It’s that part of the year when reporting our taxes is due.

If you feel overwhelmed understanding the Dutch tax system, you’re at the right place. Doing your tax returns in The Netherlands is actually not complicated at all.

At the end, you need to report the following categories:

- Box 1 – Income tax

- Box 2 – Tax on substantial interest / holding in a limited company

- Box 3 – Wealth / savings tax

This post is a general introduction to declaring your taxes in the Netherlands yourself.

DIY Dutch Tax Returns

Step 1

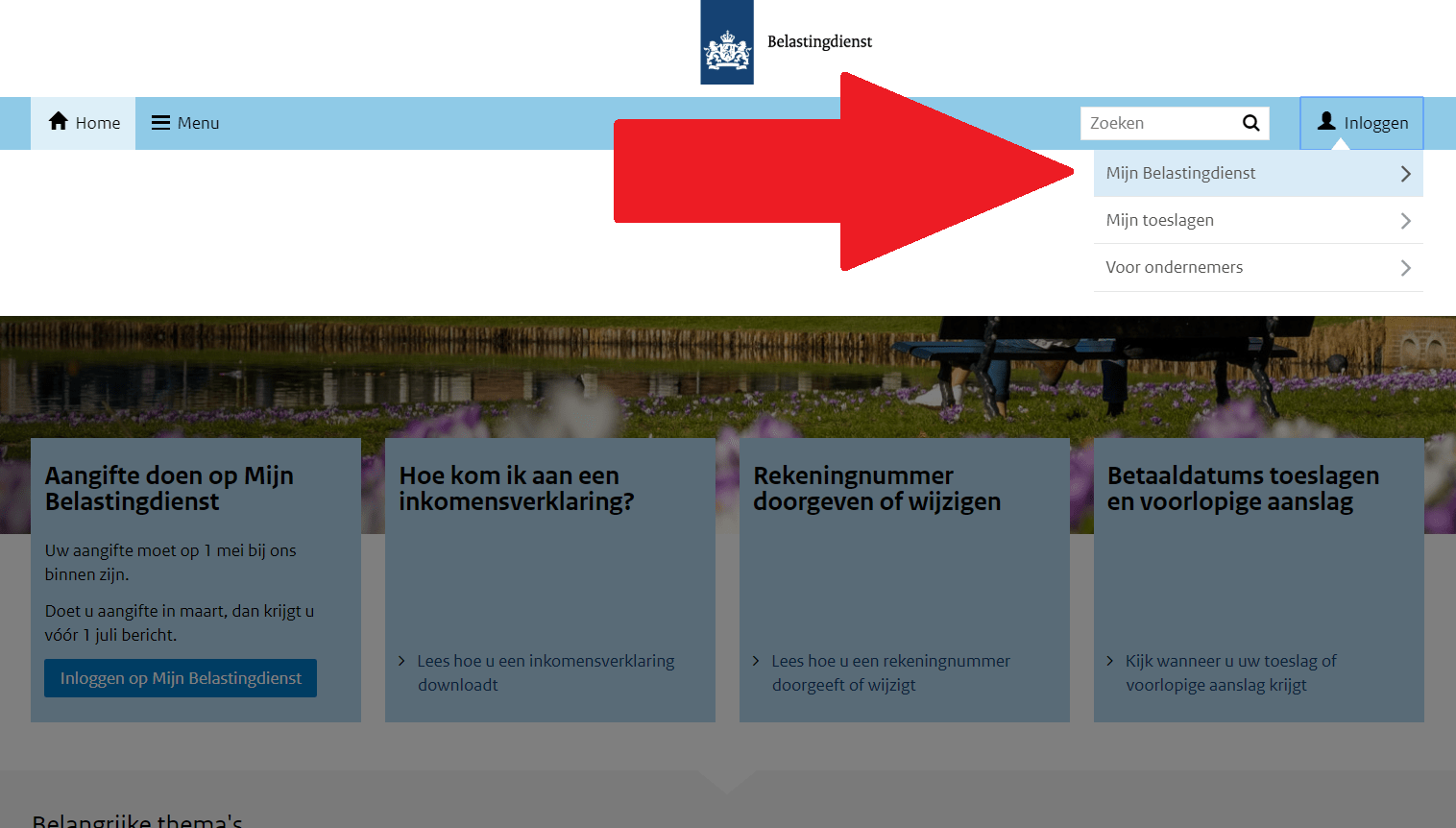

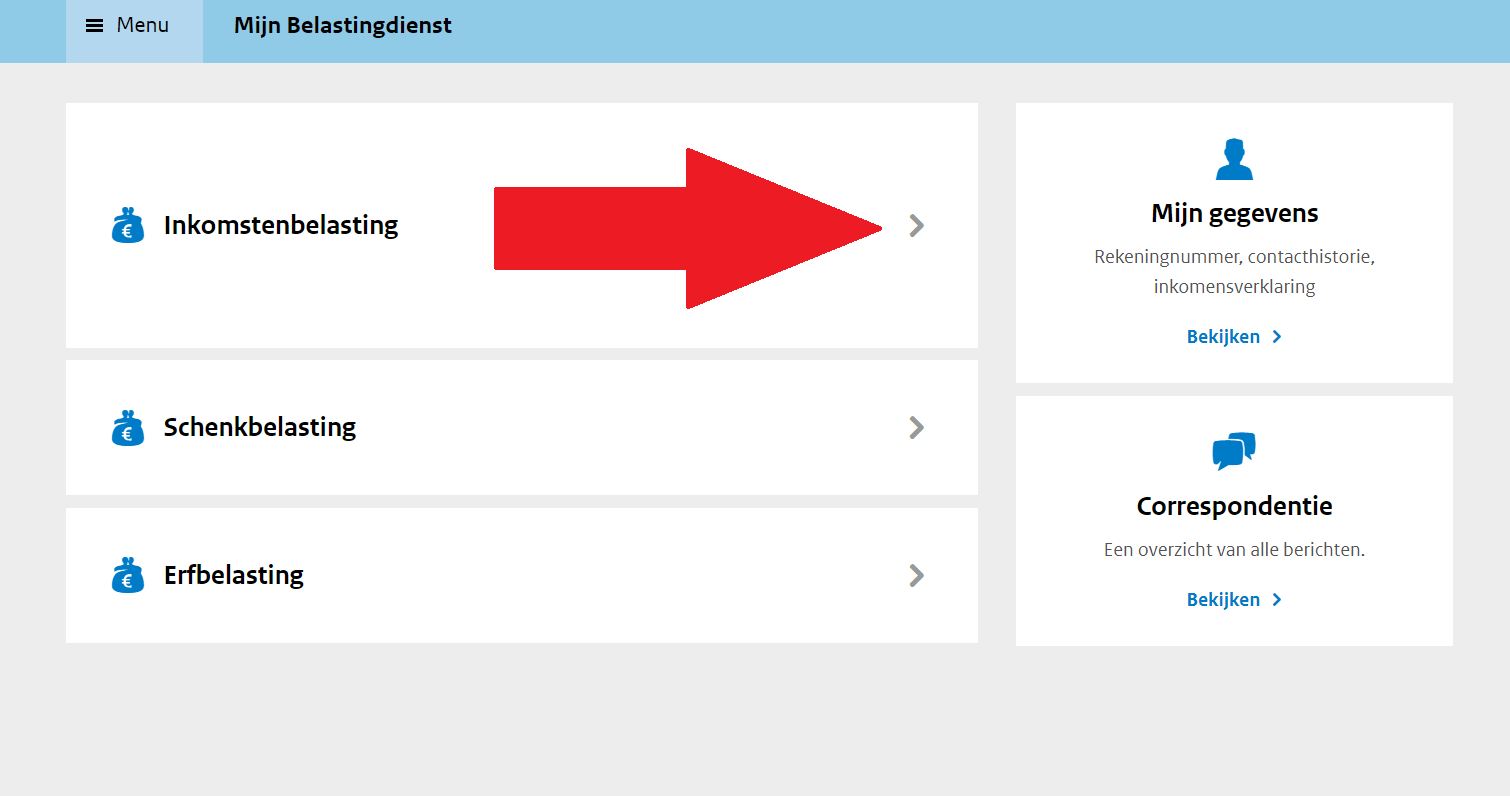

Go to the tax authorities’ website – belastingdienst.nl, click Inloggen on the header, and click on Mijn Belastingdienst.

Log in with your DigiD account.

If you’re new in the country – DigiD will serve as a single sign-on for all the government websites/apps. Get it right away if you still haven’t.

After you’re logged in to the tax authorities’ website, go to Inkomstenbelasting (which translates to income tax).

The other options are for gift tax and inheritance tax and you don’t have to do anything if they’re not applicable to you.

Select the year you want to report taxes for.

Clicking on Aangifte inkomstenbelasting doen will take you to the tax return form.

Step 2

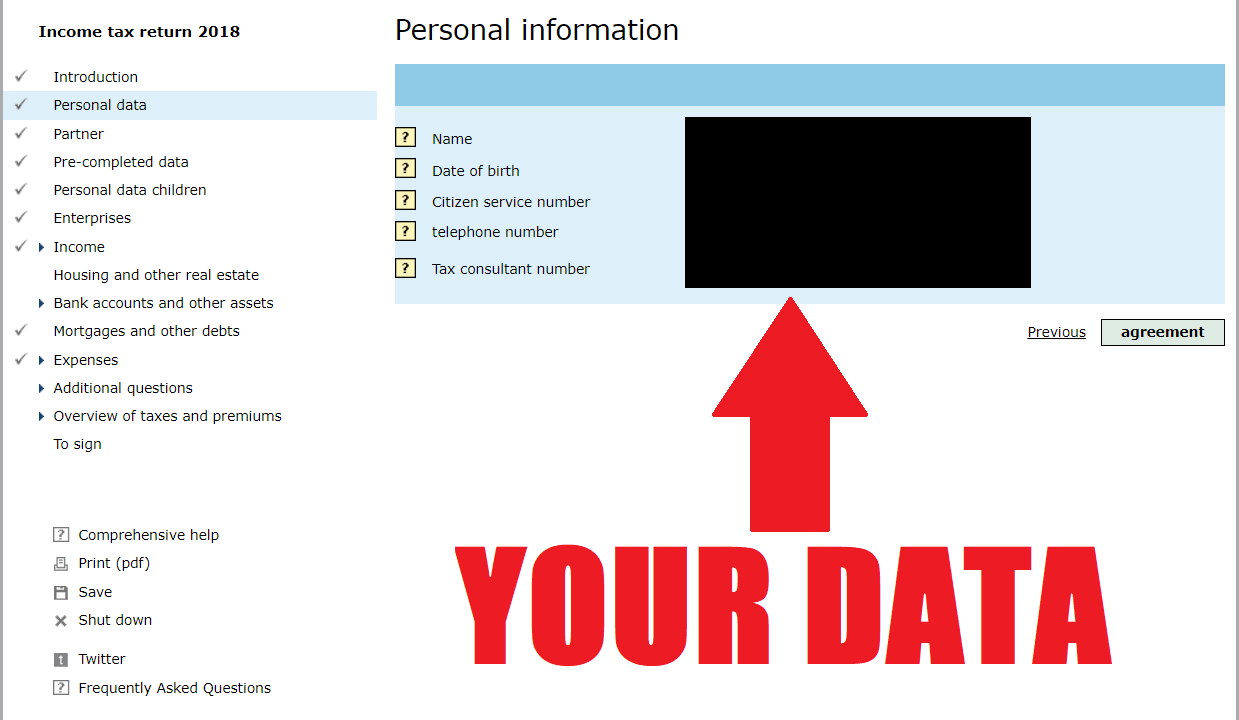

As you’re most probably an expat that doesn’t understand Dutch, right click and translate the page to English.

What will happen in the first steps is providing a few personal details – BSN number, martial status, kids, etc.

Most of the pages will be prefilled, especially if all of your income comes from employment in the Netherlands and you only own real estate in the country.

So I won’t go through every step but you can see them in the sidebar on the screenshots.

Basically, most of the process is just checking and confirming the details.

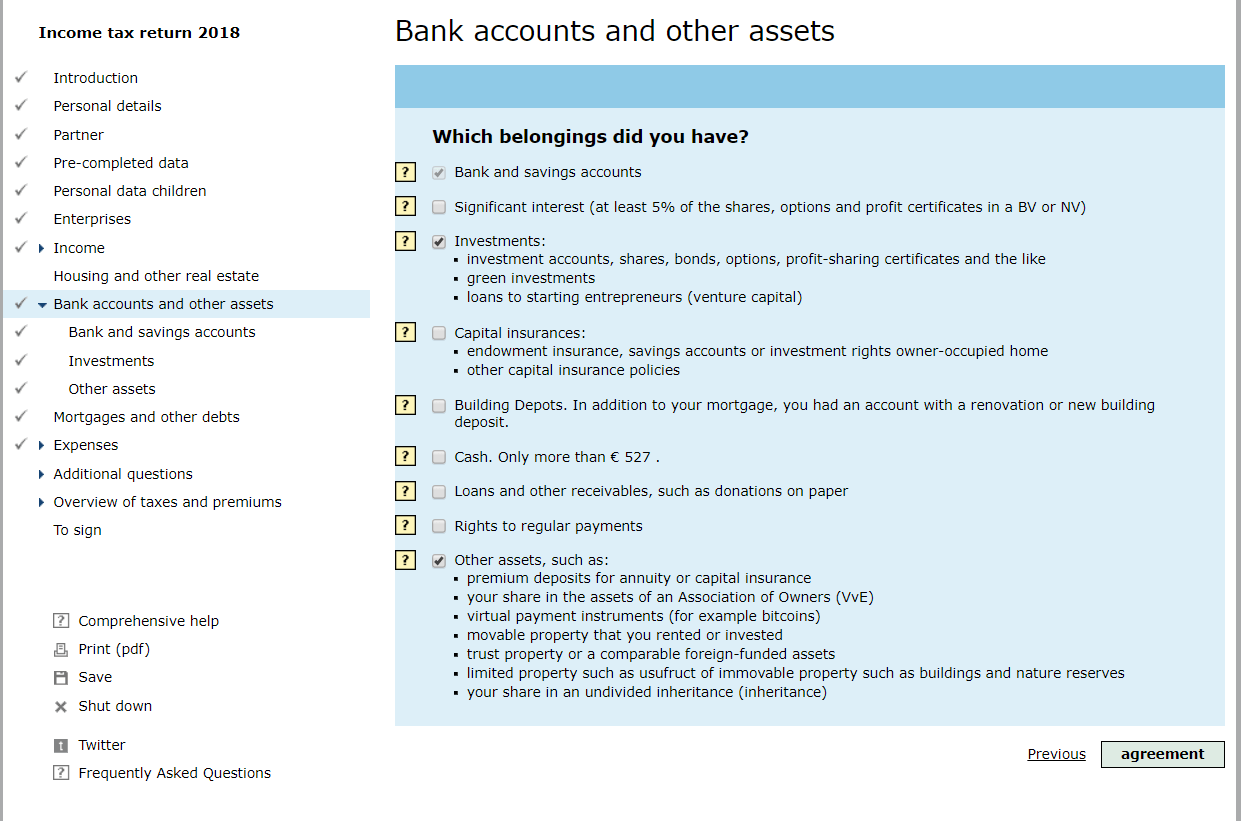

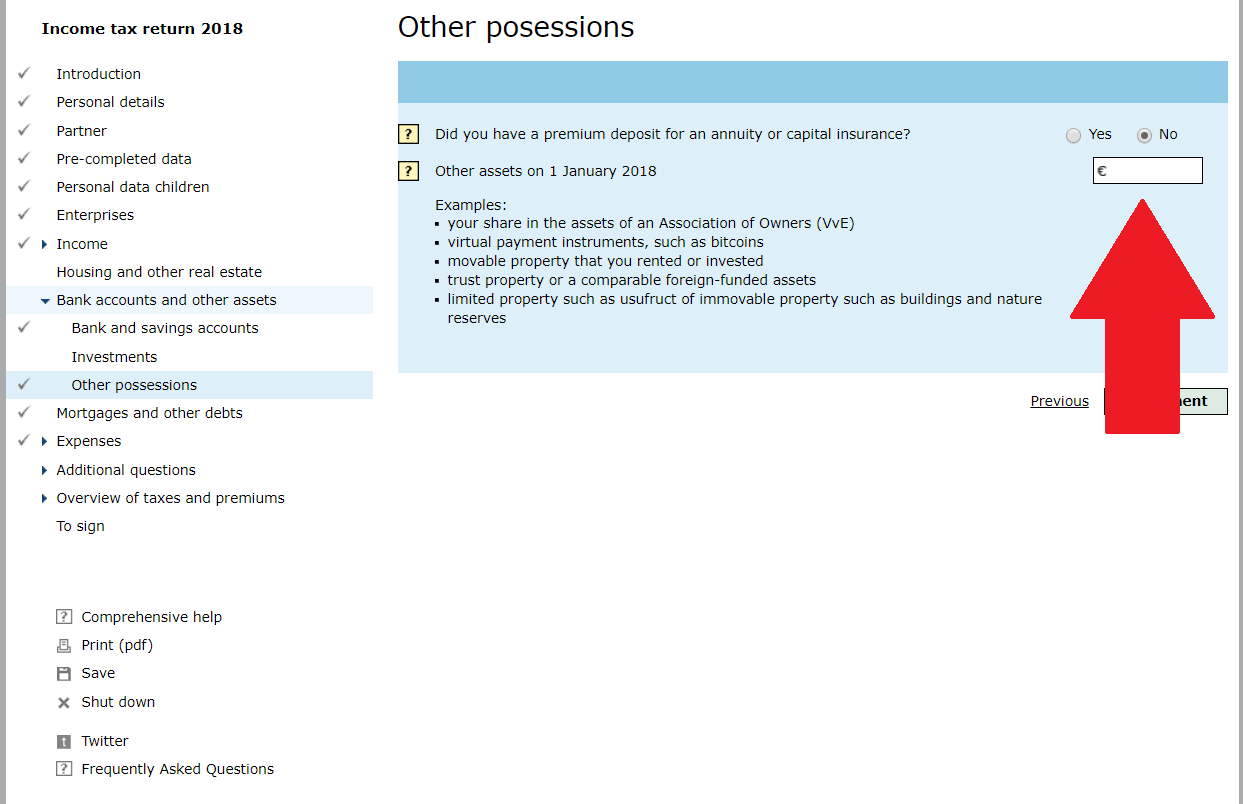

If you’re investing as a private individual, the first input you’d need to give would come in the section Bankrekeningen en andere bezittingen (bank accounts and other assets).

If you use Dutch or European platforms, this information might also be prefilled.

But if you have a stock portfolio on foreign brokers or you self custody crypto, this is where you need to report it.

In the following screen, you’ll need to declare the value of your assets on each account at 1st of January of the fiscal year that you’re doing your taxes for (i.e. the previous one).

Every category that’s applicable to you will create a few more input boxes to fill in the details.

It’s that simple.

You may need log in to your broker or bank and get the reports for your investments or mortgage, but that’s the same amount of effort you’d put if you hire an accountant. He’ll just ask you to provide the same info and put it in instead of you.

Important: if you can’t provide a certain information right away, you can always save the form by clicking on the Opslaan (save) button and you can come back in the future.

Just make sure to do it before May.

Step 3

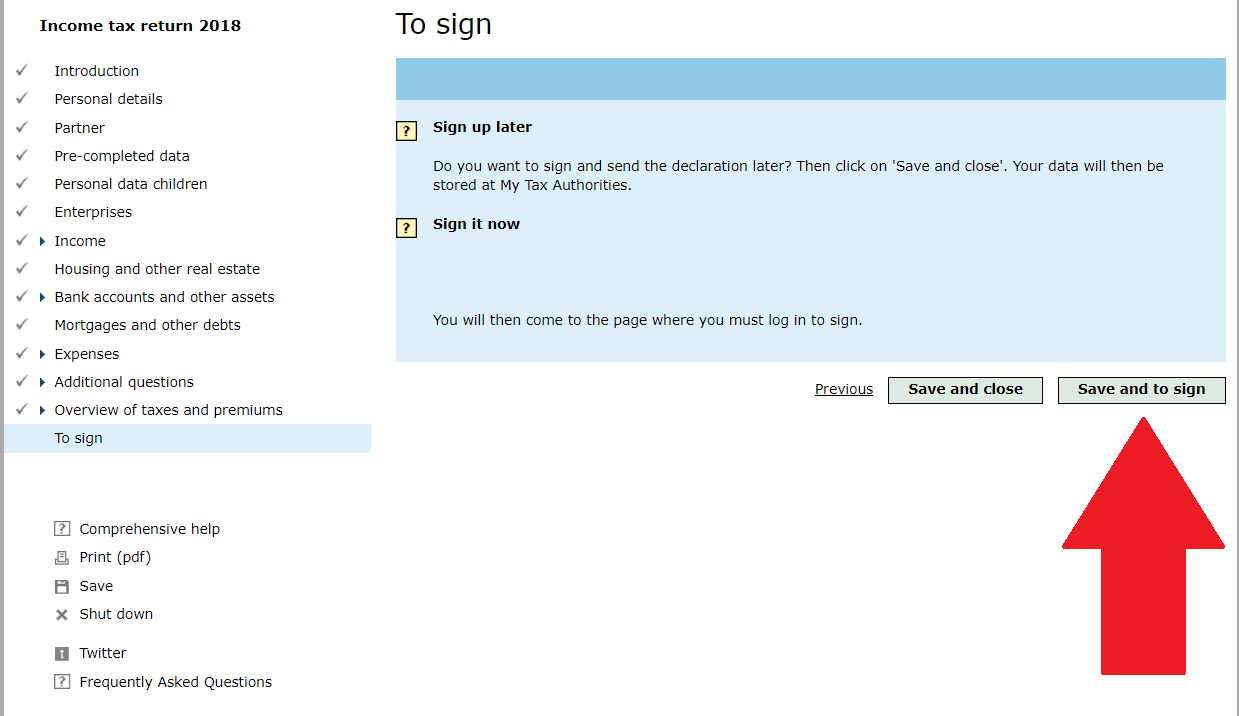

After you’re done, you’ll be presented with a summary of everything you’ve filled in.

This will also include an approximation of how much you’d owe or get back in a few months.

If everything is correct, proceed towards the ondertekenen page.

Click on the button in order to sign and submit the form.

And your part is done!

Enjoy the money you saved by Doing It Yourself.

Expats Under the 30% Ruling

If you’re benefiting from the 30% ruling, you’re considered a “non-resident tax payer”.

Practically, this means that you don’t have to declare your Box 2 and Box 3 taxes.

For example, in the section “Bank accounts and other assets” there will be a question about your savings and other assets and you can just leave it blank if still under the 30% ruling.

A few more information for new residents:

If your tax deductible expenses are high enough, you may get some money back. For example, interest paid on your mortgage, some healthcare expenses, paying for your own transport to get to work, and a handful of other factors.

The tax refund can be especially beneficial for people who didn’t live in the country for the full fiscal year. You may be pleasantly surprised with few thousand euros in certain scenarios.

You Don’t Need a Tax Advisor

Wouldn’t hiring a tax consultancy make the process easier and faster?

It won’t – the process is really straight forward as it is.

Filling the tax returns yourself doesn’t take more time than finding the appropriate tax advisor, correspond, get all the documents you need, get a form to fill in (the information of which will be proxied to Belastingdienst anyway) and pay for the service.

There are rare cases in which I wouldn’t be 100% against hiring a tax advisor:

- The first year of residency, when you’ll receive an “M Form” in your mailbox that you’ll need to submit physically.

- If you need an actual advisory role for a unique and complex international situation for the first time.

Note: for most scenarios, the tax form should be enough. I’ve had experiences with tax treaties and foreign dividend taxes that ended up as simple as filling in all the relevant details.

And if you have a specific question, you can always call the Dutch tax authorities on their free number (0800 0543).

Congratulations! You just saved between €300 and €800 for each year you’ll stay in the Netherlands.

This post is not tax advice. Just a high-level overview of the easy and efficient tax declaration process in the Netherlands. It’s everyone’s responsibility to educate themselves about taxes.

Husband & Father

Husband & Father  Software Engineer

Software Engineer