Investing through the Dutch banks is quite popular with investors from the Netherlands.

This is mostly due to the ability for automatic periodic investments and tax optimization through the Northern Trust Funds.

In this post, I’ll compare the costs of “the Big 3” Dutch banks: ING Bank, ABN Amro, and Rabobank.

Assumptions: the Type of Investor

For the purposes of this post, I’ll assume the archetype of an index investor. Someone who cost averages into index funds and holds them for the long-term.

Also, I’ll assume that the investor does this without the help of the bank. In other words, he would use a “Zelf Beleggen” option (the names differ per bank, but the idea is that it’s independent investing).

Lastly, I’ll assume that he needs the bank account outside his investment endeavors. This will allow me to ignore the €2-3 monthly fee people pay for the privilege of having a Dutch bank account. Everyone in the Netherlands pays this so it’s not specific to investors.

Dutch Banks Cost Comparison

ING Bank Investment Account Costs

ING’s fixed fees are as follows:

- No transaction costs for buying or selling index funds

- There’s a yearly 20€ “basic fee” for having the investment account

And below are the variable ongoing fees, charged yearly:

- 0.24% of your portfolio up to €100k

- 0.12% of your portfolio between €100k and €500k

- 0.06% of your portfolio between €500k and €2.5M

- Custom plan for amounts over €2.5M

From the ING’s website:

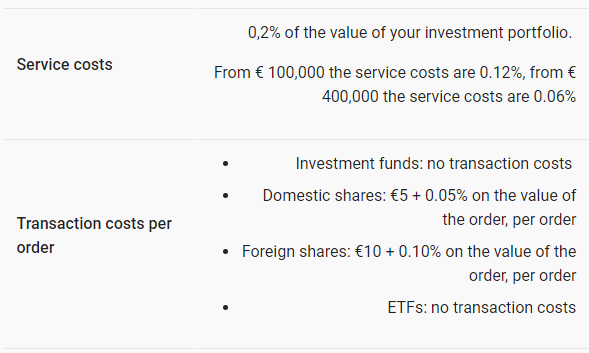

ABN Amro Investment Account Costs

ABN Amro doesn’t have any fixed costs related to an investment account.

- No transaction costs for buying and selling index funds and ETFs

Their variable annual fees are as follows:

- 0.2% of your portfolio up to €100k

- 0.12% of your portfolio between €100k and €400k

- 0.06% of your portfolio over €400k

From ABN Amro’s website:

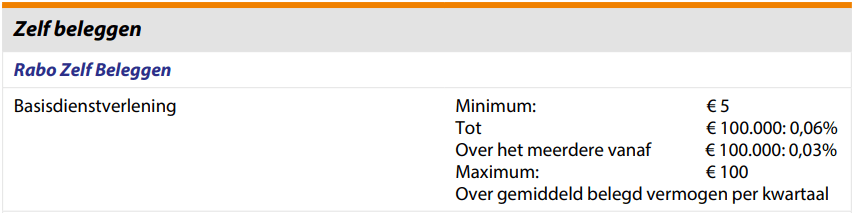

Rabobank Investment Account Costs

Rabobank’s fixed fees are as follows:

- 0.1% transaction costs for buying or selling index funds

- A minimum cost of 20€ per annum, waived if the actual fees exceed it

- A maximum cost of 400€ per annum, capped even for large portfolios

With that said, here’s what’s in between the 20€ and the 400€:

- 0.24% of your portfolio up to €100k

- 0.12% of your portfolio above €100k

From the Rabobank’s website and their “Tarieven-beleggen” pdf:

Minus points for having to download a pdf and stating on quarterly rather than on annual basis.

Scenarios: Different Investors from the Netherlands

Due to the tiered system of all banks, we need to split the analysis in three broad categories:

- Beginner investors (portfolio of <€100k)

- Intermediate investors (portfolio of €200k)

- Advanced investors (portfolio of €1M)

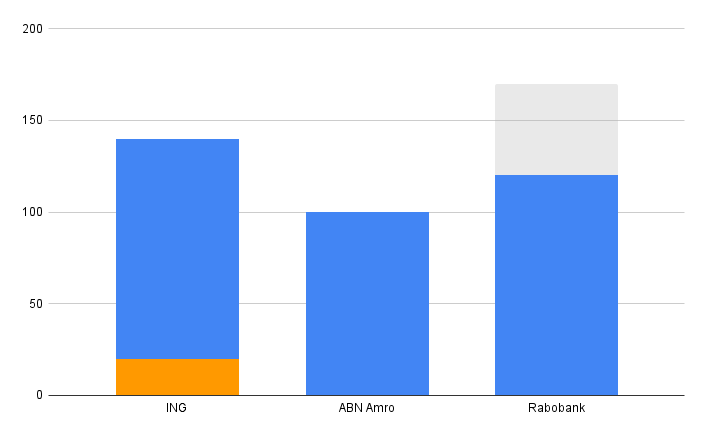

1) Portfolio of <€100k – Beginner Investors

This is the archetype of the standard beginner investor. Someone that’s willing to start or recently started investing.

Here are the costs he’d have with each of the banks per year:

- ING: 20€ basic fee + 0.24% of the portfolio

- ABN Amro: 0.2% of the portfolio

- Rabobank: one time 0.1% transaction cost + (20€ minimum fee or 0.24% of the portfolio)

Below is a bar chart representing the costs for a €50k portfolio:

Fees for a €50k portfolio. Rabobank’s transaction costs are greyed out because they’re not ongoing charges.

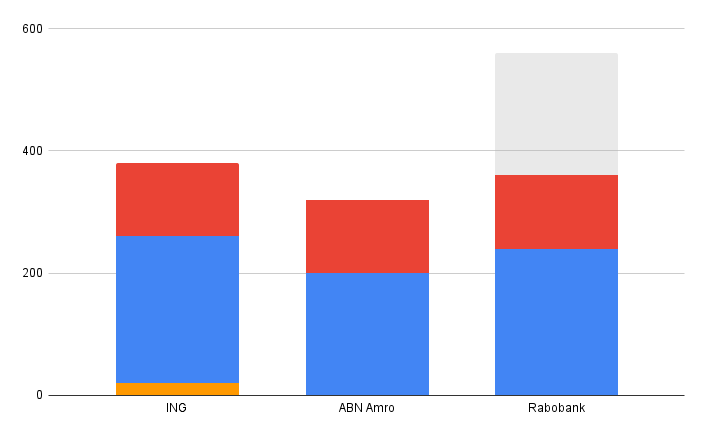

2) Portfolio of €200k – Intermediate Investors

This represents the “intermediate investor”. Someone that probably cost averaged into a diversified portfolio over a few years and will continue to do so.

Here are the annual costs for each of the banks:

ING Costs for Intermediate Investors

- Basic fee (€20)

- 0.24% of the first €100k (€240)

- 0.12% of the second €100k (€120)

- Total: €380

ABN Amro Costs for Intermediate Investors

- 0.2% of the first €100k (€200)

- 0.12% of the second €100k (€120)

- Total: 320€

Rabobank Costs for Intermediate Investors

- 0.24% of the first €100k (€240)

- 0.12% of the second €100k (€120)

- Subtotal: €360

- A non-recurring transaction cost of 0.1% of €200k (€200)

- Total: €560

Note that the 0.1% transaction costs are paid only once. So assuming the same portfolio in any follow up year, the cost would be 360€.

Fees for a €200k portfolio. Rabobank’s transaction costs are greyed out because they’re not ongoing charges

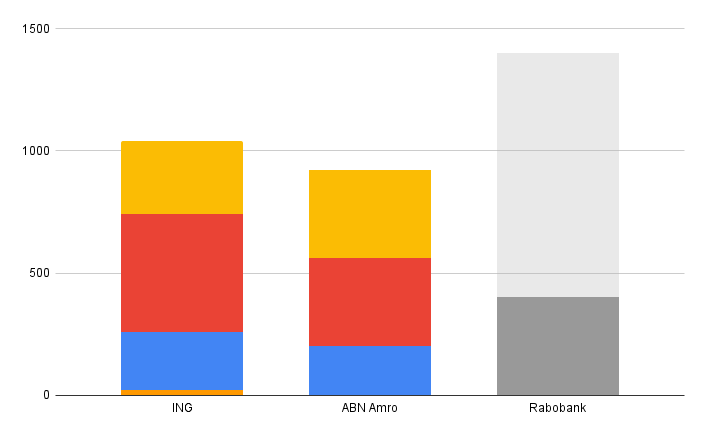

3) Portfolio of €1,000,000 – Advanced Investors

ING Costs for Advanced Investors

- Basic fee (20€)

- 0.24% of the first €100k (240€)

- 0.12% of the amount between €100k and €500k (480€)

- 0.06% of the amount above €500k (300€)

- Total: 1040€

ABN Amro Costs for Advanced Investors

- 0.2% of the first €100k (200€)

- 0.12% of the amount between €100k and €400k (360€)

- 0.06% of the amount above €400k (360€)

- Total: 920€

Rabobank Costs for Advanced Investors

- 0.24% of the first €100k (240€)

- 0.12% of the amount above €100k (1080€)

- A maximum cap of 400€ applied

- Subtotal: 400€

- A non-recurring transaction cost of 0.1% of €1,000,000 (1000€)

- Total: 1400€

Note that the 0.1% transaction fees are paid only once. So assuming the same portfolio in any follow up year, the cost would be capped at 400€.

Fees for a €1M portfolio. Rabobank’s transaction costs are greyed out because they’re not ongoing charges

PS Rabobank becomes the cheapest option on yearly basis (i.e. ignoring the transaction costs) at ~€265k.

ING vs ABN Amro vs Rabobank

So, what is the best option for an investor?

It really depends on what you’re trying to optimize for. It also heavily depends on your long-term strategy.

For example, there is a sweet spot at ~€265k where Rabobank becomes preferable to ABN on ongoing basis due to their yearly limit of €400. But if you happen to sell within 2 years, it becomes the most expensive option by a large margin.

And of course, some people consider other factors than just expenses – user experience, customer support, familiarity with a bank, etc. But if you’re interested in the investment costs only, I hope this post gave you a structured overview of them all.

Keep in mind that I wrote this post in 2024. All of these numbers can change.

Afterword

My recommendation? Use a broker instead of a bank.

I’d prefer to avoid paying yearly fees on top of the existing expense ratios of the funds. Plus, ETFs give a lot more freedom in portfolio creation.

Personally, after trying multiple brokers and banks, I ended up with Interactive Brokers (ref link, non-ref link). It’s a publicly traded company that’s available globally and they don’t have ongoing charges or account fees.

And for the experienced investors: it’s true that the Northern Trust funds recover what would’ve been lost in dividend leakage. Read the following post where I explain why the alternative is still cheaper: NT Funds vs ETFs.

For more detailed analysis on investing from Europe, visit: EU Investors Handbook.

For a comprehensive, beginner-friendly, and free resource on stock market investing, visit: How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer