Disclaimer: I didn’t do this and I’m not a part of a group that did this – it’s all hypothetical.

The goal of this post is to illustrate how knowledge about a specific event can help you spot inefficiencies even in highly liquid markets and potentially get an edge.

Introduction

I prefer my writing to be evergreen so I rarely cover current events.

But today, I witnessed an actual example of exploitable market inefficiency in real time.

Not by insiders or politicians, but by “anyone” (with at least $10M). While that’s out of reach for most people, in the grand scheme of things it’s a minuscule amount to influence a market with and get a risk-free profit.

To understand the opportunity, you need to know what Polymarket is (skip if familiar).

What is Polymarket

Polymarket is a decentralized prediction market platform where you can bet on the outcome of real-world events.

The fluctuating prices to take part represent the crowd’s collective belief in the event’s probability of happening, like in real-time sports betting. This is extremely close to the actual probability of the event, as it’s a highly-liquid, global, and permissionless market.

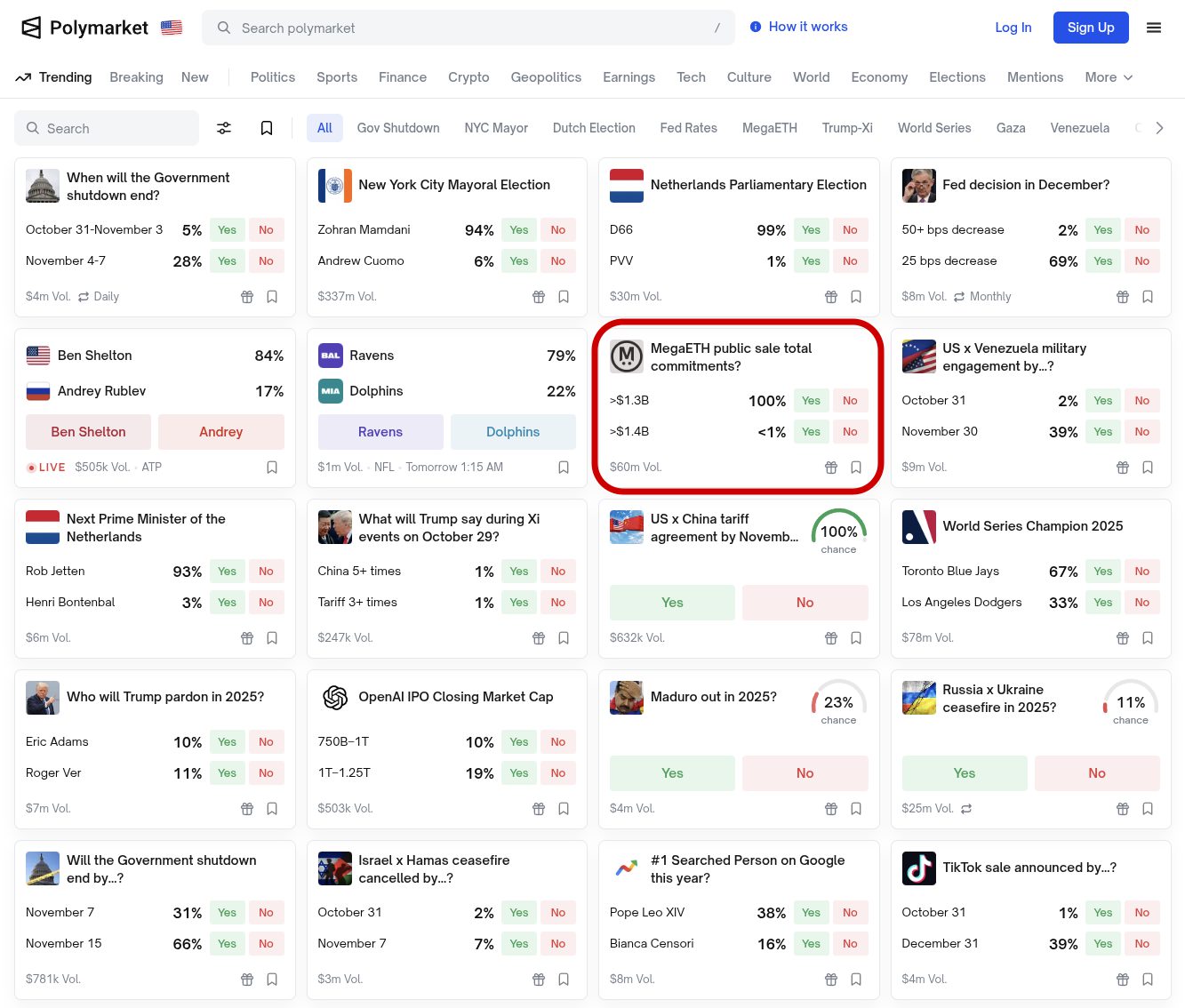

There are bets on both global events and niche markets with plenty of categories to choose from.

Here’s an image of the trending events as of 30th October 2025 (we’ll discuss the one circled in red):

PS If you have strong opinions about objectively uncertain events, this is your proving ground.

At least personally, I don’t take people’s opinions seriously until they’ve backed them up with their energy/past productivity (AKA hard-earned m0nEy), as I always do. It’s the only fair and quantifiable way to level the playing field, especially during disagreements.

The Actual Event: MegaETH Presale

The event of interest is related to the public sale of MegaETH’s token $MEGA.

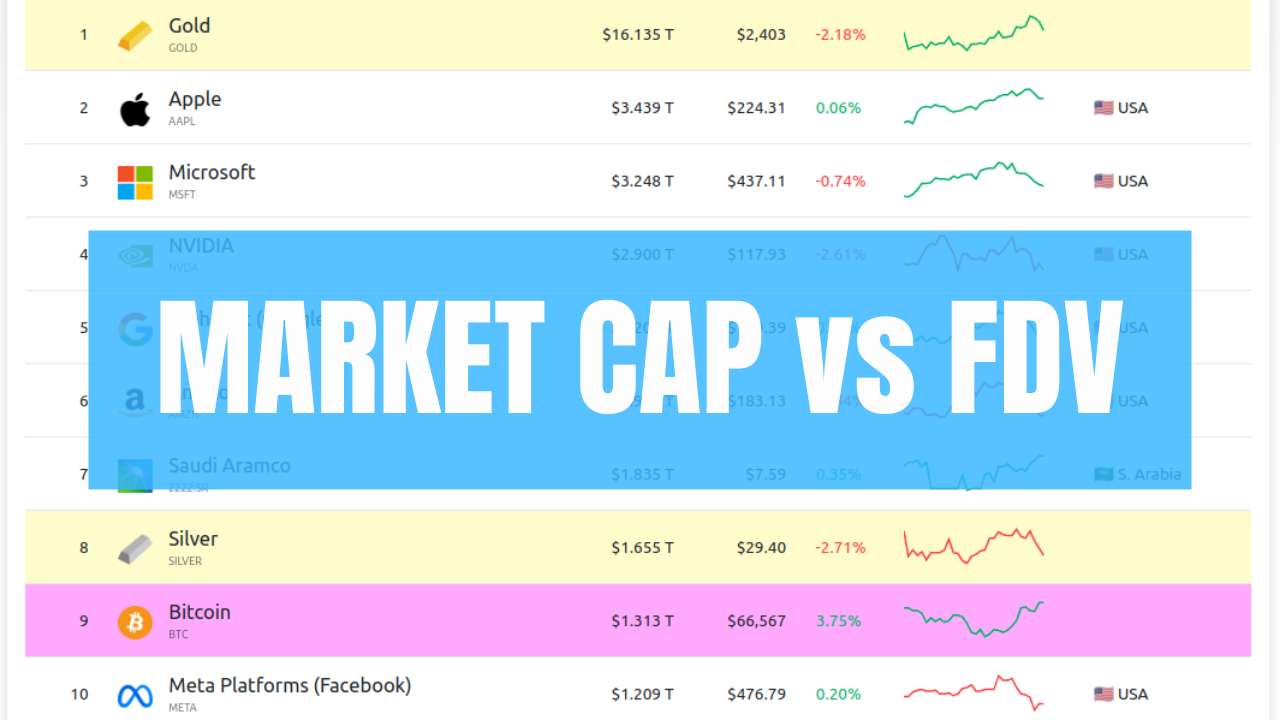

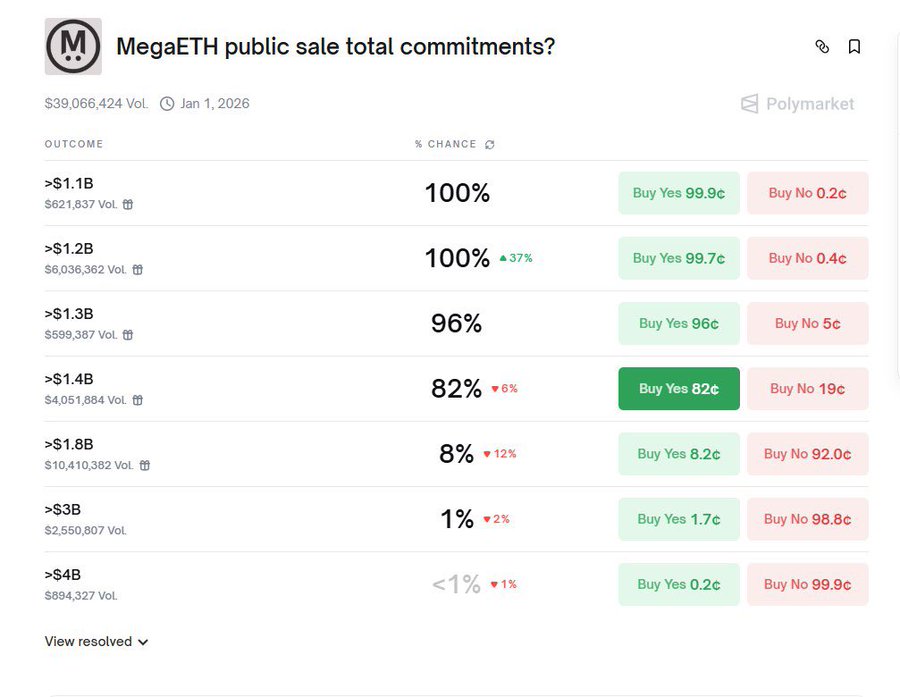

People could bet how much money will MegaETH raise during the presale round:

Source. I couldn’t find a screenshot of the beginning of the bets, this is after they raised >$1.2B (i.e. the last few hours)

I won’t explain what MegaETH is, I’ll just cover the relevant details of the presale. Check their docs for more info on the project.

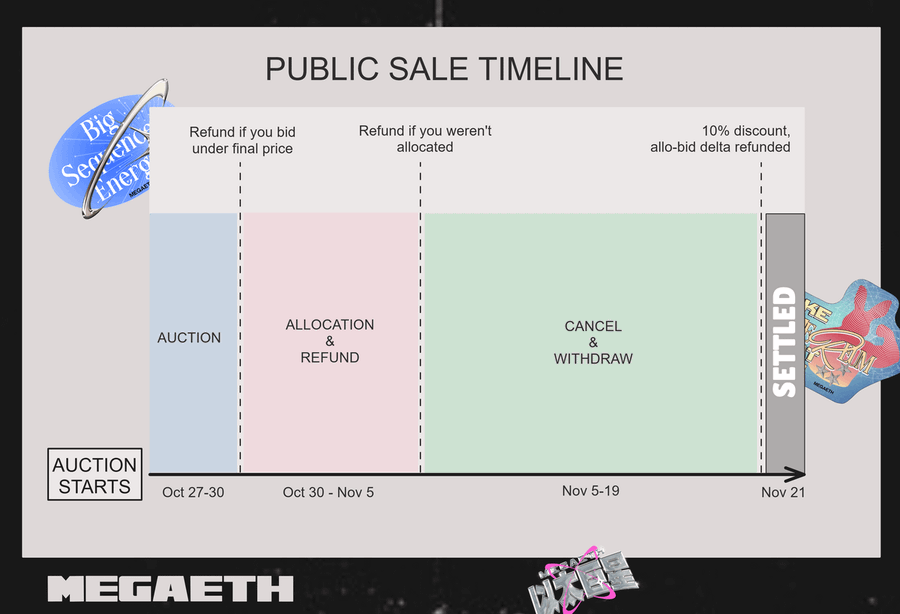

If you’ve been around in crypto and know how subscription-based presale auctions work, the picture has all the details. Otherwise, I explain it in n00b-friendly way in text below.

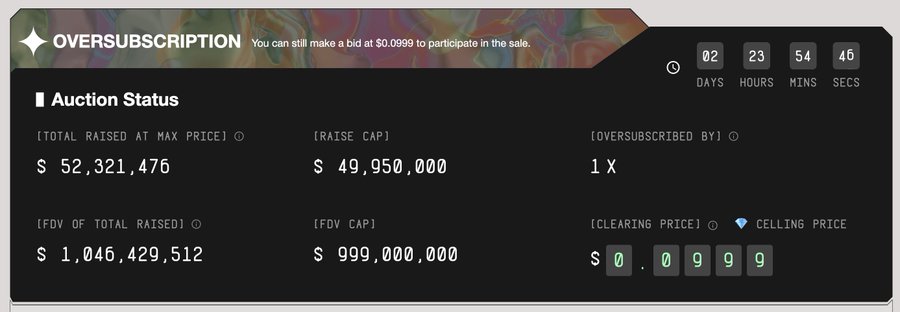

The details for MegaETH’s presale – source

In summary:

- MegaETH aims to raise (up to) $50M from investors at (up to) $1B valuation (selling 5% of the total token supply)

- The sale will be conducted using $USDT on Ethereum mainnet over the duration of 3 days

- Maximum deposit per investor is $186,282 (fun fact, that’s the speed of light in miles per second)

- KYC is mandatory to participate (identity verification and proof of address via EchoXyz’s Sonar)

- If oversubscribed (i.e. more than $50M invested), the excess money raised will be refunded

There was not a single person in CT (crypto twitter) that doubted oversubscription – it became a fact before it even happened.

Whales and shrimps alike were ready to max bid right away. Even premarket trading priced the token at 4x the presale valuation.

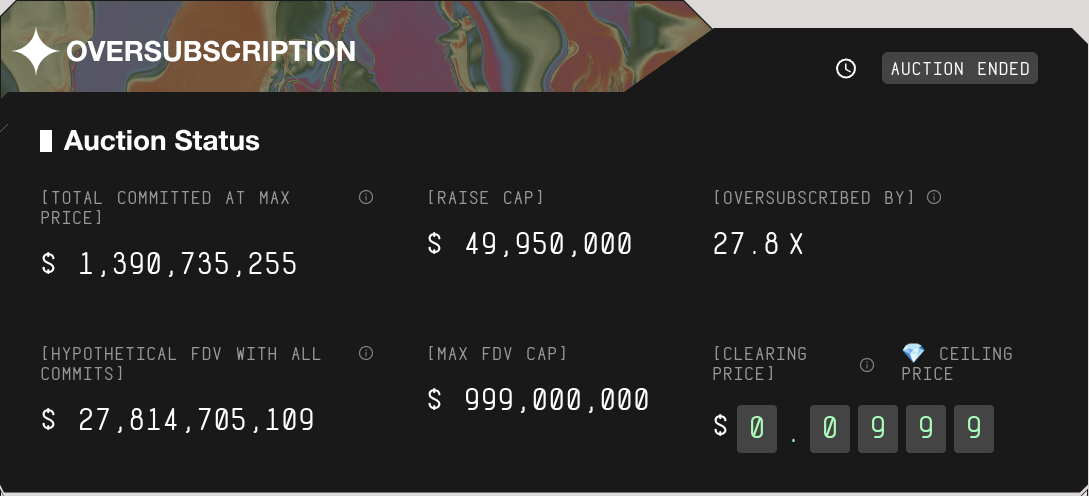

And indeed, within 4 minutes after the sale started, MegaETH already has raised more than their target of $50M.

Source. Raising >$50M within 4 minutes.

So the question becomes who gets to enter?

While the final decision is at the team’s discretion, they revealed that it will be influenced by parameters such as:

- Bid amount – given an English auction model, all bids below the maximum will be discarded

- Social media and GitHub contributions/activity within the MegaETH and Ethereum communities

- Wallets’ onchain footprint (i.e. activity in the Ethereum ecosystem & L2s or holding “prominent assets”)

To illustrate, a wallet that explored the depths of DeFi for years will have priority over a newly funded wallet whose first transaction is bidding on the MegaETH presale.

After the sale is concluded, the team has ~5 days to figure out who gets an allocation.

At the end of this period, all “extra” USDT is refunded to the ineligible wallets. And those that are eligible to invest can decide to confirm, modify, or withdraw their investment. See the image for details on the timing:

Source. The timing for: refunds on unallocated funds on 5th of November + the option to cancel your participation until 21st November.

Summary of the important points:

- If you invest using a smaller bid than $0.0999 per token or your wallet has no onchain reputation, you’ll be ineligible and will get a refund

- If you somehow end up eligible to invest but don’t want to participate, you’ll have the chance to fully withdraw your deposit

The Million Dollar Opportunity (In Simple Terms)

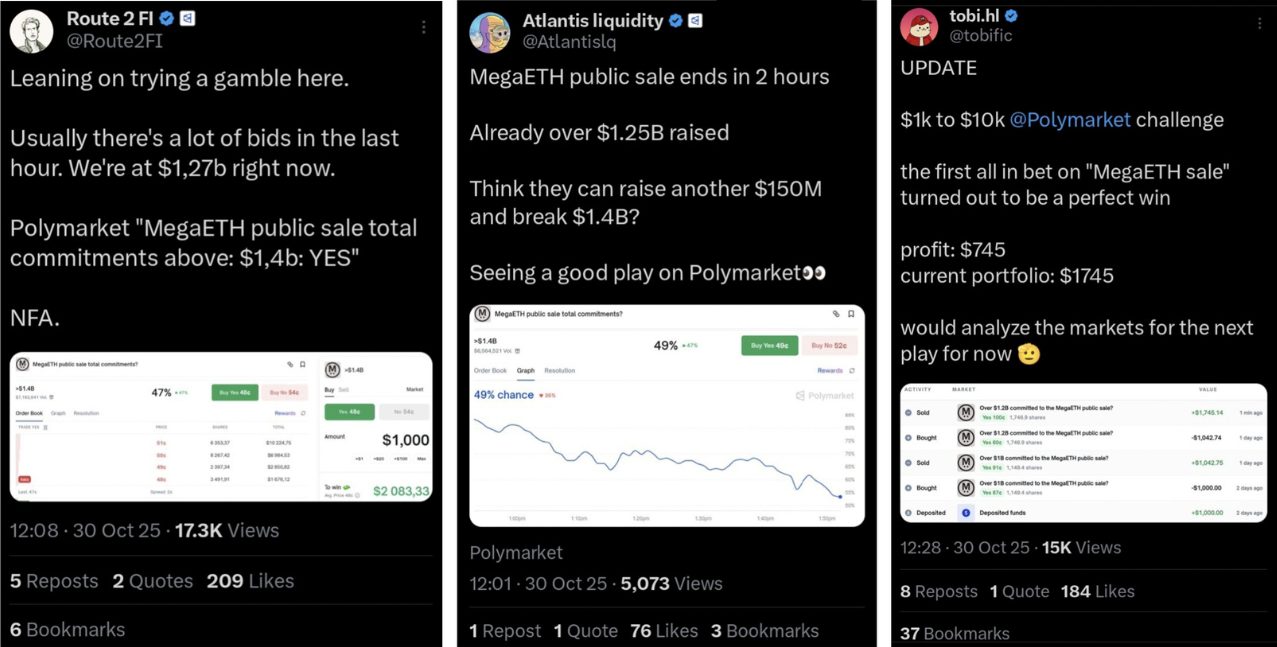

In the last hours of the presale, many were betting on the total amount subscribed.

Links to betting posts: @Route2Fi, @Atlantislq, @tobific, @PixOnChain, just to list a few

Now, imagine this scenario.

It’s 5 minutes before the event ends.

There are $1.39B committed and a highly-unlikely Polymarket bet that MegaETH will raise >$1.4B.

The auction is $10M away from surpassing $1.4B:

Screenshot from the final status. 5 minutes before the auction ended it was at $1.38B (screenshot)

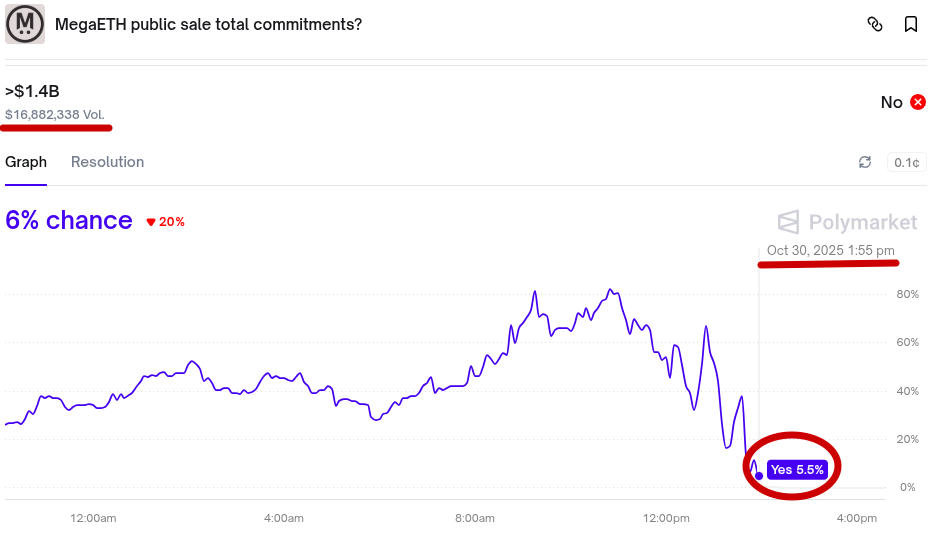

Since it’s 5 minutes before the auction ends, the market drops the probability of >$1.4B from 50% to 20% and eventually to sub 10%.

This means that if $1.4B is surpassed, you can make a 10x ROI on your bet.

Of course, the exact multiple varies by the second, but I’ll use an approximate round number.

The Market Manipulation Playbook

Basically you’re betting here, just before the event concludes:

Polymarket bet >$1.4B – 5 min before closing, 5.5% chance of happening, ~$17M in volume (link to charts)

So, how to make a risk-free $1M?

In summary:

- It’s 5 minutes before the auction ends and there are $1.39B deposited

- Polymarket betting puts a <10% probability that $1.4B will be breached, offering a ~10x ROI if you bet and end up being right

- You bet $100k (or more) that subscriptions will be over $14B (buy up the whole YES liquidity)

- You invest $10M in the MegaETH presale in the last minutes, bringing the amount to above $14B (logistics discussed later)

- You win the bet and thus $1M (or more)

- In 5 days, withdraw your USDT from the MegaETH presale

Easy?

Of course, this is the high-level idea, there are many details around it.

Be Sophisticated – Pro Tips

The analytical reader would have many questions and concerns.

Rest assured, I’ll address them all.

“How to invest $10M if the cap is $186k?”

Yes, there’s a maximum per wallet, so the answer is simple:

Use multiple wallets.

Managing 50 wallets is relatively easy – you can generate them all from the same seed phrase on Rabby Wallet or paralelize it with a team of 2-5 people.

Using a VPN when switching addresses and funding them responsibly is another layer of protection deception you can employ.

And don’t reuse the addresses you used on the presale for the Polymarket bet.

“Isn’t this trackable onchain?”

You’re not the first person that had the idea.

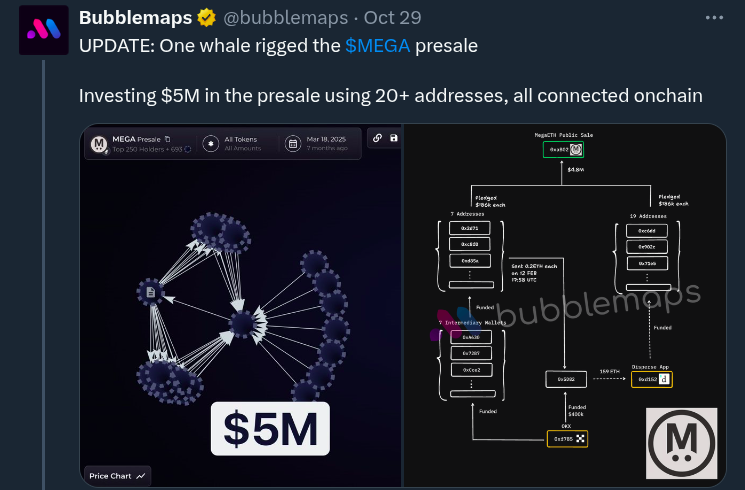

Here’s someone that tried to circumvent the $186k limit by bidding with 20+ wallets – and got caught and will be disqualified:

Link to the post – someone used 20+ addresses and funded them from the same wallet

The Ethereum blockchain is public and all transactions are traceable.

This guy made a crucial mistake – he funded the wallets from the same source.

This is known as a “Sybil attack” and is very common and easily detectable, even by AI or blockchain analytics companies like Nansen etc.

My response to the post summarizes “the solution”:

![]()

Bonus points if you start the funding from a non-EVM chain so even “timing analysis” wouldn’t reveal suspicious activity.

For example, an onchain analyst wouldn’t be able to see that a random address deposited 200k USDT to a particular centralized exchange and there’s a withdrawal of 200k USDT from the same exchange to another random address 5 minutes later, linking the dots even without a direct link between the two addresses.

“How to pass KYC?”

Not only that there’s a cap per wallet, but each wallet must be linked to a real-world identity that passed KYC (know your customer).

The answer is straight forward: “family wallets” as they call them on CT.

In summary, you need ~50 peoples’ personal details to pass KYC.

Whether you use actual family wallets or find an alternative approach with your team, that’s up to you. Tbh I can’t think of any atm.

“Why risk $10M to win $1M?”

It’s crucial to understand the presale event:

- Freshly funded wallets have around 0% chance to be included given a 27x oversubscription (but still count towards the Polymarket bet)

- You can intentionally neglect the auction using lower bids so that you’re guaranteed to be ineligible and get a refund

- Even if you manage to enter (impossible), you can withdraw your funds after the allocations are concluded

Or stay invested and sell at TGE at 2-3x, making an extra $20M (included this for teh lulz, pls ignore)

In other words:

You’re not risking $10M, but 0.

This is not an investment – it’s your influence of the Polymarket bet in your favor. You deposited stablecoins that you’ll get back within a week.

And then you use separate funds on Polymarket to win a 10x bet within 5 minutes.

Market Inefficiency or Crime?

The purpose of this post is educational – I assume you’re an honest market participant that wants to protect himself.

And you can assume that there’s a North Korean team sourcing foreign IDs from various data leaks without a concern what an arbitrary western jurisdiction considers “legal”.

Don’t engage in market manipulation.

Learn to invest in a way that you’d be immune to it.

Why I Consider This a Market Inefficiency?

Regardless of the legal status of executing something like this, one thing is for certain:

This was an event that was technically exploitable by anyone with $10M+ and good opsec. You didn’t need insider knowledge to pull it off. It’s completely based on public data.

And if the market misprices the manual possibility (i.e. not HFT or arbitrage bots) of a $10M injection within 5 minutes, I consider it an inefficiency.

PS I didn’t exploit the inefficiency. I don’t bet on Polymarket. And I don’t engage in borderline illegal activities.

Be like me and invest responsibly and for the long-term.

Lessons Learned

- Market inefficiencies are real and exploitable even by “regular” people (not insiders, politicians’ sons, or congresswomen)

- Stay curious and keep acquiring knowledge

- There are asymmetric opportunities that don’t require questioning their legality or morality – I covered multiple in my blog and this post

Important disclaimer: the reason I don’t write about crypto and time-sensitive opportunities on my blog is because I don’t want readers from the future confusing anything I’ve written as recommendation or, God forbid, financial advice, especially when the timing is guaranteed to be off, given the nature of short-term opportunities. This is not an endorsement, recommendation, nor suggestion to buy, hold, experience, gamble on, or do anything on/with any of the projects, products, services, or things mentioned or not mentioned in this post.

NFA, DYOR, GLHF.

PS Asking me whether you should try Polymarket or buy $MEGA at TGE is a criminal offence and will be prosecuted to the fullest extent of the law.

Husband & Father

Husband & Father  Software Engineer

Software Engineer