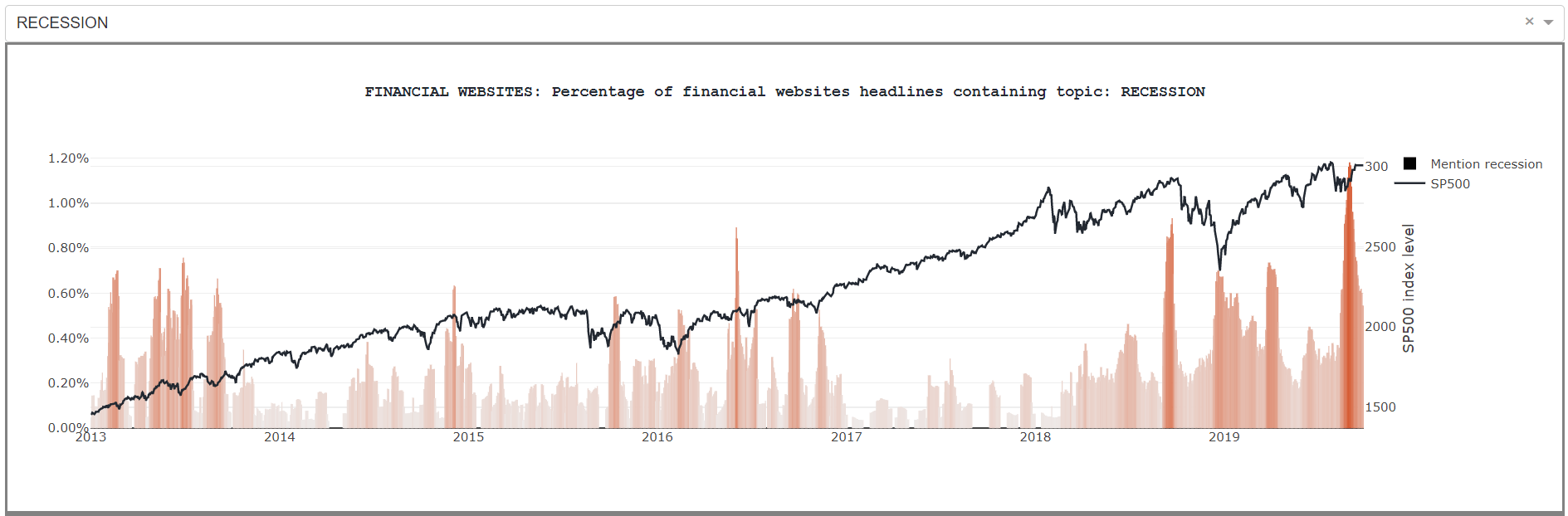

I also found an old screenshot from a website called recession-sentiment. It shows the appearance of the term “recession” in media headlines and S&P’s performance over time.

It’s interesting how correlated they are with the short-term down-trends.

And they were wrong for nearly a decade until the Covid crash.

And lastly, when it comes to predicting the last X recessions | X > [recessions], check this interesting comment I’ve saved in 2019. I’ll quote it here:

Bloomberg – Tariffs Risk ‘Recession-Like Levels’ on Indicators, JPM’s Normand Says May 2019

Bloomberg – A Recession Is Coming, And Maybe a Bear Market, Too Mar 2019

Bloomberg – U.S. May Fall Into Recession as Early as 2020, Stifel Nicolaus Says Mar 2019

Bloomberg – Most Economists See U.S. Recession by 2021, Survey Shows Feb 2019

Bloomberg – These Are the Signs a U.S. Recession May Be Coming Feb 2019

Bloomberg – Economists Think the U.S. Will Be in Recession by 2021 Feb 2019

Bloomberg – Markets Are Signaling Higher Odds of a 2019 Recession Jan 2019

Bloomberg – Markets Keep Flashing Recession Warnings Jan 2019

Bloomberg – Market Moves Suggest a Recession Is Unavoidable Dec 2018

Bloomberg – U.S. CFOs Overwhelmingly Expect a Recession Within Two Years Dec 2018

Bloomberg – Pimco Sees ‘Flashing Orange’ U.S. Recession Signal as Cycle Ages Dec 2018

Bloomberg – Two-Thirds of U.S. Business Economists See Recession by End-2020 Oct 2018

Bloomberg – Warnings Keep Coming About a Downturn That Will Hit in 2020 Sep 2018

Bloomberg – A U.S. Recession Indicator Flashes Red for Leuthold’s Paulsen Jul 2018

Bloomberg – What Will Trigger the Next Recession? Jun 2018

Bloomberg – The Next U.S. Recession Will Start in 2020, Survey Says May 2018

Bloomberg – Unemployment Hits a Low. Then Comes the Recession. May 2018

Bloomberg – U.S. Recession Looms, Yield Curve Inversion or Not Mar 2018

Bloomberg – Summers Warns Next U.S. Recession Could Outlast Previous One Feb 2018

Bloomberg – Here’s What Could Make the Next Global Recession Even Worse Jan 2018

Bloomberg – Recession Lurks in Fed’s Bullish New Jobs Forecasts Dec 2017

Bloomberg – Guggenheim Sees Recession as Soon as Late 2019 Nov 2017

Bloomberg – Wall Street Banks Warn Downturn Is Coming Aug 2017

Bloomberg – With Next Recession Looming, Central Banks Better Make Peace With Negative Rates Aug 2017

Bloomberg – How This Economic Recovery Ends Jun 2017

Bloomberg – Pimco’s Balls Sees U.S. Recession Risk in Next 3-5 Years Jun 2017

Bloomberg – AB’s Zlotnikov Warns of U.S. Recession in 2018 Jan 2017

Bloomberg – Citigroup: A Trump Victory in November Could Cause a Global Recession Aug 2016

Bloomberg – Is a U.S. Recession Looming in 2017? Jul 2016

Bloomberg – U.S. Recession Odds Climb to 55% Jun 2016

Bloomberg – U.S. Recession Coming in 2018? May 2016

Bloomberg – There’s a 100% Probability of a U.S. Recession Within a Year March 2016

Bloomberg – Three Warning Signs of a Recession Feb 2016

Bloomberg – Are We Headed for Recession? Jan 2016

Think with your own head without becoming a conspiracy theorist.

You’ll do fine.

For a comprehensive, beginner-friendly, and free resource on stock market investing, visit:

How to Start Investing: A Complete Beginner Series

Husband & Father

Husband & Father  Software Engineer

Software Engineer