Let’s address the elephant in the room first:

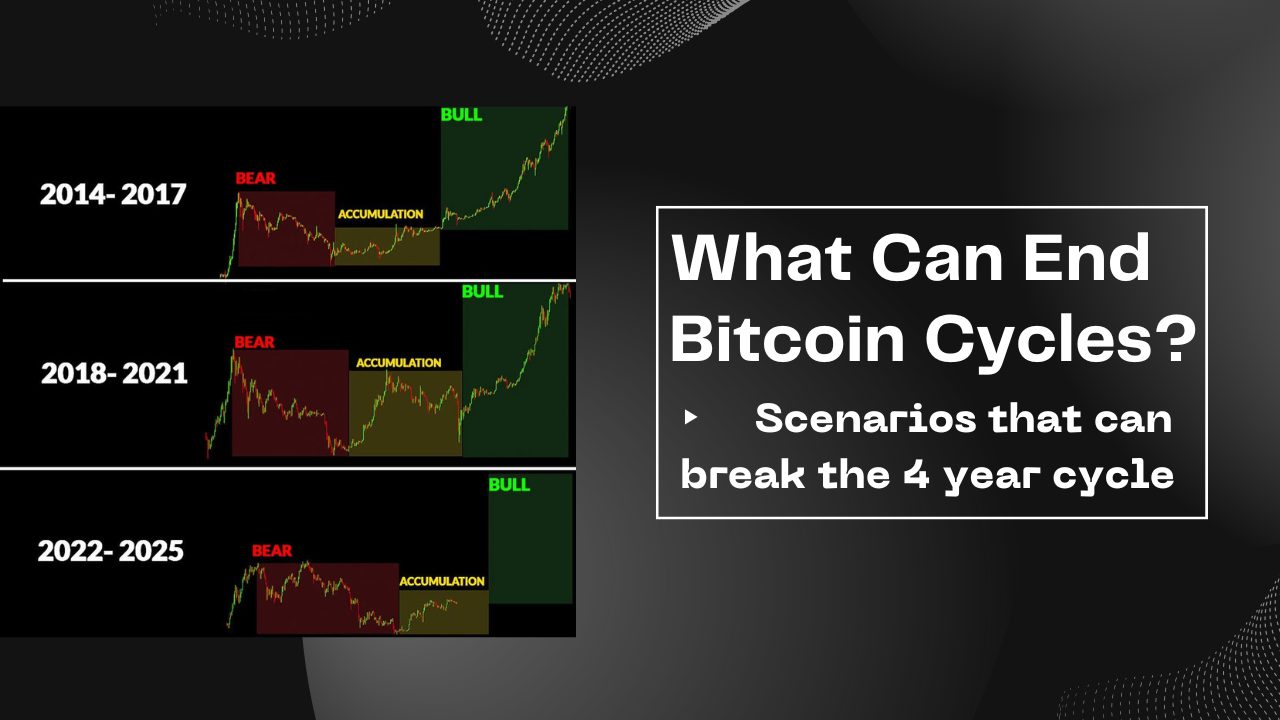

Yes, the 4-year cycle thesis is playing out once again.

As someone that serially leveraged the cyclical nature of the Bitcoin market to maximize my returns, I was quite vocal about it during the bear market:

- The 4 Year Cycle Explained

- How I Accumulate Bitcoin During Bear Markets

- Bitcoin Cycle-Based Rotation

- Tales From the Last Cycle

Not only here on dpetkovski.com, but also in countless in-person meetings, online chats, and forum/social media discussions, sometimes under my name, sometimes pseudonymously.

My pinned tweet from 2023.

Ending the thread with a bold prediction:

Don’t call me “lucky” in 2025. ⏳

And now, in mid 2025, why did I decide to stop talking about the cycle?

The “Making Money” Mindset

My cycle coverage inevitably became one of the most popular parts of my blog.

On one hand, I had insightful discussions with seasoned bitcoiners. Especially those closer to “retirement” – going deep on optimizing spending during bear markets, wealth preservation, taxes, and long-term prospects.

On the other hand, it attracted many beginners that only cared about “how to make money fast?!”

Most weren’t interested in the underlying asset, what it is, or why they’d want to hold it in the first place. The only thing that resonated with them was profit – “making money“.

Don’t get me wrong, Bitcoin’s price is extremely important.

But when that’s the only parameter your audience cares about, you’re not discussing sound money or financial sovereignty. You’re doing others’ homework while getting “wen moon” and “numbers go up” in return… As intellectually stimulating as refreshing the price chart every 30 seconds.

And yes, I non-ambiguously say to every beginner to study money. To study Bitcoin. I have a series on the topic.

Yet the result rarely changes – they’re after more of the exact “money” we’re trying to get rid of.

And unfortunately, when Bitcoin is reduced to a “profitable trade”, the mindset stays broken. The illusion persists and they continue throwing darts.

No Ideological Alignment

Let’s be realistic…

It’s very improbable to make life-changing returns from an asset you have no conviction in. You’ll panic sell at a loss at the first glimpse of volatility – something that we’re used to and welcome around here.

I mean, you can throw a few grand at a “risky investment” and cash out a couple of years later for an extra vacation. This opportunity exists for anyone connected to the internet. However, that’s not what I do, recommend, or offer.

I have a significant portion of my net-worth in this asset. I’m passionate and ideologically aligned with Bitcoin. But due to my extensive coverage of “the cycle”, the majority of the questions I’m getting about it are along the lines of: “did you start selling?”, “should I buy now?”, or “what do you think about XRP?”.

And all of a sudden, we’re discussing just another investment opportunity, no different than a memecoin, just wrapped in orange. Just another way to “make money“, bro.

Sincerely, I refuse to support non-bitcoiners in acquiring Bitcoin for the sole purpose of riding the 4 year cycle. Not because I gatekeep knowledge (my 100+ free posts prove otherwise), but because those lacking conviction see 2% pullbacks as a pro bono therapy vouchers.

Instead, here’s the deal: understand Bitcoin.

Prove that you did with your beloved and hard-earned money, just like I did.

Then we’ll talk cycles, asset allocation, retirement planning, tactical rotations, etc. But I won’t hold your hand into buying yourself a new car without being financially compensated.

Trading is completely on you.

Market Timing: We’re In A Bull Market

There is a third, more subtle reason why I stopped talking about the cycle:

We’re in a bull market.

In the “4th year”.

In the “don’t call me lucky” year of the cycle.

You should already be deep in profit if you were buying during bear markets, like yours truly:

I don’t want to motivate my readers into rash decisions while everyone starts FOMOing in. The detractors that called Bitcoin a scam now allocate “1-5% of their portfolio” because daddy BlackRock finally approves of it. Tourists bet on every Bitcoin-related product except Bitcoin itself – funds, treasuries, proxies, derivatives…

If I’m vocal about it now, it might lead beginners to be overexposed to an asset they don’t understand… And expecting similar results as mine, ignoring that:

- Almost everyone loses money in their first cycle

- 40-80% drawdowns are inevitably coming

- They’ll panic sell because of egocentric bias (I got in and now it’s different, 2020 was easy)

Maybe one day if I run a paid community I can be more transparent about my trades again.

Until then, I’ll stick to sharing knowledge and leave personal matters to the readers… As it’s always been actually.

Afterword

So, what do I think will happen during the year?

Wrong question.

By this point in the cycle, you should be extremely comfortable with your $BTC stack regardless of how it trades going forward.

If you’ve been sidelined so far, no answer will improve your position. “$140-160k until October-December” means nothing. Don’t outsource your investment decisions. Don’t blindly follow the “the cycle”. Build conviction in the asset instead.

All questions will answer themselves once you do so. I guarantee this.

And for the curious: my next post on this topic will likely be in January 2027. IYKYK.

Husband & Father

Husband & Father  Software Engineer

Software Engineer