The block reward halving is one of the key characteristics of Bitcoin.

It’s extremely relevant both for ideologists and investors, so make sure to understand it.

Introduction to Bitcoin Block Rewards

All Bitcoin transactions are grouped into blocks, which are added to the blockchain through a process called mining.

Each Bitcoin miner tries to be the fastest one to confirm a block because there’s a financial incentive associated with it.

This is the Bitcoin block reward.

Every $BTC came into circulation through mining.

The average time to mine a block is around 10 minutes.

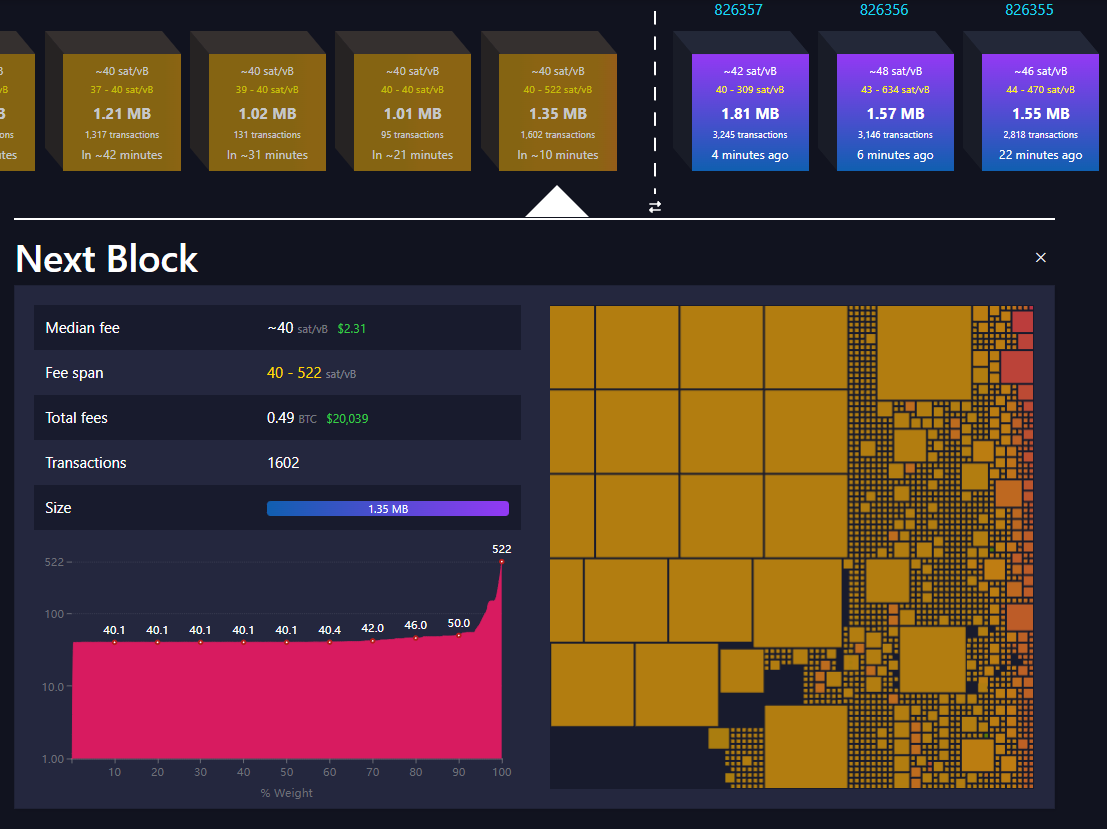

You can observe how blocks are being added to the blochchain at any Bitcoin explorer. Here is an example: mempool.space.

During the early days of Bitcoin (2009), the reward for finding a block was 50BTC. So approximately every 10 minutes, a miner received 50BTC from the network. Keep in mind that the price of BTC back then was way lower than today.

Anyway, we all know that Bitcoin has a limited supply of 21m. So this raises the question:

“How is it possible to produce 50 $BTC every 10 minutes if the supply is limited?”

And this brings us to the Bitcoin block reward halving.

What is Bitcoin’s Block Reward Halving?

As you already know, increasing the supply of a currency causes inflation.

This is achieveable because the amount of $BTC that comes into circulation lowers over time. This is known as the block reward halving.

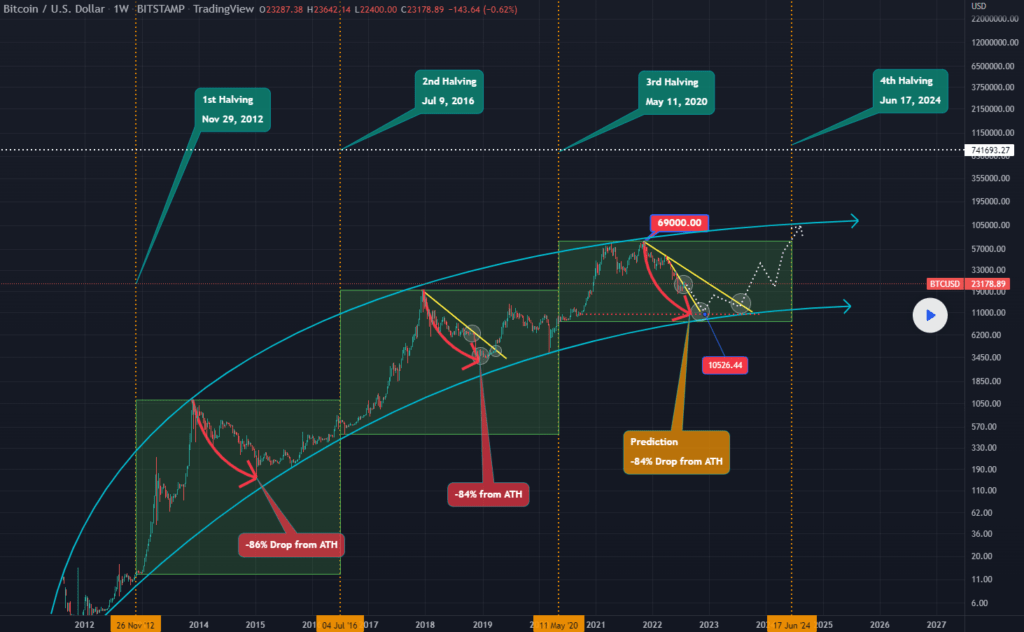

Approximately every 4 years (210,000 blocks), the reward the miners get for mining a block gets cut in half. This is part of Bitcoin’s code.

As mentioned before:

- At the beginning, the Bitcoin block reward was 50 $BTC.

- The first halving happened in November 2011 and the block reward became 25 $BTC.

- The second halving happened in July 2016 and the block reward became 12.5 $BTC.

- The third halving happened in May 2020 and the block reward became 6.25 $BTC.

- The fourth halving will happen in April 2024 – that’s why I’m publishing this post ASAP.

This process will continue in the future until all 21 million $BTC are mined. This will happen in the year 2140, when the last bitcoin enters in circulation.

After the fact, the miners will only earn from transaction fees paid by the users, not from block rewards.

The Halving’s Effect on the Bitcoin Price

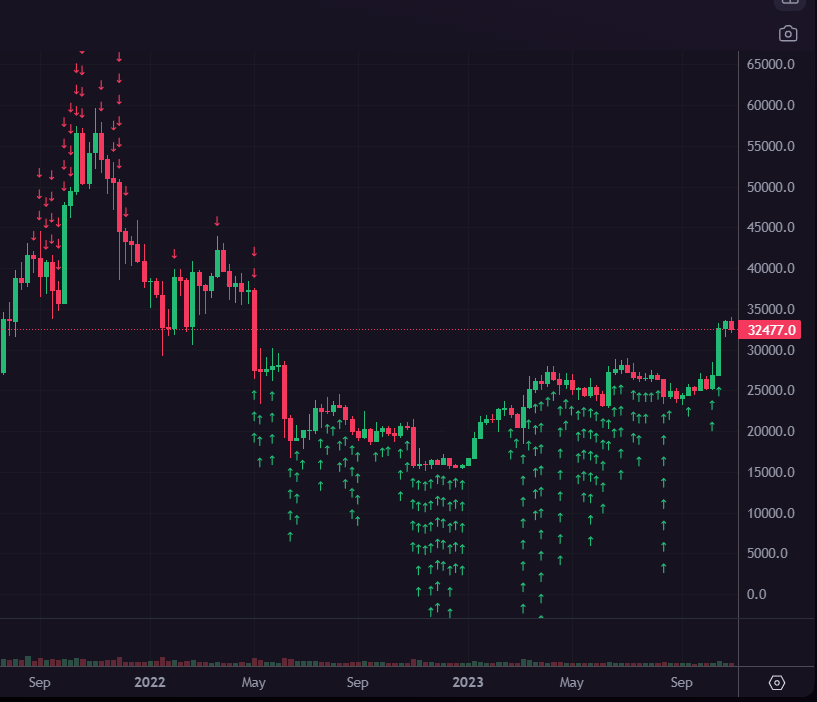

Take a look at the picture below.

The vertical lines represent the dates when the Bitcoin block reward got cut in half.

As you can see, there isn’t any significant price action during the halving events.

However, each block reward halving creates a supply shock for the Bitcoin market.

All of a sudden, the miners earn half of what they used to just a moment ago. The only way for mining to remain profitable is with a price increase. At the same time, there’s half the sell pressure from miners that sell $BTC to fund their business operations.

From there, it’s a simple function of the the law of supply and demand. And the supply side of the equation is predetermined for Bitcoin. So it all becomes a function of demand.

As long as Bitcoin stays relevant, a price increase is a guarantee.

Think about it…

The only alternative is that everyone abandons the Bitcoin network. And in this case, $BTC will go to 0.

My Experience with Previous Halvings

I’ve had a chance to be part of previous halving events and use them to my advantage.

So this is not something that I’m writing in hindsight. The Bitcoin block reward halving event is the biggest leading indicator I use to position myself for every cycle.

I’ve stated it publicly every time, but my buy orders speak for themselves:

Riding the 4 year cycles like a pro.

No luck involved.

Just understanding of the law of supply and demand.

And when everyone is terrified of the “crypto winter”, the smart money stacks cheap sats. Here’s my daily Bitcoin accumulation during the absolute depths of this cycle:

Why Does This Happen?

The answer is simple:

Bitcoin is a deflationary asset.

As long as you’re measuring the value of everything in terms of your local currency, you’ll remain a slave of your government. You’ll think in terms of “the price of Bitcoin” and say things like “housing prices went up”.

All of that is nonsense.

What actually happens is that the value of your currency went down. And this happens exclusively because of creation of more money AKA money printing.

In other words: FIAT currencies are inflationary – their supply is increasing and they lose purchasing power over time.

Unlike them, Bitcoin is deflationary – it has a limited supply, and given demand, its purchasing power increases over time.

Bitcoin: Ideology vs Investment

Full disclosure, I don’t consider Bitcoin:

- An investment

- A profitable trade

- A get-rich-quick scheme

Bitcoin fixes the root cause for the collapse of every empire in human history.

It decouples money from state.

Considering it just as a tool to “make money” is foolish.

“Money” is doomed to fail, as it has many times in history.

Only those that understand this and start their pursuit for absolute liberty may achieve the side-effect of financial gains.

Not the other way around.

If you want an introduction to Bitcoin without technical jargon and price speculation, check out my free series: Bitcoin for Beginners.

Husband & Father

Husband & Father  Software Engineer

Software Engineer