If you were smart and accumulated Bitcoin during the bear market, you’re sitting on a massive gains so far.

Of course, most of us understand the benefits of being a long-term holder. You get Bitcoin’s inevitability and that it’s an antidote for inflation and the money printer.

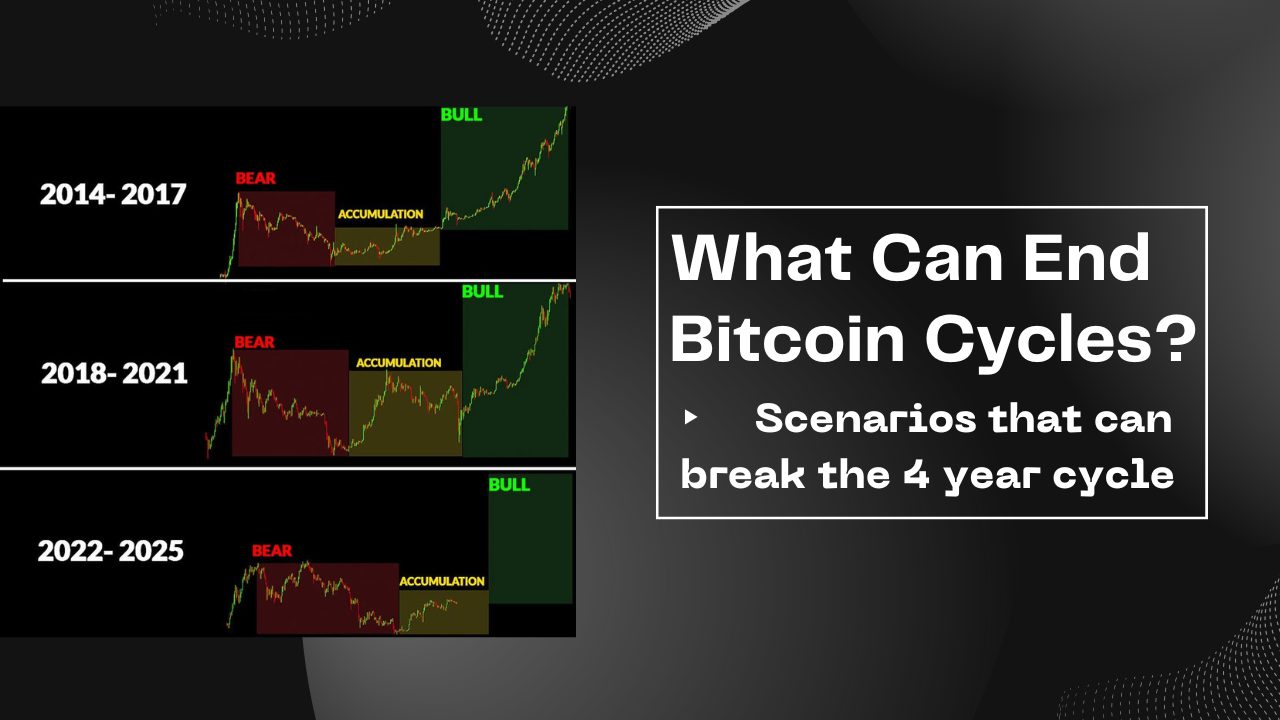

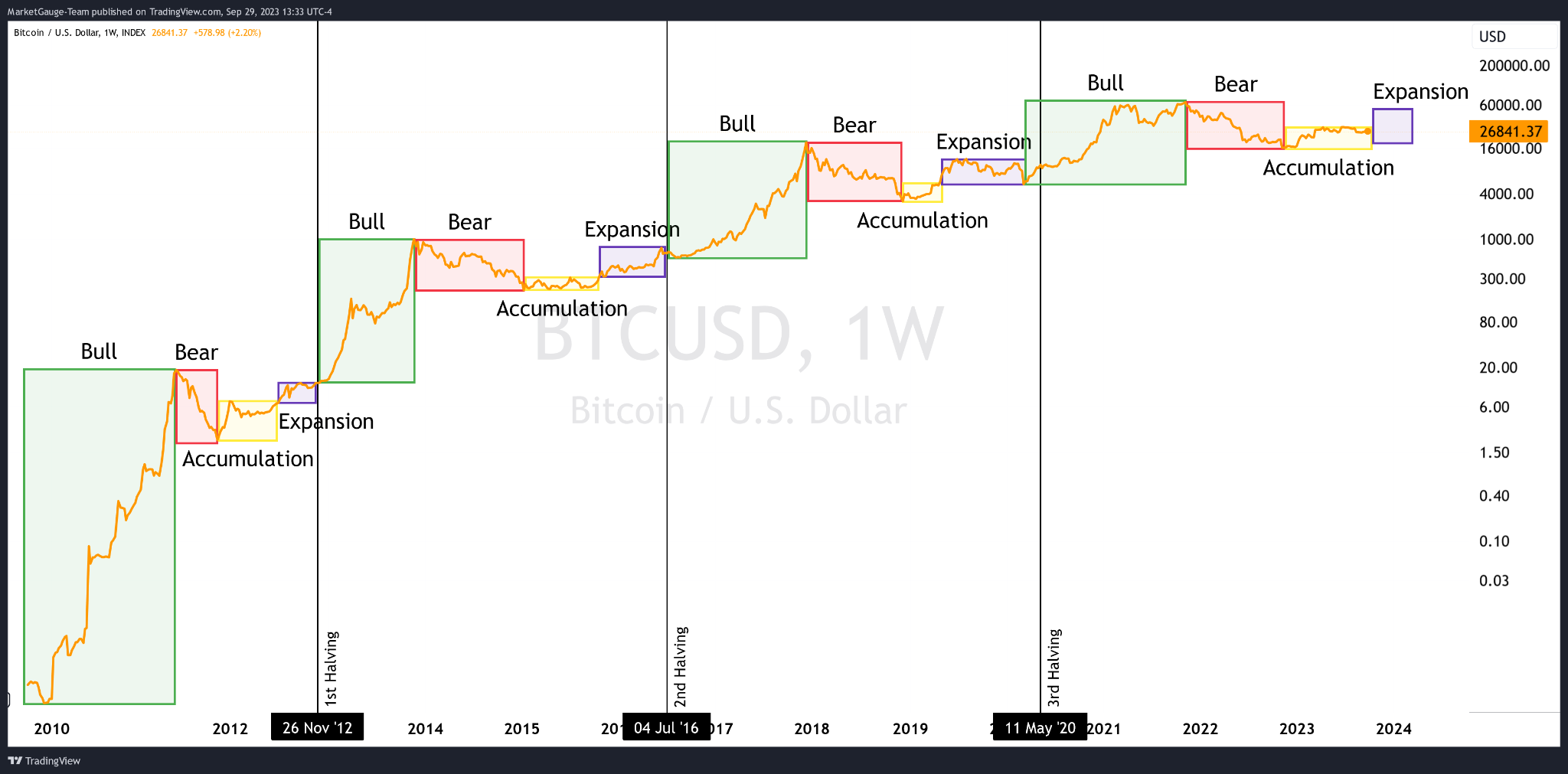

Still, some of us are also aware of the 4 year cycle that’s still intact and almost gives us a predictive power over Bitcoin’s price performance.

And of course, I’m not pulling these theories out of nowhere. I leveraged the cyclical nature of the market to realize massive profits last cycle and I’m perfectly positioned to do it again this time.

Why Take Profits at All?

“Exit into what?” is a completely legitimate question.

Personally, I don’t know about a superior asset that I’d rather have my past productivity stored rather than Bitcoin.

However, I also understand the 4 year cycles. I know that the year after the Bitcoin halving, we have new all-time-highs (like 2017, 2021, and probably 2025). And I know that the year after that is historically a slowly bleeding bear market (like 2018, 2022, and probably 2026).

So even if we’re not exiting into something else, there’s an argument to be made that holding FIAT during 2026 before re-entering in $BTC is a worthwhile move.

So TLDR, why take profits? Because I’m confident that there’ll be a boring bear market of 1.5-2 years after the retail hype dies out, which will be a perfect opportunity to accumulate more $BTC per unit of FIAT in late 2026/early 2027.

Note: Although I’m confident in the strategy, I’m holding the majority of my Bitcoin stack forever and trade cycles only with a portion of it.

Setting Up a Scenario

Let’s say you accumulated Bitcoin during the bear market, just like I did:

Let’s say you’re holding 10 $BTC at this moment.

First of all, congrats on becoming a millionaire! 🤝

Now, you have an important decision to make – how much you’re saving in Bitcoin vs. how much you’re investing in Bitcoin:

The Ratio of HODL Forever vs. Riding Cycles

Complete exit out of Bitcoin is the riskiest move a bitcoiner can make.

You never know if/when bureaucrats decide to ban self-custody and make it difficult/illegal to withdraw $BTC to your own wallet. You never know the geo-political circumstances of next year. So you don’t want to risk losing the ability of actually owning a piece of the universal store of value.

That’s why the first step is deciding how much Bitcoin you plan to hold forever. And how much of it are you comfortable trading the 4 year cycle with.

As someone with 10 $BTC, you might decide (for example) that 5 $BTC is a sufficient long-term position and use the other 5 to maximize your purchasing power.

Timing the Top vs. DCA Out

Although many know expect the Bitcoin top to be in 2025, it’d be really difficult to time it exactly.

It can be in April and it can be in November. So preparing one big sell order is really risky.

Also, what we’ve learned from previous cycles is that the price itself doesn’t tell us much. Bitcoin might peak at $140k and the person waiting for $150k to sell will never get a chance. On the other hand, someone might sell everything at $250k (which seems high from today’s perspective), while Bitcoin continues rising, leaving him sidelined forever.

That’s why I like to incorporate a DCA Out approach in the year after the halving (2025 in this case).

This means taking the total amount of $BTC that you’re planning to sell and dividing it in smaller chunks across the year.

Important: these are chunks measured in $BTC, not in FIAT.

For example, given that we’re selling 5 $BTC throughout the year, this might mean selling 0.5 $BTC for the next 10 months, starting from January 2025, regardless of its price.

While I don’t dislike this approach, I like to have some variability based on Bitcoin’s performance:

Non-Linear DCA – An Approach For Maximizing Profits

A linear DCA is okay, but it may lead to “overselling” your position early. It can also lead to “underselling” when greed is off the charts.

Still, because we can’t time the exact top, I like constructing an amalgamation of both DCA and performance-based indicators.

So again, the scenario is: we have 10 $BTC, we want to sell 5 during the year.

We can allocate, for example, 4 $BTC for a linear DCA out (as explained in the previous section) while using the 1 remaining one to be more aggressive in spectacular months.

For rounding purposes, I’ll illustrate selling across 10 months: you sell a fixed amount of 0.4 $BTC per month, or 0.1 $BTC per week. And having the optionality to increase this amount using the 1 remaining Bitcoin.

For example, we have a weekly candle of 20%+ or surpass some price-based threshhold? We can sell 0.25 that week.

We have a flat week? Then we sell the fixed minimum of 0.1.

I like this balanced approach because we choose a portion to commit to a strategy that human emotions won’t interfere with. But at the same time, we allow some flexibility based on what we think is going on.

Flexibility & Decisions

I gave an example with a nice round number, but everyone’s situation is different.

Your assessment would be based on how much Bitcoin you have, when you acquired it, how long you’ve worked for it, your expectations, understanding of the asset, financial circumstances, and… everything.

But if you plan to adopt a similar strategy, these are the decisions you’d need to make for yourself:

1) HODL vs Trade Ratio

In the example I presented a ratio of 50/50.

But that’s by no means an ideal ratio. Maybe 80/20 is better for some and 20/80 for others. Or instead of ratios, you might want to lock a couple of $BTC you’d hold forever and decide what to do with the rest.

Or simply HODL 100% of your stack and don’t take any risks.

It’s a perfectly fine strategy in my opinion – and it may (or may not) outperform over a decade.

2) Non-Linear DCA Ratio

Next is determining the non-linear ratio of cost averaging out of Bitcoin.

In the example, I had 80% fixed and 20% variable/optional (4 vs 1 $BTC).

But this ratio can be 50/50, or some might decide that they want to go fully linear (i.e. selling the exact same amount every month, regardless or price).

I prefer to have 20-40% flexibility. Here’s why:

If Bitcoin’s cycle top disappoints us (i.e. imagine peaking at $120k), then I’d rather hold the majority of my coins, while still taking profits with the minimum amount. In this scenario, the drawdown also wouldn’t be massive, as historically Bitcoin doesn’t retest previous cycle’s lows. It’d be a typical case of smoothening volatility as the asset matures.

If Bitcoin does exceed expectations (i.e. imagine the cycle top being $420k), then I’d rather sell more aggressively, profiting off of the full stack I intended to. And if these levels turn out to be unsustainable, the drawdown will be more brutal, giving us a chance to reenter at a significantly lower price, in percentage terms from the cycle top.

3) Factors to Increase the DCA

And lastly, the final decision is to determine what are the factors affecting the increase/decrease of the weekly sell amounts.

These can be relative/percentage-based (for example selling more in weeks where performance is above 20%) or absolute/price-based (meaning selling more as we surpass some targets such as $150k, $200k, etc.).

To me this makes sense, because we’d be more aggressive when it’s more profitable and casually taking profits while we dance around the known levels.

Btw, “known levels” is a weird term in Bitcoin – 2 weeks ago most of the world didn’t believe we’ll hit $100k per coin.

But that’s a story for another time.

Why Take The Risk?

This is something I had to articulate for myself in detail, so I’d like to share it.

The reason I question why am I doing this at all is because I’ve “taken the orange pill”. I am a Bitcoin maximalist in the monetary sense. I believe that Bitcoin is inevitable. I think that more and more countries will adopt it as a strategic reserve, as El Salvador did. And I believe that it’s either 0 or millions in the long run – with the likelihood of collapse being minimized with every next block.

So, if I’m so bullish on Bitcoin in the long run, why am I taking the risk by trading a portion of my stack?

Two points:

First answer: this is where the split of hodl-forever vs. ride-cycles allocation comes in handy. I determined the balance I’m comfortable holding forever and I’m in peace with it. For some it may be 1 $BTC, for others it may be 10.

Second answer: I did this in the past and I’m confident in doing it again. Since this strategy has been massively outperforming for me so far, I decided to continue the rotation until we witness the death of the 4 year cycle.

Actually, I rebalance between stocks and $BTC based on the bear and bull phases of each cycle.

And the Bitcoin I plan to rotate this time is bought with proceeds from selling stocks while Bitcoin was bleeding… Stocks which were bought from the proceeds of exiting Bitcoin during the last cycle.

So I’ll nurture the rotation until the cyclical nature breaks. I almost have nothing to lose.

Worst case scenario, I’ll have more profits and a bit less Bitcoin in that one last cycle – and that’s way within my risk tolerance.

Can The Cycle Break?

The cyclical nature is programmed due to the block reward halving of Bitcoin which happens roughly every 4 years.

There are two (extreme) scenarios where I can see it breaking:

The Good Scenario – Everyone’s on Board

Currently, those that are aware of the Bitcoin cycles have the ability to outperform every asset/class in the world in relative terms. I’m not exaggerating.

The reason that this opportunity exists is because there are still people that believe that Bitcoin is a scam/ponzi/pyramid scheme or are simply not interested in it. These people represent the majority and they’re not aware how Bitcoin or how money works.

The good scenario means all of them coming on board. Not necessarily through their own willpower and intelligence, but due to governments starting to back their currencies with Bitcoin, like they did with gold for a long time. Then, anyone using dollars for example would have an implicit claim on a piece of USA’s Bitcoin.

If such a scenario does happen, there will be a point in time where the value of Bitcoin will explode parabolically. This is not n00b speculation. This is the law of supply and demand. Similar to prices for everything, it’d be a result of the collective sentiment about the asset.

If such a scenario occurs, the sentiment will switch from 5% adoption to 100% adoption. And then, Bitcoin would “stabilize” – whatever that means in a scenario where the dollar is replaced by a superior technology.

The Bad Scenario – Nobody’s on Board

Yes, the 4 year cycle can break if, for whatever reason, Bitcoin turns out to be a failed experiment.

Of course, every next block added to the blockchain makes an incrementally stronger statement that this won’t happen.

Disclaimer

NFA, DYOR, HFSP. All good acronyms.

Whatever you decide to do, remember, never leave yourself without Bitcoin in self custody.

And as I said in my Bitcoin Price Prediction: don’t call me lucky in 2025.

Husband & Father

Husband & Father  Software Engineer

Software Engineer