Whenever I present Bitcoin to a seemingly curious disciple, an infamous question always pops up:

“And did you sell?”

It’s disappointing but I don’t hold it against them. Bitcoin aside, a person without investing experience has no preference of holding assets to worthless cash.

Most people think in terms of “making money”, effectively asking whether I won this round of roulette or the wheel is still turning.

In this post, I’ll explore the options one can exit into and assess their suitability.

Exiting Into Cash

“People that use FIAT currency as a store of value, there’s a name for them – we call them poor.”

- Michael Saylor

Funny punchlines aside, please do think about it.

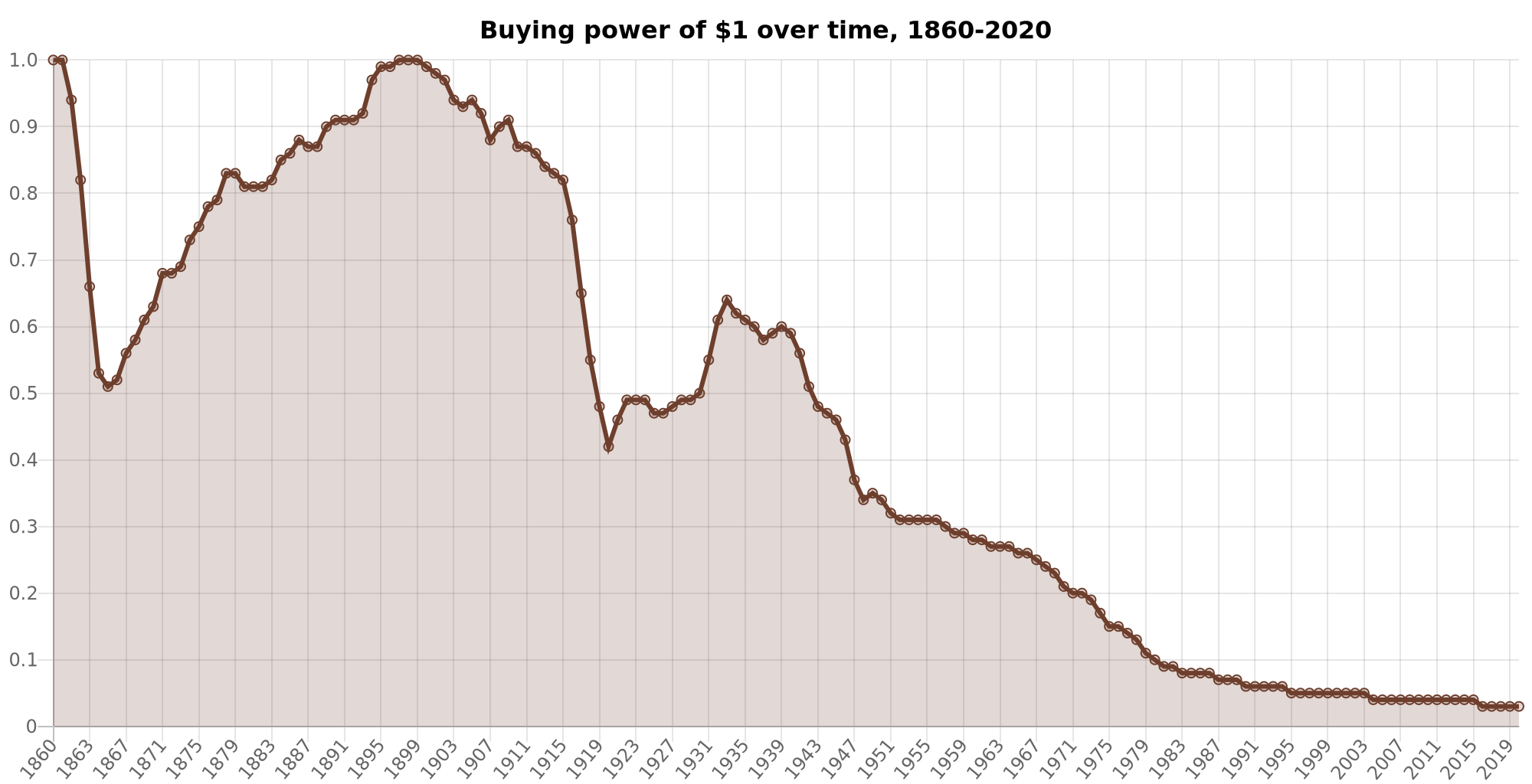

Do you really want your wealth stored in a currency whose supply grows exponentially, diluting your share of it?

In a currency that’s programmed to lose value over time due to quantitative easing?

And note, we’re not talking about surviving a month here, we’re talking about storing a lifetime of productivity to last for generations!

Heck, a dollar from 30 years ago (1994) costs $2.13 today.

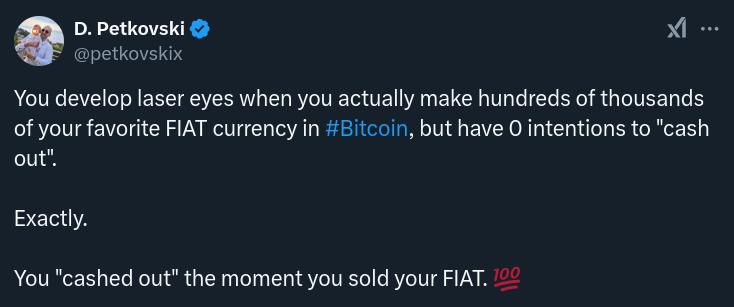

FIAT slaves would say “prices doubled in 30 years”, but those of us with laser eyes know better:

The currency lost 50%+ of its purchasing power in 30 years.

So back to Michael Saylor’s interview – the anchor states, loudly and clearly, “Let’s be honest, most people want to sell their assets at a profit!”.

Do they? 🤔

I mean, people with negative net worth grinding on a treadmill might think that m0ar ca$h will solve some problem of theirs.

So fine, you sell a valuable asset and now you have 💰 MONEY 💸.

What happens the next day?

You see where this is going?

Basically, the people that prefer MONEY are people that severely lack in that department. And they always will. Smart people keep a 6-18 months of expenses in cash and urgently invest the rest. Because every dollar you won’t spend or utilize today will be worth a tiny fraction of its value until you pass it on.

So, do you think that Michael Saylor… Or myself… Have any use of a random lump sum of cash 💵?

If we had a better idea how to allocate some extra cash, we would’ve done it in the first place.

I said it best in my tweet from 2023:

Summary: people that use FIAT currency as a store of value, there’s a name for them – we call them poor.

Exiting Into Real Estate

This is a common consideration. Not just with normies, but also with investors.

If you already have a place to live and still have massive gains from Bitcoin, would you sell some to buy more properties?

In most cases, the answer should be NO.

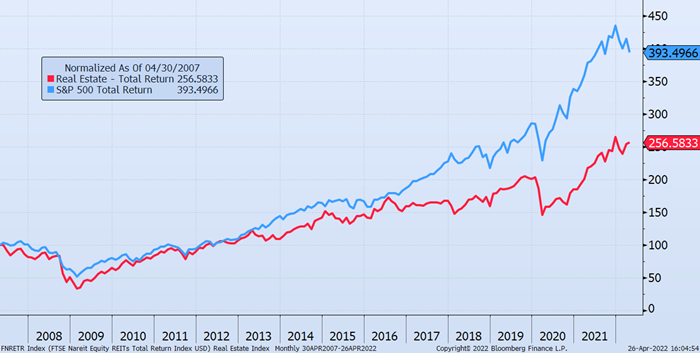

Let’s analyze… A property will bring cash flow and will appreciate through inflation, but the returns will be lower than Bitcoin’s. Heck, even the stock market outperforms real estate, with everything included (rent, price increases, etc.):

But fine…

You want to play the landlord game and you accept that you’re trading an asset that takes 0 effort and expense to maintain with an asset that requires frequent management, reporting, endures heavy regulation, ongoing taxation, and is highly illiquid. So what are you doing spending your money on an apartment?

Get a mortgage from a bank, fix the price for the next 30 years, and pay (less than) the (actual) inflation rate in interest while earning rental income.

Congratulations, you kept your money in a superior asset and you’re still a real estate magnate.

TLDR, on a 5 year time frame:

- The median house price in the US went from ~$240k to ~$350k (Zillow, 2020 to 2025) – a ~45% increase.

- The S&P 500 went from ~3,240 to ~5,880 – an ~80% increase.

- Bitcoin went from ~$7k to ~$93k – a ~1,328% increase.

Exit Into Stocks

The stock market is an amazing asset class. I even have a beginner series on it.

It’s designed to go up forever and encapsulates the growth and strength of the global economy.

But something else it also encapsulates really well is the devaluation of currency AKA inflation. That’s why stocks perform best while the government is less responsible with its spending and the central bank is more aggressive with printing.

Now, can you think of another asset that also has this characteristic?

Exactly – it’s Bitcoin itself!

So what’s the benefit of exiting Bitcoin for stocks? The only thing I can think of is to smoothen the volatility.

But do you really want that? When you’re buying stocks, you’re investing in a “risk-on” asset class, just without the asymmetric upside that Bitcoin offers.

And comparing their respective CAGRs (compound annual growth rates), we have the ~10% average return of the stock market vs. ~100% average return with Bitcoin.

So unless someone is building a safety cushion for retirement, a full exit into stocks makes less and less sense.

Although, I have to add that I consider the stock market as a great vehicle for storing and preserving wealth as well.

Exit Into Gold or Commodities

Many consider Bitcoin to be Gold 2.0 and I agree to an extent.

I love gold as much as any libertarian. And if we didn’t have Bitcoin, I’m sure my allocation in this precious metal would be somewhat higher.

Without going into too much detail, here are a few downsides of gold compared to Bitcoin: expensive to store, difficult to transfer, significantly less liquid and de facto OTC. But most importantly, usually underperforms both stocks and Bitcoin in price.

So I’m not against holding some gold, but a full exit from Bitcoin into it would be insane in this day and age.

So, what other commodities besides gold? Uranium? Crude oil? Rolex, AP, or Patek watches?

Yeah, sure, get a few if you want to.

But if you’ve played this right, you’ll probably still have Bitcoin to spare and, again, ask “exit into what?”.

Conclusion

Bitcoin is currently the best asset in the world to store your energy in.

Everything trends towards 0 against $BTC.

Husband & Father

Husband & Father  Software Engineer

Software Engineer