This post can be summarized really simply: “I buy as much Bitcoin as I can during bear markets”.

However, evolving in the market, besides just buying, I found an edge that I’ve leveraged successfully in the past and I’m doing it again now.

You can consider this post an intro to making mad gains without getting lucky.

Warning: these strategies are not for people that didn’t build conviction by themselves and especially not for n00bs.

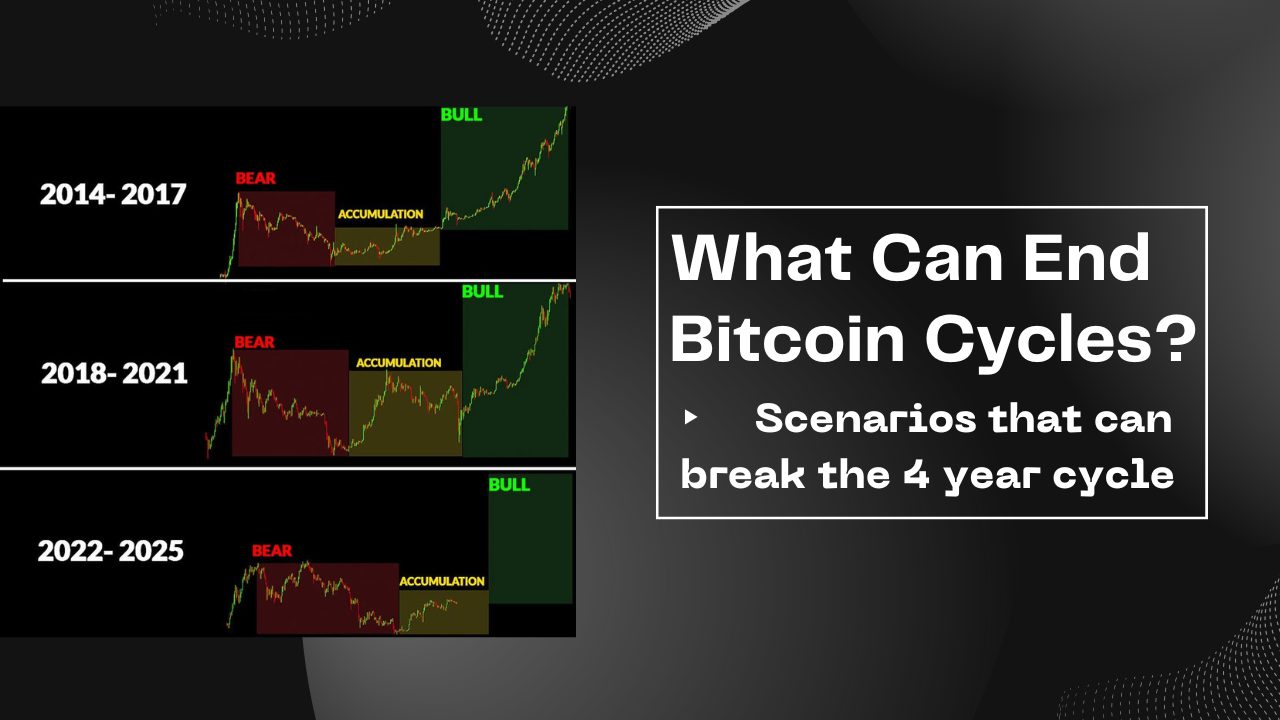

Market Cycles Explained

A market cycle is a time period in which Bitcoin goes from boring to explosive and back to “Bitcoin is dead”.

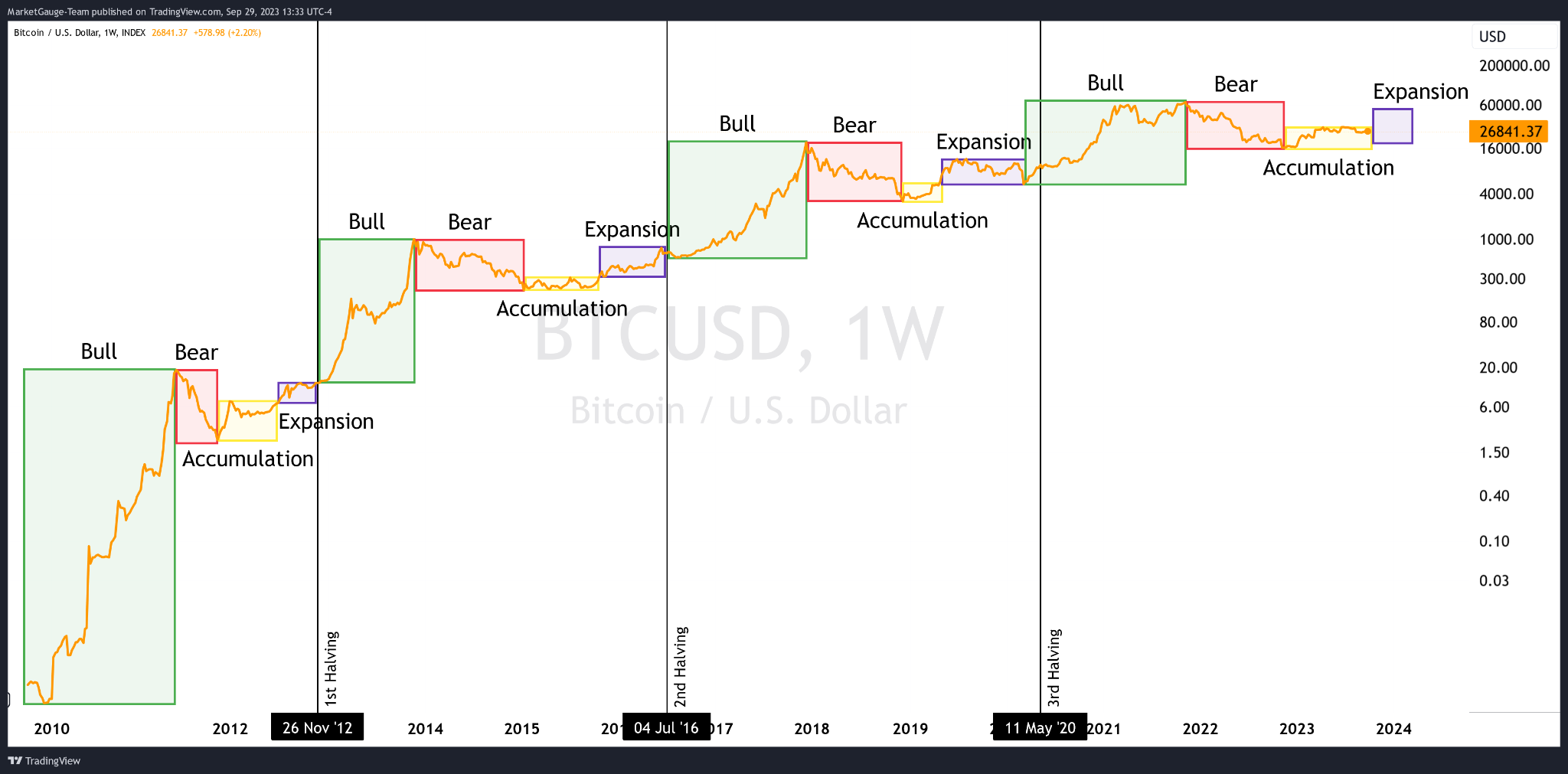

You can observe the cyclical nature of this asset class in the image below:

I carefully dissect this in the post The 4 Year Cycle, so make sure to understand it.

And the reason the cycle resets on a 4 year time-frame is because of Bitcoin’s block reward halving (the vertical lines). This is an event that’s programmed to occur approximately every 4 years.

And every subsequent all time high (ATH) was higher than the previous one. So far, $BTC reaches its peak within 1.5 years after each halving event.

And after a cycle or two, this becomes predictable:

- A bull market slowly emerging in the year prior to the halving (2015, 2019, 2023)

- Reaching the previous ATH in the year of the halving (2016, 2020, 2024)

- Mania phase with new all time highs in the year after the halving (2017, 2021, 2025?)

- An ~80% crash and a boring price action during a bear market (2018, 2022, 2026?)

Fun fact – this is the meaning behind this popular sequence of emojis: 🟢🟢🟢🔴.

Of course, past performance is not a guarantee for future results. But until all market participants understand the supply and demand dynamics of Bitcoin, the opportunity will be there. And when they do, it will be reflected in the price.

Understanding this allows me to maximize the amount of Bitcoin I own compared to holding.

Trading vs Investing

Before going further, there is one distinction that even experienced bitcoiners are missing: trading vs investing.

Before deploying capital into anything, you have to have a crystal clear representation about what you’re doing:

- If you’re trading, you enter a market with the goal to exit in profit.

- If you’re investing, you acquire assets that you’d hold for the long-term.

Thus, I want to clarify that I’m ideologically aligned with the inevitability of Bitcoin and I have a multi-coin position that I’ll never touch.

At the same time, I also have a trading allocation which I use to overperform the market, realize profits, and boost my holdings.

And there is a clear distinction about which wallet belongs where, so the decision making along the way is immune to emotions or any human intervention.

Price Targets vs Time Targets

When it comes to how the Bitcoin cycles currently play out, I’m not a big fan of price targets.

Setting price or net-worth goals means taking unnecessary risk.

For example, let’s say you plan to sell all your Bitcoin at $150k. As I mentioned before, being 100% out of $BTC is a massive risk. But since we’re discussing in the trader role, we can entertain the idea:

If it turns out that it doesn’t reach that target this cycle, you’ll end up bag-holding for 4 years. And if it turns out to go to $500k this cycle, you’d have missed out on serious gains.

Nobody knows what price will be the top, so focusing on a specific number for a 100% exit makes no sense.

I understand that people are in love with round magic numbers and have net-worth goals. But I assure you that reaching $1M is not much different than reaching $900k or $1.1M.

That’s why I have multiple targets. And they’re not distributed per price, but through time.

For example, as we enter the second half of 2024, I’ll start considering exiting in percentage terms. These are not definitive numbers, but just an illustration of an approach: selling 5% per month starting 3 months after the halving + additional sells based on circumstances, sentiment, and feeling.

There should always be something left to ride the full wave which minimizes the both the risks of exiting too early or too late.

As long as you entered during the bear market and exiting during the bull market, you should be in a significantly better place, regardless of price.

How I Ride The Bitcoin Cycles

The Bitcoin halving was the single indicator I used to position myself for every cycle.

I divide each cycle into 3 periods:

- Accumulation Phase – 6-12 months after the last ATH, the price settles

- Post-Halving Phase – the period after the halving, bull run confirmed

- Serial ATH Phase – the period of subsequent new all time highs until the price crashes

Accumulation Phase

During the Accumulation Phase, I go in heavy.

Heavy and with size.

My bank account balance never crosses €10k during this phase, as every cash inflow is immediately invested in Bitcoin.

Also, I’m selling parts of my stock portfolio to aggressively acquire even more Bitcoin.

Post-Halving Phase

During the Post-Halving Phase, I’m not going all-in anymore.

I’m still a buyer, but mostly targeting local dips or market inefficiencies caused by too much panic due to some news.

Btw, during this period there are many opportunities emerging, but that’s beyond the scope of this post.

Serial ATH Phase

And during the Serial ATH Phase, I’m done buying $BTC.

I’m actually starting to slowly DCA out, expecting that the music can stop at any moment.

I’m not trying to time the exact top – as long as I continuously take profits in this phase, I’ll sell the top too.

This phase lasts 6-18 months after the halving. And while I uniformly distribute my sell orders, I allow myself some flexibility based on intuition. Maturing in a market gives you this superpower, but that’s a topic for another post.

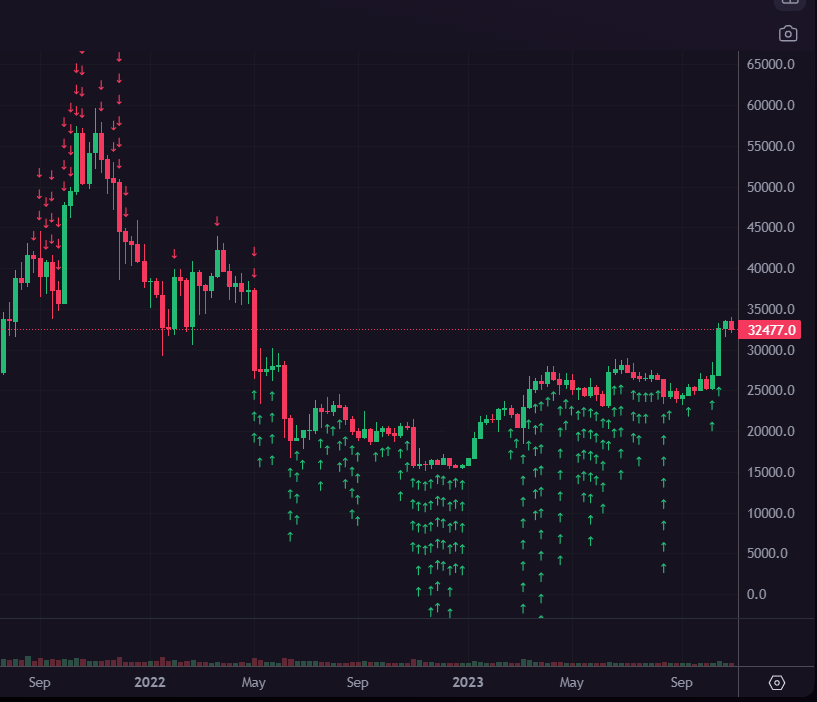

Here’s a picture of my last cycle exits and reentering during this cycle’s lows:

And during the selling phase, I’m rebalancing the profits back into my globally diversified ETF portfolio.

The stock market is a safe place to keep profits until the next Bitcoin accumulation phase where I can do the opposite.

PS If you’re wondering how I’m managing this tax-wise: I live in the Netherlands where we’re taxed based on net-worth, not capital gains. So it’s as simple as reporting all my accounts’ balances as of 1st of January.

What Comes After The Final ATH?

Although visible in hindsight, in the present we can’t be sure which all-time-high will be the final one.

That’s why I’m not starting to buy back immediately after a crash.

I’m actually in a “do nothing phase” for a 6-12 month period with no new all-time-highs. This is a sufficient time-frame of downward price action to confirm that the music stopped for the cycle.

And then I restart the accumulation phase.

If you want a more detailed post about my experience in the previous cycle, read Tales From The Last Cycle.

Husband & Father

Husband & Father  Software Engineer

Software Engineer