Blog

IWDA vs SWDA – What’s The Difference?

New investors that want to diversify globally don’t understand the difference between $IWDA vs $SWDA. And indeed, both of those represent the iShares Core MSCI World UCITS ETF (Acc), so the distinction might be confusing to beginners. In this post, I’ll explain why some ETFs have multiple tickers and how to choose between them. iShares …

Show Your Work by Austin Kleon (Book Notes)

Shortly before launching my blog/website, I had a TODO item to read “Show Your Work: 10 Ways To Share Your Creativity And Get Discovered” by Austin Kleon. I wasn’t necessarily seeking for motivation, as I already had an idea what I want to share with the world. But I’ve taken notes that this book was …

10 Requirements: Choose a Good Hardware Wallet

Choosing a hardware wallet is a serious and extremely responsible decision. A user has to do dedicated homework instead of picking the cheapest or the first available option. When I was evaluating which hardware wallets to buy, I relied on the following list of requirements. Read on and see the reasoning behind each. 1) Has to …

7 Reasons to Acquire Multiple Citizenships

I’m a big proponent of personal freedom and acquiring multiple citizenships is a major factor for that. When I talk about this, whether on X or IRL, people often seem to misunderstand the benefits a second nationality can provide. In this post, I’ll cover my top 7 reasons why everyone should strive to be a …

The Art of De-Risking: A Mid-Curver’s Take on the Crypto Market

Are your legs shaking, anon? For those of you reading from the future, I’m writing this on a red day where most gamblers’ portfolios are down bad. Many speculate that it might be the end of the bull market. Instead of giving you my opinion on that, I’ll cover what has been consistent in the …

Bitcoin Cycle Top Indicators Analysis

As most of you already know, I like to accumulate Bitcoin during bear markets, in accordance with the 4 year cycle theory. In other words: my entries are based on time rather than on price. At the same time, I want to share certain indicators that people might consider following, especially during the pivotal moments …

EU Countries Without Capital Gains Tax (2025)

Europe is known for high taxes and overregulation. However, there are places throughout this continent that are quite favorable for investors, and especially welcoming for the less active ones. In this post, I’ll summarize the European countries in which it’s possible to lower the capital gains tax rate to 0%. No Capital Gains Tax in Europe …

Luxury is Subjective – The Cultural Bias in Status Symbols

What is luxury? In simplest terms, it’s a condition of abundance – possessing or experiencing something considered rare, valuable, or exclusive, often accompanied by a sense of indulgence and enjoyment. At the same time, it’s is not a universally accepted concept across all cultures and societies. The perception of luxury can vary greatly from one …

Liquidity Provision (LP) and Impermanent Loss (IL) Explained

Executing trades in a decentralized manner is completely different to placing orders on exchanges. Instead of relying on an order book, DEXs (decentralized exchanges) use liquidity pools and AMMs (automated market makers). In this post, I’ll explain how this work in a beginner-friendly way. Note: this is an educational post, not a recommendation. I’m not …

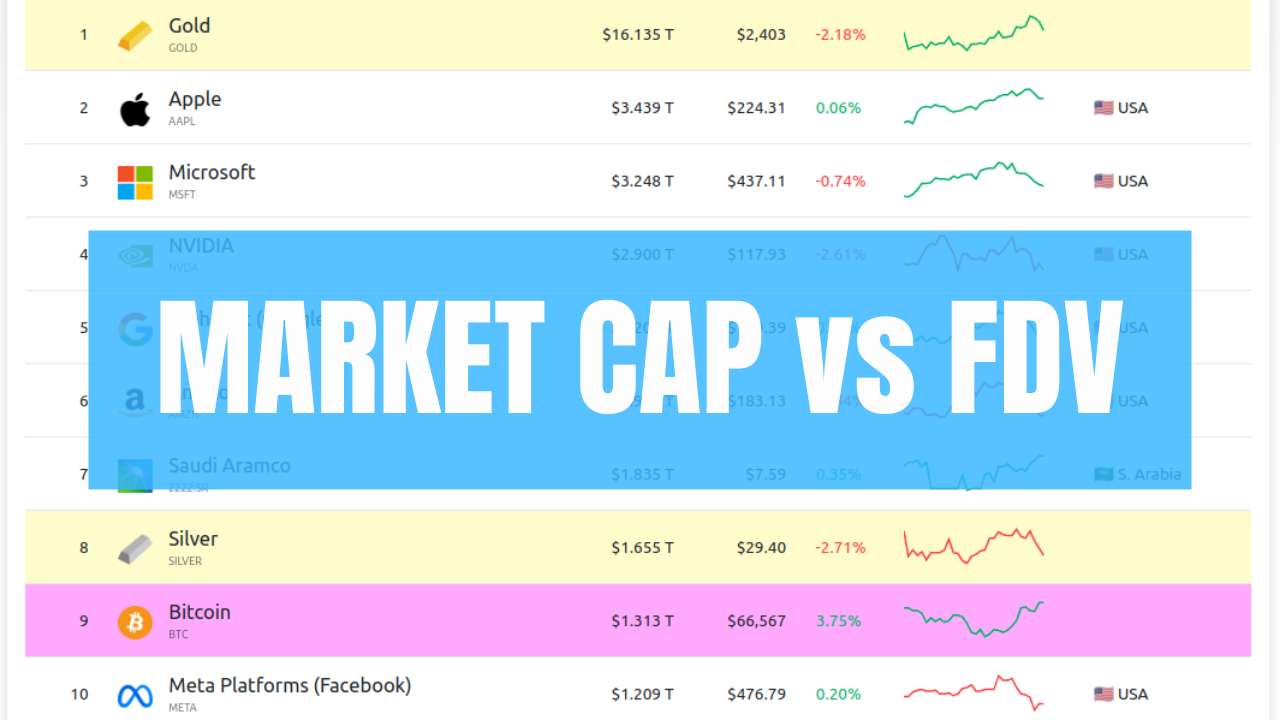

Market Cap vs Fully Diluted Valuation (FDV) – Explanation & Practical Analysis

Market capitalization (or market cap) represents the total value of an asset. For a publicly traded company, the market cap is its current share price multiplied by the number of shares. A hypothetical example: The price per share is $50 There are 10,000,000 shares outstanding The market cap is the price * the shares = …

9 Months Development & Stats: SGA Preterm Baby

As our little one reached the 9 month milestone, the time came to reflect on another trimester of his remarkable journey. A reminder: our son was born one month prematurely and also he was SGA (small for gestational age). In this post, I’ll share his progress and achievements until his 9th month, to give parents an …

Review of the Keystone 3 Pro Hardware Wallet

A couple of days ago, the CEO of Keystone stumbled upon my post “Is Ledger a Hot Wallet?“. This initiated a discussion and he offered to send me a Keystone 3 Pro device to try their Bitcoin-only firmware. I’m exceptionally selective in accepting gifts to avoid reciprocity bias, so I explicitly asked if there is anything …

CSPX vs SXR8 – What’s The Difference?

If you’re a beginner investor, you might be uncertain about the difference between $CSPX and $SXR8. And indeed, both of those represent the iShares Core S&P 500 UCITS ETF (Acc). In this post, I’ll explain why some ETFs have multiple tickers and how to choose between them. iShares Core S&P 500 UCITS ETF First, let’s …

Hardware Wallets Comparison (Trezor, BitBox02, Ledger, Coldcard)

Practicing self-custody comes with the burden of picking the right hardware wallet. That evaluation is highly personal journey, as the circumstances and needs vary from person to person. In this post, I show you my thought process and requirements. Below, you can find a comparison between a few of the industry-standard hardware wallets and my conclusions. …

Sticking to a Strategy (Notes From the 2020 Recession)

I wrote this post for a discontinued blog during the market crash of March 2020, before the Covid recession was officially announced. I decided to republish it on dpetkovski.com because it’s evergreen content – it gives unique insights into the mind of a retail investor during market turmoil. And the thought process should be applicable …