Many expats in the Netherlands aren’t sure whether to get a linear mortgage or an annuity mortgage.

In this post, I will explain the differences between linear vs annuity mortgages.

This will allow you to avoid overspending on a cookie-cutter solution from a financial advisor.

Annuity Mortgage

Annuity mortgage is the most common type of mortgage in the Netherlands. And in the world, actually. This is the “default” mortgage you’d get in most places.

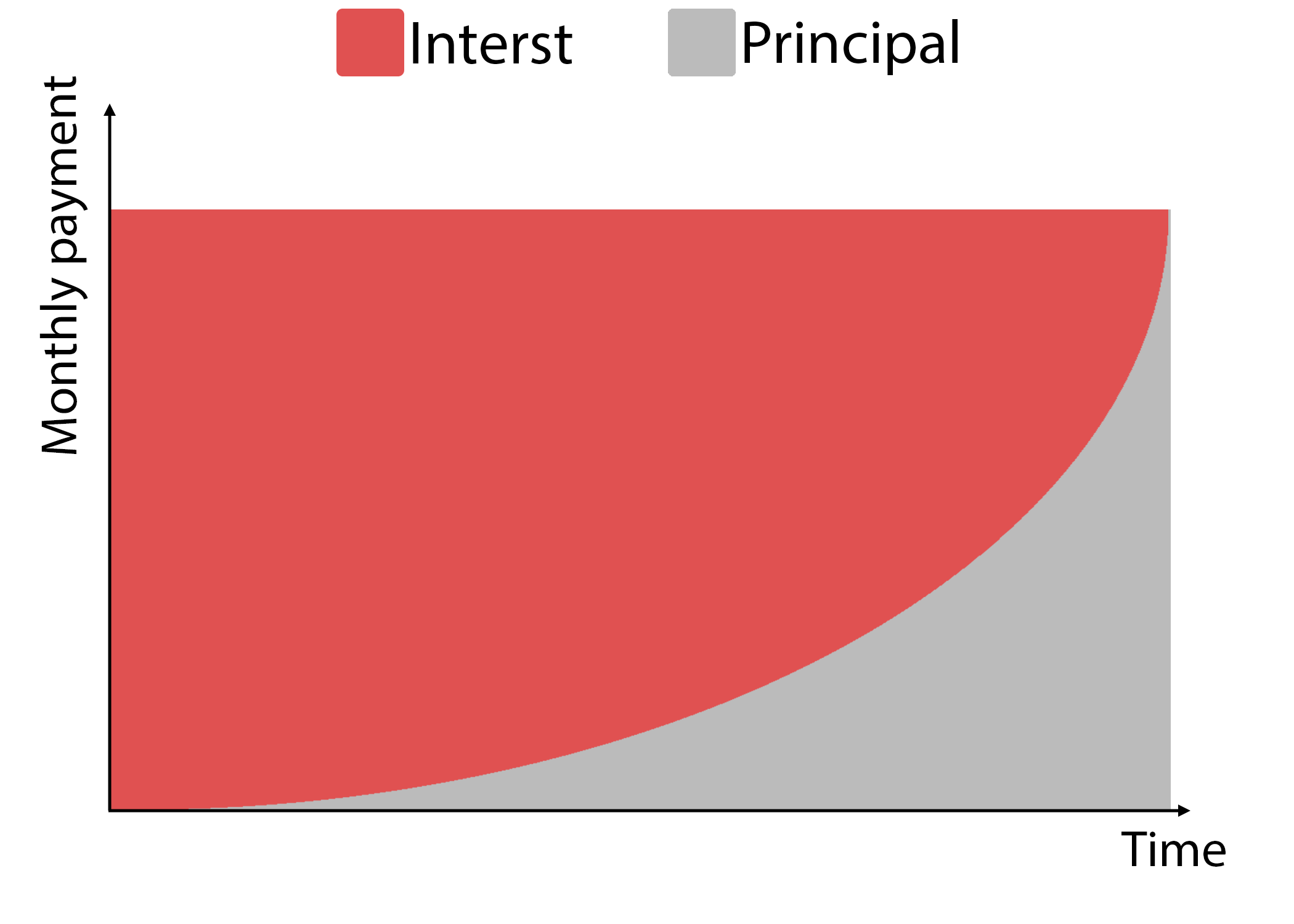

With an annuity mortgage, the amount you’ll pay per month will be the same throughout the whole mortgage duration.

However, in the first years, the greater chunk of the payments will be interest, while the principal will be paid out later.

This is shown in the picture below.

As you can see, at the beginning the payments consist mostly of interest.

The actual repayment catches up later in the process.

Pros and Cons (Annuity Mortgage)

The interest is tax deductible.

This means that during the first years, the borrower will get a large chunk of his payments back through tax returns.

In other words, the net amount spent on housing will be lower in the first part of the mortgage duration.

This makes the annuity mortgage appealing for people expecting to earn more in the future.

However, you hardly build any equity in your home during the first half of the mortgage duration. This will also make the total interest paid higher throughout the full duration.

For most people, the idea of “paying less today” seems quite appealing but they end up paying more in the long run.

Linear Mortgage

Linear mortgage is another option for people looking to finance their homes.

Similar as the previous type, the monthly payments consist of part interest and part principal. But there is a difference:

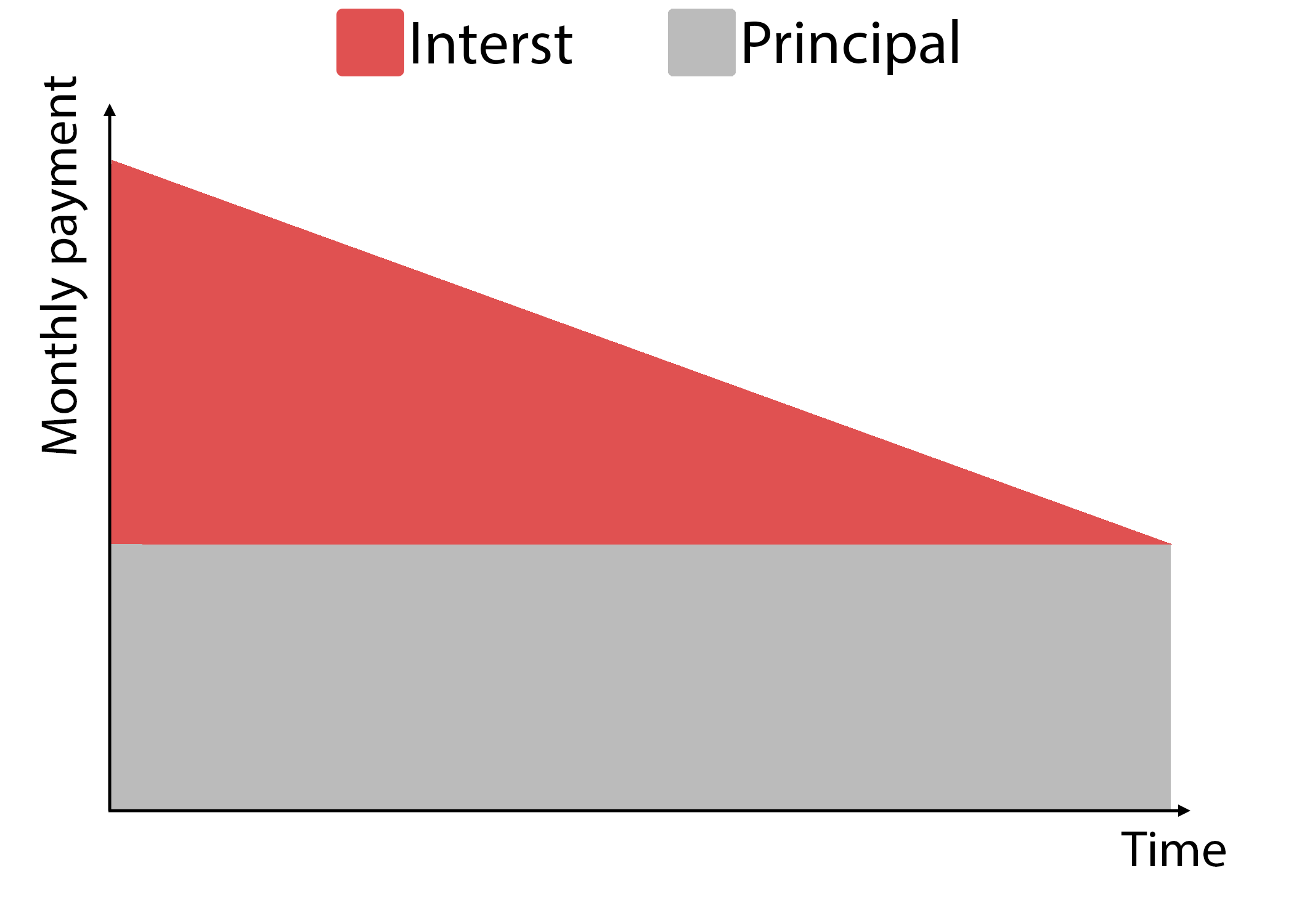

Basically, the principal amount paid out per month is a fixed amount, while the interest payments decrease over time.

This is shown in the picture below.

As you can see, the debt repayment is the same throughout the mortgage duration.

But the interest is calculated on the remaining amount each year.

And since the interest is based on the outstanding principal, the interest payments decrease over time, as more of the debt is repaid.

Pros and Cons (Linear Mortgage)

Since the interest payments are lower, that means lower tax returns.

In other words: the net housing costs will be higher at the beginning.

However, as more of the principal gets repaid, the full monthly payments keep lowering over time.

So linear mortgage means faster reduction of debt, or in other words, building more equity as early as possible.

And since the principal is repaid earlier, the total interest paid will be lower over the mortgage duration.

Interest Types: Fixed vs Variable

Once you’re set on the linear vs annuity debate, it’s time to decide on a fixed or variable interest rate. Or something in between.

Let me explain.

Variable Rate Explained

A fully variable rate means that your mortgage rate will be adjusted based on the current rates every year.

For example, the current rates may be 3.5%. But next year they may fall to 3% or increase to 4%.

This leaves the borrower exposed to IR risk, as a rate increase would mean higher monthly payments. But at the same time, allows people that expect rate cuts to get a lower mortgage rate later.

Fixed Rate Explained

A fully fixed rate means that the interest rate will be fixed over the full duration of the mortgage.

The amount itself is calculated based on the current rates. However, there is a “premium” added for the 30 year uncertainty going forward.

However, although it’s higher today, it leaves the borrower with the peace of mind.

Basically, no economic factor will make him pay crazy-high rates in the future.

Fixed vs Variable Rate or a Combination of Both

There is a third option:

The banks allow people to fix the mortgage rates for a part of the duration.

For example, you could get a 10 year fixed mortgage. This means that your rate will be fixed during the first 10 years and will be variable afterwards.

This might be a good balance for people that are buying a “starter home” (i.e. a they plan to upgrade within 10 years). The shorter period you’re fixing the rate for the lower it will be, as the banks have less uncertainty.

Of course, any evaluation depends on the current interest rates and the financial circumstances of the buyer.

The Verdict: Linear vs Annuity Mortgage

Guess what I’m about to say.

Exactly – it depends.

Your current situation, family status, spending habits, risk aversion, future earning potential, forecasts of the housing market and the economy, etc. all have an impact of this decision.

So yes, it really depends on everything.

That’s why you need to sit down and run the numbers.

My Preference

First of all, a disclaimer: I did my evaluation in 2019, in a completely different economic environment. Although no conclusions are eternally applicable, insights into another buyer’s thought processes should be beneficial.

What made most sense to me is finding a mortgage provider that allows penalty free extra repayments and getting a linear mortgage (for more efficient debt reduction) with a 10 year fixed rate. This meant fixing the rate to 1.7%.

Given the two-digit inflation in the upcoming years, this was a great decision. Also, a <2% rate is historically and objectively low.

Then, although you can repay more than the monthly payments, don’t do it aggressively. This way, you can enjoy tax benefits and not accumulate opportunity cost by putting all your money in your primary residence.

And in 10 years, after you already paid out around a third of the home, assess your situation. If you see that the upcoming rates are high, make use of the repayment possibility and lower the principal amount. Or maybe you’d want to relocate by then. This heavily relies on personal circumstances to speak in objective terms.

But remember, all personal finance related topics require ongoing reevaluation.

And whenever you face uncertainties and need to take risk, just make sure it’s calculated, get it?

Next Steps: Linear vs Annuity Mortgage

Needless to say, nothing I wrote is financial advice.

And you don’t need it.

Save what you would’ve spent on advice and make your own decision.

You can always confirm your thought process with the free and non-committing introductory meetings all mortgage advisors offer.

Husband & Father

Husband & Father  Software Engineer

Software Engineer