Are your legs shaking, anon?

For those of you reading from the future, I’m writing this on a red day where most gamblers’ portfolios are down bad. Many speculate that it might be the end of the bull market.

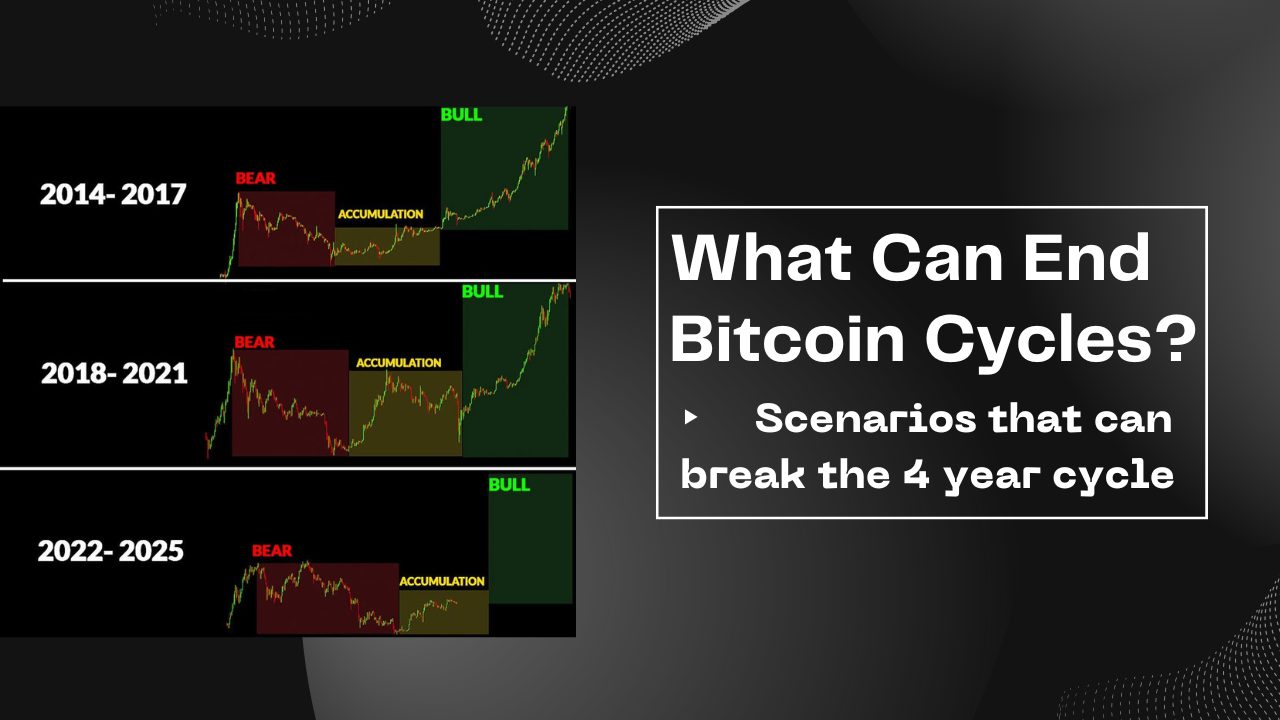

Instead of giving you my opinion on that, I’ll cover what has been consistent in the previous cycles.

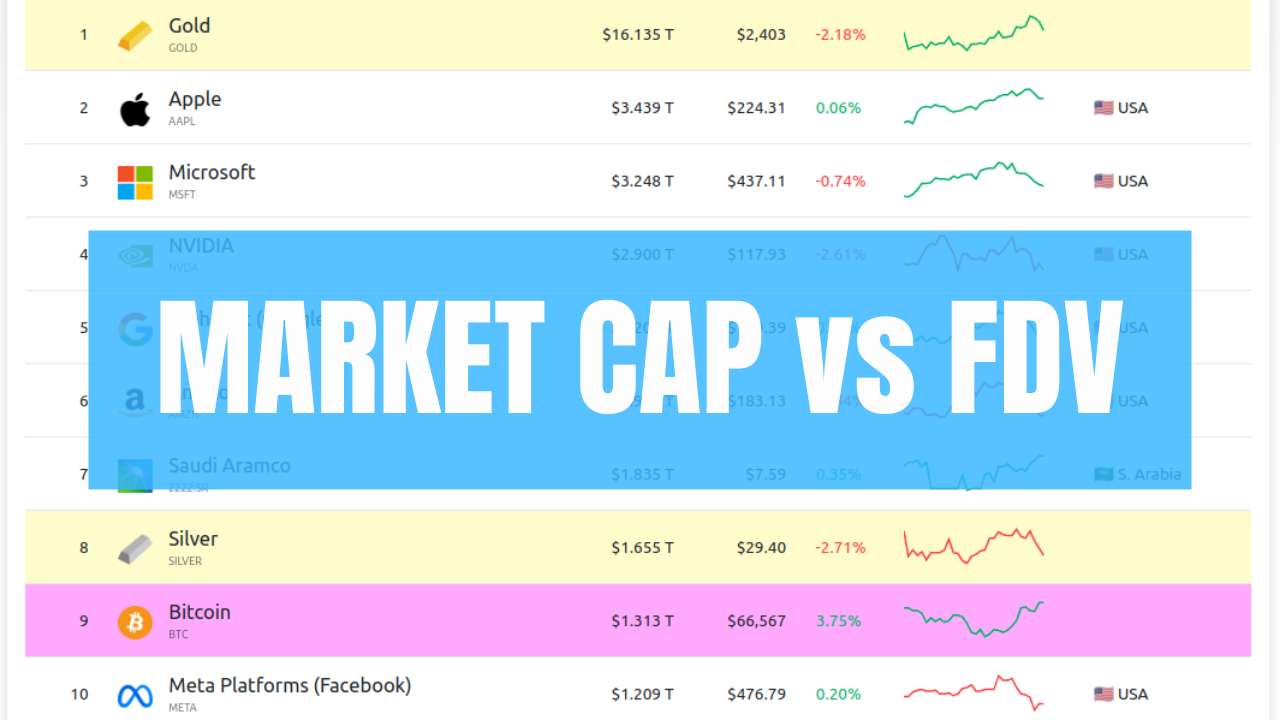

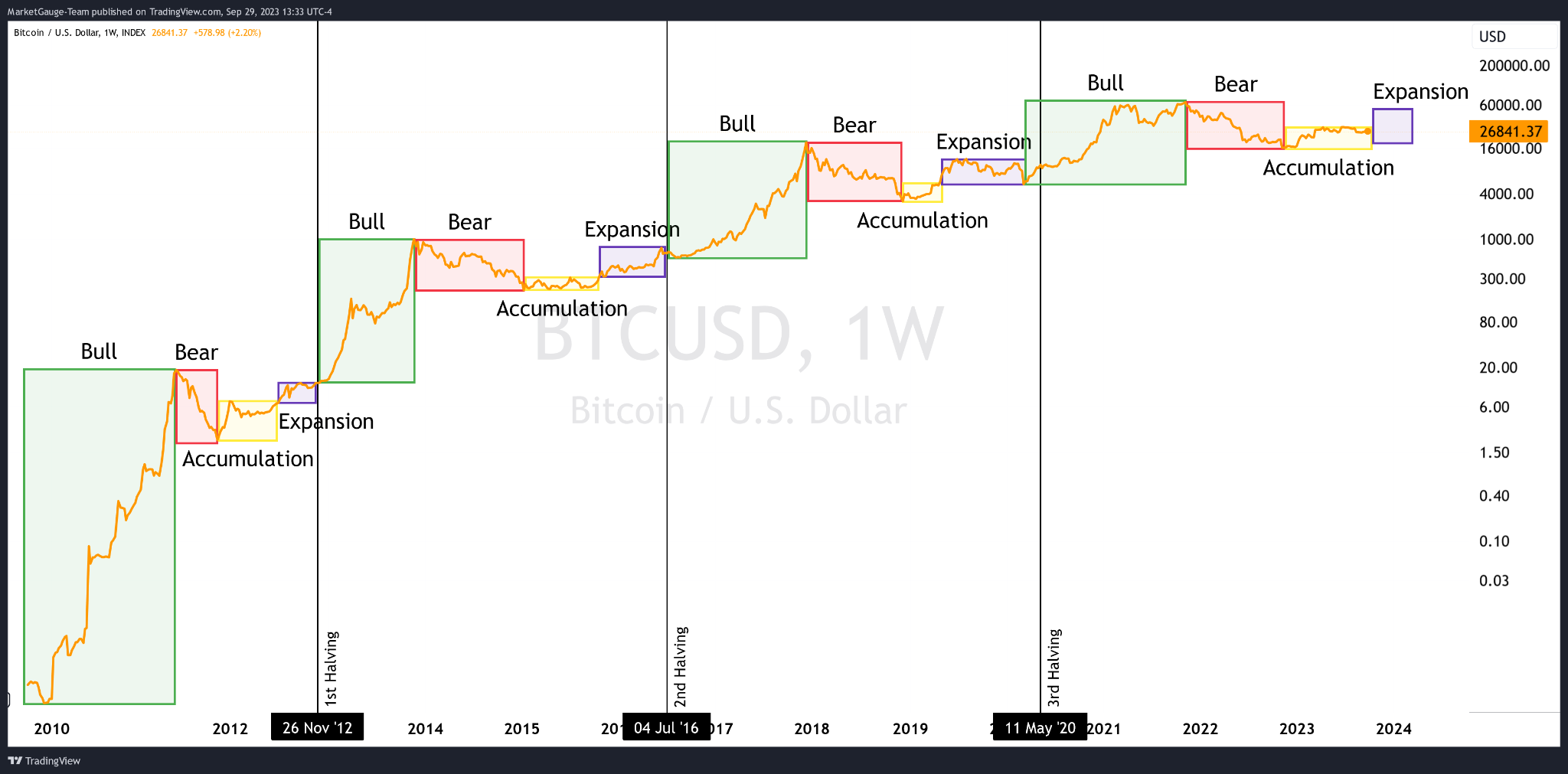

Previous Cycles Peaks

I already covered the 4 year cycle theory in detail, so I won’t explain why and how it happens.

But in summary, the market peaks around 12-18 months after the Bitcoin halving, which happened on 20th of April this year (2024).

This is also consistent with the various cycle top indicators, and as every cycle, Bitcoin’s performance is heavily correlated with the rest of the crypto market.

Of course, past performance is never a guarantee for future results, but you now have a time window in which historically it made sense to start de-risking.

If you’re happy to be in the middle of the curve and to outperform any traditional benchmark consistently, you should be out by then.

Of course, if you started buying this year (2024), then you’re probably hoping for a higher return than it might be realistic. And you’ll probably end up disappointed and bag-holding for 4 more years (for your blue chips) or forever (most cryptocurrencies will trend towards 0 in the mid-to-long-term).

You Need an Exit Strategy

Spend some time thinking about your goals and stress-test them against probable realities, in a manual and sloppy Monte Carlo simulation-like analysis, typical for a gambling addict.

Jokes aside, you have a decade of history to understand what a realistic expectation might be.

One idea, for people that accumulated during the bear market, is to start taking profits from early 2025. Not exiting fully, but slowly DCA out month over month, starting with the riskiest positions first.

I’m not saying that this is the perfect strategy nor that I’m doing exactly that. It’s just an example of the direction you should start thinking in if you have accumulated unrealized gains.

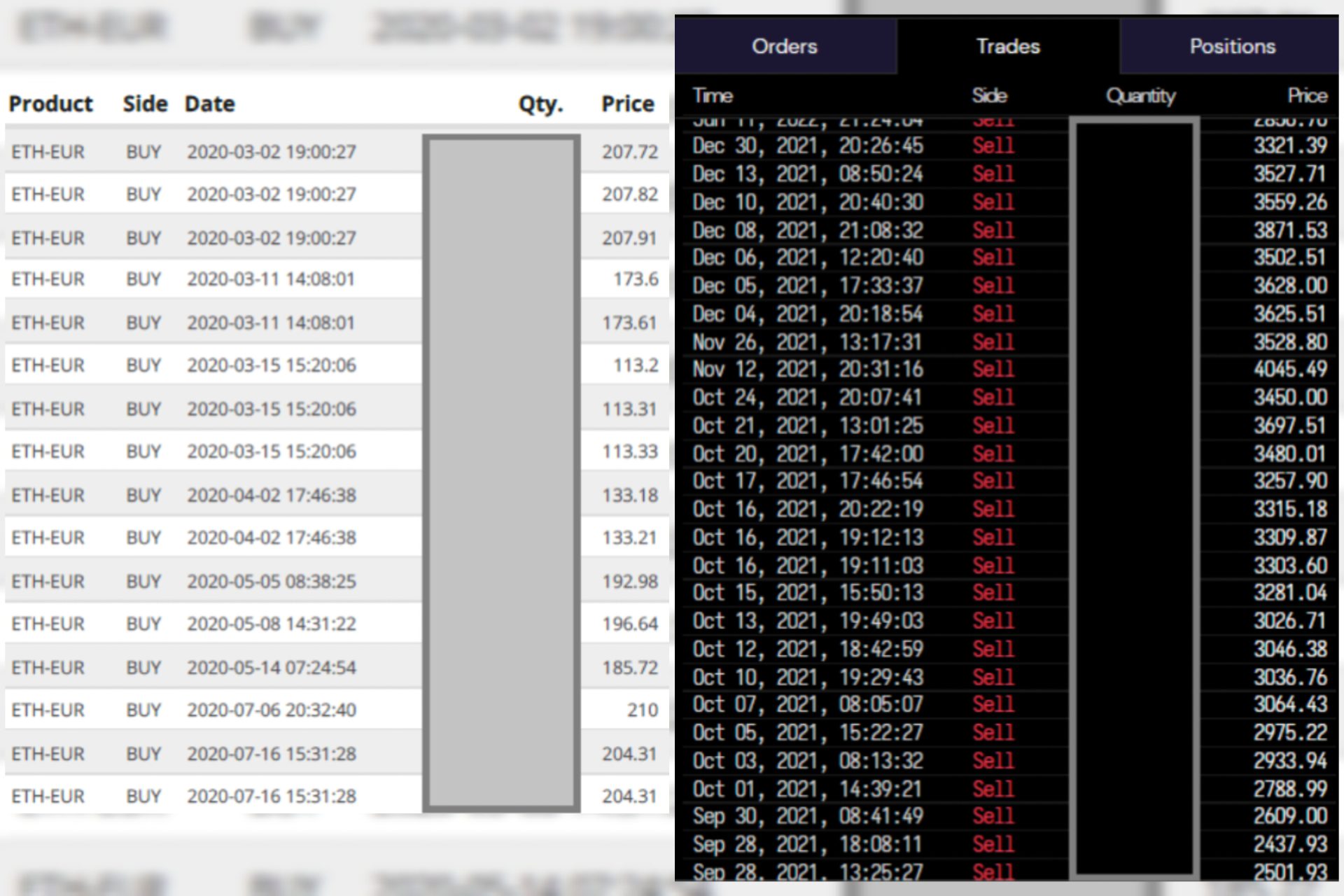

I documented how I did this in the previous cycle with Ether and I’m positioned to do it again.

TLDR for those that prefer a picture over a thousand words:

Buy orders (left) and Sell orders (right)

De-Risking in Practice

Personally, my entry points allowed me to start taking profits already.

Not with Bitcoin – that’s my long-term hold. But with the short-term positions I built and the airdrops I received. I basically trimmed the riskiest holdings, as I’ve already made multiples of returns with those.

This is what I mean by de-risking.

You start with the highest risk positions and you get rid of those first.

For example, I follow trends closely and like to profit off of new narratives. But most importantly, I don’t join cults nor commit to “diamond hand” forever. As a trader, I don’t really care about the longevity of projects and not overstaying in what I wouldn’t have held in the long run in the first place. And once I’m out, I’m out, 0 FOMO if it continues going up in price.

Mid-curving means developing intuition, confirming it with careful analysis and market sentiment, and building conviction to deploy enough capital so that a 3-10x already means significant profits in absolute terms.

Avoiding Unnecessary Exposure to DeFi

Leveraging DeFi to boost your returns can be life-changing when done right.

And as we go deeper in the bull market, “done right” is less about positioning for the future and more for avoiding unnecessary exploits, losses, or opportunity cost.

In other words, I’d strongly suggest starting to be more selective and risk-averse.

This means: not jumping on third-tier airdrop opportunities, avoiding chasing yield on stablecoins, dumping airdropped governance tokens, etc.

Note: there is still serious money to be made. But avoid locking up funds indefinitely and for uncertain rewards. The airdrop meta has changed, the bull market matures, and if you were accumulating during the bear market, then everything should be becoming less attractive to you too.

PS I got over 80 airdrops this year, worth low 6 figures in $USD. Most of them were smaller amounts, but a handful were substantial, and a few more are coming my way.

And all of this is sold and sits in FIAT accounts earning 3-4% risk-free interest for the time being.

What Do We Do Next?

First of all, maybe it looks as such, but don’t take this post as “start selling now!”.

Do whatever you think is right.

The mature stages of a bull run are a gold mine of opportunities for those that know what they’re doing.

However, what I’m not doing is “rotating profits”. What’s out is out. It’s taken off the table and there’s zero urge to risk existing profits for the sake of deploying them.

No inclinations to “buy the dip”, no desire to outperform the/a market on a weekly timeframe.

And there is no rush, really.

Accumulating $BTC in the depths of a bear market makes you focused on the macro-perspective and immune to day-to-day price movements.

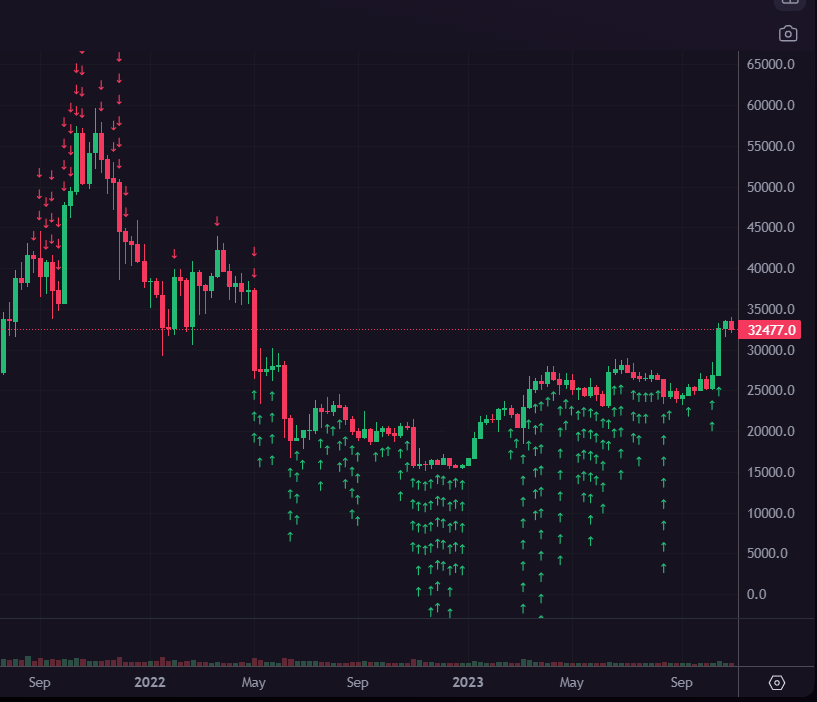

My sell orders from the previous cycle (red arrows) and buy orders from the current cycle (green arrows)

After we exited the levels from the image above, I stopped buying, almost completely.

For the first time since the bear market, sitting on heavy FIAT stack and being on lookout for asymmetric opportunities. And when there are none, there are none.

And regarding my long-term $BTC position – there will be a bear market after 2025. It will be long and miserable, just like the one in 2022. And we will have the chance to accumulate Bitcoin at the new, higher depths.

And of course, I have a hold-forever Bitcoin stack that will never be traded or speculated with.

If you want to read more about my approach to market cycles, head to:

- The 4 Year Cycle – Bitcoin Price Prediction

- How I Accumulate Bitcoin During Bear Markets

- Tales From the Last Cycle – Exit Crypto in Profit

- Bitcoin Exit Strategy (Cycle Based Rotation)

Husband & Father

Husband & Father  Software Engineer

Software Engineer