Every cycle, there are people that claim that their favorite crypto project will be “the next Bitcoin”.

Usually this is because their choice is faster, cheaper, more private, or better in any arbitrary parameter that they value.

This is unrealistic and misleading.

I won’t debate whether those attributes make a blockchain “better” or not. Let’s actually assume that there is a superior technology than Bitcoin.

As a matter of fact, let’s create one right now!

Creating a Better Bitcoin

Are you ready? Within minutes, you will create a superior Bitcoin.

Clone/download the Bitcoin code from its GitHub repository.

Once you have code locally, we will make a small change to make Bitcoin faster.

Open the file src/kernel/chainparams.cpp and search for the variable consensus.nPowTargetSpacing.

It represents the average time between blocks and, as you can see, it’s initialized at 10 minutes. Change it to 5 minutes (from 10 * 60 to 5 * 60).

Congratulations! 🎉

You’ve just created a “faster Bitcoin”. ⚡

Many would argue that a 2x increase in transaction speed makes this a “better Bitcoin”. 📈

Why will it fail to dethrone the king? 👑

The Network Effect – Decentralization, Security, Economic Activity

Our good tech can’t compete with Bitcoin because it lacks the network effect.

Nobody knows or cares about this project.

Yes, the blocks are mined at a faster rate. But the market doesn’t see a fit for a technology with faster transactions as a substitute for the (existing) decentralization, security, and economic activity of Bitcoin.

At the end, all market participants need to decide whether to allocate their limited resources into the legacy Bitcoin or your new fork.

Let’s analyze each of them:

1. Miners and Security

A Bitcoin miner owns expensive hardware and uses energy that he pays for to run it.

He provides security to the Bitcoin network and in return earns block rewards and transaction fees.

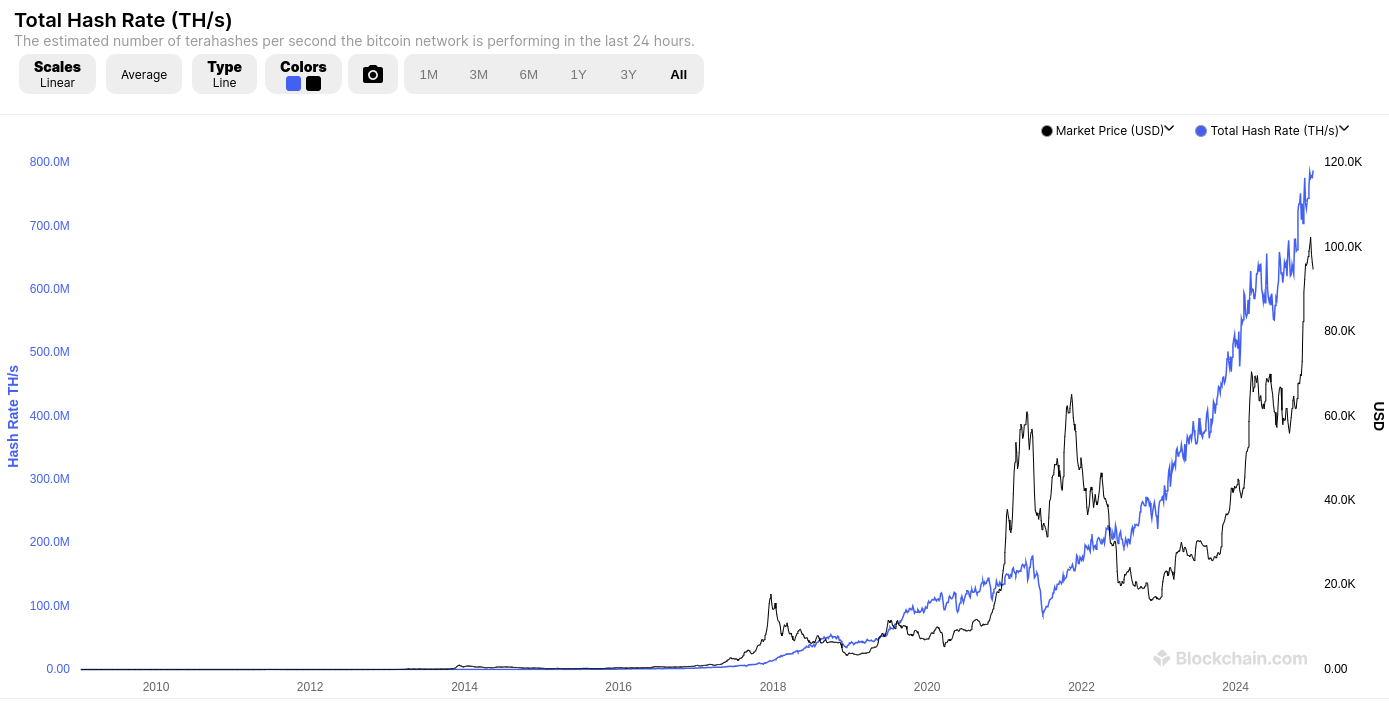

At the time of writing (block 877991), the total hash rate of Bitcoin network is over 850 EH/s and growing:

In contrast, your blockchain has no security whatsoever. Anyone with access to a laptop can attack it – creating fake transactions, rendering it unsafe and useless.

In order for your project to become “the next Bitcoin”, you’ll have to convince the majority of this hash power to join your network and abandon Bitcoin.

Of course, that’s not impossible but it’s (very) improbable.

2. Nodes and Validation

Nodes run the Bitcoin software and validate all transactions as they’re added into blocks.

They do this by confirming that the transactions comply with Bitcoin’s rules. And if a tx isn’t, they’ll reject it by not broadcasting it to the rest of the network.

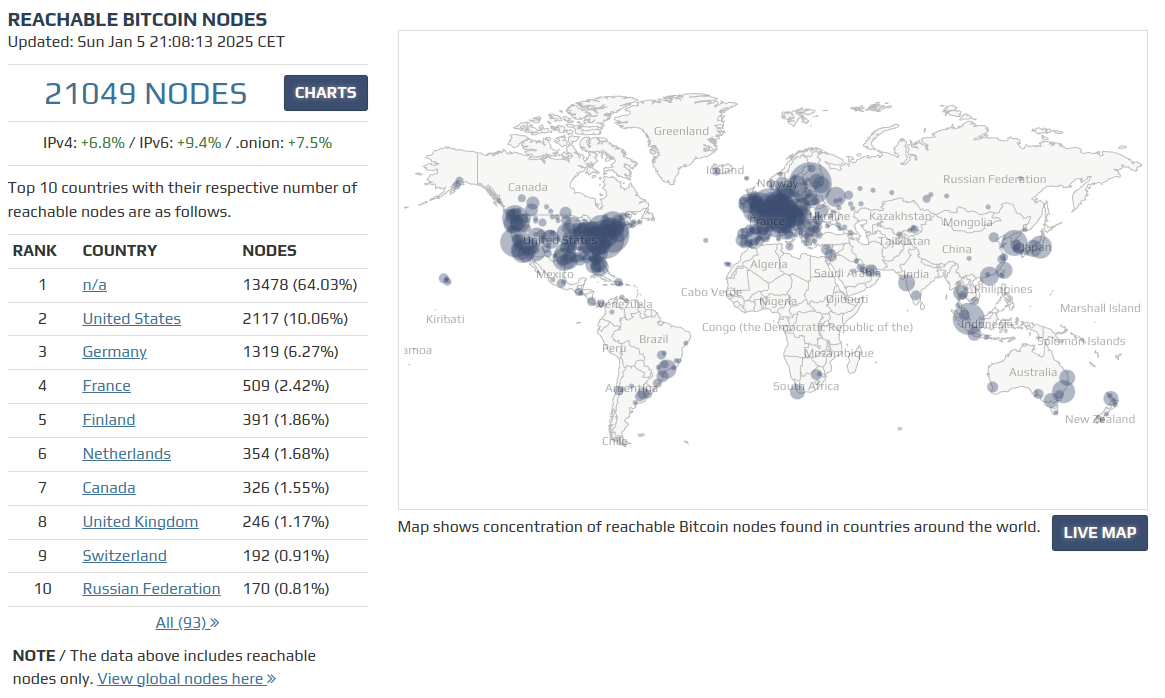

At the time of writing (block 877991), there are over 21k nodes worldwide:

In contrast, your network has 0 or 1 node (yourself), which means that it lacks integrity. If a couple of node runners join your network, they can simply censor all transactions. Or broadcast (falsely) that all wallets send funds to their address. But are the transactions really fake/false if most of the network reached consensus that they’ve happened?

In the Bitcoin network, any user can safely assume that when they send a transaction and pay the fee, it will arrive at its desired destination.

In order your project to become “the next Bitcoin”, you’ll have to convince a lot of people that running a node is in their best interest, maybe even incentivize them in some (expensive) way.

Of course, this is not impossible but it’s (very) improbable.

3. Hodlers and Market Cap

Lastly, we’re looking in the hodlers, investors, and traders – the common market participants of Bitcoin.

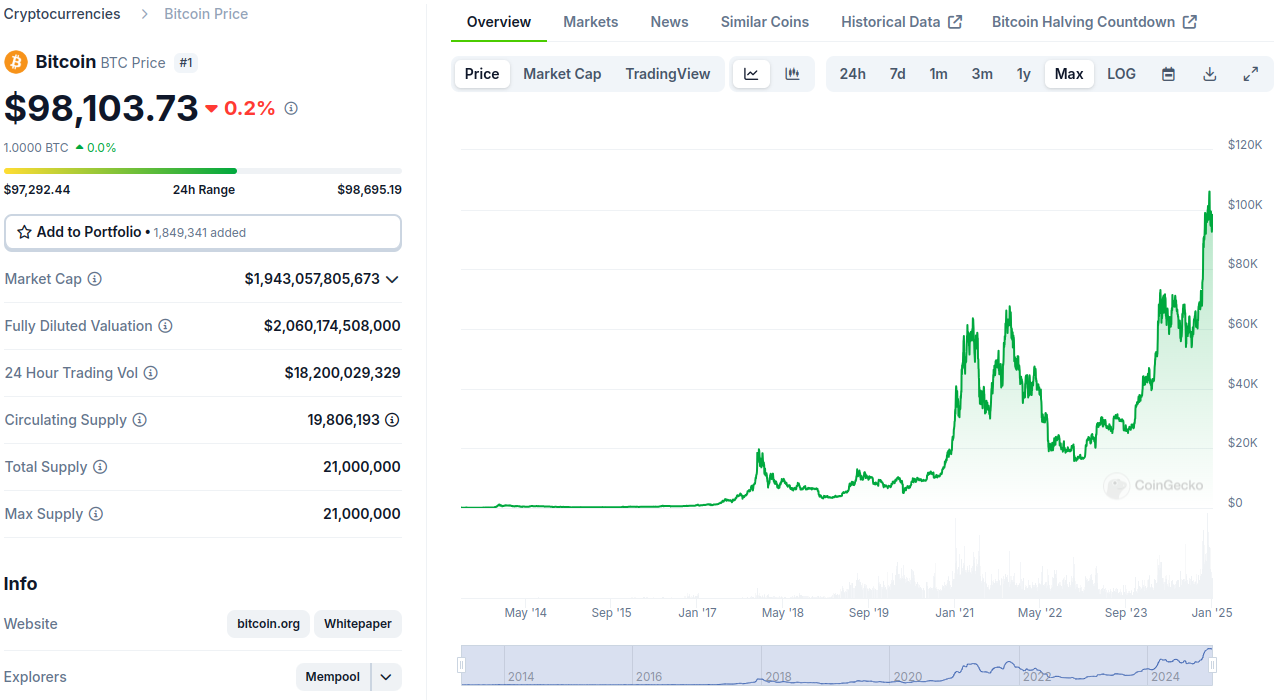

At the time of writing (block 877991), Bitcoin is an asset with a market cap of almost $2T and daily trading volume of $18B:

In contrast, your network has almost no holders and lacks vision beyond “improving” the transaction speed.

You can hope to get market share by running a marketing campaign, forking off of Bitcoin Core, and giving coins to all $BTC holders at a 1:1 ratio. And in order to become “the next Bitcoin”, your project simply needs to surpass the market cap of Bitcoin. And that can happen if most of the 100+ million of market participants end up preferring this new faster version.

Say it with me, third time’s the charm:

Of course, this is not impossible but it’s (very) improbable.

What About Legit Projects?

Okay, I see your point. We indeed created a fake Bitcoin.

But first of all, what does “legit” mean?

There are multiple large cap projects that are forks of Bitcoin – Dogecoin and Litecoin are two you’ve probably heard of. What makes $DOGE more “legit” than any other coin?

Okay, you may mean projects that don’t “try” to be Bitcoin, but have a different value proposition.

That’s the point – they do have a different value proposition. Bitcoin isn’t better than Ethereum in smart contracts. Bitcoin will never be better than Monero in privacy. It won’t be faster than Ripple. It can’t compete with the memecoin UX of Solana. But the market, as a whole, including you and me as its participants, decided that decentralization and decoupling money from state are more valuable than private, fast, or cheap transactions or any other value proposition.

In other words: none of those is superior money to Bitcoin.

Conclusion: The Next Bitcoin?

In order to dethrone Bitcoin, you’d need to have the value proposition of Bitcoin, everything it already has (market cap, miners, nodes…), and be better at it.

And that’s practically impossible due to the above-mentioned network effect.

Bitcoin is not a multi-trillion asset because it’s the best tech in the world.

It is superior money – status achieved and continuously confirmed on the shoulders of its always-increasing security, decentralization, and economic activity.

Husband & Father

Husband & Father  Software Engineer

Software Engineer