Every investor eventually faces the dilemma of where to park idle cash temporarily.

In this post, I’ll compare my top Money Market Fund alternatives for Europeans.

My goal is to show the importance of analyzing these opportunities in more detail – understanding how they achieve the returns and making an informed decision of what makes sense for yourself.

Without further ado, let’s analyze YCSH vs E0UA vs ERNX vs a Trade Republic account.

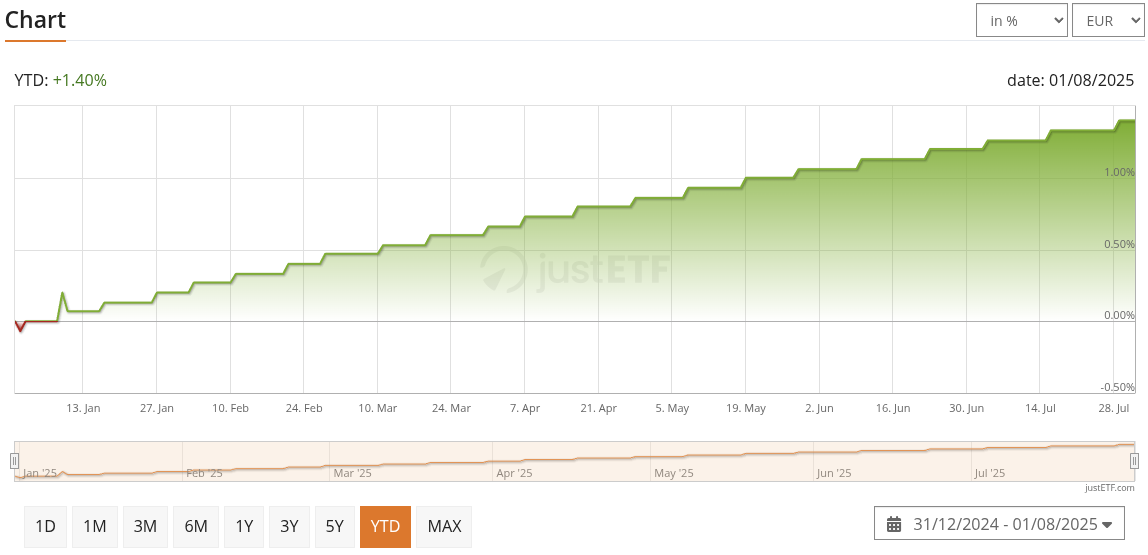

YCSH (iShares € Cash UCITS ETF)

Isin: IE000JJPY166

iShares € Cash UCITS ETF (YCSH) is an actively-managed ETF by BlackRock domiciled in Ireland.

The ETF aims to provide returns similar to money market rates, at the moment of writing that’s slightly under 3% (Overnight ESTR for reference).

It has a TER of 0.1% and is an accumulating fund (reinvests the interest in the fund itself instead of paying it as a dividend, removing dividend tax obligations).

At the time of writing, the fund manages >€582M and achieves the target return by depositing EUR in 140+ banks.

Its diversification, predictability of returns, and low risk make the ETF suitable for investors having spare cash that they don’t want to deploy to risk-on assets.

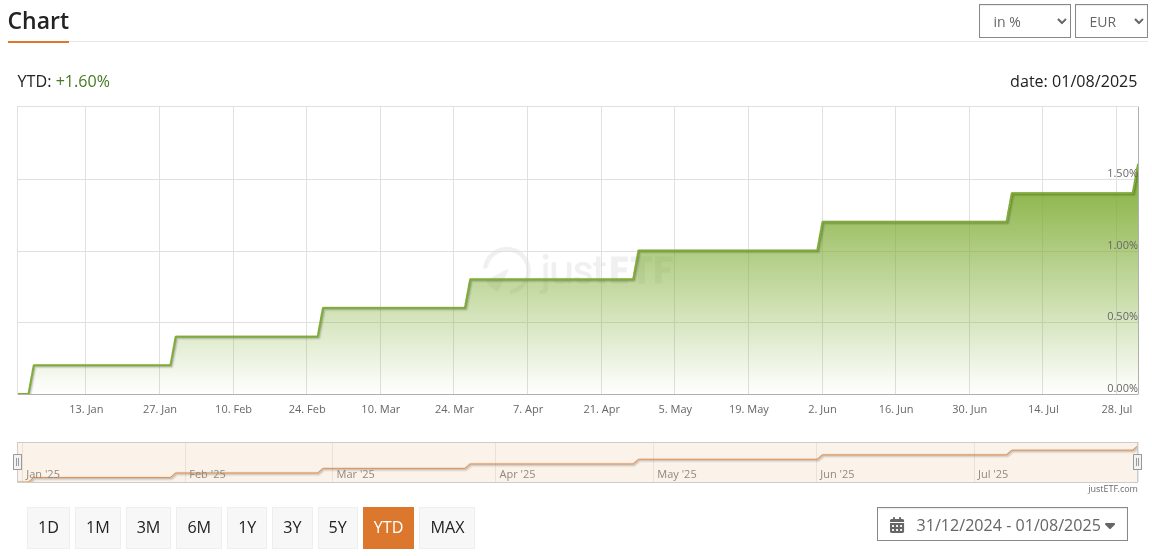

E0UA (iShares € Govt Bond 0-3 month UCITS ETF)

Isin: IE000JLXYKJ8

iShares € Govt Bond 0-3 month UCITS ETF (E0UA) is another BlackRock ETF aiming to provide predictable returns, close to the risk-free rate.

Unlike YCSH, this ETF buys government bonds from various EU countries. As of time of writing, the funds holds 27 bonds and due to their ratings and short-term maturity, there’s virtually no volatility.

E0UA is also an accumulating fund with a TER of 0.07%, so slightly cheaper than the previous one.

The only downside is its NAV (net assets under management) of ~€10M. This isn’t a concern if you’re parking a few thousand, but if you’re buying 10% of the fund (what a weird thing to say, but in this case it’s realistic) you might consider liquidity risks.

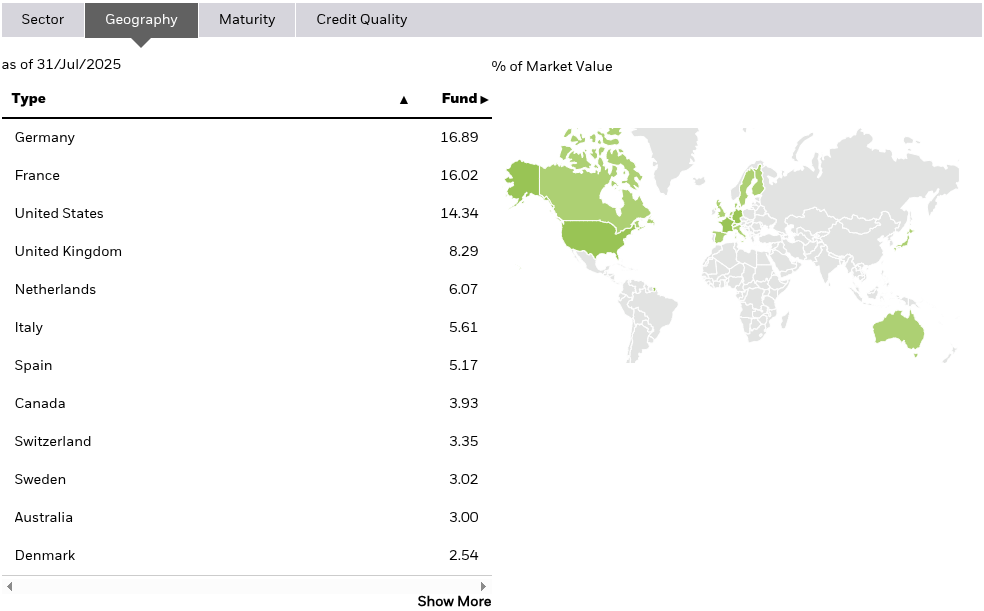

ERNX (iShares € Ultrashort Bond UCITS ETF)

ISIN: IE000RHYOR04

iShares € Ultrashort Bond UCITS ETF (ERNX) is yet another fund offered by BlackRock that achieves a higher return than the previous two by holding both government and corporate bonds.

The bonds in the portfolio are all investment grade with times to maturity of 0-1 years (fixed rate, 85% of the holdings) and 0-3 years (floating rate), diversified geographically and across sectors.

At the time of writing, the fund holds 630 bonds, charges 0.09% in total expense ratio, and is an accumulating fund.

With assets under management of >€4.8B, it’s the largest of the funds.

So the question is if the investor is comfortable with some corporate bonds exposure (i.e. inherently riskier than government bonds, but still only high rated bonds) to get a slightly higher return.

Trade Republic Account

Trade Republic is a German-based broker operating in 17 countries across Europe.

Besides its investment services it offers an EUR account that earns interest on uninvested cash.

Trade Republic deposits your idle cash into partner banks (Deutsche Bank, Citibank Europe, etc.) or money market funds (MMFs), achieving returns in line with the current European Central Bank’s deposit rate (at the time of writing 2%). The deposited cash is insured up to €100k under EU Deposit Guarantee Scheme.

Two things to check from your side: in some countries TradeRepublic offers interest on deposits up to €50k, so there’s no point in depositing more than that. Also, check the tax treatment of interest in your country compared to the capital gains tax if you choose ETFs.

Unrelated to its utility as a savings account, Trade Republic also offers a debit card allowing you to spend your balance and earn an additional 1% cashback on your purchases. Here are the referral link and non-referral link if you decide to open an account.

Verdict: YCSH vs E0UA vs ERNX vs TradeRepublic?

Personally, I park my idle cash in YCSH (for mid term) and TradeRepublic (for instant liquidity).

But I’d definitely consider E0UA and ERNX if I’d like to diversify further.

Also, note that this post is published in August 2025 and things might be different if you read it in the (distant) future.

Husband & Father

Husband & Father  Software Engineer

Software Engineer