Category: Bitcoin

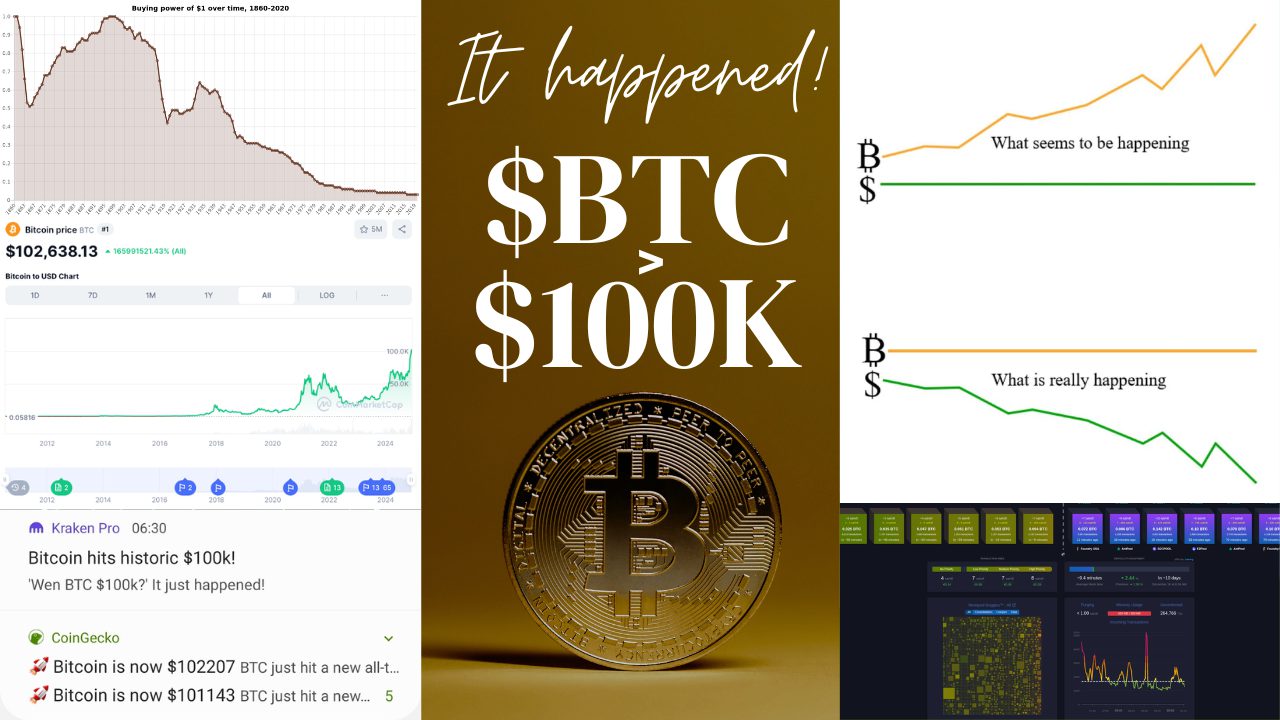

Bitcoin Surpasses $100k American Dollars! 🚀

It’s a fraud, a pyramid scheme, a ponzi, a scam, a cult, an MLM, imaginary asset without intrinsic value, and a greater fool theory… I salute you if you were brainwashed too! ✊ Congrats on being part of history. ðŸ™ðŸ¤ðŸ™Œ Remember, Bitcoin has no top because FIAT has no bottom. Or to paraphrase: nothing has …

My Hardware Wallet Recommendations: BitBox02 & Keystone 3 Pro

I write about self custody and security a lot on this blog. The holy grail of securing digital assets is using a hardware wallet. And I’ve compared most with each other: Trezor, BitBox02, Ledger, Coldcard or the Keystone 3 Pro review. In this post, I’ll give my summary and recommendations: BitBox02 & Keystone 3 Pro …

50 Facts to Wake You Up From Oppression

Dear reader, do you consider yourself free? If you think paranoia is reserved for the most delusional echelon of conspiracy theorists, I invite you on a journey through 50 eye-opening reality checks. Enjoy! You vs. The Government 1) The sole purpose of your existence, apart from reproduction for the sake of it, is to fund …

Bitcoin Exit Strategy (Cycle Based Rotation)

If you were smart and accumulated Bitcoin during the bear market, you’re sitting on a massive gains so far. Of course, most of us understand the benefits of being a long-term holder. You get Bitcoin’s inevitability and that it’s an antidote for inflation and the money printer. Still, some of us are also aware of the …

The Self Custody Manual: A Practical Guide to Buying Bitcoin and Hardware Wallets

The Self Custody Manual is a step-by-step guide on buying Bitcoin and securing it in cold storage. Get your free copy at: The Self Custody Manual.

What is a Seed Phrase – BIP39 Standard Simply Explained

Understanding seed phrases is essential for protection of your digital assets. I already covered best practices of seed phrase protection and today I’ll explain exactly what we’re protecting. Private Keys vs Seed Phrase The ownership of a crypto wallet boils down to having the private keys that control it. A private key is a string of alphanumeric characters that …

10 Requirements: Choose a Good Hardware Wallet

Choosing a hardware wallet is a serious and extremely responsible decision. A user has to do dedicated homework instead of picking the cheapest or the first available option. When I was evaluating which hardware wallets to buy, I relied on the following list of requirements. Read on and see the reasoning behind each. 1) Has to …

Bitcoin Cycle Top Indicators Analysis

As most of you already know, I like to accumulate Bitcoin during bear markets, in accordance with the 4 year cycle theory. In other words: my entries are based on time rather than on price. At the same time, I want to share certain indicators that people might consider following, especially during the pivotal moments …

Review of the Keystone 3 Pro Hardware Wallet

A couple of days ago, the CEO of Keystone stumbled upon my post “Is Ledger a Hot Wallet?“. This initiated a discussion and he offered to send me a Keystone 3 Pro device to try their Bitcoin-only firmware. I’m exceptionally selective in accepting gifts to avoid reciprocity bias, so I explicitly asked if there is anything …

Hardware Wallets Comparison (Trezor, BitBox02, Ledger, Coldcard)

Practicing self-custody comes with the burden of picking the right hardware wallet. That evaluation is highly personal journey, as the circumstances and needs vary from person to person. In this post, I show you my thought process and requirements. Below, you can find a comparison between a few of the industry-standard hardware wallets and my conclusions. …

Inflation Explained

I’ll start with a story from 2014. A friend from Macedonia started an interesting discussion – how much money a person would need to stop relying on a salary: “In our country”, he said, “you can live comfortably on €400 per month, which is less than €5k per year. Multiply that by 40 (years), and …

How I Accumulate Bitcoin During Bear Markets

This post can be summarized really simply: “I buy as much Bitcoin as I can during bear markets”. However, evolving in the market, besides just buying, I found an edge that I’ve leveraged successfully in the past and I’m doing it again now. You can consider this post an intro to making mad gains without …

Introduction to Hardware Wallets (Cold Storage for Beginners)

If you’re reading this, you probably accumulated sufficient amount to start worrying about security. You also probably use an exchange to store your coins and understood that it defies the purpose of decentralization. Lastly, you most probably heard the phrase “not your keys, not your coins” but are uncertain what it actually means. Let’s start …

I Didn’t Get Lucky – The Opportunity in Bitcoin

I keep seeing people in investing communities that are vocal about the alleged risks of Bitcoin. And price speculation is perfectly fine when observing an asset purely as an investment. However, that’s far from Bitcoin’s value proposition. But it’s understandable. This is mostly done by bad stock pickers that consider $BTC gambling, think that dividends …

Bitcoin Tax in All EU Countries (Capital Gains & Wealth Taxes) (2024)

If you’re a Bitcoin HODLer, this post might be not only relevant, but potentially life-changing for you. Whether you plan to live off of $BTC or simply want to optimize your taxes while stacking, understanding the tax treatment of this asset is of utmost importance. In this post, I’ll do a detailed breakdown of Bitcoin …