Blog

CSPX vs SPYL – What is The Best US ETF

A US ETF is usually the core of most investors’ portfolios. I’ve already covered the most popular UCITS ETFs (CSPX, VUSA, IUSA), but since late 2023, we have a new contender: $SPYL. In this post, we’ll analyze whether SPYL can dethrone CSPX as the best US ETF. CSPX Ticker symbols: CSPX, SXR8, CSP1; ISIN: IE00B5BMR087 …

Recover Accounts on Different Hardware Wallet

Although I regularly cover hardware wallets and the seed phrase management on my blog, there is one concern that I’m often asked about. I’d paraphrase/summarize it as: “If my hardware wallet malfunctions after the company goes bankrupt, will I lose my money?” And the answer to that question is: no. As long as you have your …

Can Bitcoin Reach One Million Dollars?

Can Bitcoin reach million dollars? Undoubtedly! Probably not this cycle, but why am I so sure that it’ll happen at all? Well, let’s forget about Bitcoin for a moment. Let me take you on an eye-opening journey… And by the time you’re done reading, you’ll be as certain as I am. House Prices in 1963 …

Receive Tax Free Dividends in The Netherlands

If you’re a long-term index investor residing in the Netherlands, you can receive dividends tax free. Although I’m not a big fan of dividend investing, I still want to share some strategies that ETF investors can utilize without much effort. Basically, you’d leverage the tax treaties and tax codes of different countries to legally avoid dividend …

Why I Don’t Like the Term “Hardware Wallet” – Signing Devices and Keychains

As most of you know, hardware wallets are devices that give users total control over their digital assets. I cover this in detail in my security posts and in the self custody manual for beginners. So let’s start with a quick recap: What is a Hardware Wallet? In an oversimplified summary, a hardware wallet is …

My Approach to Calisthenics & Strength Training

Although fitness is not the top priority in my life at this moment, I hold certain standards in regards to my physical condition. I developed certain habits via research and analysis, and in this post, I will share some of my knowledge and experience on calisthenics and strength training in general. As to methods there may be …

Real Diversification – Banks, Passports, Residencies, Driving Licences, Assets

As investors, many of us understand the role of diversifying our portfolio across assets and asset classes. However, if you’re pursuing a free and abundant life, handling the financial aspect is just the base layer of the pyramid. In this post, I want to give examples of diversification that most people don’t consider – but …

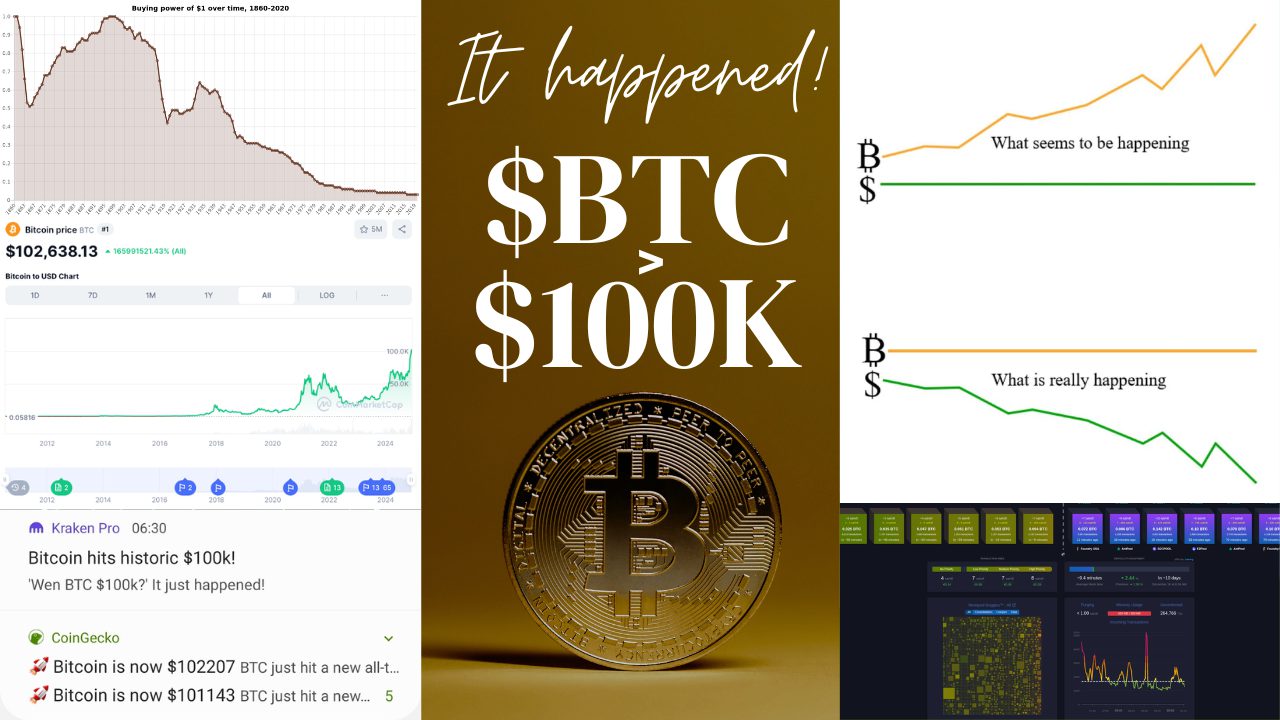

Bitcoin Surpasses $100k American Dollars! 🚀

It’s a fraud, a pyramid scheme, a ponzi, a scam, a cult, an MLM, imaginary asset without intrinsic value, and a greater fool theory… I salute you if you were brainwashed too! ✊ Congrats on being part of history. ðŸ™ðŸ¤ðŸ™Œ Remember, Bitcoin has no top because FIAT has no bottom. Or to paraphrase: nothing has …

My Hardware Wallet Recommendations: BitBox02 & Keystone 3 Pro

I write about self custody and security a lot on this blog. The holy grail of securing digital assets is using a hardware wallet. And I’ve compared most with each other: Trezor, BitBox02, Ledger, Coldcard or the Keystone 3 Pro review. In this post, I’ll give my summary and recommendations: BitBox02 & Keystone 3 Pro …

How to Cash Out Millions in the EU Tax Free

EU has a reputation of imposing oppressive tax rates. While this is true in general, investors can make use of the different treatments of investment profits to significantly lower or even fully avoid paying capital gains taxes. If you’ve made significant profits in the past years, this post will save you a lot of money. …

50 Facts to Wake You Up From Oppression

Dear reader, do you consider yourself free? If you think paranoia is reserved for the most delusional echelon of conspiracy theorists, I invite you on a journey through 50 eye-opening reality checks. Enjoy! You vs. The Government 1) The sole purpose of your existence, apart from reproduction for the sake of it, is to fund …

Bitcoin Exit Strategy (Cycle Based Rotation)

If you were smart and accumulated Bitcoin during the bear market, you’re sitting on a massive gains so far. Of course, most of us understand the benefits of being a long-term holder. You get Bitcoin’s inevitability and that it’s an antidote for inflation and the money printer. Still, some of us are also aware of the …

12 Months Development: SGA Preterm Baby

Happy birthday to the little one! 🎉 And with that, it’s the time to reflect on another trimester of his remarkable journey. A reminder: our son was born one month prematurely and also he was SGA (small for gestational age). In this post, I’ll share his progress and achievements until first year, to give parents an …

The Self Custody Manual: A Practical Guide to Buying Bitcoin and Hardware Wallets

The Self Custody Manual is a step-by-step guide on buying Bitcoin and securing it in cold storage. Get your free copy at: The Self Custody Manual.

What is a Seed Phrase – BIP39 Standard Simply Explained

Understanding seed phrases is essential for protection of your digital assets. I already covered best practices of seed phrase protection and today I’ll explain exactly what we’re protecting. Private Keys vs Seed Phrase The ownership of a crypto wallet boils down to having the private keys that control it. A private key is a string of alphanumeric characters that …