I often talk about crypto cycles and their relevance for timing entries and exits.

In this post, I will share my experience with the cycle of 2021. The goal is to show how volatile and life-changing (in both directions) this market can be.

The interesting part is that I incorporated exactly the same strategy to position myself for the current cycle.

With that being said, read on and enjoy the role of crypto historian!

Setting the Stage

The year is 2020, during the “Covid crash”.

Asset prices were getting slaughtered and the recession that doomers expected was upon us. Here’s the chart of $BTC, losing 50%+ of its market cap within days:

Assets’ prices were bleeding but I was religiously following my DCA schedule. “Time in the market beats timing the market” and dumped all my savings in my portfolio.

Now, a little bit about me back then…

I was already serious about investing, but the majority of my portfolio was in the stock market. I did own some crypto, mainly $BTC and $ETH that I accumulated during the 2018/2019 bear market. However, this was around 10-15% of my investment portfolio.

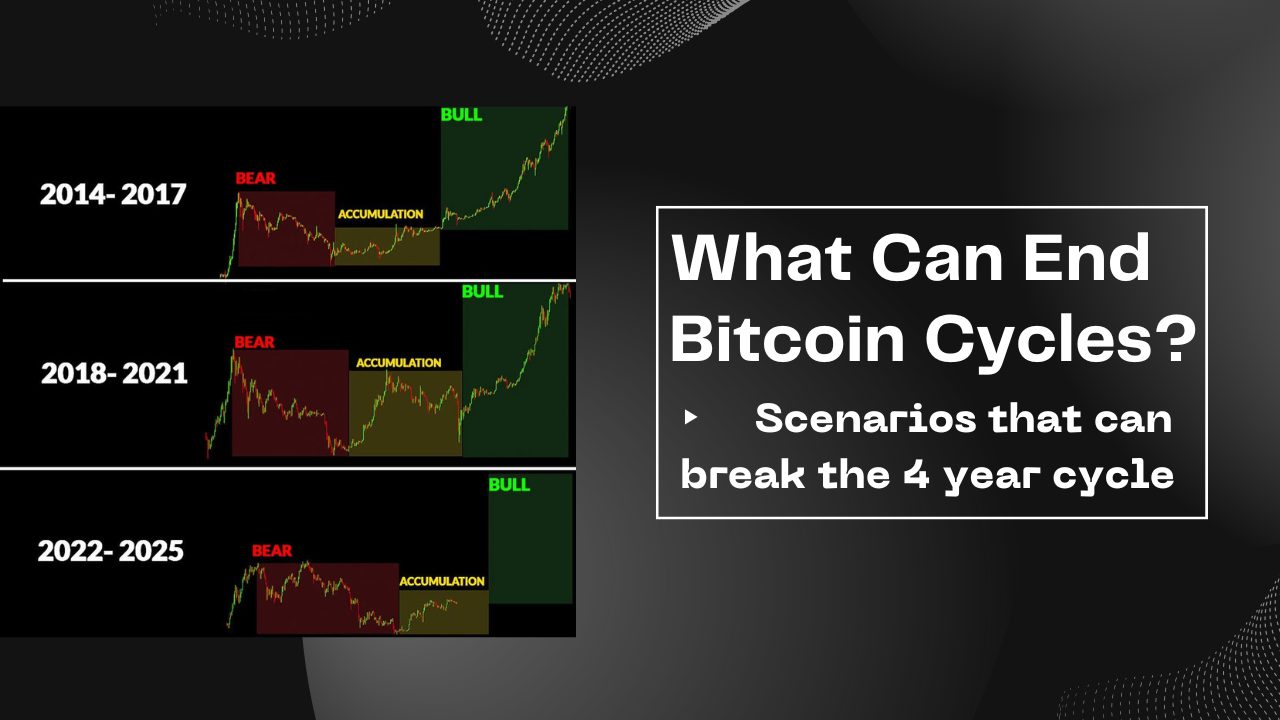

I wasn’t completely orange-pilled but I had market experience and understanding of the 4 year cycles due to the Bitcoin halving.

This gave me a strong conviction that $BTC is either infinity or $0 in the long run, and that it’ll at least reach its all time high in 12-18 months after the halving, pulling the altcoin market with it.

The crash was an opportunity to enter crypto more heavily and position myself for what’s coming our way.

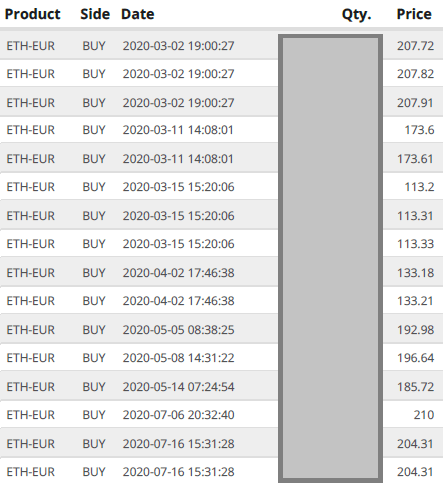

Buy Orders From 2020

Ether was trading around $150-200 back then.

My thought process was: even if it comes back to its previous all-time-high of ~$1,200, that’s a massive win! Especially for a stock investor‘s mind that normalized 10% annual gains and that “you can’t beat the market”.

Anyway, here are my entries during 2020:

I want to point out that I didn’t necessarily tried to time the absolute bottom.

As long as the price was below $250 or on local dips, I was scooping up more $ETH.

From today’s perspective, it sounds mind-blowing that a working-class person could accumulate 10-20 $ETH per month.

But there I was.

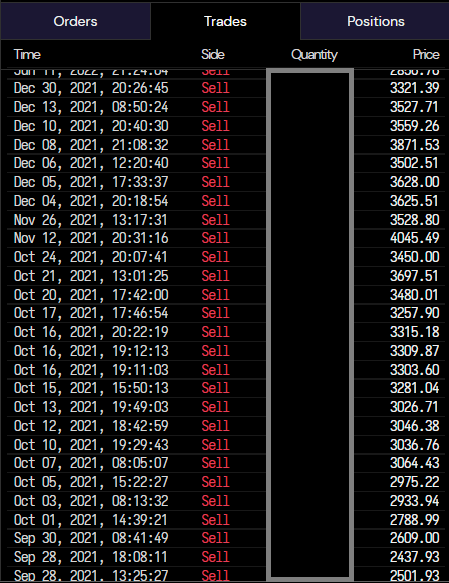

Sell Orders From 2021

Based on the 4 year cycle theory, mid-late 2021 was the year to exit crypto.

And as you can see here, I also didn’t try to time the absolute top.

I was accumulating around €150-200, so any exit above €2,500 was an extreme outperformance of anything I’ve experienced so far.

This is my cost averaging out of $ETH:

I switched Coinbase for Kraken as my main exchange. I preferred a platform with a human customer support team.

TLDR I exited the market with mid 6 figures in profits. And I can proudly say that I’m one of the few that didn’t end up bagholding into the depths of the subsequent bear market.

After the crypto bubble of 2021 burst at the end of the year, I re-allocated most of my profits into the stock market.

I simply bought more of the ETFs that I already held (see more details if interested).

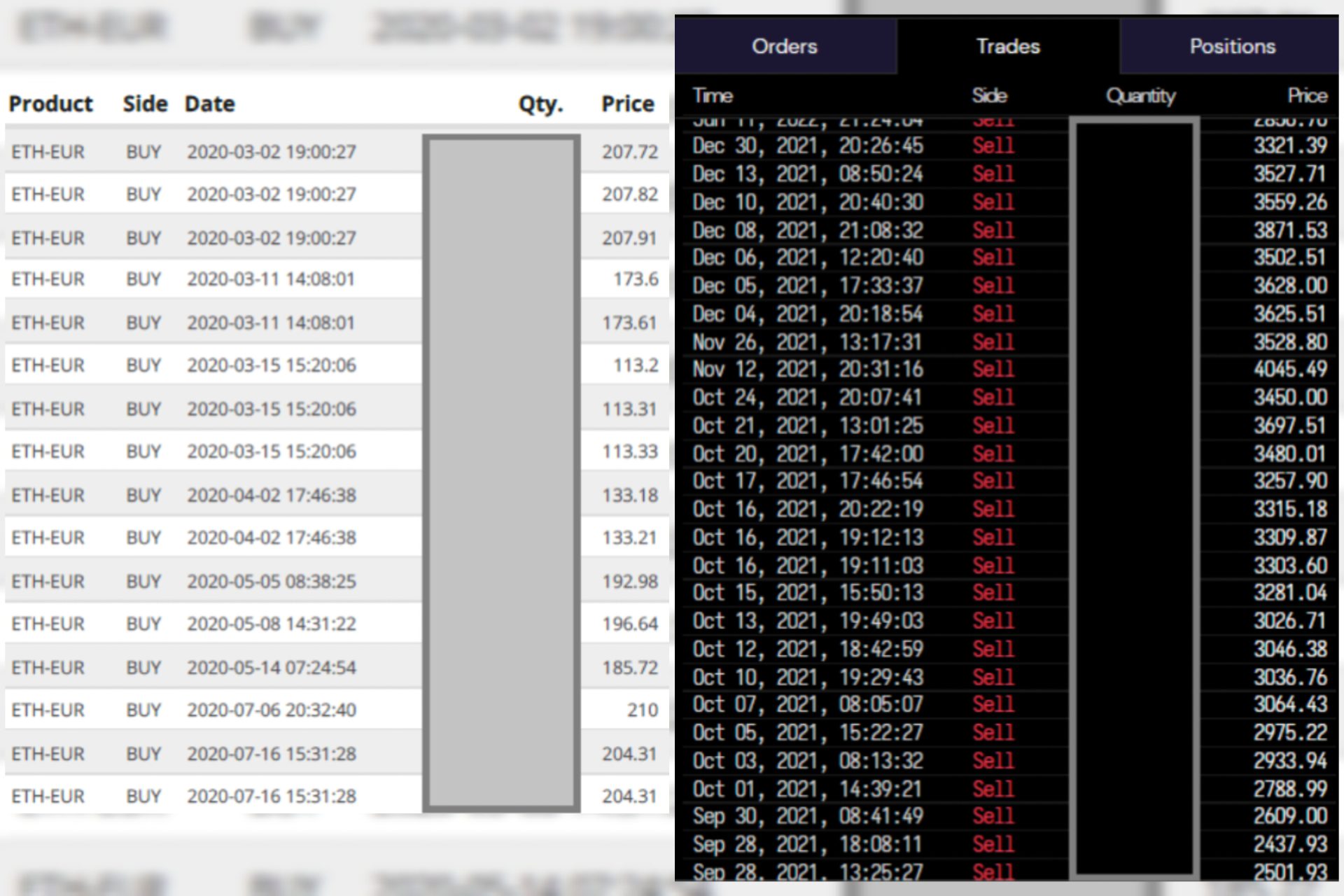

2020-2021 Bull Market Commentary

First cyclers can’t comprehend how a crypto bull market unravels.

Remember the image of the brutal Covid crash from above?

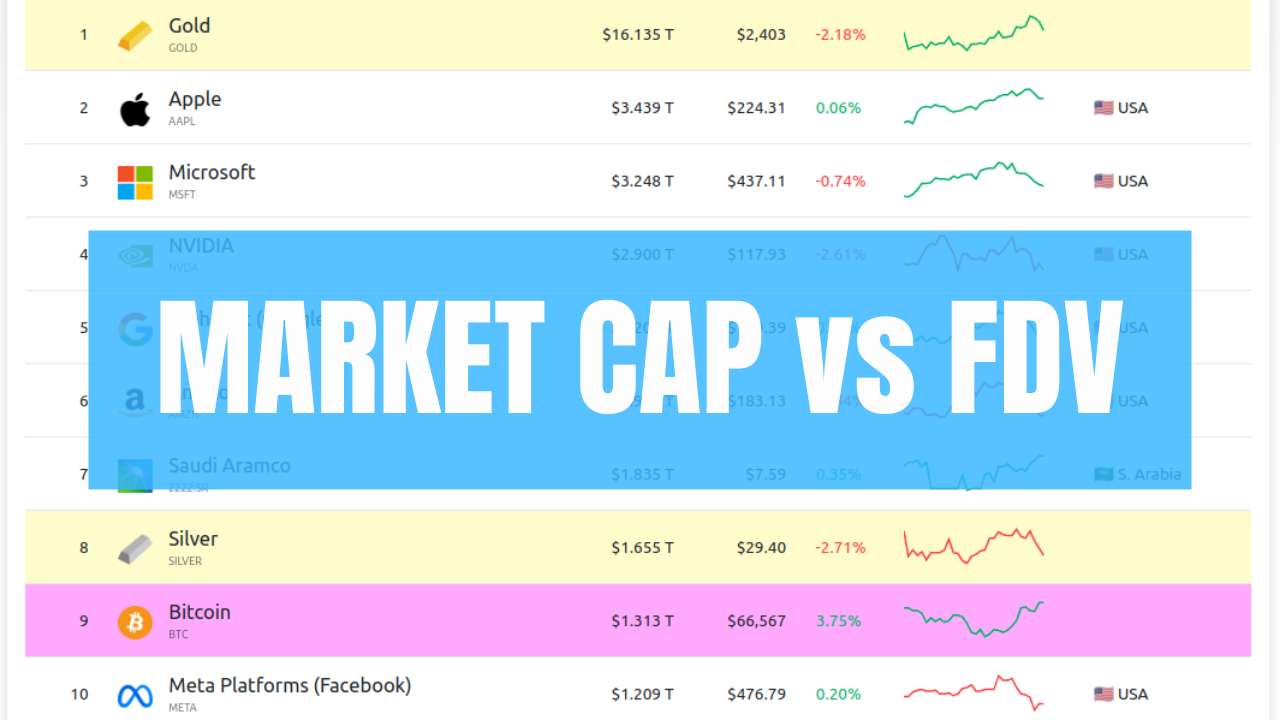

Well, towards the end of 2020, Bitcoin surpassed its previous all time high. And in the next year, $BTC peaked at ~$69k. 🤯

Note the crash of 2020 circled in red:

Based on the 4 year cycle, we’re at a similar stage – ATH in the year of the Bitcoin halving, preparing for the mania phase.

Make the most out of it.

Or don’t.

Do whatever you think is right.

Once again, here’s a merged image of what I did:

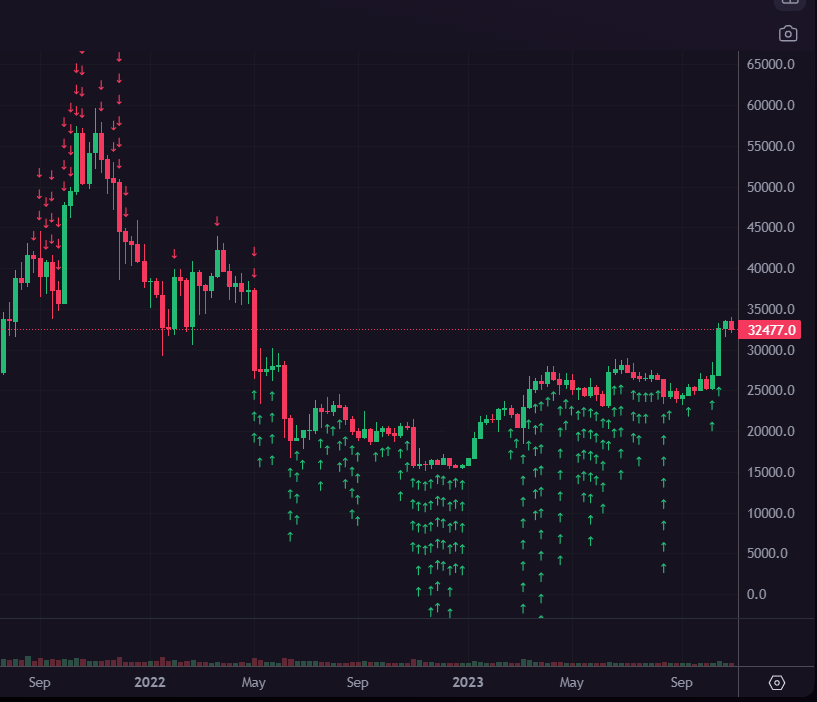

What Am I Doing This Cycle

Many n00bs will feel motivated and run to buy due to FOMO (fear of missing out).

Be careful!

If you’re inexperienced, you’re most probably buying the top and will lose everything.

I already did most of my buying during the depths of the bear market, so it’d be irresponsible for me to recommend anything to anyone as of now.

Below are my $BTC sell orders from 2021 and buy orders from 2022 and 2023:

Needless to say, my portfolio already surpassed 7 figures this year.

If I can summarize a veteran tip in a single sentence, it would be:

Stick to high-conviction assets so that allocating with size can be done unemotionally and feels comfortable.

Of course, that’s easier said than done, so take your time.

The most important thing is to build a strong foundational knowledge about the monetary system and the asset class you’re entering, whether that’s Bitcoin, stocks, crypto, or falling for other scams.

Enjoy losing money!

Husband & Father

Husband & Father  Software Engineer

Software Engineer