Due to being relatively misinformed but overly confident in their level of expertise, pseudo-intellectuals can be especially harmful at the beginning of your investment journey.

In this post, I’ll describe some of the common narratives they’re spreading so that you can recognize and protect yourself accordingly. But be careful, they’ll make it very easy for you to rationalize and accept their viewpoint.

Without further ado, here are the top 3 things pseudo-intellectuals say or do to keep you poor:

“The Market is Hot”

Pseudo-intellectuals are impressed by the people that grabbed their “once in a lifetime opportunity”.

Think about people that bought cheap homes after the housing crash of 2008. Or those that invested in stocks during the Covid crash of 2020. Or those that bought Bitcoin a couple of cycles ago.

You know the type.

I wish I got a penny every time someone said that “house prices went crazy” or “the market is hot” or my favorite “stocks are at all time highs”.

These people have a misconception that the cyclical nature of markets will make them return to previous lows… And that this will finally be their opportunity to get rich themselves!

It won’t.

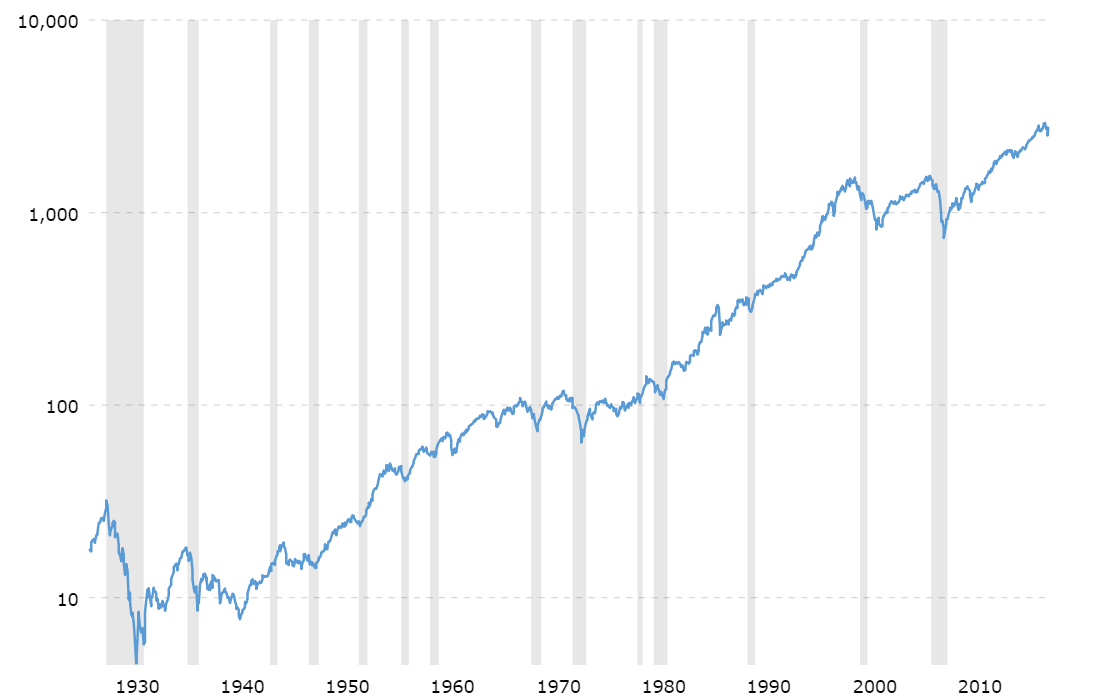

And 5 seconds of googling can show you the reality of the situation. Here’s the chart for S&P 500 on a long enough time frame.

Notice something?

Surprise! The market is (almost) always at all time highs!

Stocks aside, they say the same thing for any asset class – precious metals, Bitcoin, real estate…

What they miss is that all markets did, do, and will seem high/hot/crazy in the present, without hindsight.

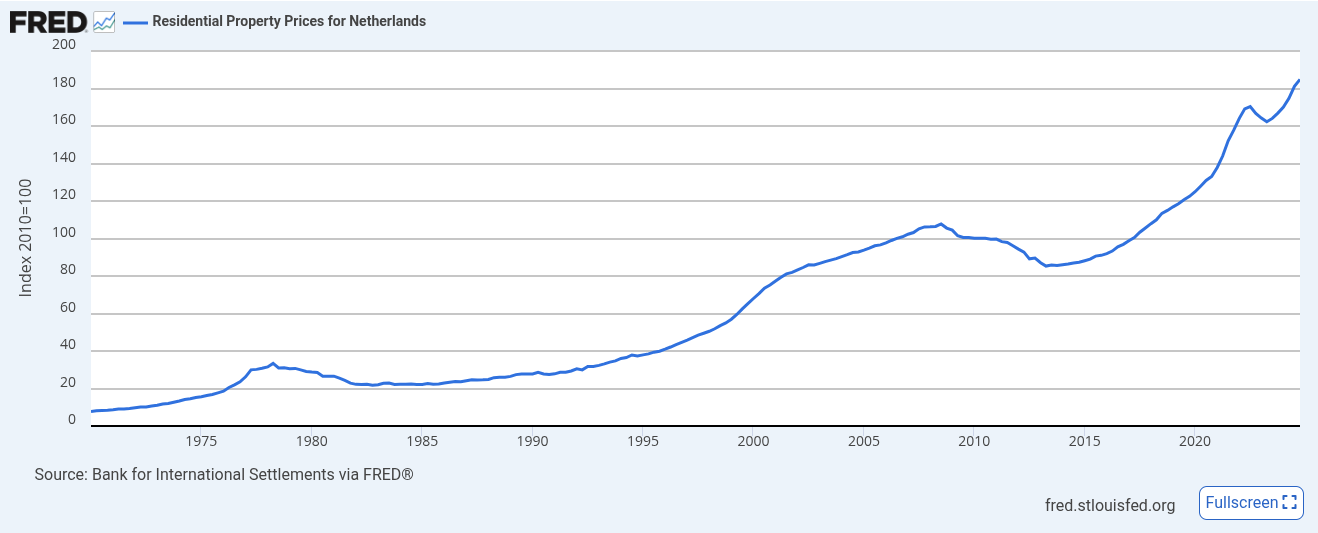

In 2019, when we bought our first apartment in The Netherlands for under €170k, do you think the people were saying “OMG, it’s so cheap! You’re getting a great price! 🦄”?

Hell no!

All neighbors, colleagues, acquaintances were singing the same doomer gospel as people do today.

The market is “crazy”, it will “collapse”, it should “cool off”… All that.

And yes, after the property prices increased by 50%, the housing market had a stagnant 2022 (cooled off?), and then continued surging further.

But the worst part?

These are the same people that will refrain from taking risk in economic turmoil because [insert current macro event].

Yes, whatever happens in the present will feel unique – at no time in the past it was more uncertain than today… The exact day when they need to make an investment decision.

“Don’t Invest More Than You Can Afford To Lose”

There is not a single serious investor in the world that would say this.

Imagine someone with a net-worth of $10M. He “can’t afford to lose” almost all of it, but can play around with $10k. Do you really think that he should keep $9.99M in cash? Eaten by 20% inflation year over year?

Something doesn’t add up, does it?

Seasoned investors don’t “make bets” with their money. We don’t invest with hopes to trade out of the investment ASAP and have “more money”.

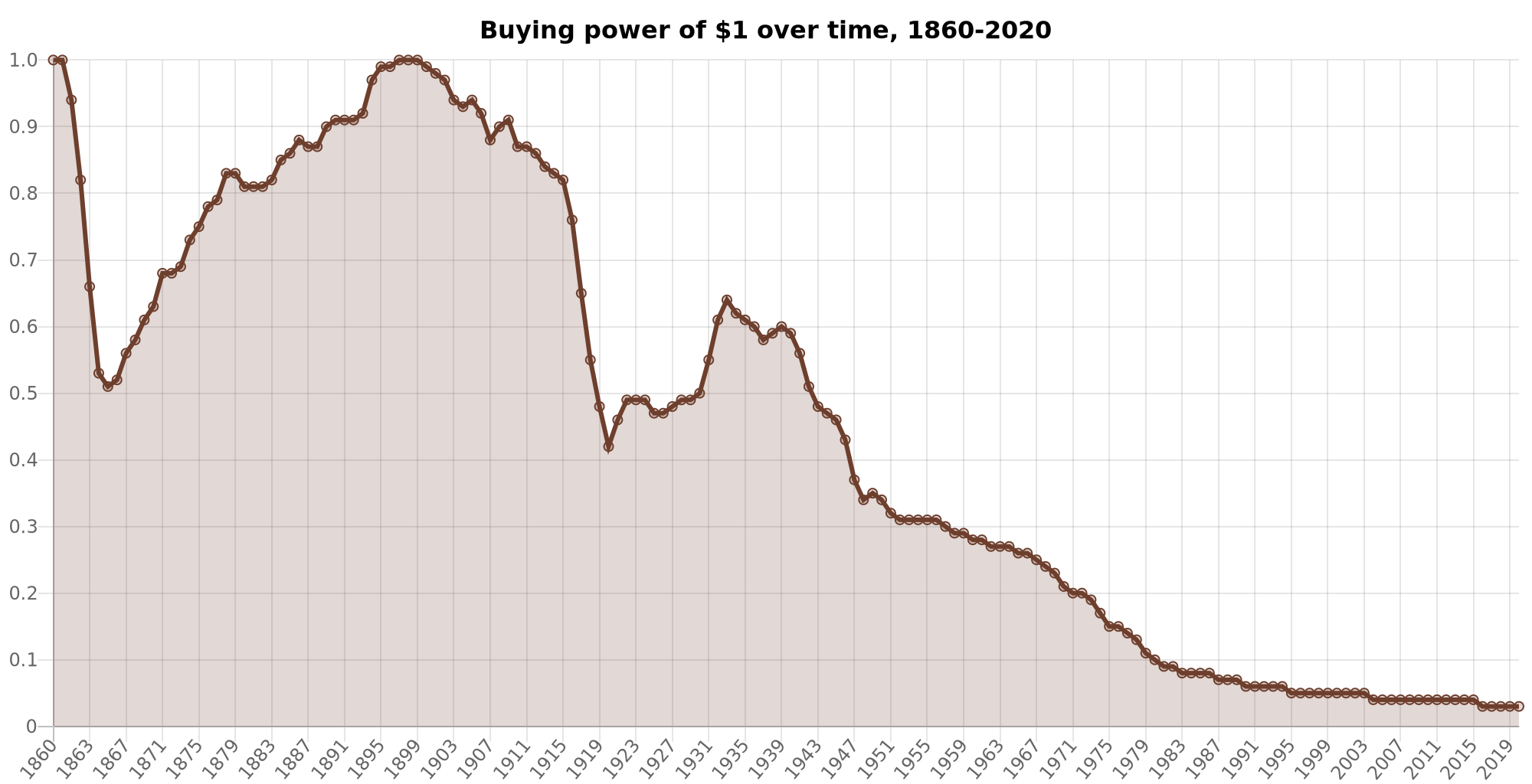

Money is what investors want to get rid of in the first place!

That’s because we know to value other assets more than having worthless cash.

And when you build conviction in an asset, you should only keep in FIAT money what you can afford to lose. Because you will:

If you value “money” that can be produced out of thin air more than hard assets, you’re the last person that should have an opinion on how others should invest.

In most cases, the portfolio of these people is $0 – because 100% of their net worth is in the “can’t afford to lose” category.

They never made money, never experienced gains, nor took any type of risk.

And they’re not so vocal with good intentions. They’re coping for their losses from opportunity cost.

Misery loves company.

“Money Is Made In Crashes” & Appeal to Authority

Another misconception popularized by the most ignorant.

Yet, they haven’t made their wealth during economic downturn. They didn’t make any money in a booming economy either. So how did they develop such a strong opinion?

The reason pseudo-intellectuals get these ideas is because of their tendency to appeal to authority. They’re notorious for quoting “experts” or admiring extravagant stories.

But let me tell you a secret…

Experts can be wrong too. 🤯

Michael Burry executed one of the most impressive shorts in history and did it with size. His fund made multiples off of the credit default swaps he had on the subprime mortgage market.

He even got a movie for the trade – The Big Short, watch it.

And ever since, Michael Burry is a perpetual contrarian/bear, anticipating a collapse year over year while the market returns 10%-30% continuously.

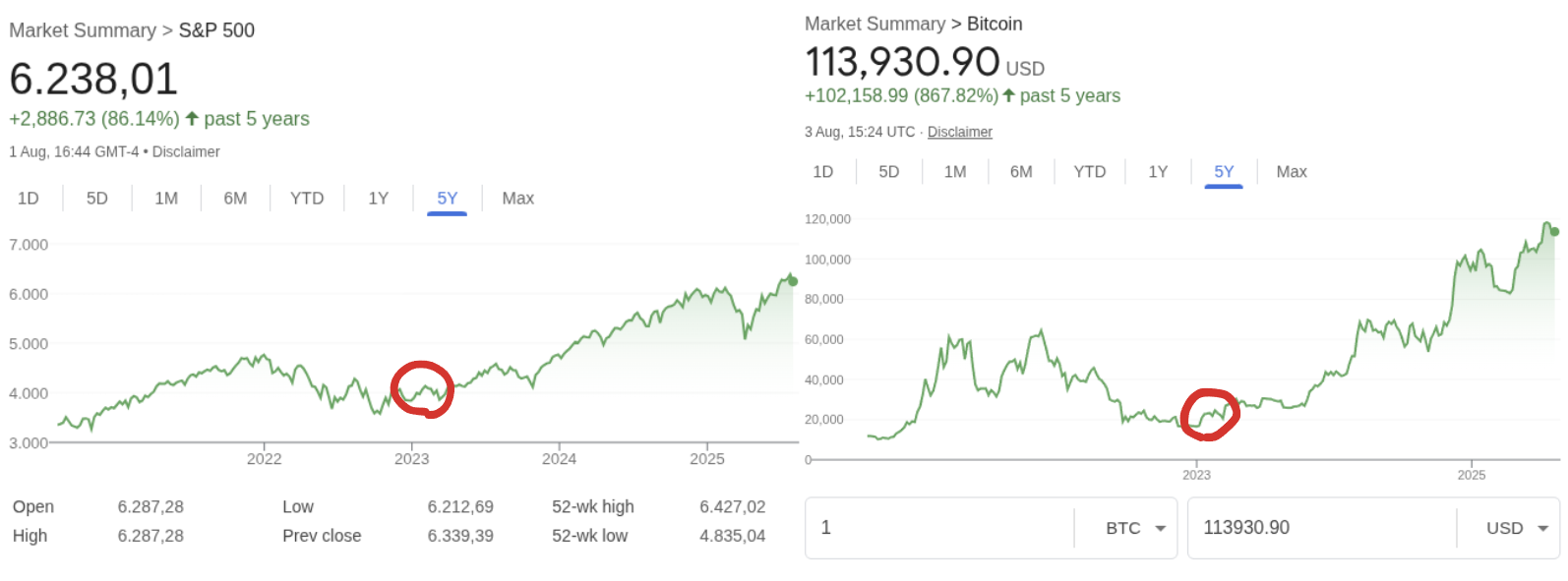

Here is his famous tweet from January 2023 (later deleted):

At the same period, people simply holding the S&P made 50%+ and those holding Bitcoin made 400%+.

The performance of S&P (left) and Bitcoin (right) since Michael Burry’s tweet (circled in red).

I have every right to say this because I don’t rely on hindsight to convey my point.

Actually, here’s what I was doing a month earlier than Michael Burry’s tweet – heavy accumulation of Bitcoin in the depths of the bear market (December 2022):

Accumulation of $BTC at the cycle low, December 2022

Imagine if I was influenced by every investor, expert, or influencer that tried to convince me I should stay out of the market or that Bitcoin is a scam etc.

While on the topic of Bitcoin, many expert were terribly wrong on it too. Just to list a few examples:

- Elon Musk put Bitcoin on Tesla’s balance sheet in 2021 just to sell it at a loss in 2022 missing out on billions.

- Germany (the country) sold a ~50k BTC stack, just for the price to double within the year (missed out on billions).

- Warren Buffer and Charlie Munger ridiculed it serially while it outperformed their portfolio multi-fold.

And I can go on – just from the top of my head: Nassim Taleb, Jamie Dimon, Paul Krugman, Peter Schiff, Kenneth S Rogoff, Nouriel Roubini, Janet Yellen, Christine Lagarde, Larry Fink (before switching sides), and countless others…

I have to mention the legendary appearance of Peter Zeihan on Joe Rogan on, wait for it, January 7th 2023 (a week after my screenshot lol)

It’s hard convey his point using words, you’ll have to see for yourself to see how “convincing” some “experts” are:

Imagine if you relied on his opinion and sold the absolute bottom while smart money were accumulating. 😉 And you sit impoverished, having missed a generational opportunity with no one to blame but yourself…

It seems that picking the expert to trust is more difficult than picking a winning stock, my friend.

And when everything else fails, pseudo intellectuals will hit you with the mother of all appeals to authority:

“Warren Buffet keeps X% of his assets in cash, and I’m no better investor than him…”

Which warrants the question: “How much of your net worth is invested in Berkshire Hathaway stock?”

And I get crickets.

You had 50+ years to let Warren Buffet’s company manage your assets… And you didn’t make use of it.

No need to quote him further.

Anyway, my point is that while there are and always will be examples of funds profiting off of a market turmoil, most investors made their wealth in a good market and over time.

Always remember Fidelity’s study on dead people being the best investors. You’ve read that right. That’s people that bought and didn’t touch their investment for a very long time.

And almost all experts would agree that buying the S&P and holding it is a winning strategy.

Ask Warren Buffet if you don’t trust me.

Conclusion

Never wait for someone to tell you what to do with your money.

Don’t trust, verify.

Think with your own head.

Husband & Father

Husband & Father  Software Engineer

Software Engineer