Market capitalization (or market cap) represents the total value of an asset.

For a publicly traded company, the market cap is its current share price multiplied by the number of shares. A hypothetical example:

- The price per share is $50

- There are 10,000,000 shares outstanding

- The market cap is the price * the shares = $500M

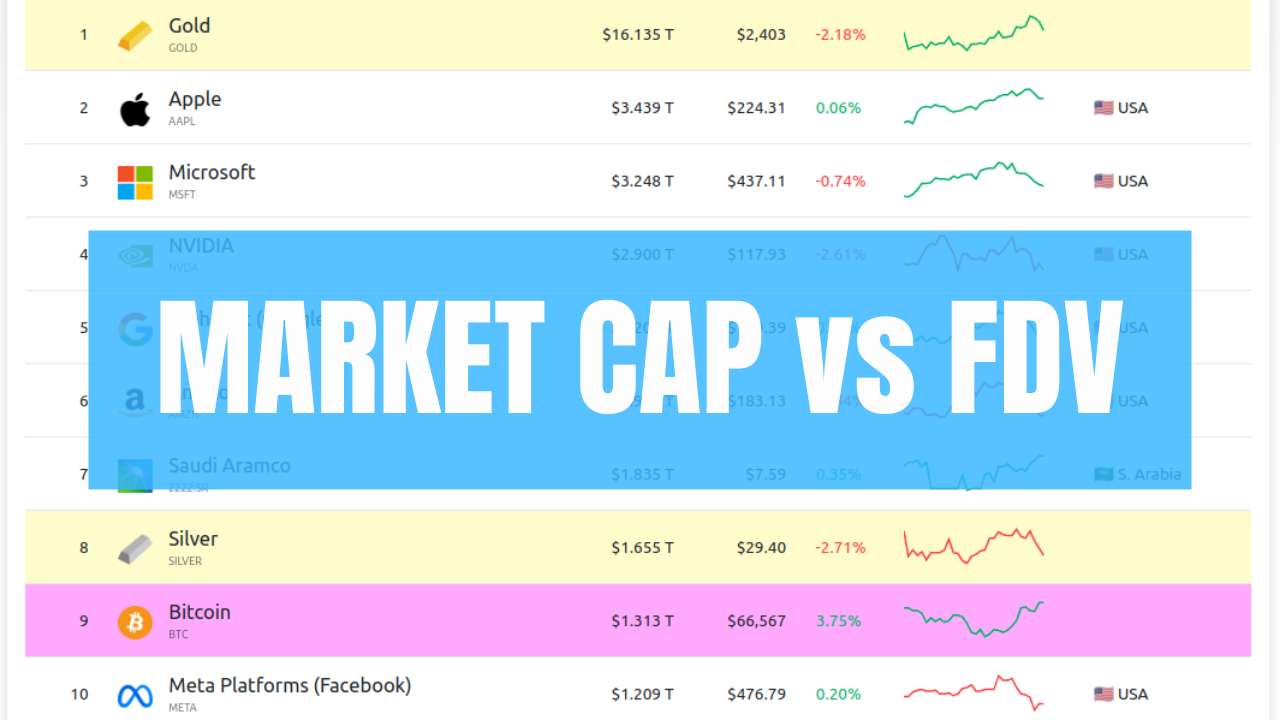

The term market cap is not specific to stocks but to most other assets, such as commodities, ETFs, and cryptocurrencies. A page I really like is Assets By Market Cap, which shows a current snapshot of various assets ordered by market cap:

Snapshot: 20 July 2024

Finding the Market Caps for Coins

In terms of cryptocurrencies, the market cap is the product of the price and the circulating supply of a coin.

In other words, it’s a measure that shows how large a project is.

Reliable places to find the market capitalizations for cryptocurrencies are:

Just type in your project of choice and take a look.

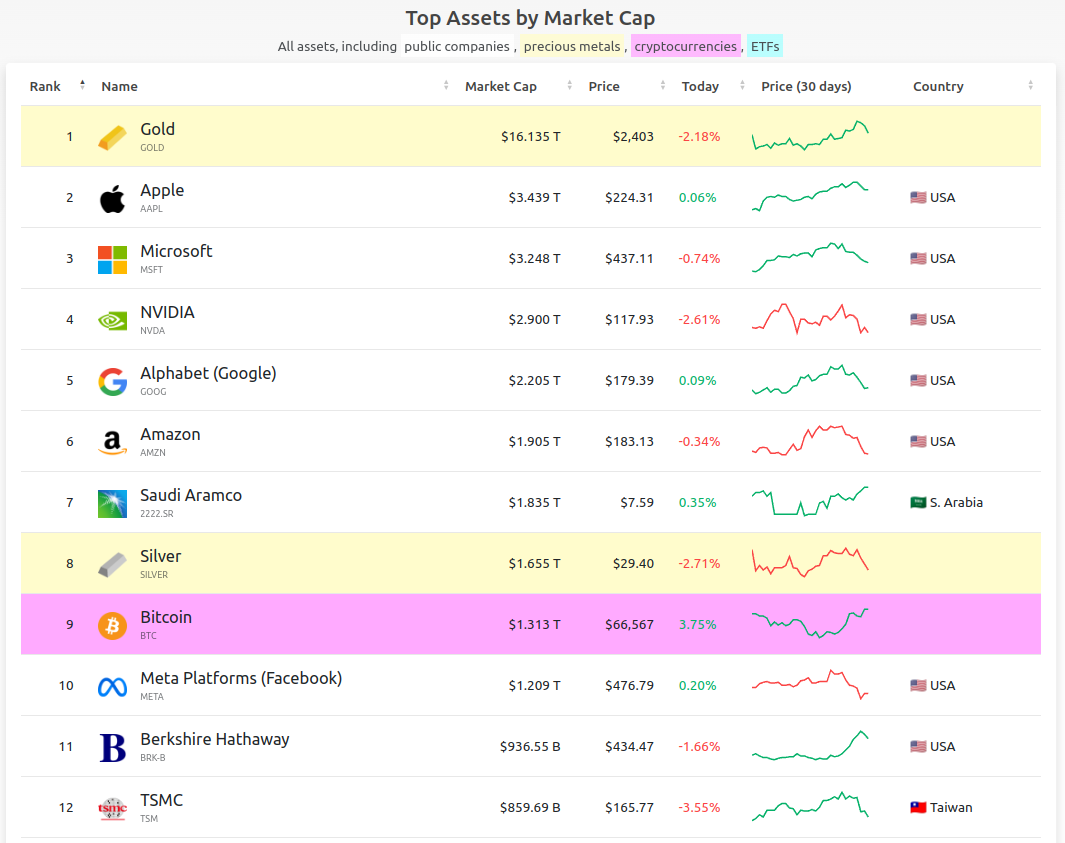

Here’s an example for Bitcoin (from April 2023):

Screenshot taken on 25 April 2023. Why weren’t you buying then?

As you can see above the chart, there are these relevant fields:

- The market cap – how big is the project currently, expressed in $USD

- The “fully diluted” valuation – how big the project would be if all units are in circulation (remember, there is still Bitcoin that will be mined, so we don’t count those in the market cap)

- Volume – how much $BTC was traded in the last 24h, expressed in $USD

- Circulating supply – how many $BTC are in circulation at this particular moment. As you can see, currently we have 19,355,918 $BTC out of the 21M that will ever exist.

The market cap is the reason why Bitcoin is #1 largest project.

Not the price.

You can find the same information for stocks on Yahoo Finance.

A Common Misconception (You Probably Have)

A common bad habit many people have is looking only at the price.

I’m referring to thinking that a coin can do a 10,000x because its price is under $1.

This is incorrect.

To see the potential of a coin, you have to look at the price, but also at the market cap and the circulating supply. And that’s only the beginning.

Many already understand why, but I’ll give an example.

Analysis of a Hypothetical Project: $SCAM

Let’s say there’s a new meme coin called $SCAM. Its current price is $0.0001.

Before going all in thinking “If it hits just $1, I’ll make a 10,000x!!1”, check whether it’s possible for it to do such a multiple.

You take a look at the market cap, and you see that it’s $2B (i.e. there are 200,000,000,000 tokens in circulation).

Now, what’s the possibility of $SCAM doing a 10,000x? Well, that would mean that the market cap would become $20T.

Is it realistic to expect that the market will value a scam coin at 20 trillion dollars? Overtaking Bitcoin’s market cap more than 10 fold and surpassing the global value of gold?

The answer is obvious, but let’s check the crypto market for educational purposes:

Comparing to Market Caps of Similar Projects

We know that $SCAM has a market cap of $2B.

The first step is to assess where this stands in comparison to projects in the same category. The largest meme coin out there ($DOGE) has a market cap of around $20B.

So:

If $SCAM overtakes $DOGE, it would do a 10x.

If $SCAM overtakes $SHIB, it’s a 5x.

So, in the highly unlikely scenario that this new meme coin jumps to one of the top positions per market cap, it will be just a 10x.

And I’m saying “just” because the n00bs’ dreams of 10,000x and early retirement after throwing their life savings of $170 in a meme coin should disappear after reading this.

Basically, if you see that a coin already has >$1B market cap, you might expect a maximum of 2-5x and that’s if the marketing team, the sentiment, the ponzinomics, and the market conditions are stellar in the short run.

In other words: you’re better of sticking to $BTC and/or $ETH for a similar performance without the extra risk.

If you want to practice, try a similar analysis with any of the meme coins.

TLDR

A $2B market cap meme coin won’t do a 10,000x, even if its price is $0.0000000000001.

Misconception: Ignoring FDV

As we saw with Bitcoin in the example above, there is a discrepancy between the market cap and the fully diluted valuation.

Again:

- Market cap represents the price * number of units in circulation

- Fully diluted market cap is the price * all units that will ever be in circulation

In the case of Bitcoin, these represent the $BTC that will be mined until 2140.

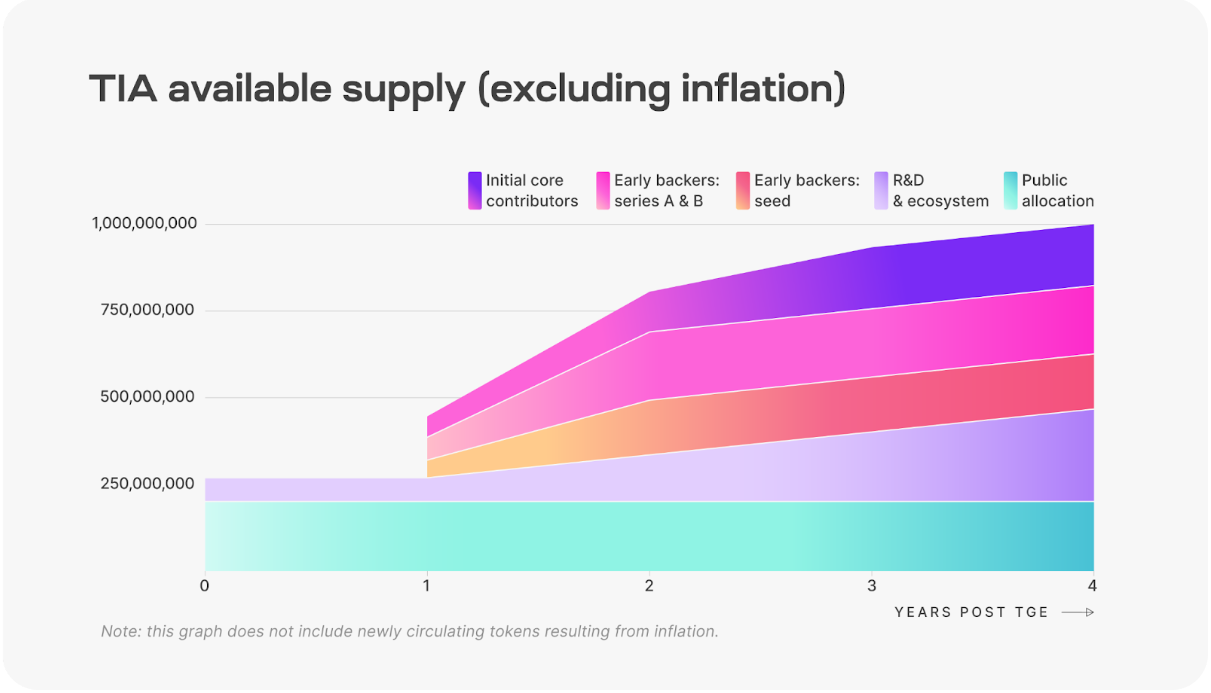

But many projects have tokens locked for future incentives, or unvested tokens for early investors, backers, VCs, etc.

These locked coins aren’t part of the circulating supply just yet, but they’ll be released in the future.

Here’s an example of the release schedule for Celestia ($TIA):

FDV Analysis of a Another Project: $NOTSCAM

Let’s say you understand market cap now and you find another coin: $NOTSCAM.

You assess its fundamentals, team, roadmap, etc. and you think it’s a legit project with amazing utility.

Its market cap is only $100M and its competitors in the crypto market are trading at $1B market cap. So a 10x becomes somewhat probable.

Enter FDV – fully diluted valuation.

You read the projects’ tokenomics in their docs and you see that only 1,000,000 tokens are circulating from the total supply of 100,000,000.

This means that 99% of the token supply will enter the market in some point in the future.

These can be in the form of:

- Community incentives

- Unvested team allocation

- Early backers’ locked tokens

- Venture capitalists & seed round investors (that bought at lower pre-market prices), etc.

Regardless, now you know that new tokens will flood the market at some point. That means increased sell pressure, potentially suppressing or even crashing the price permanently. You can see the same pattern with almost all VC pumps-and-dumps – which I won’t name, but you can find a few for practice.

So, indeed, $NOTSCAM has a $100M market cap with 1% of its supply in circulation. But it has a FDV 100x larger, amounting to $10B.

This is already much larger than any competitor.

I.e. entering becomes much riskier and a two digit multiple in returns becomes impossible.

Conclusion

Learn.

And remember that all analysis is multivariable and never linear.

Needless to say, these are by no means the only aspects you should consider when evaluating investments. But definitely a starting point to clear up two of the largest misconceptions for beginners.

Husband & Father

Husband & Father  Software Engineer

Software Engineer