As some of you already know, I recently bought an apartment in Dubai.

I’ve already covered the overall experience, but in this post I’ll dive into the awesome ways I saved mid-five figures in the process.

Although not all steps are directly replicable by anyone or at anytime, they’ll still provide interesting insights for people that are interested in doing the same.

Payment Plan vs. Paying in Full

In Dubai’s real estate market, developers commonly offer flexible payment plans to attract investors.

They allow paying in installments during construction, without the need to get a mortgage.

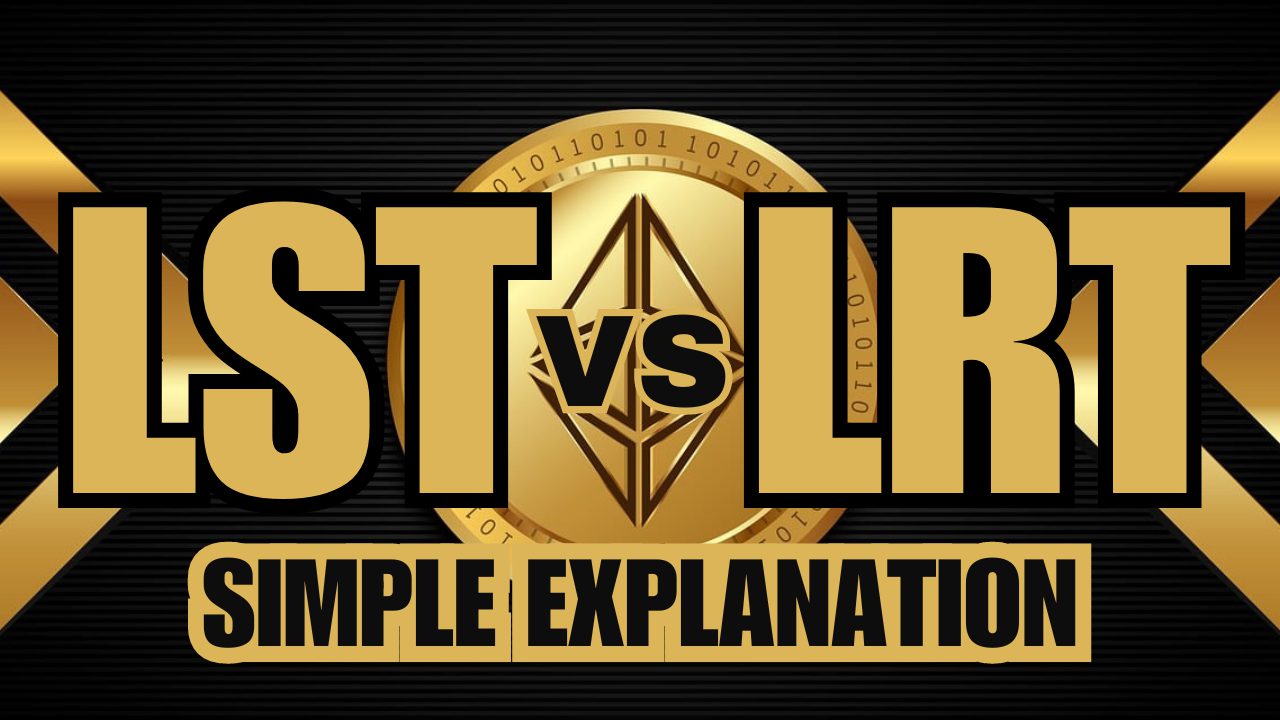

Here’s an example of a post-handover payment plan:

Payment Plan for Ruba in Arabian Ranches III by Emaar

As you might imagine, this puts investors in a favorable position as they don’t need to have the full amount upfront. Especially the post-handover payment options, where you can use rental income to pay off the remaining amount.

In my case, when I was buying the apartment in Dubai I was presented with two options:

- A 50/50 payment plan, where you pay 50% in a few installments until the handover date and 50% on handover

- A 70/30 payment plan, where you pay 70% in installments until handover and 30% in installments post handover

The shorter duration one had around 5% discount on the total price due to less time uncertainty for the developer.

I thought these are highly standardized and don’t allow for variations. But a couple of weeks before the registration, I learned that I can pay the apartment in full for an even larger discount. This was never “hidden” – it’s actually preferable for the developer. But it’s understated in marketing materials as most buyers find the flexibility and lower initial financial burden of payment plans more appealing than on a one-time discount.

However, I had spare cash that I wanted to deploy into something ASAP, so I decided to be a cash buyer (i.e. pay upfront).

I paid for the apartment in full for a ~10% discount on the total price.

Paying With Stablecoins (USDT)

I loved doing business in the UAE! Everyone’s focused on efficiency and getting the job done, rather than slowed by bureaucracy and procedures.

As such, most developers accept cryptocurrency payments when selling properties.

This was very beneficial for me because, as a European, I avoided wire transfer fees, intermediary bank fees, currency conversion fees, etc.

Depending on the route I’d have taken, all of this would’ve costed me 2-4% of the total purchase price (+ stress), which is not insignificant on a 6 figure purchase.

I bought $USDT, withdrew it to my self custodial wallet, and paid onchain for a fraction of the cost I would’ve paid by going the “traditional route”.

Bonus points: the money arrived within seconds and we avoided unnecessary delays, retaining full transparency and control.

I’ll end with a quote from my post I Bought an Apartment in Dubai With Crypto:

… next time someone says that “crypto has no use case”, just send them this post.

Nailing the Peak: From Stocks to Bricks

As I mentioned in the payment plans section, I discovered (relatively late in the process) that paying in full came with a sizable discount.

I was prepared to do the the 50/50 payment plan (with cash to spare), but I was €40k-50k short of covering the full purchase price upfront.

That left me with two options:

- Stick with the 50/50 plan, make a downpayment and avoid opportunity costs

- Find an extra €50k and unlock a ~10% discount on the total price

So…

It’s January 2025. If I avoid tying up my liquidity, what are my options?

The S&P 500 is above 6,000 and Bitcoin above $100k.

S&P 500 until January, 2025

Given the 4 year cycle theory and the yield curve inversion, I was definitely not gonna deploy capital in any of those in the short term.

Dubai real estate seemed like a better opportunity at this particular moment.

So with the goal to utilize as much cash ASAP, I decided to come up with €50k and pay the apartment in full… Getting a nice discount in the process, not bothering with payment plans nor taking unnecessary risks.

I sold some of my S&P 500 ETFs to cover the difference.

(Note: I live in the Netherlands where we don’t have capital gains taxes, so there are no extra expenses for this trade.)

In an interesting turn of events, Trump started imposing tariffs shortly after.

The stock market dropped 15% year-to-date as of the time of writing this post.

I don’t want to pretend that I “knew” it was the local top – no one does in the present.

But my conclusion that all markets were relatively hot turned out to be correct, so I’m happy I took profits at the best possible time.

And now, I got a 10% discount on the apartment and a 15%+ discount on the stocks to reenter as I earn.

I definitely consider this a success story.

Summary

For those that want a short version of the story:

How I saved $40k buying real estate in Dubai?

- I went with full payment upfront instead of a payment plan, unlocking a discount

- I paid with stablecoins instead of FIAT, saving on FX fees and bank fees

- I sold stocks around the local top, right before a crash, to rebalance into real estate

Husband & Father

Husband & Father  Software Engineer

Software Engineer