Welcome to the third and last post of the Supply and Demand Series.

The first two posts described the self-regulatiing nature of the free markets and their efficiency in maximizing revenue and benefit to society.

In this post, I’ll talk about government intervention and regulation.

Specifically, how government impositions make the markets less efficient by creating deadweight loss, i.e. less benefit to society.

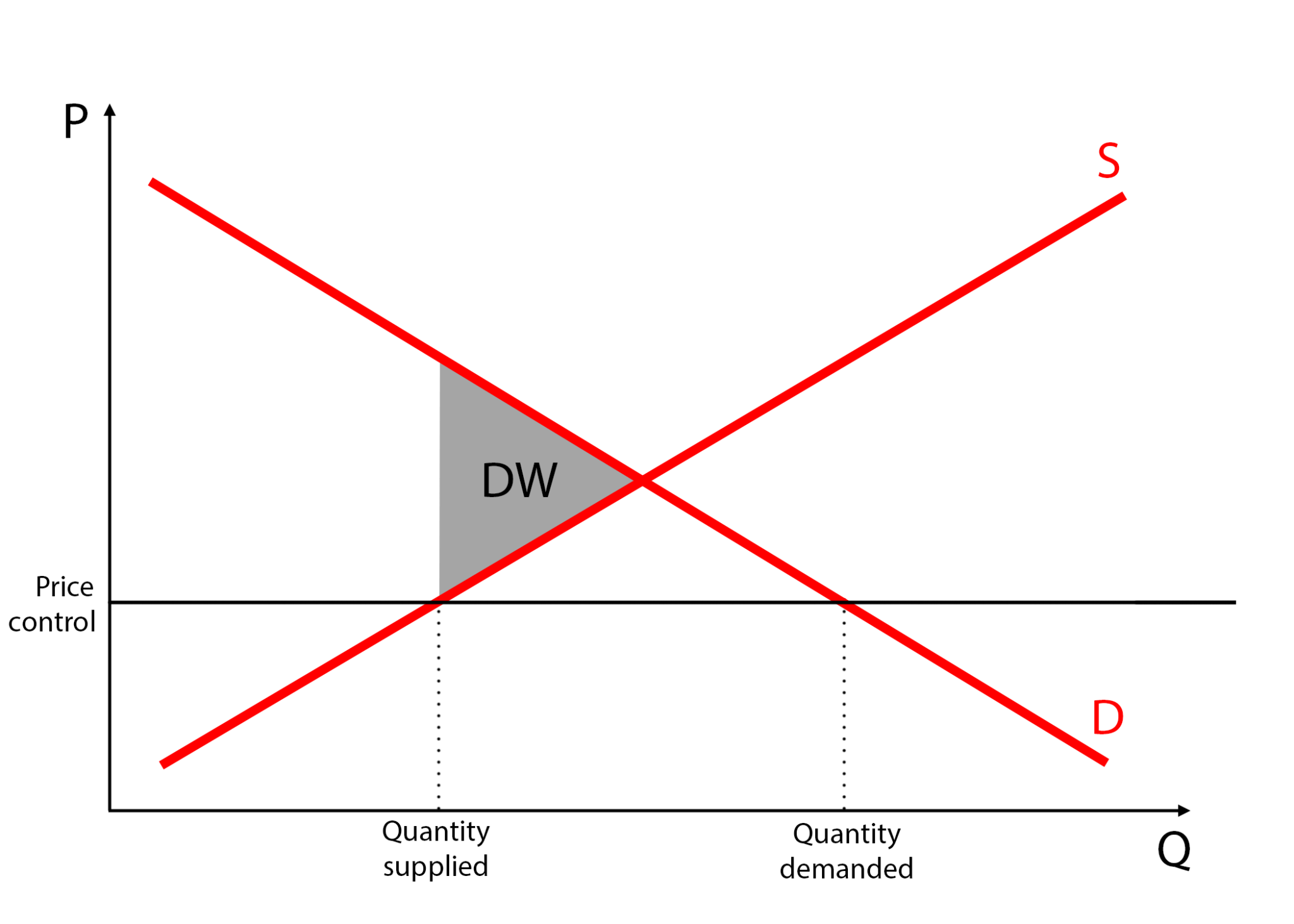

Price Ceilings

A price ceiling is the maximum price a seller can charge.

This is illustrated by the black line in the picture below.

If you need a reminder, the equilibrium price and quantity are at the point where the supply and demand curves intersect – and the price ceiling prevents the price to be set that high.

If the price ceiling is above the equilibrium price (and in the picture it’s not), then it won’t matter.

However, if it’s below it, it will lead to a lack of supply. The quantity demanded will exceed the quantity supplied, creating excess demand that can’t be satisfied.

The reduction in quantity exchanged leads to deadweight loss illustrated by the grayed out area in the picture.

Price ceilings are popular with housing costs in countries aspiring to downgrade to socialism. Apologies for sneaking an opinion in a finance post. Regardless, rent control (or any type of price ceiling) can lead to discrimination (suppliers prioritizing relatives), black markets (receiving extra cash under the radar), corruption (bribery), and/or reduction in quality (no motivation to offer good service), as well as countless inefficiencies due to fear and lack of opportunities for the buyers.

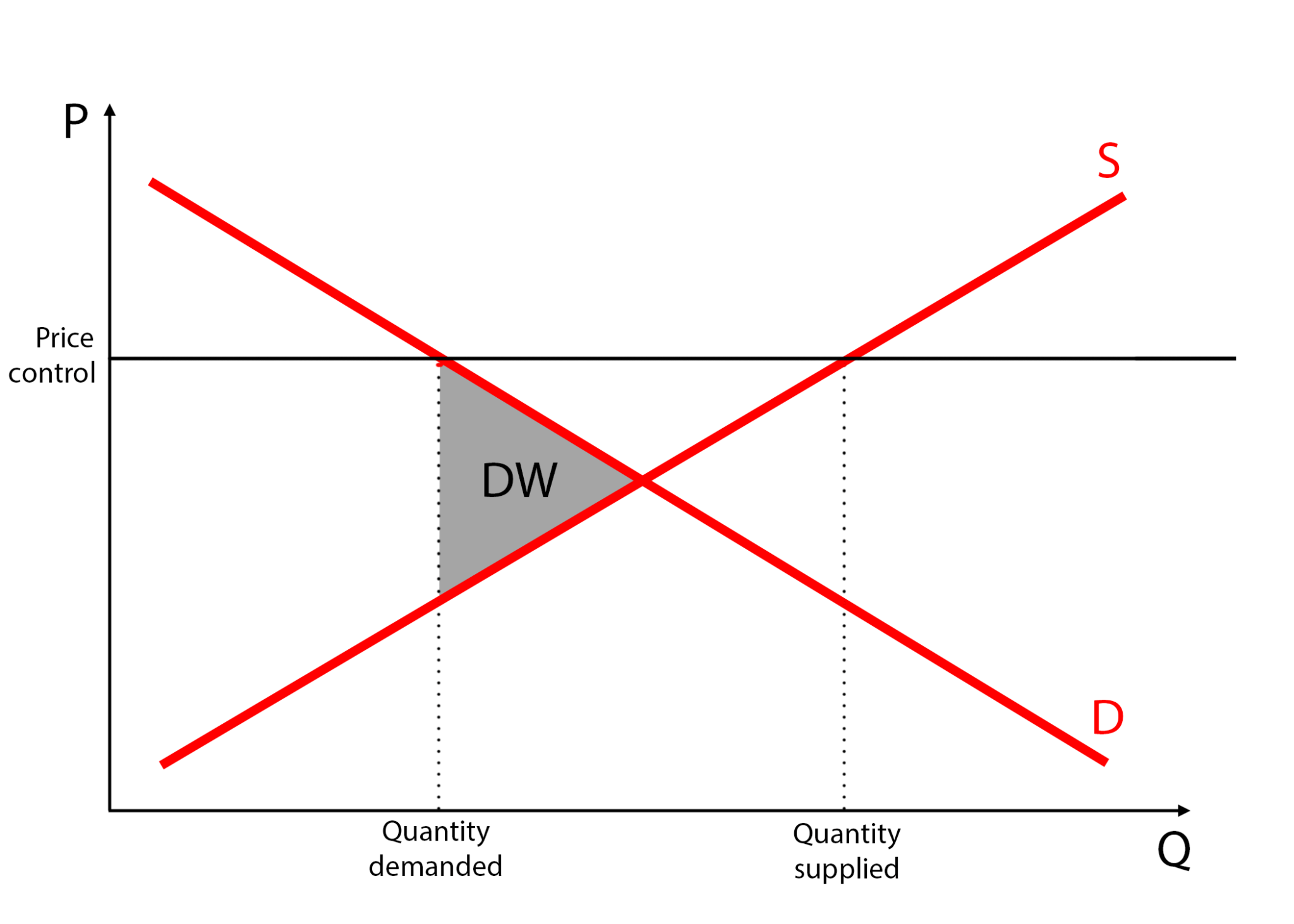

Price Floors

A price floor is the minimum price a seller must charge.

This is illustrated by the black line in the picture below.

If the price floor is below the equilibrium price (and in the picture it’s not), then it won’t matter.

However, if it’s above it, it will lead to lack of demand. The quantity supplied will exceed the quantity demanded, creating excess supply that won’t be utilized.

The reduction in quantity exchanged leads to deadweight loss illustrated by the grayed out area in the picture.

An example of a price floor is the minimum wage – creating an excess supply of unskilled workers that won’t be employed because companies can’t afford to hire them below the legal minimum (even if the workers are willing to work for less). The result? More unemployment and illegal workers, or reduction in working hours and thus even lower incomes – all of which adversely affects the portion of society the government intended to help in the first place.

Other inefficiencies include suppliers allocating resources for production of goods that nobody will be willing to buy at such a high price.

Deadweight loss everywhere.

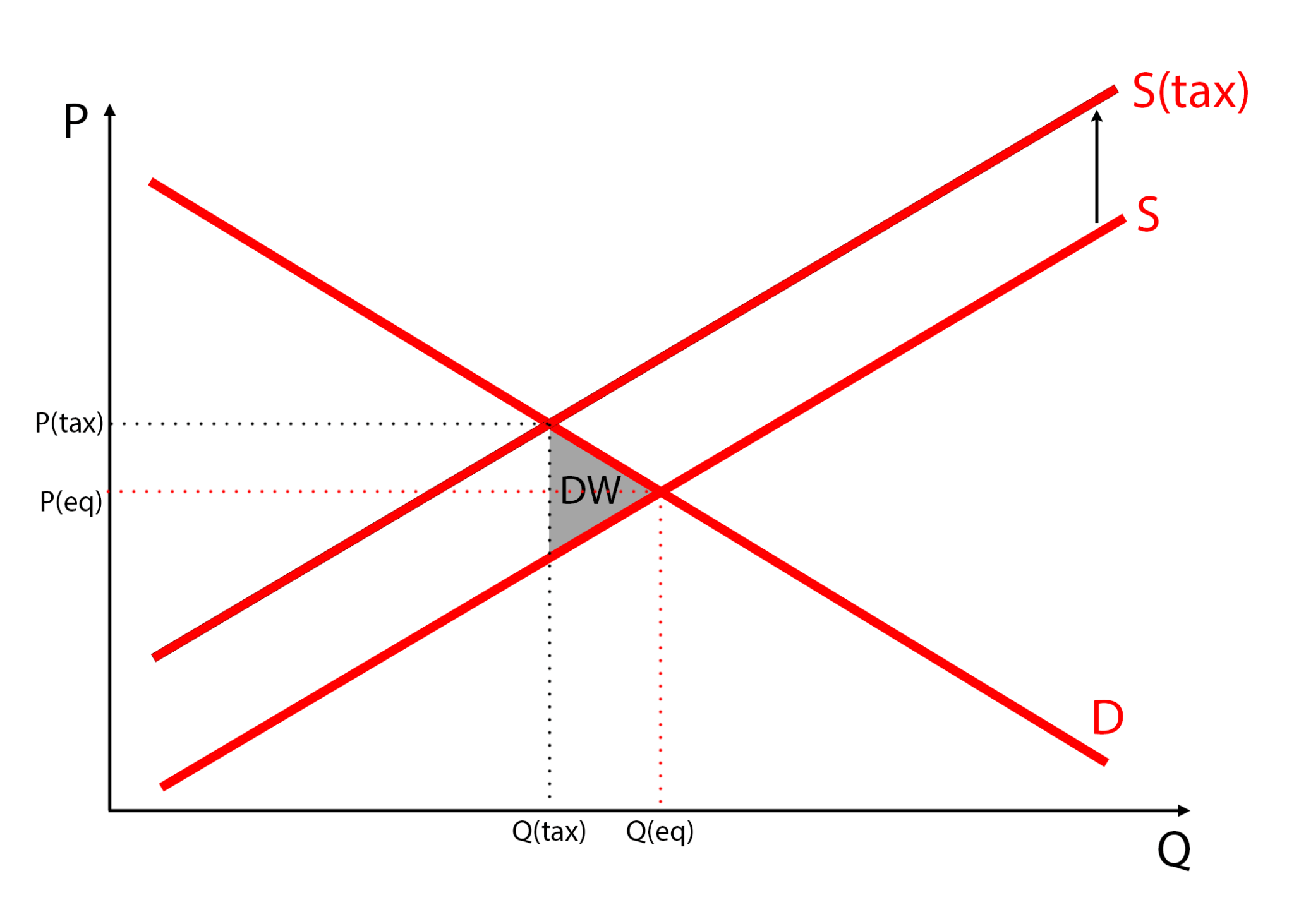

Taxes

Taxes decrease the amount suppliers receive and increase the amount that consumers pay.

Let that sink in…

Let me say it in another way: tax is the difference between what consumers pay and what suppliers earn for the same unit.

The deadweight loss is obvious already. No charts necessary. But I’ll include one below anyway.

Taxes on quantities exchanged can be divided into taxes on producers and taxes on consumers (such as VAT).

- A tax on producers shifts the supply curve upward, creating an artificial equilibrium price, resulting in reduction in the quantity exchanged, thus a deadweight loss

- A tax on consumers shifts the demand curve downward, creating an artificial equilibrium price and a reduction in quantity exchanged, resulting in a deadweight loss

Other Macroeconomic Obstacles to Efficiency

Tariffs

A tariff is a tax levied on goods imported in a country.

The goal of the tariff is to “protect domestic producers” – by increasing the price of imports, local consumers will need to pay more for foreign goods, thus going for a domestic substitute.

But the primary goal of a tariff is the government’s revenue. Ultimately, it benefits the government and producers in a few domestic sectors at the expense of the domestic consumers. And let’s not forget that reduction in competition reduces efficiency (and quality).

A trade war is an unproductive cycle of two countries imposing tariffs on each other.

Quotas

Quotas are upper or lower limits on the quantity permitted to be imported, produced, or fulfilled in a country.

In regards to imports, the goal of quotas is to limit the supply of foreign goods and protect certain domestic industries. However, similar to tariffs, it ultimately harms domestic consumers, who’ll be forced to pay for products priced at premium in the uncompetitive domestic market, reducing the quantity demanded and creating deadweight loss.

Voluntary Export Restraints

A volunary export restraint (VER) is an agreement between two governments in which the exporting country agrees to limit the exports into the importing country.

A country has interest to enter such an agreement in order to avoid other potential trade restrictions with the other country. However, the economic impact is similar to that of a quota, with the difference that a voluntary export restraint is not imposed by the importer, but the exporting country itself.

Again, deadweight loss everywhere.

Conclusion

Government interventions and impositions reduce the benefits to the society.

This is the third post of a 3 part series on Supply and Demand:

- Supply and Demand – An Introduction

- Consumer and Producer Surplus & Deadweight Loss

- Obstacles to Efficiency – Taxes, Price Controls, Trade Restrictions (the current one)

Husband & Father

Husband & Father  Software Engineer

Software Engineer