“The 4 Year Cycle” is one of the most important posts you’ll ever read.

I mean it.

People that understood the cyclical nature of the markets will never struggle financially.

In this post, I’ll explain the single most relevant indicator for Bitcoin’s price and how I used it to build a position with full conviction.

If you’re ready for a mindset shift, read on!

Prerequisites

Having some preliminary knowledge will be helpful.

If you’re a complete beginner, I recommend going through the links below. It’s not mandatory, but it’ll make this post easier to grasp.

- The Inevitability of Bitcoin

- Bitcoin Block Reward Halving Explained

- Supply and Demand – An Introduction

If you’ve witnessed a boom-and-bust cycle, you’re probably knowledgeable enough.

What is the 4 Year Cycle?

The 4 Year Cycle refers to the time period in which Bitcoin goes from boring to manic and back to “crypto is dead”.

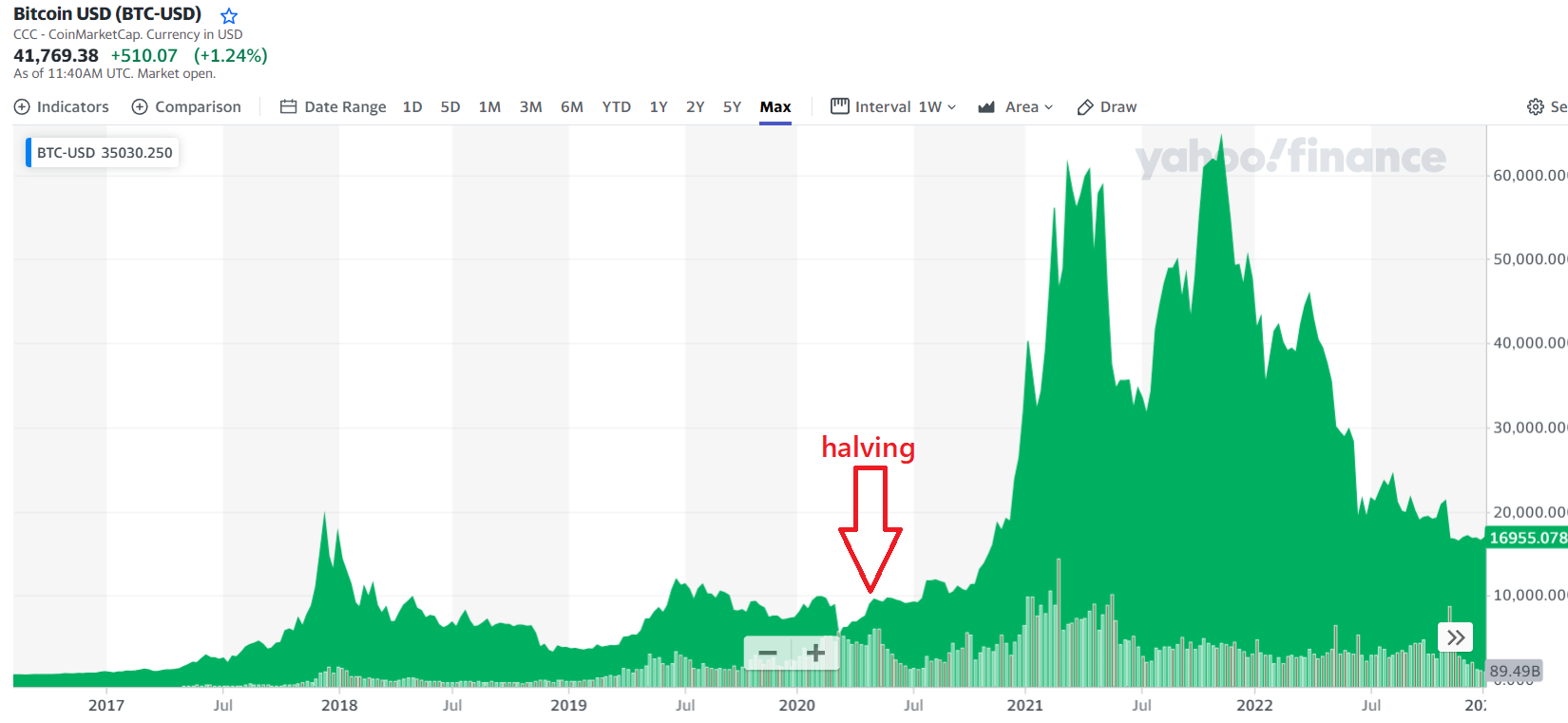

This is easy to see in a multi-cycle Bitcoin chart (scaled logarithmically for visibility):

Bitcoin price chart, logarithmic scale, CoinGecko

As you can see, every subsequent all time high (ATH) is higher than the previous one.

And there is a reason for that:

What Causes the 4 Year Cycle?

There is a single key factor causing the 4 Year Cycle: the Bitcoin block reward halving.

I already explained it in detail in the linked post, but in summary:

- The reward that the miners receive for finding a block halves every 4 years

- This creates a “supply shock” – miners earn less $BTC which reduces sell pressure

- Given a non-decreasing demand, a price increase is a guarantee

Yes, I’m oversimplifying.

But ultimately, it’s really just the price complying with one of the most basic laws of economics – the law of supply and demand.

History of the 4 Year Cycle

Note that the Bitcoin halving is a leading indicator.

That means that it happens first and then the price movement follows. Almost like a prediction.

So far, $BTC reached a new ATH within 1.5 years after each halving event.

Here’s an image of the first Bitcoin cycle – halving in November 2012, $BTC exploded to almost $1,000 at its peak:

Then, there was a brutal crash and a bear market.

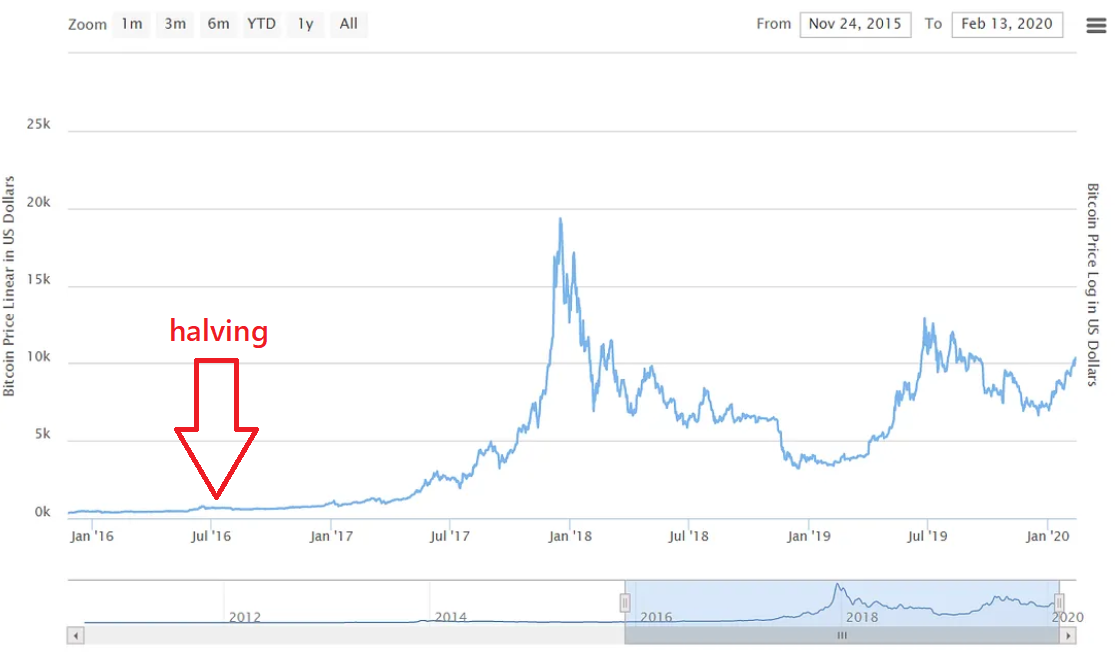

Here’s the chart after the second halving in July 2016, peaking at almost $20k in late 2017:

And below is the chart of the third bull run of 2020/2021 – halving in May 2020 and $BTC reaching $69k in the next year.

I intentionally left a longer time frame, so you can see how insignificant the previous peak looks in comparison:

So what do we observe?

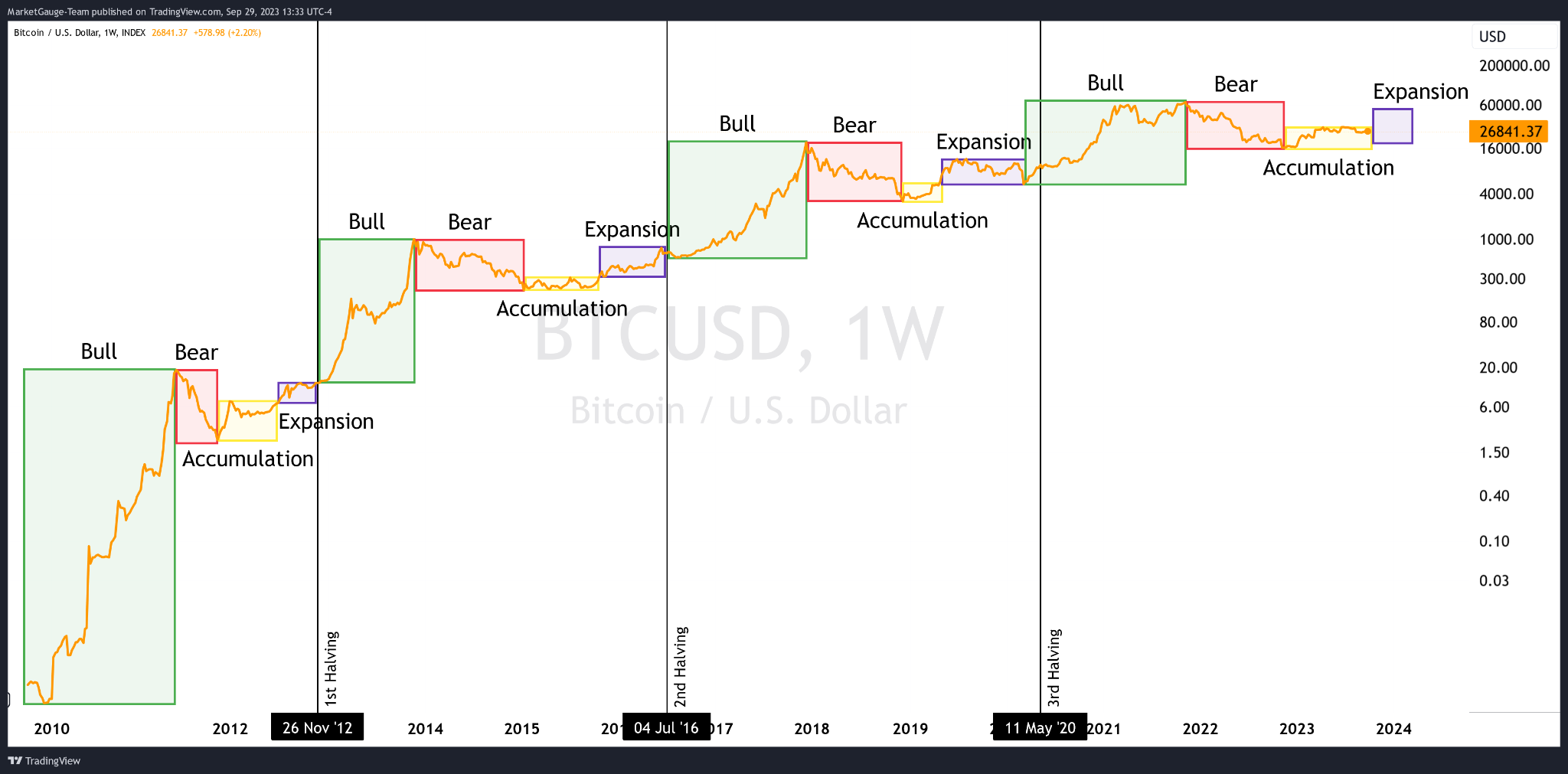

- A bull market slowly emerging in the year prior to the halving (2015, 2019, 2023)

- Reaching the previous ATH in the year of the halving (2016, 2020, 2024?)

- Mania phase with new all time highs in the year after the halving (2017, 2021, 2025?)

- An ~80% crash and a boring price action during a bear market (2018, 2022, 2026?)

And we repeat.

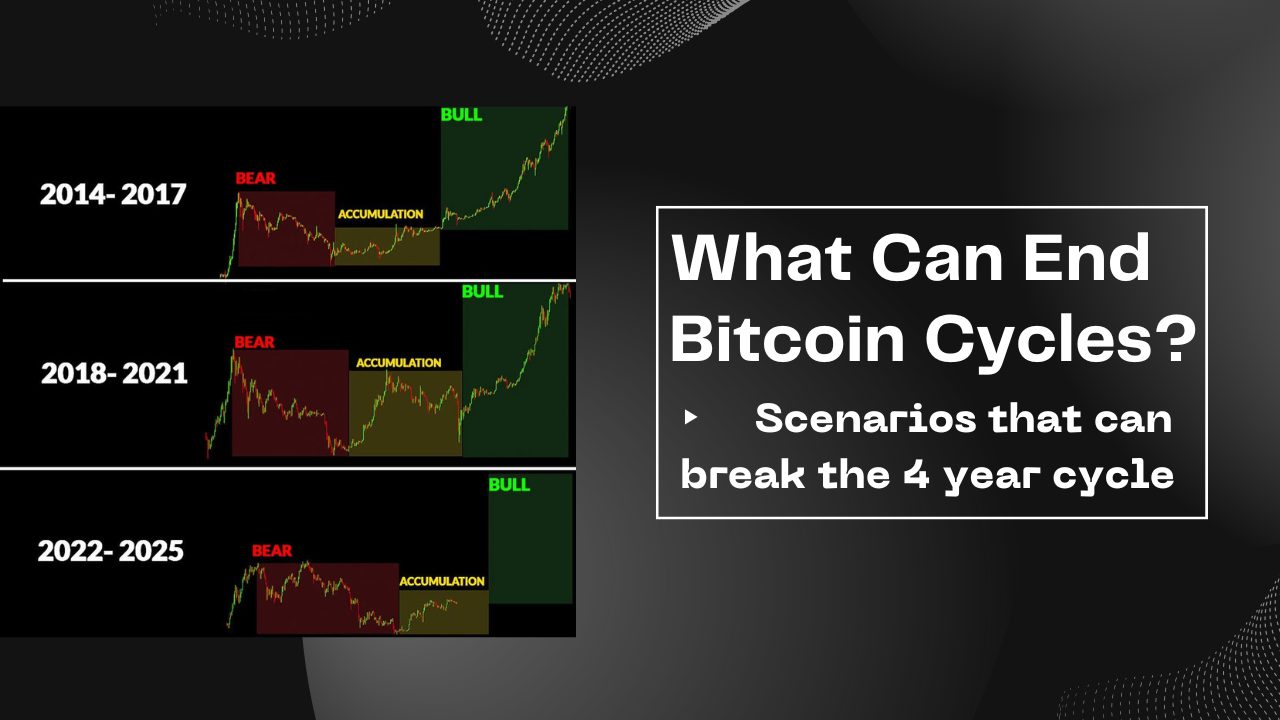

Actually, I’ll leave you with a more descriptive picture of these cycles.

Study this image carefully:

The short summary is:

You should accumulate during the accumulation and expansion phases.

That leads us to:

My Experience with The 4 Year Cycle

After I understood the deflationary nature of Bitcoin and how the money printer works, following the halving cycle was a no-brainer.

I’ve used the Bitcoin halving as the one and only indicator to position myself for the previous bull market.

I was accumulating during the 2019 bear market and made multiple 6 figures until 2021. I actually reallocated the profits into stock market ETFs as I was exiting, to keep them safe until the next bear market.

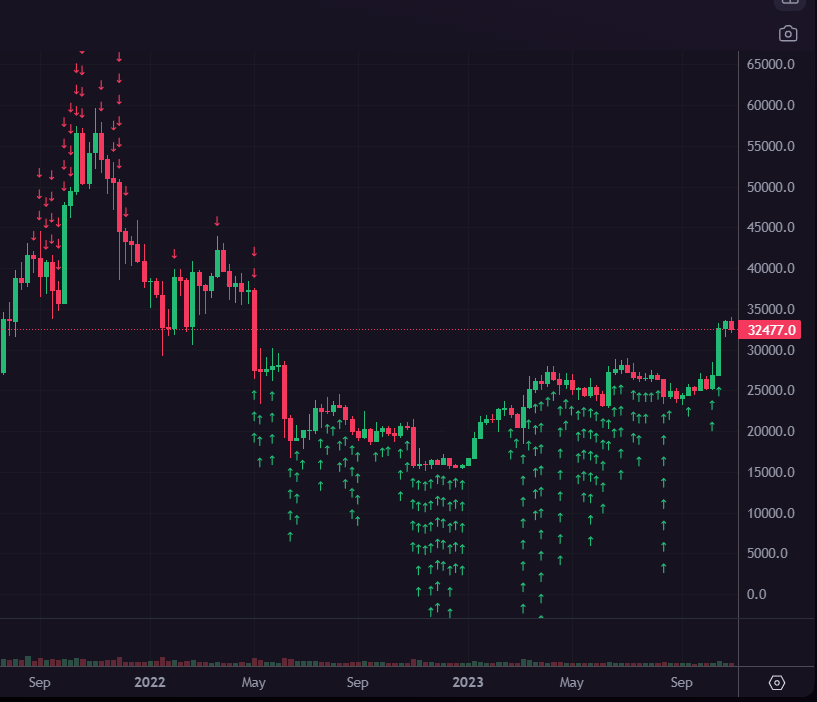

Below you can see my sell orders at and around the all-time-highs in 2021.

And then, rebuying heavily during the bear market:

Same as the last cycle, the day-to-day volatility is irrelevant to me.

I’m more focused on the big picture – the macro trend. The phase of the cycle we’re in. More comfortable allocating capital for the mid-to-long-term.

In summary, I just accumulate heavily as long as we’re in the boring phase of the cycle.

Bitcoin’s price may crash or increase 20% tomorrow and that won’t change my expectations or mood. Because in 2025, during the hysteria phase of the cycle, it won’t matter how bumpy the road was.

Considering Other Factors

“But is it really just the halving?”

“Aren’t prices driven by human emotions such as fear, greed, and the like?”

“What if China bans mining again?”

Human Emotions

We will see fear, greed, FOMO, FUD… They’ll all be here!

But they’re not the leading factors for massive price movements.

They enhance a bull run and deepen a bear market.

They’re the reason why the price doesn’t “only” double but skyrockets in multiples each halving cycle.

They’re part of the demand, same as the next point:

Institutional Adoption

In previous cycles, only small companies and some controversial figures were interested in Bitcoin and crypto.

Now we have the world’s largest asset managers offering Bitcoin ETFs.

The slow and steady process of adoption began a long time ago and now we’re taking it to a next level!

Heck, Bitcoin even became an official currency of a country (El Salvador)!

Elections & Monetary Policy

Then, we have the election year.

This means printing a lot of money to “stimulate the economy” attract voters, which is great for people holding hard assets.

This will also give speculators and institutions access to cheap capital, a major part of which will flow into Bitcoin and crypto.

The Hash Rate

Let’s not forget the hash rate!

I’ll let the picture speak how secure the Bitcoin network has become:

You already saw how convinced I was in 2020.

Imagine how I’m feeling now, when the fundamentals are stronger than ever.

Sometimes, I can’t sleep from excitement!

Important!

All these points are good for Bitcoin. But it doesn’t matter that much what some government decides about “crypto”, how it’s taxed, whether someone writes something on X, or whether the humans feel FOMO, FUD, greed, panic, or are happy or sad.

In other words: Bitcoin doesn’t need BlackRock, EU bureaucrats, Chinese miners, approvals, or the US government to succeed.

Fundamentals matter much more and Bitcoin will continue doing its thing regardless – same as it always has.

Finally, Price Predictions! 🚀

The part that everyone wants to read!

First of all, nobody can predict the absolute top with 100% certainty.

And it doesn’t matter.

What does matter is that we’ll see a major price increase during the next year to year and a half after the halving.

Actually, let me quote something I wrote before the bull market of 2020/2021, but I’ll change the years to 2023/2024:

I anticipate a price close to the ATH in mid/late

20202024 followed by a steady growth and finishing in a rally/bubble during the gold rush at/after mid20212025, as the effects of the supply shock start shaking the world.

You see? It’s a cycle – the same concepts apply!

We’re just 4 years later now – 2025 is the new 2021. 🤯

As I said in my pinned post on X:

And the new ATH – it can be a multiple of 5 or 20 from the cycle bottom. External factors and black swans can push or suppress the price.

However, I do think that Bitcoin will reach at least low six digit $USD.

Even with “just” 4x from here, it’s definitely an asymmetric risk opportunity that comes once every 4 years and can’t be ignored.

Building a Strategy Around the 4 Year Cycle

So, if you accumulate strategically during the bear market, you have a different kind of a problem…

How to Prepare an Exit Plan?

First of all, you don’t have to sell ever.

However, if you want to take some profits, don’t wait for a magic number.

It’s too risky to wait with your full position to sell at (for example) $200k – you might never get the chance or you might sell too early if the price continues rising.

Instead, you might set multiple price targets. For example, selling 5% on every $10k increase after the ATH is breached. Or selling 10% every month, starting at March 2025.

These are not definitive strategies, just example approaches.

It’s not really a standard DCA out strategy, but it has to be done incrementally if we’re mindful about the proximity to the cycle’s top. I wouldn’t be against making a final sell after the blow off top, so that a portion of the capital stays in the market for as long as possible.

And the best part?

It will turn into a bubble. The previously mentioned factors will make the price unsustainable.

And then, Bitcoin’s price will go down 60-80%.

This will allow people like me to start reentering the market again after a year or so.

And if you were on the fence this time, consider this good news! You can bookmark this post for the halving of 2028 and see how applicable it’ll still be. Because this is exactly what’s going to happen:

- Bull run – already started as we approach the halving

- New ATH – year to year and a half after the halving

- 70-80% crash

- 2-2.5 years of

bear marketmisery - Repeat.

After some time, it becomes obvious and predictable. It’s just differs in the details.

Follow the macro trends and enjoy the ride. 🚀

Disclaimer

“PaSt PeRfOrMaNcE dOeSn’T gUaRaNtEe FuTuRe ReSuLtS!!11”

^ This is not an argument against taking risks.

It is an argument for taking calculated risks.

Know what you’re getting into.

And if you’re a beginner, beware of scams… and everything. You’ll probably learn by losing money.

I think that the 4 year cycle remains applicable because the majority of the market doesn’t understand Bitcoin. Most people actually compare it to the Tulip mania (which lasted one year and never recovered).

But if all market participants see Bitcoin’s value proposition, the price might stabilize. I cover this in more detail in this post.

Conclusion

I won’t dare to give a TLDR. You have to read the whole thing again and DYOR.

I’ll wrap it up with some financial advice:

Don’t invest in anything solely because of reading this post.

Apart from the previous sentence, absolutely nothing you’ve read here is financial advice.

Enjoy becoming a millionaire in 2025! 🔥

If you want an introduction to Bitcoin without technical jargon and price speculation, check out my free series: Bitcoin for Beginners.

Husband & Father

Husband & Father  Software Engineer

Software Engineer