Choosing accumulating vs distributing ETFs is a dilemma many new investors face when starting to invest.

If you’re still learning, you might be somewhat confused about the meaning of these terms.

And you’re at the right place!

Difference Between Accumulating vs Distributing ETFs

The main difference between accumulating and distributing funds is the way they handle the dividend payments:

- Distributing ETFs pay out the dividends to investors

- Accumulating ETFs reinvest the dividends automatically

Below are the details for both types:

Distributing Funds

Distributing funds make dividend payments to investors in cash.

When you’re investing using an ETF, your money is distributed across the stock of the underlying companies. This means that the following actions take place:

- The underlying companies make dividends payments to the fund

- The fund receives the dividends and proceed to pay them out to the investors

- Your broker receives this payment and credits it to your account

So using a distributing ETF means that you will receive cash payments, in line with the distribution frequency of the fund.

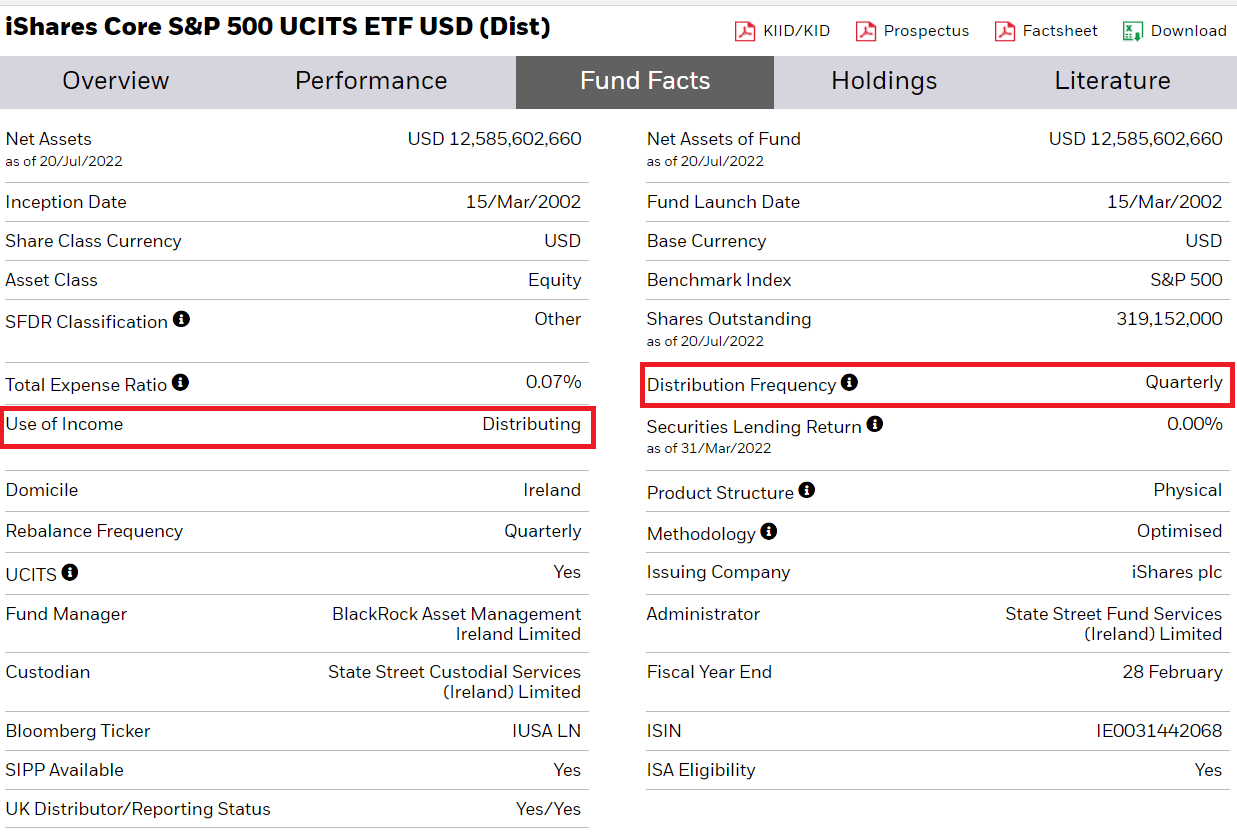

Below is a screenshot of the details of IUSA – a distributing ETF tracking the S&P 500 index.

Note the “Use of Income” and the “Distribution Frequency“. They describe that the ETF pays out dividends every quarter.

Accumulating Funds

Accumulating funds reinvest the dividend payments in the fund.

The way the ETF works is exactly the same as any other – you buy shares of the ETF and your money is invested in the underlying companies. This means that the following actions take place:

- The underlying companies make dividends payments to the fund

- The fund receives the dividends and buys more shares of the underlying companies

- You don’t receive any cash, but your portfolio grew for the equivalent amount

So using an accumulating ETF means that you won’t receive cash payments, but will have the dividend amount automatically reinvested for you by the fund.

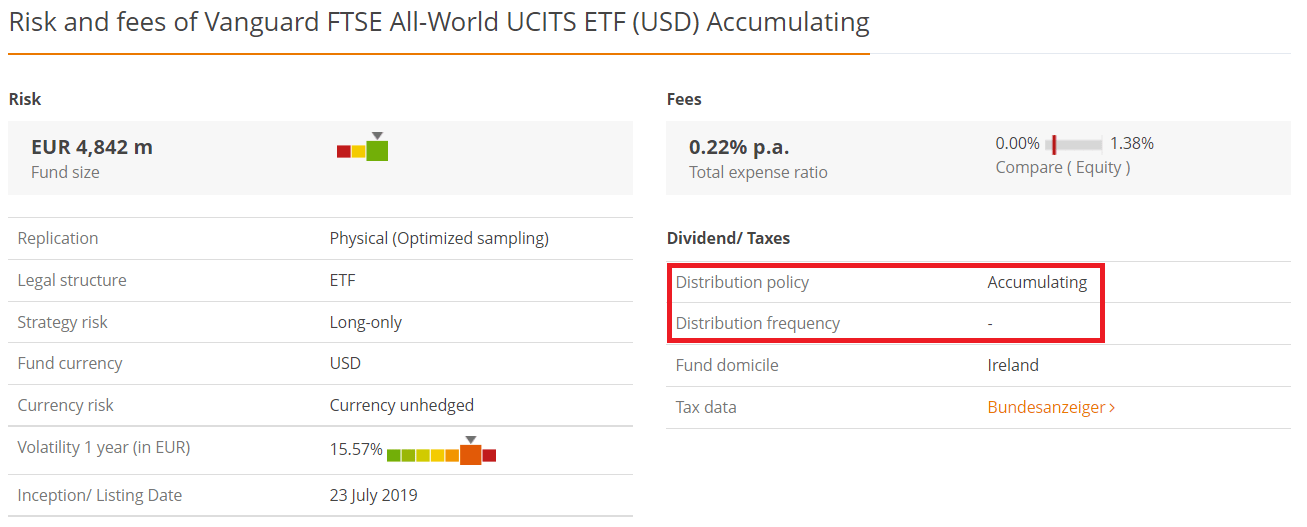

Below is a screenshot of the details of VWCE – an accumulating ETF tracking the FTSE All-World index.

Note the “Distribution policy” and the “Distribution frequency”. They describe that the fund reinvests the dividends instead of paying them out.

Examples of accumulating and distributing ETFs

Note that there may be multiple ETFs tracking the same index, with the same costs, but different distribution policies.

For example, the ETFs CSPX (iShares Core S&P 500 UCITS ETF (Acc)) and VUSA (Vanguard S&P 500 UCITS ETF) both track the S&P 500 and both have a TER of 0.07%. But the one from iShares is an accumulating ETF and the one from Vanguard is a distributing ETF.

Other ETFs that track the same index are IVV (iShares Core S&P 500 Index), VOO (Vanguard S&P 500 ETF), SPY (SPDR S&P 500 ETF), etc.

I’m trying to convey that there are various options and you need to pick the one that’s both available and makes sense to you – by going through the details as in the pictures above.

Oftentimes, the type of the ETF is part of its name – having Dist. or Acc. as a suffix. If not, the factsheet of any fund will have fields such as “Use of income” or “Distribution policy”.

Which One is Better?

Remember: it doesn’t mean that you can get “more money” by going one way or the other.

Whether the dividend is paid out or not will be reflected in the price of the ETF.

And when you face the dilemma, you’re basically asking yourself the question of “do I want some extra cash every quarter or I want it automatically reinvested?”.

Oftentimes, it boils down to your preference and/or the tax implications regarding dividends in your country.

My Opinion

I have a clear preference for accumulating funds because receiving dividends is equivalent to selling.

When possible, I prefer my sell orders to be voluntary in frequency and amount rather than scheduled. Plus, I don’t need extra cash – I’m actually trying to get rid of the excess. So the only logically consistent conclusion is to prefer accumulating ETFs.

Of course, everyone’s situation needs specific evaluation as it can depend on various other factors… The most relevant might be the age and retirement status, as distributing funds might make more sense for people who foresee that they’ll earn less in near future. I would still argue that selling works just as fine, but this is the moment where the tax implications might influence the final call.

Need a beginner-friendly, comprehensive, and free resource to kick-start your stock market journey? Visit:

How to Start Investing: A Complete Beginner Series.

Husband & Father

Husband & Father  Software Engineer

Software Engineer