A lump-sum payment describes a payment that happens once, at a particular time, as opposed to multiple smaller payments over time.

If you accumulated a somewhat large amount of savings, you might wonder how to put them to work.

At the end of the day, if you just dump them in the market, there are countless scenarios that can happen.

In this post, I’ll classify these scenarios in a few categories and explain what each means for your long-term portfolio.

The Nature of a Lump-Sum Investment

Usually, the best moment to do a lump-sum investment is now.

You’ve read that right.

Many peoples’ initial tendency might be to consider this approach naive, stupid, or even gambling.

But is it really?

In reality, after you figured out your asset allocation and the time horizon of your investments, it shouldn’t make a difference whether you’re investing $100 or $200k.

Of course, when it comes to the short-term performance, there will always be some uncertainty. So, let’s review a few scenarios that can occur – what happens if you get lucky after a lump-sum investment and what happens if you don’t.

Lump-Sum at the Beginning of a Bull Market

Dumping a large amount of money at the beginning of a bull market can be considered a perfect timing.

This means that your investment portfolio will start at the bottom and will experience growth during the full bull run… Until the next recession, when the losses won’t even bother you with all the compounded gains you enjoyed throughout the years.

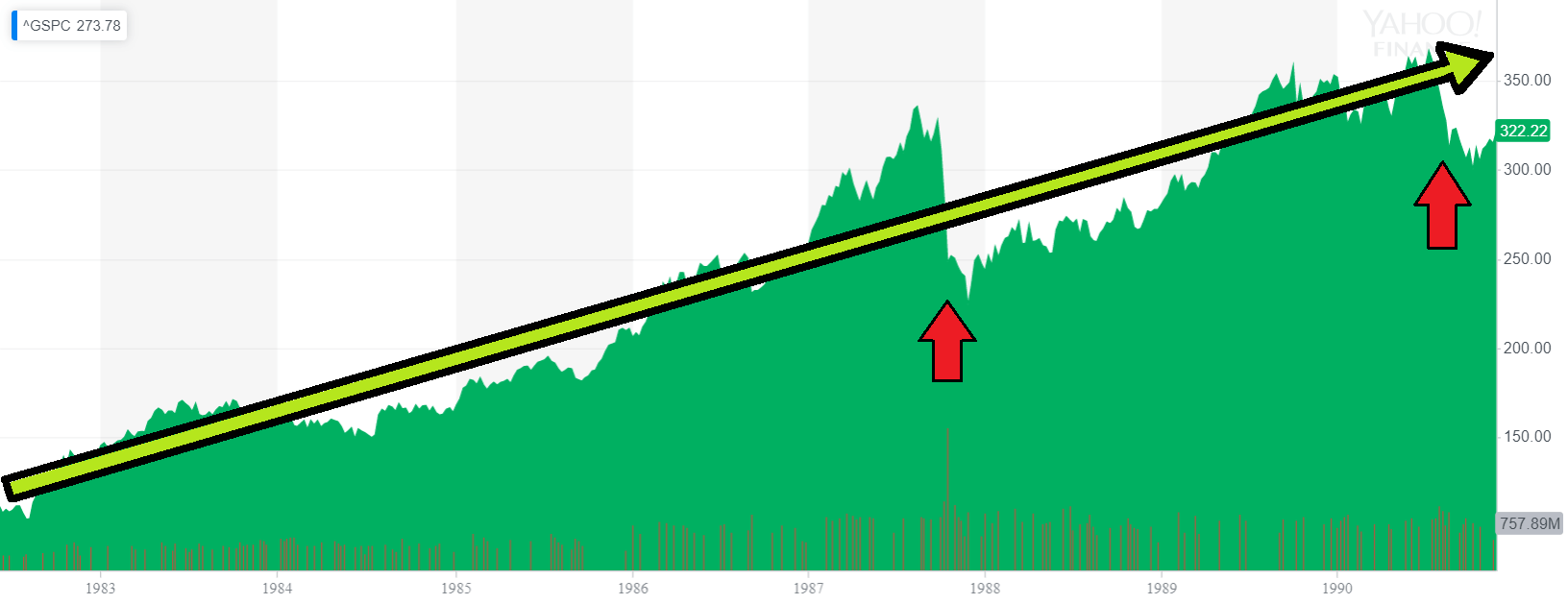

The red arrows below point to two recessions between 1982 and 1991. The person who invested at the beginning of this period has no issue handling them.

S&P 500 (1982-1991) – Market crashes and recessions become easy to handle.

Starting at the absolute bottom is the best-case scenario.

It’s also a highly improbable scenario.

Lump-Sum Before a Recession

Long story short: this is the worst case scenario.

Imagine putting all your savings in an S&P 500 ETF in 2000.

You’d go through the dot-com crash, recover over the next 7 years, just to experience another severe recession (a great one), and wait a few more years just to break even.

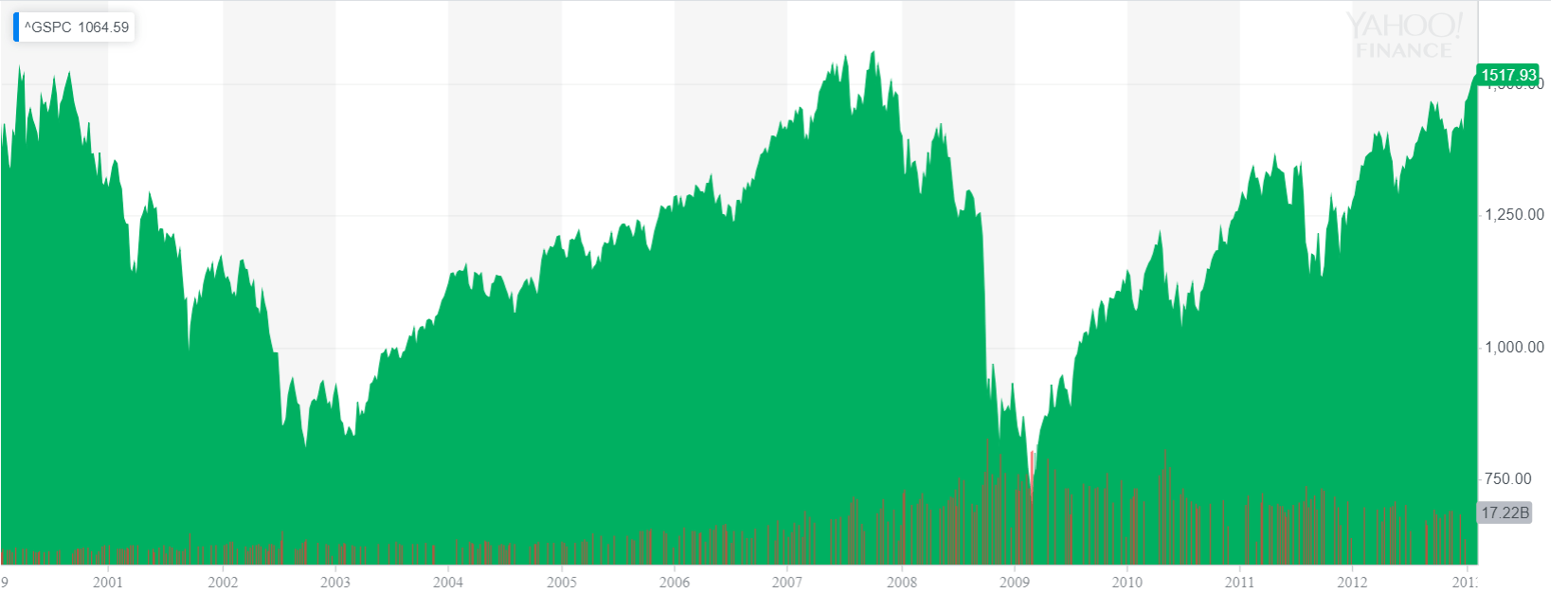

S&P (2000-2013)

Entering before a recession is the worst thing that can happen when doing a lump-sum investment. Notice that entering a year earlier or a year later would make this a completely different experience.

Still…

If you think that you can “wait for the next crash”, you’re wrong.

By not entering the market, you would hold cash until you start seeing a recovery after the next crash. But what if after two years you’re still waiting for the recession? Another year passes by and you still do… Five years later, there were a few corrections refreshing the stock market, but still no signs of a recession. Even if there is a market crash right then, think about what you’ve lost over the years.

Let me list a few things:

- You lose a portfolio growth averaging at around 10% per year

- You lose dividend payments, maybe reinvesting them, and the compound effect

- Opportunity cost, because you lock your money in waiting mode for an unpredictable event

- Your money losing value year after year because of inflation

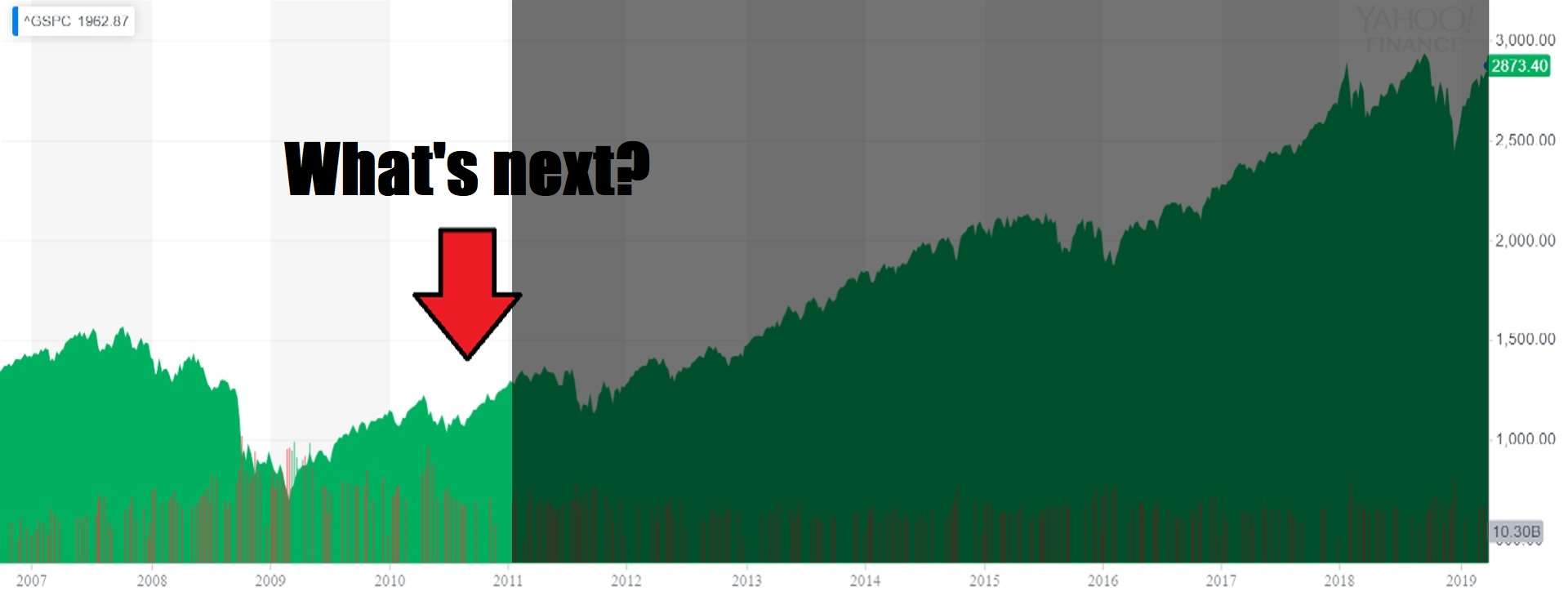

So, imagine that someone with a post-recession trauma thought that the stock market is overvalued in 2010 and decides to wait for a crash before entering.

That person would still be waiting, and more likely than not, any next recession won’t even touch the levels he missed by not entering earlier.

Of course, when you enter the stock market, you should be prepared for the volatility and economic crises.

Fortunately, they are historically “once in a decade” events – and usually opportunities to build even more wealth.

Entering right before a recession is also a highly improbable scenario.

That leads us to:

Somewhere in Between

Okay, the last section might have made you more scared of investing than you previously were. And although it’s true that anything can happen at any time, let me tell you what’s the most probable scenario.

“Anything in between” is the actual period in which you’ll most probably enter the market.

Not only it’s good enough for a lump-sum strategy, but it also embodies the slogan “time in the market beats timing the market“.

It ensures that you’ll be in the market for as long as possible.

Of course, there is a infinitesimal risk that the market will collapse forever and that the sun will explode an hour after you invest…

So the question becomes: how do you prepare yourself for an encounter with a black swan?

Conclusion

If you’re still not 100% comfortable with trusting the “time in the market” narrative, that’s perfectly fine.

The purpose of a passive portfolio is to make you sleep better at night, not worse.

That’s why DCA (dollar cost averaging) is the middle ground that works for most people.

Even if you have a large amount of savings, you can always split them into equal parts and invest them over the next months/quarters/years.

Also, remember that dollar cost averaging can be supplemented with extra lump-sum investments should the circumstances arise (EOY bonuses, spotting good entries, etc.).

And whenever things get overwhelming, you should remember the time horizon that you’re investing for:

The long-term.

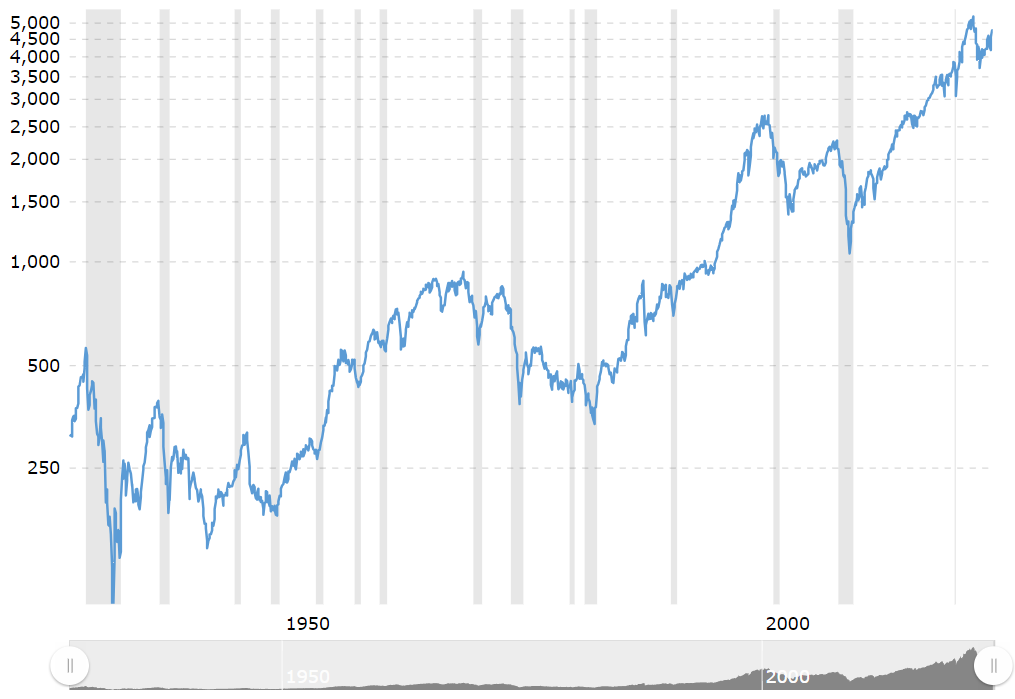

That should remind you how the stock market performed through the years of volatility, corrections, bear markets, and recessions.

S&P 500 since the 30s on a logarithmic scale. Source

And just so you don’t get overconfident, also remind yourself that past performance does not guarantee future results.

So, your turn.

What’s your investment strategy like?

Don’t have one? Visit How to Start Investing: A Complete Beginner Series for a comprehensive, beginner-friendly, and free resource on stock market investing.

Husband & Father

Husband & Father  Software Engineer

Software Engineer