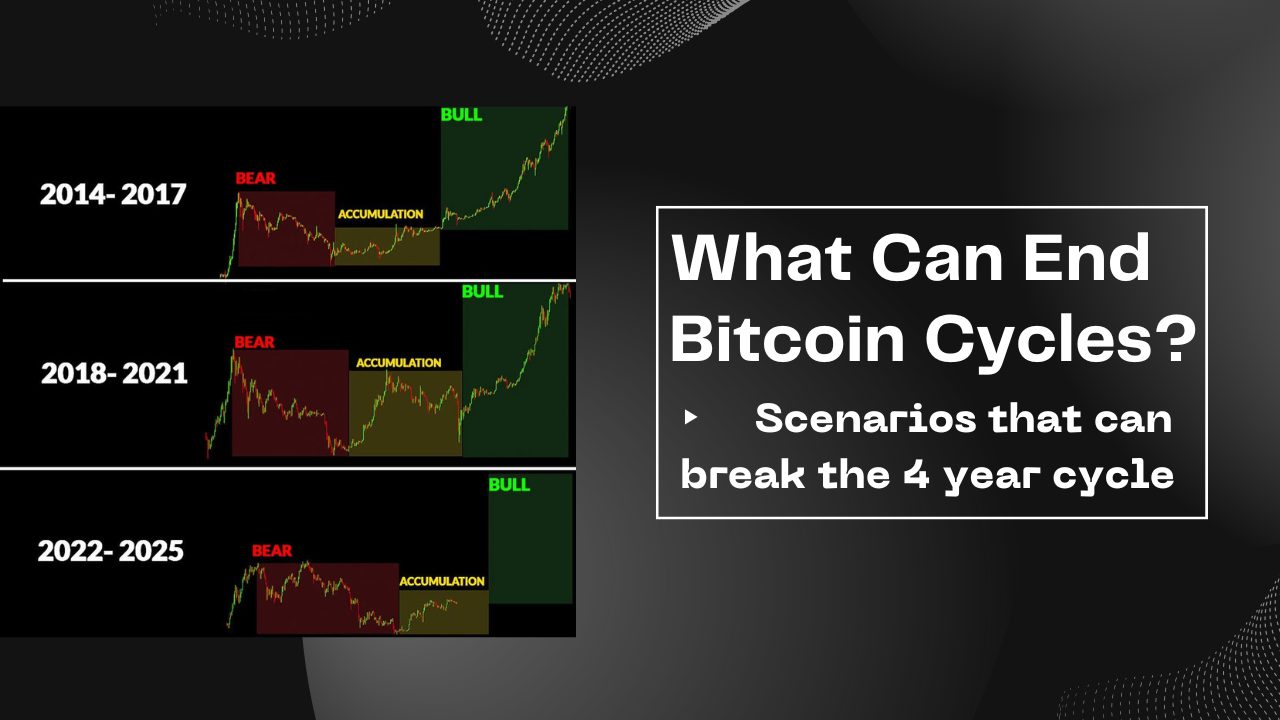

If you’re aware of 4 year cycle, you practically have predictive power over Bitcoin’s price performance without relying on luck.

And you might wonder whether the “cycle is dead” or if we’re in a “supercycle”.

Personally, I think that the 4 year cycle will remain intact for the foreseeable future.

But not forever. There are two (extreme) scenarios where I can see it breaking (a good one and a bad one) and a third scenario, which is more realistic and gradual:

Scenario #1: Everyone’s on Board

Currently, those that are aware of the Bitcoin cycles have the ability to outperform every asset/class in the world in relative terms. I’m not exaggerating.

The reason that this opportunity exists is because there are still people that believe that Bitcoin is a scam/ponzi/pyramid scheme or are simply not interested in it. These people represent the majority and they’re not aware how Bitcoin or how money works.

The good scenario means all of them coming on board. Not necessarily through their own willpower and intelligence, but due to governments starting to back their currencies with Bitcoin, like they did with gold for a long time. Then, anyone using dollars for example would have an implicit claim on a piece of USA’s Bitcoin.

If such a scenario does happen, there will be a point in time where the value of Bitcoin will explode parabolically. This is not n00b speculation. This is the law of supply and demand. Similar to prices for everything, it’d be a result of the collective sentiment about the asset.

If such a scenario occurs, the sentiment will switch from 5% adoption to 100% adoption. And then, Bitcoin would “stabilize” – whatever that means in a scenario where the dollar is replaced by a superior technology.

Scenario #2: Nobody’s on Board

Yes, the 4 year cycle can break if, for whatever reason, Bitcoin turns out to be a failed experiment.

Of course, every next block added to the blockchain makes an incrementally stronger statement that this won’t happen.

Scenario #3: Uptrend / In Between

The world is not black and white.

In the long run, Bitcoin is indeed an “either million or 0” asset, but neither would be a sudden move that happens overnight.

As Bitcoin adoption continues, as more people become aware and start accumulating $BTC, the volatility will continuously diminish.

In other words, we will probably experience a gradual slowdown in the cycles’ impact on Bitcoin’s price.

We already see this on cycle-to-cycle basis. The bottom-to-top performance in the cycle of 2017 was 12,900%. And in the subsequent cycle of 2021, it was 2,155%.

Unsurprisingly, this correlates with Bitcoin’s growth in adoption, users, hash power, market cap, and decentralization.

For a beginner-friendly onboarding to the revolution, read Bitcoin for Beginners.

Husband & Father

Husband & Father  Software Engineer

Software Engineer