In my previous post on this topic, I wrote about events in recent history that lead to the death of the gold standard.

I’ll do a short recap and jump into the aftermath – what’s been going on after we went off the gold standard.

The Gold Standard: Modern History

These are the major events worth knowing about in regards to gold as a reserve currency in recent history:

- 1900 – The gold standard act

- 1933 – Confiscation of citizens’ gold

- 1944 – Confiscation of world’s gold reserves

- 1971 – The Death of the Gold Standard

Again, go read part 1 to understand all of these in more detail:

The Death of the Gold Standard (What Happened in 1971)

Aftermath: The Death of the Gold Standard

Since 1971, the US dollar isn’t backed by anything.

It’s not really different than points in a video game.

But what’s the problem with this if everyone agrees to trade in this currency?

I agree, having a consensus on how to conduct trade isn’t the actual problem.

The actual problem is that an entity has full control over this currency and its circulating supply. This creates FIAT Money – a kind of money that’s made legal tender by decree.

How FIAT Affects Your Life

As you can probably already see, this requires your government to act in your best interest. You must believe that they’ll do.

I hope you can see how unfair the power disbalance is, putting you at a disadvantage… You work your whole life, exchanging precious time for units of this currency, while the federal reserve has the ability to simply create more of it.

When more money appears, it dilutes the purchasing power of existing money.

So your years of productivity from the past can’t buy as much in the present. And your wealth in the future will be worth much less than it is today.

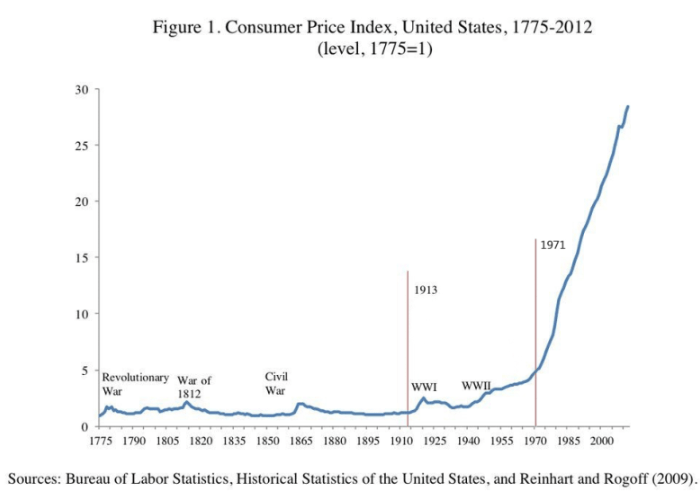

But don’t take my word for it – after 1971, the gold’s price rose from 40$/oz to 120$/oz. Assets’ prices also exploded upwards:

But that’s the wrong way to say it…

Nothing really got more expensive.

The money got cheaper.

People got literally robbed. And they continue to be up to this day.

You as well.

And nobody needs to explicitly tax you or use any tactics to confiscate your savings – the increasing of the money supply itself dilutes your purchasing power year over year.

As a participant in the economic system, the biggest mistake you can do is ignore this.

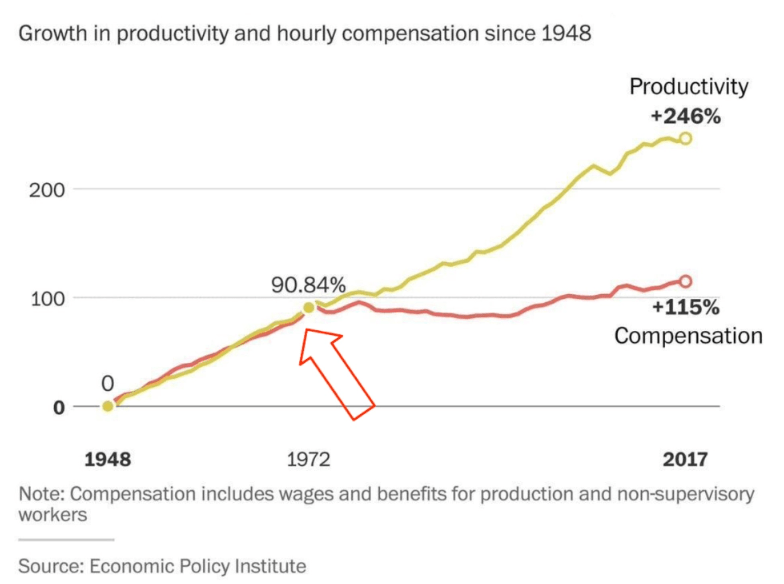

I won’t convey it as good as “WTF Happened in 1971” (wtfhappenedin1971.com). Check them out to see more charts such as this one:

Conclusion

Human history teaches us that faith in an entity will eventually lead to a collapse.

On a more short-term level, our purchasing power is the crucial factor of how our experience in life will be. Even if you’re not the materialistic type, this holds true. You’re a human – you need calories to survive and shelter to protect yourself.

As long as your well-being is determined by someone that can dilute, control, and confiscate your wealth, you’re guaranteed to suffer.

Read my “How the Money Printer Makes You Poor” to understand to which extend you’re affected.

And then…

You understand that you need an asset that allows you to fully own it. An asset that can’t be controlled, manipulated, or tampered with. An asset that’s resistant to violence, censorship, and confiscation.

And only then you get laser eyes…

And take your first step towards liberty.

Husband & Father

Husband & Father  Software Engineer

Software Engineer