Being an index investor means buying market cap-weighted funds that are as diversified as possible and not trying to outsmart “the market”.

However, some of us think we know better. So we try to outperform traditional benchmarks such as the S&P 500 or FTSE All-World.

I’ve done this successfully year over year. And in this post, I’ll share some of the ETFs that enabled me to achieve that.

Enjoy!

QDVE

Ticker symbols: QDVE, IUIT, IITU; ISIN: IE00B3WJKG14

QDVE (iShares S&P 500 Information Technology Sector UCITS ETF USD (Acc)) is an ETF tracking the S&P 500 Capped 35/20 Information Technology index.

It’s an index tracking the tech constituents from the S&P 500 and is market cap weighted but capped per company – 35% max for the first one and 20% for the others.

As you’d probably figured so far, it has a much higher concentration of companies (~70, with ~22% allocation in the top one as of now).

QDVE has a TER of 0.15% and it’s an accumulating fund (it reinvests the dividends instead of distributing them to investors).

In summary, I refer to this investment as a “sector boost” because it’s my optimal exposure to tech. And I prefer it over Nasdaq 100 trackers because $QDVE is more concentrated – Nasdaq 100 includes other non-financial / non-tech companies as well.

Index investors swear by diversification so sector concentration might not be appealing.

Below is the historical performance of the top 10 companies in S&P 500 vs the index itself. QDVE is a way to capture a part of that by going overweight in the winners, without buying individual companies.

SEC0

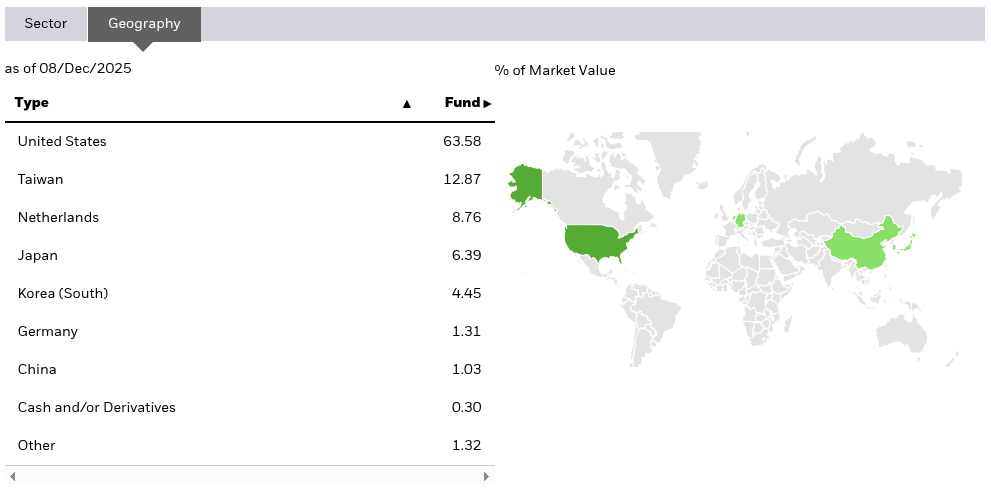

Ticker symbols: SEMI, SEME, SEC0; ISIN: IE000I8KRLL9

SEC0 (iShares MSCI Global Semiconductors UCITS ETF USD (Acc)) is another ETF offered by BlackRock, aiming to track the MSCI ACWI IMI Semiconductors & Semiconductor Equipment ESG Screened Select Capped index.

For simplicity, I refer to this investment as “semiconductors”.

I bought this ETF early in the “AI revolution” as a balanced exposure to Artificial Intelligence as an investor. Concentrated enough in the sector, but diversified enough across companies and countries.

Currently, it has 249 constituents and it’s not only US-based.

I liked it as a vehicle to add some international diversification via a strategic investment rather than global market cap weighing diluting US performance.

Its current top 3 holdings are:

- ASML Holding (7.81%)

- Taiwan Semiconductor Manufacturing (7.36%)

- Broadcom Inc. (7.16%)

Last week these were in the opposite order so make sure to visit the iShares page of SEC0 for up-to-date info.

SEC0 has a TER of 0.35% and is an accumulating fund. As you probably noticed, I don’t buy distributing funds.

Of course, 0.35% might sound high to “pure” index investors, but here’s its performance against the S&P 500 in the past 3 years:

In other words, if you bought this ETF with a part of your portfolio, you’d have outperformed the S&P 500 more than two-fold.

And it’s not a coincidence that I’m comparing them on a 3 year timeframe. That’s the moment when you had the opportunity I had – to anticipate that early ChatGPT or Will Smith eating spaghetti were the beginning of something much bigger.

Important, please don’t ask me if I think we’re in an “AI bubble”.

It’s your decision whether you want to accept more risk/volatility for potentially higher returns.

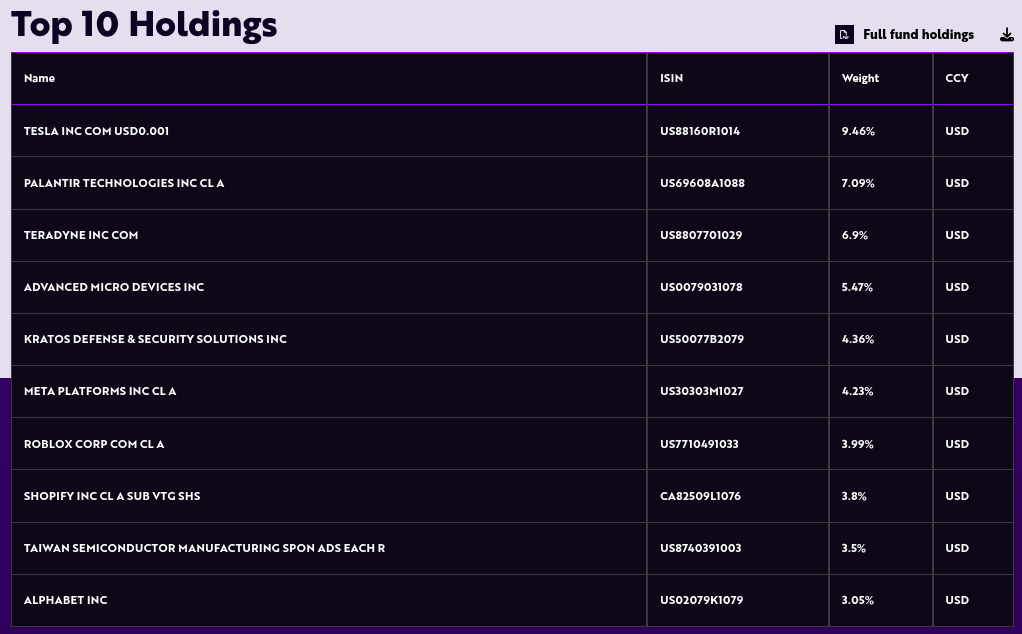

ARKI

Ticker symbols: ARKI, AAKI, ARCI; ISIN: IE0003A512E4

ARKI (ARK Artificial Intelligence & Robotics UCITS ETF) is a fund offered by ARK Invest – an investment management company run by Cathie Wood.

It’s not tracking an index – ARKI is an actively-managed ETF that invest in companies involved in artificial intelligence, autonomous technology, and robotics. It’s an accumulating fund with a total expense ratio of 0.75%.

I also gave it a nickname when referring to it casually: “AI”.

This ETF has been in my portfolio for the shortest time of the three. I bought after the “tariff crash” of 2025. I don’t consider it a long-term hold as I do, for example, SPYL. However, so far it has had a great performance and, same as the rest, it outperformed the S&P by a significant margin.

I realized some profits and rebalanced into my less volatile positions.

Below you can see the top 10 holdings of the fund and an interesting interview where Cathie Wood’s shares her vision and expectations about AI and robotics as an investor and a fund manager:

Other ETFs I Like (Core-Satellite Strategy)

Now, there’s no comparable reward to the market proving that your past expectations were correct, against all odds, bears, and naysayers.

Still, I don’t attempt to outperform a hurdle rate with 100% of my net-worth. [redacted]% of my stock portfolio is still in an old, boring, core position that tracks the S&P.

And this allocation will only increase as I smoothly transition from accumulation to protection over time.

Anyway, I believe strategic ETFs belong in such a core-satellite portfolio for most people. With the core positions tracking the S&P 500 or other globally diversified indices (FTSE All-World, Solactive GBS Global Markets Large & Mid Cap, MSCI World, etc.). I won’t go into too much depth because you’re already familiar with such ETFs: SPYL, IWDA, WEBN, etc. The standard picks.

And to balance out the volatility of riskier satellites, there can be a certain allocation of YCSH (or similar money market ETFs), to get a (low and almost risk-free) return on a portion of your savings. This allocation should inversely scale with your conviction of how good you think the upcoming years will be. This is very important. It’s basically firepower for future lump-sums – you don’t want the majority of your assets returning 5-10% below inflation forever (i.e. what people refer to as 2-3% per year).

Remember, taking strategic positions is a completely different ballgame than set-and-forget investing. And it’s not for everyone.

I intentionally don’t share my current, past, or target allocations, as I don’t want to influence less experienced investors into taking more risk than they’re comfortable with.

At the same time, I think it’s worthwhile to read stories from investors that outperformed the market year-over-year. This post is my contribution to that.

At the end, if you are still reading investing blogs, you probably seek something more exciting than VWCE, don’t you?

Important Disclaimer

I wrote this post in the past (before you read it). My (early) conviction already captured the ETFs’ stellar performance.

I have no opinion on how these will perform starting from an arbitrary point in the future. Be mindful that many people ask me if it’s a good idea to buy gold after it went up 50% or Bitcoin at all-time-highs. But it’s really hard to encapsulate all my knowledge, expectations, established risk tolerance, time horizon, and strategy in an hyper-condensed summary such as a “yes” or “no”.

Or in simpler terms: use this post as a starting point of your homework and further analysis, not as a guide or recommendation that you would follow blindly.

Thanks for reading. 🙏

Husband & Father

Husband & Father  Software Engineer

Software Engineer