I recently had an in-depth discussion on X covering a plethora of intriguing topics: hard money, intrinsic value, gold, Bitcoin, what defines “rich”, taxes, lifestyle, etc.

The discussion is between me (@petkovskix) and the user @anubisSonOfRa with whom I often have insightful exchanges.

You can find the post on X, but I’ll present it here in a more readable format.

It started on an excerpt from my post “Can the 4 Year Cycle Break”:

@petkovskix

…

Currently, those that are aware of the Bitcoin cycles have the ability to outperform every asset/class in the world in relative terms. I’m not exaggerating.

The reason that this opportunity exists is because there are still people that believe that Bitcoin is a scam/ponzi/pyramid scheme or are simply not interested in it. These people represent the majority and they’re not aware how Bitcoin or how money works.

…

(This is the relevant part and below is the first response)

@anubisSonOfRa

Speaking of people not interested, yesterday I had a discussion about Bitcoin with one of my closest friends. We’ve had this discussion before and yesterday we had it once more. I didn’t manage to convince him of anything this time either.

He kept coming back to the “no underlying value” point. I tried to examplify with some analogies. I’m probably not the best person to explain certain things and I even sent him one of your posts:

I thought maybe someone else can bring him around. Nope, did not work… ☹️

His response to your post was:

“It was a bit too PRO-Bitcoin I think. I still don’t understand the actual value of Bitcoin. What is the valuation? I understand the decentralization etc., but not why it works as a currency and value.”

It is what it is I guess.

I wonder if he’d ever buy Bitcoin and if, what changed his mind.

@petkovskix

What an interesting topic. First of all, I’m flattered that you shared a post of mine to convey the point!

It didn’t end up with the intended effect, but still. 🙂 This is a good reminder to write something that answers “what gives #Bitcoin value” more explicitly.

I usually approach such discussions from two angles:

1. Hard Money

I’d put Bitcoin aside and only discuss money from whatever perspective makes sense at that moment (whether it’s QE, the gold standard, inflation, quality of goods & services, etc.)

The point being to convey why hard money is superior to FIAT. And this can be a long discussion, based on the knowledge and political orientation of the other person.

I like this approach because it doesn’t put the focus on a “speculative asset”, but really addresses what is a superior form of money. The “underlying value” topic is encapsulated in it as well – gold doesn’t have a “price” in nature. We as people gave it a price – all of us, all market participants, direct and indirect.

Only after covering solid ground for gold, I’d switch to why Bitcoin is superior (global, uncensorable, unconfiscatable, all the good stuff).

This approach works best with people that have solid financial background and experience and can keep track while going deep in these topics (such as what happened in 1971, executive order 6102, the artificial price hikes per ounce, the French warship, reckless spending, financing wars, welfare, etc.)

2. What is Value?

This is my other approach for discussing the “value” of things – usually more suitable for people with less market/investing experience.

It’s important to distinguish what intrinsic value means in terms of investing (i.e. discounted cash flows, or current price minus strike price, etc.) and that this has nothing to do with intrinsic value of things outside of financial markets.

“Value” in general sense is a more philosophic concept in my opinion. And any Austrian economist would agree that everything is in the eye of the beholder – some people pay 6 figures for a watch/bag others wouldn’t even pay $10 (and similar examples: the value of a bottle of water at home vs in a desert, etc.)

The message is that “the value” of Bitcoin IS its market cap.

We, the humanity as a whole, based on our buying, selling, hodling, or ignoring the asset, decided what its value is. And we do it on ongoing basis.

And absent of overregulation, this is true for everything else.

It can easily be supported by picking any asset / object / currency / whatever, and doing a similar analysis, which is always a fun challenge.

This can also be a good lesson on the law of supply and demand and how prices are set in free markets in general.

• • •

Apart from these two discussions, there can be a handful of follow ups, but I believe those are easier to handle.

For example: why $BTC and not [another #crypto] – for which the answer is its properties and “the network effect” (I published a post on it).

Another follow up is that it’s still early to say with full confidence, which of course can be acknowledged by not going all in, but scaling the exposure with one’s conviction.

I have to add that I’m not entertaining the discussion about acceptance as a currency/buying coffee, but really address this from a global money perspective. This is easy for me because I’m not into spending $BTC or using the lightning network – Bitcoin’s utility for me is as a technology for preserving my past productivity which allows me to be intellectually honest in these discussions rather than rely on apologetics or similar practices.

• • •

Of course, apart from this some might want to discuss the perspective of $BTC as an investment, which is a completely separate topic.

@anubisSonOfRa

Your post is a good one nonetheless and worth sharing. In the best of cases my friend would have discovered your site, read up on Bitcoin, and bought some for himself. Win for him, win for you. 😀

Who knows, maybe he’ll come back to it sometime in the future…

1. Hard Money

We’ve discussed this aspect before and I think this is where you and I differ from him and the likes of him. We find the aspect of hard money much more important.

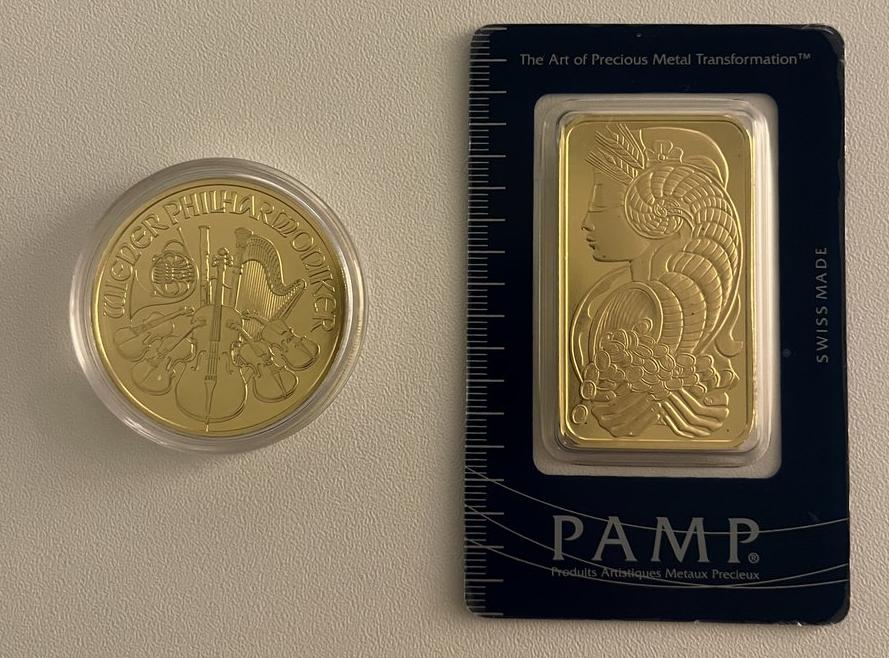

I for one used to have an not small amount, for me, of savings in real gold. Still have a panda, kangaroo, some small bars etc left and you know I’m never ever going to sell my last dragon or tiger. 😀

My friend would never buy gold even though he defends the value of gold when we talk about Bitcoin. Unfortunately though, it seems he attributes much of the value to the usage in different industries, which we know is a small part of the total amount of gold.

He definitely knows what happened in 1971 and some of the other things you mention, but my take is he doesn’t put much weight to them.

He is well versed on the economy and economic history, more than me. At uni he studied economics. His political views lean to the right and views in general are: less state, more private enterprises. With that said, he can’t seem to grasp how something can work as a currency/neutral asset if it’s not issued by the state. It’s a bit strange really…

He’s of course not the only one with the same background who thinks this way. It would make more sense if he was leaning to the left.

I see your point though. Keeping discussions non-Bitcoin while still discussing the properties Bitcoin holds is probably the right thing here.

2. What is Value?

You’re spot on here, dear D.! Very well written.

I need to discuss Hermès and Veblen with him! 😀 Maybe there’s an angle here.

Some background. He used to own a Lamborghini, which he sold to buy a house in Spain. He also bought some entry level Breitling… Not sure what that’s about. Lambo I can understand, Breitling I can’t. I guess he could rationalize those purchases with the fact those things gave him joy.

We’ve also discussed buying art as investment.

I must stress here, neither of us are rich, I’m certainly not…

I don’t want you to get the wrong picture. One doesn’t have to be, what I call, rich to own a Lambo. You can’t be poor though. As for the art, there’s lots of art to buy which isn’t expensive.

Neither of us know anything about the art market, but the value aspect here is something I should bring up next time we discuss these type of things…

3. Miscellaneous

I try avoid discussing Bitcoin and other crypto during these discussions because they are indeed different and he, like most people not into this space, can’t tell the differences between Bitcoin, Solana, Chainlink, Pepe or anything else. “They’re all the same”…

Getting him and a couple of others I know off of zero is something I try to do without pushing too hard, which I think would defer them.

I gifted him and another friend Lyn Alden‘s great book Broken Money… I though they would at least find the history of money and characteristics part interesting.

They haven’t read it yet.

結束

@petkovskix

Good read, as usual!

First of all, I have to give my humble opinion on “economics at uni” – that usually breeds Keynesians and monetarists, so there’s the first opportunity to discuss the subjectivity of value and free markets. Brush up on Milton Friedman and Thomas Sowell plus the plenty of good topics from personal experience as well!

But at the end, if a person is already “established” as an investor, maybe the greed factor is not there to give that initial push most of us had when considering #Bitcoin for the first time. I wouldn’t talk for everyone, but I know that myself and many others entered the space to “make money” (which is a poverty mindset), and only afterwards grew into it.

Those are nice very nice bullion collections btw! I also like a few of the dragons, but my favorites are more classic – the Vienna Philharmonic and the American Buffalo.

Now, what do you mean you’re not rich? You don’t use FIAT currency as a store of value, do you?

Jokes aside, that’s always an interesting discussion – what does “rich” mean? Since the previous topic is more or less exhausted, I’d like to hear how you would describe/define that term.

@anubisSonOfRa

Yes, I know focus is on Keynes. I studied some economics at uni but that wasn’t my major, it was his though. Here Austrian and Chicago school of economics are taught, but more so in passing. Keynes is definitely where the focus lies…

Yes, could be.

“Greed, for a lack of a better word, is good”

Greed, desperation, there are probably others. People, companies and countries who need Bitcoin will be the first ones to adopt it. Saylor for instance has mentioned this numerous times. MicroStrategy wasn’t really going anywhere so they needed something… That something turned out to be Bitcoin.

My friend is probably “fat and happy” as they say.

Similar situation here. I made my first purchase as some sort of investment I thought could go up in value…

Didn’t have nowhere the conviction I have today neither did I have the knowledge I have today, and I’m still learning!

I have the Philharmonic! It’s a nice one, but I prefer the Chinese zodiacs. Those are probably the last ones I’d sell. I’ve sold some through the years to buy stocks and Bitcoin, never for consumption. I also like this one. A very beautiful stamp IMHO…

• • •

I’d probably call someone rich if they:

- Don’t have to work anymore, selling their assets or not. Work can be fun of course, that’s not the point here though.

- Can travel and stay pretty much anywhere without having to think about the cost.

- Can eat pretty much anywhere without breaking a sweat. I for one can’t eat stuff like this on a weekly nor monthly basis, the whole menu serving i.e.

That doesn’t equal happiness, but I’d call them rich. Flying private or having a yacht isn’t needed to be called rich in my book.

What are your thoughts on richness?

@petkovskix

I still don’t know to be honest. But I’m on a quest to figure it out and asking the question is also my way of understanding it eventually.

I usually lean towards “no financial concerns” + answers similar to yours (especially the first one), but at the same time, given people’s circumstances and preferences, all 3 can be achieved with “negligible amounts”, so I’m always taken back into thinking that there’s something else.

For example, point #1 is definitely a characteristic of being rich, but that can also be achieved by a middle class housewife or someone that rents out an apartment, etc.

Also, in many places of the world, fine dining is cheap in global terms, so people that geo-arbitrage(d) can easily afford it – even for western standards, partners that earn at least a double of the average salary each can go to Michelin restaurants way more frequently. Of course, there are also people that don’t prefer to indulge in (what we learned to consider) luxury. I find myself with that mentality quite often, although I know to make exceptions when I feel like it.

So this makes answering the question a bit difficult for me. Whatever comes to my mind, I can find a counter argument where people with relatively low net-worth can enjoy a similar lifestyle.

So usually I trivialize it to a dollar amount (such as 3 or 10M). But even with this approach, we see people that earn 8 figures per year and grind hard and we see people that are comfortable with less than a million.

So yeah, still on a quest to find an answer, which undoubtedly will be something quite subjective.

Btw, have you seen this post of mine? It’s an interesting expansion of this discussion:

Luxury is Subjective – The Cultural Bias in Status Symbols

Lastly, I compliment your gold collection once again. Great picks! And may I ask what was/where did you have that dish? Looks delicious.

@anubisSonOfRa

You’re correct about circumstances and preferences playing a major role in determining what one can afford.

I wouldn’t count a middle class housewife as being rich though. She might not have work per se, but she’s dependent on someone else for her lifestyle.

I think this should never be the case for someone rich. Independence is everything. Very important point IMHO.

I also have a hard time seeing someone who rents out one apartment being able to not work anymore, at least where I live…

Maybe if their monthly expenses were very low and I mean very low. I could see it with 2 or 3 apartments though. Buying or financing them would require more than the average person has in my country for sure…

I get the point though, people who don’t really have “a lot” of money are able to have this lifestyle.

You’re very correct about the fine dining part. Where I live the prices are what I would call high to very high…

I could afford a monthly menu at any of them when I think about it, not weekly though. It would cut too much into my cash flow for me to feel comfortable and I don’t want to sell anything in able to eat at Michelin restaurants.

I’ve had the good fortune of dining at some fine restaurants on my travels in different parts of the world and yes, I do see a very big difference in prices as I do with hotel rooms. There are some very good “deals” to be made in eastern Europe and certain parts of Asia…

€3M is not a bad amount, but not enough for being rich in my country nor yours IMHO. I’ve seen the prices of flats in AMS. A rich person should be able to live in Apollolaan and have some money for other things no?

€10M yes, rich! I don’t think life magically turns out to be better with this amount but it’s something to aim for. Not forgetting though: the journey is the goal!

• • •

I’ve read that post! I agree with it. Culture is big factor and it’s also a big factor in saving/investing.

It’s no coincidence I own physical gold. When my grandmother was alive and she smiled, her smile was brighter than the sun from the gold. 🤣 I’m exaggerating a bit, but you get the picture. Thank you for the kind words about the gold. 🫶

The dish is quenelle from scallop, king crab, and tagetes. I’d best describe it as a taste of heaven. One of the best dishes I’ve ever eaten. Was at Aira in Stockholm, Sweden. Two star Michelin restaurant.

Over… and out! 😀

@petkovskix

Indeed, I was too casual with the approximations on the housewife and the landlord, and I agree about independence being crucial.

But you get the point – not only that it’s liveable on a few thousand almost anywhere in the world, but also that it’s achievable in various ways and with relatively low net worth (i.e. less than a million liquid).

You said something interesting: “… would require more than the average person has in my country…” – and maybe that’s closer to defining “rich” than most other things – a relative concept describing people in the [50+x] percentile in terms of wealth?

Of course, people like us may have instincts to discard that definition because it sounds low (and surpassed in many multiples already). But 50%+ of the population would disagree.

Would love to explore this further but I don’t have much to add, unfortunately. But it seems it’s more of a subjective rather than an objective measure and also pushed further on each personal milestone (because that’s the only reference point a person has).

• • •

On the topic of 3 vs 10, of course, I agree – the more the merrier. 🙂

At the same time, the country where one prefers to spend a quality retirement is also a choice, especially in that range of net worth (i.e. not for the housewife or the small-time landlord).

I wanted to expand on this because QoL can drastically change. For example, personally, I don’t really see myself pursuing such a lifestyle in the Netherlands, and it’s not because of the relative HCOL.

In this reply, I’ll share two major reasons for it:

1️⃣ We have a wealth tax of >2%, meaning that even in the lowest bounds of “being rich”, we’re wasting €100k+ per year for existing (regardless of whether gains are realized, whether money is lost, etc.). I don’t want to shift the discussion into comparing tax systems, so I’ll keep it short: crossing a border and establishing residency removes this liability permanently.

Of course, I don’t have the burden of family ties or reliance on the local system, so it’s easier. But I’ve had contact with 5+ locals that found it unbearable – some of them even earn less per annum than the wealth tax they owe and are forced to sell assets to remain free residents.

I consider it normal to break ties with a country once it’s not in your best interest.

I’ve done it previously as well and many people do it serially.

2️⃣ Scaling of experience/luxury with wealth. This has been something that we’ve discussed many times at home.

I feel that there’s a limit (at least in the wealth range we’re discussing) to how much the quality of life can scale as one throws more money into improving it.

To give a specific example, I didn’t feel a massive improvement in lifestyle on a $200k NW and a $1M NW (while employed). In both cases I didn’t know the gas prices or grocery prices, travel frequently, eat out, order delivery whenever we feel like it, etc. Of course, there are exceptions to this, but they diminish as the net worth continues to grow.

And since price becomes less of a factor, we can assess quality.

Now… 🙂 Without getting too political, I’ll just say that minimizing the gap between the minimum and average salary, having the ability to get paid without working, overtaxation, and the inability of companies to afford adequate workforce, all lead to lack of productivity and thus lower quality of services as the incentives to do the best job possible are slim to none.

And everyone, rich and poor equally, end up with stores which are less clean, waiting times that are much longer, less customer care, etc.

Please don’t take this as complaining, I’d hate to be perceived as such. My point is that there’s no amount of money that one can willingly pay to have a better overall experience (i.e. not just while seated in the top ranking restaurants).

At the end, I’d feel more welcome in a society that celebrates my success (makes “the rich” want to pay more) than one that demonizes it (taxes “the rich” more).

Of course, this observation is not exclusive to NL and we see similar instances in other European countries (luxury cars being vandalized in Spain, “tax the rich” banderoles in France, luxury watches getting snatched in UK…), and although those are all rare (and mostly in liberal enclaves), I’d feel more at home in places that welcome success. Coincidentally, I’ve observed that it has an inverse relation with the height of the taxes/general government interference.

Both of these points are a bit beyond the initial discussion, but I thought it’s a good idea to add a couple of reasons why I like to keep a more global perspective. Interested in your thoughts on this as well!

@anubisSonOfRa

1️⃣ Yep, I remember that belter of a post you had about the tax system in Netherlands, I must say I was surprised. Didn’t know it was how it is…

I completely understand. It’s money that could be spent on improving QoL in other areas.

2️⃣ Pretty much the same here. My NW has increased a good amount the last 5-6 years or so, with ’24 being exceptionally good.

Not much changed in my life during those years though. A bit nicer hotels and fine dining a bit more often. No fancy watch, car, or similar. I can honestly say I don’t crave it. If I’d 10x my NW from here I still wouldn’t buy a Lambo, I’d travel more though…

I agree with the difference between being unemployed and being paid an average wage is too low. Same in my country. Not enough carrot and not enough stick. I feel this is something which can be seen in other parts of society as well…

Things are getting sloppier in a bunch of areas.

Higher taxes on the rich to me is the same as lets fire a bunch of workers when the company isn’t performing as intended. No real ideas, just take the most obvious step in order to show power of action…

Doesn’t matter if it’s a good thing to do or not.

Violent crime is getting out of hand. I guess that’s something every generation says as it grows older, but man, it is getting out of hand…

I’m not sure I’d be 100% comfortable wearing a €50k watch on my wrist given where and how I move. There’s been numerous cases of watch robberies both out in public and in people’s homes. Sad state of affairs really…

Poor people are getting the shortest end of that stick though since we have had a rise in bad neighbourhoods in a relative short period of time. They used to be “just” poor, now they’re poor and stuck in a bad neighbourhood…

The rise in crime is probably the biggest negative in my country from my POV. It kind of sets the mood for so much else in society. 😢

@petkovskix

Yeah, definitely, to a greater or lesser extent in various places.

So to pivot back on the topic of what “rich” means – maybe it’s the state when one can afford to feel abundant.

Of course, a big part of it is quantifiable through material possessions, but there might be additional layers, similar to Maslow’s hierarchy of needs (for example, the Tsar probably didn’t feel rich during the Bolshevik revolution).

It’s always an interesting discussion!

@anubisSonOfRa

I feel the same way! Longest posts I’ve written here are responses to you. 🤝

Husband & Father

Husband & Father  Software Engineer

Software Engineer